US equity futures are slightly higher , hovering near all time highs as traders bet that data on Friday will bolster the case for interest rate cuts even as the latest BofA card data hints at a big beat in today's retail sales print (see preview here); tech stocks lag. As of 8:00am S&P futures are 0.2% higher following back-to-back record closes earlier in the week, with Nasdaq futures modestly in the red after incremental headlines since yesterday’s close which were net negative, with soft guidance from AMAT on uncertain macro environment in Semis and weaker China activity data. Pre-market, NVDA fell 0.3%, with the rest of Mag 7 moving higher; Health Care and Financial are outperforming. Intel rose more than 3% in premarket trading on a report that the US government may buy a stake in the struggling chipmaker. US Treasuries are mixed, with the yield on two-year notes falling one basis point to 3.72%. The yen led gains among major currencies against the dollar as the greenback weakened 0.3%. Commodities are mixed, with precious metals higher and base metals lower. Today, key macro focus will be Retail Sales and Trump-Putin Summit.

In premarket trading, Mag 7 stocks are mostly higher (Alphabet +0.5%, Tesla +0.1%, Microsoft +0.1%, Amazon +0.3%, Apple +0.1%, Meta +0.7%, Nvidia -0.09%).

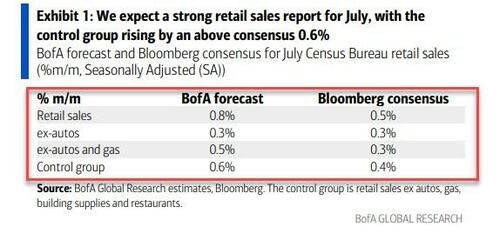

Economists expect government data on Friday to show a solid increase in July retail sales, driven by incentives that boosted vehicle purchases and a surge in online spending during Amazon.com Inc.’s Prime Day event. However, underlying fundamentals are likely to be soft, with many consumers avoiding goods marked up by tariffs, according to Bloomberg Intelligence. Our preview pointing to a stronger than expected report is here.

“In this market bad news is good news,” said Anthi Tsouvali, a multi-asset strategist at UBS Global Wealth Management. “I think investors are positioned to expect that the number will probably be lower than consensus.”

JPMorgan expects retail sales to grow by 1.0% MoM vs 0.6% prior, with much of the July strength coming from increased auto sales; the forecast is well above the Street’s consensus of 0.6%. Today’s print will help assess the health of consumers after the weak July NFP print. Notably, with July Core CPI at 0.3% MoM, if Feroli’s estimates come to fruition, that represent a still strong spending growth on inflation adjusted basis.

While US stocks surged since rebounding from April’s sharp selloff, when President Donald Trump’s tariff policies rattled markets, the rally gained further momentum in recent weeks as signs of a cooling labor market and benign consumer price increases strengthened the case for rate cuts. Money markets are pricing around a 90% chance of a quarter-point cut when the Federal Reserve meets next month, up from about 85% at the beginning of the week. The rally has left US stocks vulnerable to profit-taking if the Fed delivers dovish signals at the upcoming Jackson Hole economic symposium, according to Michael Hartnett's latest analysis. With investors piling into risk assets on hopes of rate cuts, an accommodative stance from Fed Chair Jerome Powell could trigger a “buy rumor, sell fact” reaction, Hartnett wrote.

While a deal to end the war in Ukraine is likely still far away, “we do expect some progress in today’s meeting and a path set for further discussions,” said Mohit Kumar, chief European strategist at Jefferies International. “If we move toward a peace deal, it would be positive for the European markets.”

