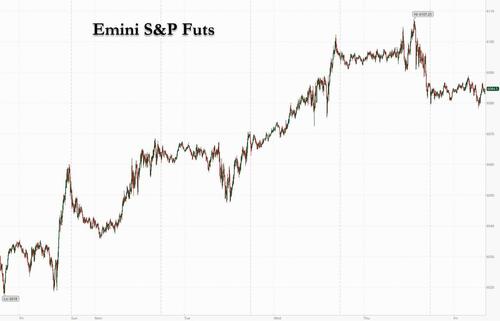

Futures are flat ahead of what Goldman called "the most important remaining macro report of 2024", the November jobs report, which will directly determine if the Fed cuts rates in two weeks. S&P futures were down 0.1% at 8:00am ET, flatlining in a quiet overnight session; Nasdaq 100 futures were fractionally in the green even as Mag 7 stocks are a touch lower this morning. China's CSI/HIS rallied, along with European Luxury/Autos names. Modest gains in the dollar put the greenback on course to rise for the ninth week out of the last 10. Treasury yields ticked higher by 1-3bps across the curve. Commodities are mostly lower for both oil and base metals; oil extended its slide to a third day. Bitcoin pulled back from its record high, after briefly tumbling as much as 7% before erasing most of the losses. Trump tapped prominent venture capitalist David Sacks as his crypto and AI guy and also picked David Perdue (former CEO of DG with excessive business experience in Asia) to be Ambassador to China last night; Today, all eyes on NFP (preview here): the Street’s estimate is for a 220k print, up sharply from 12k jobs in October, temporarily low due to hurricanes and strikes. For the unemployment rate the Street’s estimate is 4.1%.

In premarket trading, Lululemon surged 9% after the company edged up its full-year outlook on strong sales overseas, a sign the upscale activewear brand is fending off upstart competitors and navigating slower growth in consumer spending. Ulta Beauty jumped 11% after the cosmetics retailer increased its annual projections. Smith & Wesson Brands tumbled 13% after 2Q results at the gunmaker came in weaker than expected. Here are other notable premarket movers:

Today's jobs report will determine whether the S&P 500 can build on its 27% rally this year. Excitement around artificial intelligence and optimism that President-elect Donald Trump’s policies will boost US markets have propelled the benchmark toward its best year since 2019. Economists estimate that US nonfarm payrolls rose by 220,000 in November as hiring rebounded from weather-related and strike disruptions (preview here). It’s the final payrolls report before the Fed’s next interest-rate decision, with swaps trading putting the odds of a quarter-point reduction later this month at around 65%.

“If we get a surprisingly hot number, you can expect pricing to come back more to 50-50,” said Michael Brown, a senior strategist at Pepperstone. “Given the time of the year, market volumes are lighter than usual, so you are more likely to see an outsize reaction — and that’s another reason for people to sit on their hands.”

The S&P 500’s price-to-book ratio has surged to 5.3 times in 2024, approaching a peak of 5.5 hit in March 2000 during the height of the technology bubble, according to data compiled by Bloomberg. BofA’s Hartnett said there’s a high risk of “overshoot” in early 2025 if the S&P 500 nears 6,666 points — about 10% above current levels. He also warned that the rally in US stocks as well as cryptocurrencies has left the asset classes looking frothy.

Meanwhile in Europe, France’s week of political tumult was set to end positively in markets. The nation’s bonds outperformed euro-area peers after National Rally leader Marine Le Pen told Bloomberg News a budget could be delivered within weeks. The euro was steady. As for European stocks, they rose again after six straight sessions of gains, led by a 1.4% gain in the CAC 40 as French President Macron meets with key politicians in an effort to cobble together a new administration. Swedish online pharmacy Apotea steals the spotlight, suriging over 50% in its stock-market debut. Meanwhile, Puig Brands fell to its lowest since IPO earlier this year. Here are the biggest movers Friday:

Earlier in the session, Asian stocks was little changed, as Korean equities extended declines on political uncertainty, while Chinese shares climbed ahead of a key policy meeting. The MSCI Asia Pacific Index erased a loss of as much as 0.5% and swung in a narrow range. Chipmakers TSMC and SK Hynix were among the biggest drags on the measure after the rally in tech shares halted on Wall Street overnight. Chinese megacaps Tencent and Alibaba were among the largest boosts to the regional gauge. South Korea’s Kospi fell 0.6% to close at its lowest level in three weeks. The nation’s ruling party leader called for swift suspension of the president’s duties, while local media reported speculation on a possible second order of martial law. Military officials said there’s no need to worry about a possible second martial law decree. Hong Kong and mainland China stocks strongly rebounded from Thursday’s loss, with traders looking to next week’s Central Economic Work Conference for more details on stimulus. Japanese and Australian equities tracked US peers lower. Stocks in India were steady after the central bank kept borrowing rates unchanged but eased the cash reserve ratio requirement.