In Europe, the Stoxx 600 hit the highest level since March and heading for a fourth straight day of gains, as investors looked ahead to a meeting between President Donald Trump and his Russian counterpart, as well as key US economic data. Cable maker NKT is the region’s biggest advancer on the Stoxx 600 after strong results and upgraded guidance, while jewelery maker Pandora is the biggest decliner after disappointing earnings. Here are the biggest movers Friday:

Earlier, Asian stocks also rose as stronger-than-expected economic growth in Japan drove the country’s stocks to another record while Hong Kong’s market slipped after China’s weak July economic data. The MSCI Asia Pacific Index was up 0.7% Friday, poised for a 2.4% weekly gain. Japanese benchmarks’ advance following the GDP report was led by financial stocks that rose on renewed expectations for Bank of Japan rate hikes. Stocks climbed in Taiwan and fell in Singapore, while South Korean markets were closed for a holiday. Chinese shares listed in Hong Kong were a notable drag on the region Friday after data showed disappointing factory activity and retail sales in July, suggesting US President Donald Trump’s trade war is starting to weigh on the economy. Hong Kong stocks are still outperforming most regional markets year to date. Here Are the Most Notable Movers

In FX, the Bloomberg Dollar Spot Index is down 0.3%, while the yen leads G-10 peers with a 0.7% gain, taking USD/JPY below 147.

In rates, treasuries are steady, with 10-year yields flat at 4.28%. US long-end yields are about 1bp cheaper with shorter maturities little changed, steepening 2s10s and 5s30s curves slightly; German 30-year reached a new 14-year high. European government bonds edge lower.

In commodities, brent crude drops 0.7% to about $66.40 a barrel, and European natural gas futures fall 1.1% toward the lowest level this year. Spot gold adds $9, and Bitcoin climbs 1% toward $119,000.

Today's economic data slate includes July retail sales and import/export price indexes and August Empire manufacturing (8:30am New York time), July industrial production (9:15am), June business inventories and August preliminary University of Michigan sentiment (10am) and June TIC flows (4pm). Fed speaker slate includes Goolsbee on CNBC (8:30am)

Market summary

Top Overnight News

China’s economic momentum cools in Jul, with retail sales rising 3.7% Y/Y (down from 4.8% in June and below the Street’s 4.6% forecast) and industrial production advancing 5.7% (down from 6.8% in June and below the Street’s 6% forecast). WSJ

China has told foreign companies not to hoard rare earths as fears about Beijing’s export curbs drive up demand for the metals vital in a range of critical technologies. Beijing is warning buyers that they are at risk of greater supply restrictions if they stockpile rare earths and derived products such as magnets used in electric motors. FT

Japan's economy grew much faster than expected in the second quarter as export volumes held up well against new U.S. tariffs, giving the central bank some of the conditions it needs to resume interest rate hikes this year. GDP rose 1.0% on an annualized basis, government data showed on Friday, marking the fifth straight quarter of expansion after the previous quarter's contraction was revised to growth. RTRS

Donald Trump will meet with Vladimir Putin at 11 a.m. local time in Alaska for their first summit in seven years. The two will measure success on very different terms: Trump wants a Ukraine ceasefire, while for Russia’s leader, the meeting on US soil alone marks a win. BBG

London is bearing the brunt of the UK’s jobs slowdown. One in four of all job losses since October came from the capital due to tax rises, elevated wage costs and weak consumer spending. BBG

Berkshire bought a $1.6 billion stake in UnitedHealth last quarter, sending the stock climbing premarket (UNH +12% in the pre). It exited T-Mobile and cut its Apple interest by 20 million shares, though it remains Berkshire’s top holding. BBG

With both the producer price index and the consumer price index still showing accelerations, consumers may be wondering why the price of goods across the board isn’t increasing more. But logistics experts are warning that those higher prices are currently hiding in “the middle mile,” otherwise known as warehouses and distribution centers, and are yet to come. CNBC

US shale producers are idling drilling rigs and holding back spending as they shelter from an Opec-induced price slump that is likely to send American output sharply lower. FT

The Trump administration will likely shed around 300,000 workers this year, its new human resources chief said on Thursday, which would amount to a 12.5% decrease in the federal workforce since January. RTRS

Alaska Summit

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks predominantly traded in the green after the region mostly shrugged off the indecisive performance seen on Wall St in the aftermath of the much hotter-than-expected PPI report, although the upside was capped overnight amid disappointing Chinese activity data and as participants await the Trump-Putin meeting on Friday. ASX 200 extended on record highs with the advances led by outperformance in mining, energy and the utilities sectors. Nikkei 225 rallied above the 43,000 level with sentiment lifted following stronger-than-expected Japanese GDP data. Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark dragged lower by losses in tech as JD.com's shares were pressured following a drop in its earnings, while the mainland ultimately weathered the miss on Chinese activity data which showed retail sales fell short of the most pessimistic of analyst forecasts.

Top Asian News

European bourses began with gains, Euro Stoxx 50 +0.4%; with the STOXX 600 and Euro Stoxx 50 both set for a second straight week of advances. Follows a mixed Wall St. finish and a mostly higher APAC handover, as China was strong despite domestic data underwhelming for July and the Nikkei 225 was bolstered by Japanese GDP; though, the Hang Seng succumbed after JD.com earnings. In Europe, sectors have a positive bias with Basic Resources, Chemicals, and Autos leading; the latter support by the Volkswagen–Xpeng partnership expansion. Utilities hit by Fortum (-2.5%) numbers while Luxury has been tarnished by Chinese retail sales and Pandora (-12%) missing Q2 expectations.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Today is my last day before a couple of weeks of holiday, also known as two weeks of shouting at children. Henry and Peter will have everything under complete control while I'm away, unlike me with my family. See you in a couple of weeks.

Markets and US inflation data yesterday were in many ways a mirror image of that seen on Wednesday, with Treasury yields spiking (10yr +5.1bps) after the US Producer Price Index (PPI) reading came in well above expectations, though the S&P 500 (+0.03%) managed to recover to eke out a third consecutive record high. Both headline and core producer prices saw their largest monthly increases since March 2022—back when inflation was surging and the Federal Reserve pivoted sharply to a more hawkish stance. This hotter-than-expected print suggests that a September rate cut is far from guaranteed, especially amid growing signs that companies are passing tariff costs on to consumers.

Headline PPI rose by +0.9% month-on-month (vs. +0.2% expected), pushing the year-on-year figure to +3.3% (vs. +2.5% expected). The surprise was significant enough to exceed every economist’s forecast on Bloomberg, marking the biggest miss relative to the median estimate since April 2021. Core PPI, which excludes food, energy, and trade services, also surprised to the upside at +0.6% for the month (vs. +0.2% expected), lifting the annual rate to +2.8% (vs. +2.5% expected). As a partial counterbalance, the PPI components that feed into core PCE—typically the key takeaway from the print — weren’t as worrying, with our US economists tracking a modest uptick from +0.26% to +0.29% for the July core PCE print.

Still, the concern is that the July PPI print could signal the beginning of a more sustained period of elevated inflation, particularly as higher tariffs continue to be passed through to consumers. While July’s CPI wasn’t as strong—suggesting businesses may be absorbing some of the costs—the sharp rise in producer prices raises questions about whether more of these costs will eventually reach consumers. Notably, the July report doesn’t reflect the new tariffs imposed on August 7, including a 35% rate on Canadian goods, 25% on India and 15% on the EU, Japan and Korea. Given the volatility in tariff rates, many businesses have delayed repricing, meaning the full impact may not be immediate.

The PPI release prompted a notable shift in market sentiment. Pricing had been leaning clearly towards a September rate cut and a swift pace of easing thereafter. However, the data led to a reassessment, with the implied pricing of a cut at the September meeting falling by -3.4bps to 23.3bps. While a 25bp cut is still seen as likely, it’s no longer fully priced in. Federal Reserve officials echoed this caution, pushing back against Treasury Secretary Bessent’s suggestion on Wednesday of a 50bp cut in September. St. Louis Fed President Musalem stated it was “too early to say exactly what policy I will be able to support” in September, and noted that a 50bp cut would be “unsupported by the current state of the economy and the outlook.” Similarly, San Francisco Fed President Daly told the Wall Street Journal she didn’t see the need for a 50bp cut either.