In FX, the euro is little changed but is still one of the better performing G-10 currencies. The yen drops 0.4% while the kiwi is the weakest of the G-10’s. The Bloomberg Dollar Spot Index is up 0.1%.

In rates, treasuries are flat ahead of the US jobs report, with US 10-year yields unchanged at 4.18%. Treasuries extended Thursday’s curve-flattening move. Front-end yields are 1bp-2bp cheaper on the day with long-end slightly richer, amid similar price action in core European bonds. French bonds outperform after National Rally leader Marine Le Pen said Thursday that a budget could be delivered in weeks. US session includes November jobs report at 8:30am New York time and four scheduled Fed speakers ahead of self-imposed quiet period beginning Saturday.

In commodities, oil added to its declines on concerns that OPEC+’s decision to push back the revival of halted production won’t prevent a surplus forming next year. WTI fell 0.5% to $67.90 a barrel. Spot gold rises $5 to $2,637/oz. Bitcoin falls 1%, having failed to sustain a break above $100,000.

Looking at today's calendar, we get the November jobs report (8:30am), December preliminary University of Michigan sentiment (10am) and October consumer credit (3pm). Fed speaker slate includes Bowman (9:15am), Goolsbee (10:30am), Hammack (12pm) and Daly (1pm)

Market Snapshot

Top Overnight News

A more detailed look at markets courtesy of Newsquawk

APAC stocks were mixed with some cautiousness in the region after the weak lead from Wall St and ahead of the key US jobs data. ASX 200 was dragged lower by early underperformance in tech and healthcare, while gold miners also suffered after initial declines in the precious metal. Nikkei 225 was the laggard and briefly fell beneath the 39,000 level despite encouraging Household Spending data. Hang Seng and Shanghai Comp were buoyed despite the lack of any major fresh catalysts heading into next week's trade and inflation data releases, as well as the Central Economic Work Conference where Chinese leaders are said to discuss economic growth and stimulus.

Top Asian News

Mixed performance thus far from Europe following a flat open amidst a lack of fresh pertinent catalysts and in the run-up to the US jobs report later today which will help shape expectations for near-term Fed policy. European Sectors are mixed with no clear bias or theme, with the breadth of the market narrow at the open before gradually widening. In terms of majors, CAC 40 narrowly outperforms in the aftermath of the French political developments as President Macron looks to name a new PM within days, with French Banks once again seeing a strong performance. Furthermore, luxury stocks see upside amid a possible China play in the run-up to the Chinese Central Economic Work Conference next week. US equity futures see flat trade across the board but with a mild downward bias in the RTY in a continuation of its recent underperformance, with traders awaiting the latest US jobs report.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Just two weeks now until most people's Xmas vacation start and one of my 7-year old twins last night declared for the first time that he didn't think Santa was real which means the only holdouts in the family now thinking Santa is real are his identical brother and Brontë the dog. The end of the innocence is nearer in our family.

Just when you thought it was safe to relax into Christmas, along comes US payrolls today to keep you on your toes, especially with an upcoming close call as to whether the Fed cuts in 12 days time. Futures are currently pricing in a 70% probability that they will.

The Santa Claus rally we've seen over the last few weeks took a little breather last night in the US ahead of the data today. The S&P 500 (-0.19%) just missed out on 12 days of gains in the last 13 sessions, which would have been the first such run since 2013. However a more recent run continued in Europe yesterday as the STOXX 600 (+0.40%) was up for a 6th consecutive session.

As a background to today's report, last month underwhelmed, with nonfarm payrolls printing at just +12k, which was the weakest since December 2020 when the pandemic was still buffeting the economy. Private payrolls were at -28k, the first negative print since December 2020. But those numbers were impacted by strike action, whilst Hurricane Milton also hit Florida during the survey reference period. Our US economists expect a decent bounce back to +215k today. That would leave the unemployment rate unchanged at 4.1%, and they also see average hourly earnings growth at +0.3%.

Moving back across the Atlantic, France continues to serve up an abundance of headlines. Michel Barnier has now officially resigned, but will be staying on until a new Prime Minister is appointed. President Macron, in a televised speech last night, reiterated his plan to remain President for the remainder of his term until 2027 and said he would appoint a new PM in the “coming days.” Macron criticised both political flanks, saying that far-left and far-right legislators tried to provoke an early presidential election, before stating that the new government’s priority will be approving a budget. There is a concern amongst some lawmakers that the special stopgap emergency powers could lead to higher taxes for millions of families, however Le Pen called the stopgap legislation better than former PM Barnier’s plan.

Before Macron’s evening speech, markets became increasingly relaxed about France’s debt risk, with the Franco-German 10yr spread tightening a further -5.7bps tighter yesterday to 77.8bps. That came as Marine Le Pen gave a surprise Bloomberg interview, which was taken constructively by investors, as she said that France could pass a budget in “a matter of weeks” if the next PM was prepared to cut the deficit at a slower pace. So that suggestion of a compromise helped spreads to tighten, and the move yesterday was actually the biggest daily decline in the spread since July right after the first round of the legislative election.

For more information, Henry wrote a note here on why this is a long way from the sovereign debt crisis. One particular difference is we’ve not seen any signs of contagion from France to other countries, and only yesterday both the Italian and the Spanish 10yr spreads over bunds reached their tightest level in 3 years, at 108.7bps and 65.5bps respectively.

In response to the more stable politics, European equities had a decent session yesterday but the French market didn't out-perform as with their Government debt. Nevertheless, the STOXX 600 (+0.40%), the CAC 40 (+0.37%) and the DAX (+0.63%) all advanced for a 6th consecutive session with the DAX hitting a fresh record high.

The S&P 500 oscillated between gains and losses before ultimately closing -0.19% lower. That said, there was quite a divergence between mega caps and small caps, as the Magnificent 7 (+0.38%) moved up to another record, whilst the small-cap Russell 2000 fell -1.25%. Treasury curves flattened as the 2yr yield was +1.8bps up to 4.144%, whilst the 10yr yield (-0.04bps) was broadly flat at 4.176%. Later on, Richmond Fed President Barkin spoke to the potential inflationary pressures of the Trump administration’s tariff plan, saying that tariffs are an "inflationary pressure," and that the overall impact depends on how consumers, corporates and the Fed all deal with them. He also noted that consumers have started pushing back on higher prices, and demand may not stay as strong if prices continue to climb. We’ll hear from a few more Fed speakers today after the jobs report, and bear in mind that it’s the last opportunity for them to speak ahead of their pre-meeting blackout period.

In terms of data yesterday, the weekly initial jobless claims were a bit worse than expected. They ticked up to a 6-week high of 224k (vs. 215k expected) in the week ending November 30, which slightly pushed up the 4-week average to 218.25k. The rise wasn’t particularly big, and the continuing claims for the previous week came down, so it wasn’t a one-sided picture.

Asian equity markets are mostly trading lower outside of China this morning. The Nikkei (-0.88%) is leading losses with the KOSPI (-0.37%) also lower but both well off their lows. Chinese stocks are outperforming with the Hang Seng (+1.34%) and the Shanghai Composite (+1.01%) strong ahead of a key Chinese economic meeting next week. S&P 500 (-0.10%) and NASDAQ 100 (-0.01%) futures are just on the wrong side of flat.

Early morning data showed that Japan’s household spending contracted in October for the third straight month, falling -1.3% y/y (but better than the -2.5% expected) as against a -1.1% drop the previous month. Separately, Base pay for full-time workers increased by +2.8% in October from a year ago, the biggest gain for comparable data back to 1994.

To the day ahead now, and the main data highlight will be the US jobs report for November, but we’ll also get the University of Michigan’s preliminary consumer sentiment index for December, and German industrial production for October. From central banks, we’ll hear from the Fed’s Bowman, Goolsbee, Hammack and Daly.