The backdrop of higher inflation and reduced expectations for rate cuts pushed Treasury yields higher across the curve. The 2-year yield rose by +5.7bps to 3.73%, while the 10-year yield climbed +5.1bps to 4.29%, closely mirroring the moves in the opposite direction seen after the CPI release. Higher yields also supported the dollar index, which gained +0.38% after two days of declines. The momentum was further boosted by weekly jobless claims, with initial claims steady at 224k for the week ending August 9 (vs. 225k expected). Continuing claims fell to 1.953m (vs. 1.967m expected), reinforcing the view that the labour market remains resilient.

The backdrop also proved a tougher one for equities, though the S&P 500 managed to recover from a -0.4% drop at the open to close +0.03% higher. However, the overall mood was cautious, with over 70% of the index constituents losing ground and the equal-weighted version of the S&P falling -0.65%. The small-cap Russell 2000 dropped -1.24%, reversing most of its post-CPI rally of +1.98%. Measures of financial stress edged higher, with the VIX volatility index rising +0.34pts from its 2025 low. The Mag-7 were a notable exception, gaining +0.42%, led by Amazon’s +2.86% advance, while Intel jumped by +7.38% on reports that the US government was in talks to potentially take a stake in the company.

Looking ahead, the key event today is the Trump-Putin summit in Alaska, where the two leaders are expected to discuss Ukraine. The meeting is scheduled for 8:30pm London time, so any developments may emerge after US markets close. In a Fox News Radio interview, Trump estimated a 25% chance of the meeting being unsuccessful but suggested it could pave the way for a second meeting involving Ukrainian President Zelensky. He described this potential follow-up as “very, very important,” indicating it could be the forum for striking a deal. Our Peter Sidorov notes that while an imminent breakthrough is unlikely, the summit will still be an important signpost for US-Russia relations and the war in Ukraine.

In Europe, equities performed strongly, with the STOXX 600 rising +0.55% to its highest level in nearly three months. The UK’s FTSE 100 gained +0.13% to a fresh record, while Italy’s FTSE MIB (+1.11%) and Spain’s IBEX 35 (+1.24%) reached post-2007 highs. Sovereign bonds sold off in tandem with US Treasuries, with 10-year bunds, OATs, and BTPs seeing yields rise by between +3.2bps and +4.0bps. UK gilts underperformed, with yields up +5.0bps following a stronger-than-expected Q2 GDP print of +0.3% (vs. +0.1% expected). This dampened expectations for another Bank of England rate cut this year, with the probability of a December cut falling to 60% from 67% the previous day.

Asian markets are mostly higher this morning, led by the Nikkei (+1.43%), driven by a better-than-expected annualised QoQ GDP of +1.0% (vs. +0.3% expected) with decent upward revisions to Q1. Although positive our Japan economist reviews the data and notes that the 1st reading is often very inaccurate so it's hard to read too much into it at this stage. 10yr JGBs are up a couple of basis points this morning but that could be more catching up with yesterday's global move.

In China, YoY retail sales and industrial production figures came in below expectations at 3.7% (vs. 4.6% expected) and 5.7% (vs. 6.0% expected), respectively. New home prices and fixed asset investment also missed on the downside. Despite this, markets are trading higher, with the CSI (+0.47%) and Shanghai Composite (+0.48%) up. The S&P/ASX200 (+0.42%) is also climbing. Meanwhile, the Hang Seng (-1.21%) is the biggest underperformer of the session. South Korea is closed for a public holiday today. S&P (+0.20%) futures are outperforming the Nasdaq (+0.05%) equivalent.

For the day ahead, aside from the Trump-Putin summit, attention will turn to US retail sales and industrial production data for July, as well as the University of Michigan’s preliminary consumer sentiment index for August.