US stocks are set for a quiet finish to a busy week in which the Fed's first step in what will be a series of rapid interest rate cuts propelled markets to fresh highs. After all four major indexes - DJIA, SPX, Nasdaq and Russel - closed at a record high for the first time since November 2021, futures are flat this morning, with the S&P unchanged and Nasdaq up 0.1%, as Mag 7 stocks are mostly higher led by the +1.1% and +0.7% in TSLA and AAPL. Overnight the BOJ spooked risk assets when it kept rates as expected but surprised markets by announced a 330BN yen annual sale of its massive ETF holdings. The yield on 10-year Treasuries climbed three basis point to 4.13% after yesterday's sharp move higher, which helped the dollar rise for a third day. Commodities are mixed: oil is lower, while previous metals/ags are both higher this morning. Today sees a much-anticipated call between Xi and Trump at 9am New York, with TikTok and trade likely on the agenda.

In premarket trading, Mag 7 stocks are mostly higher, with NVDA the sole laggard. Tesla (TSLA) climbs 0.6% as Baird upgrades the electric-car maker to outperform, noting that the company is increasingly viewed as the leader in physical AI (Nvidia -0.2%, Alphabet +0.1%, Microsoft +0.1%, Apple +0.9%, Amazon +0.4%, Meta +0.2%).

In corporate news, Apple is rolling out several new iPhone designs with the iPhone 17 Pro, Pro Max and iPhone Air going on sale Friday. Jefferies has approved a proposal by SMFG to raise its ownership to about 20% from 15% as their partnership deepens. OpenAI is being probed over risks to teen safety after a senate hearing. Nvidia plans to invest £2 billion ($2.7 billion) to support the UK’s AI industry in partnership with several VC firms

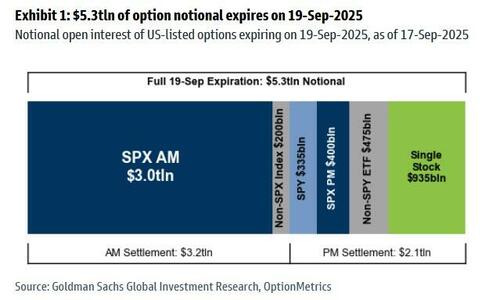

Today is record, for September, quad-witching Friday with over $5.3 trillion of notional options exposure set to expire including $3.0 trillion of SPX options and $935 billion notional of single stock options

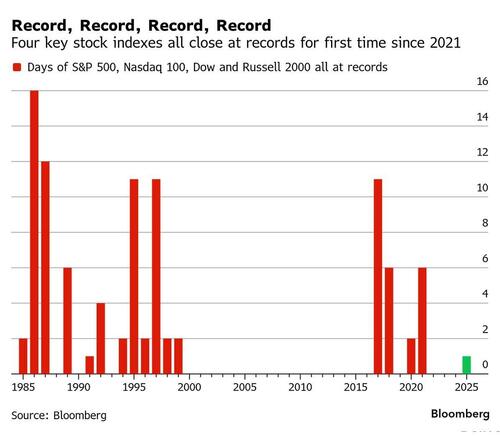

Thursday’s price action saw the S&P 500 Index, the Nasdaq 100, the Dow Jones Industrial Average and the Russell 2000 all close at all-time highs - a rare occurrence seen on just 25 other days this century, data compiled by Bloomberg show.

The bullish momentum has defied seasonal headwinds as strategists lift their outlook for the year; indeed, not even Friday’s $5 trillion quarterly triple-witching options expiry is expected to drive volatility - at least not immediately - with traders focusing rather on the next nonfarm payrolls report for bigger moves.

Despite rising risks and record valuations, FOMO keeps pushing the market higher in what is typically a bearish month. The S&P 500 has gained 2.7% so far in September, hitting fresh record highs on brisk volumes, with small and mid-caps notably outperforming as they play catch up to Big Tech. The prevailing narrative is that the Fed is cutting into a soft landing, a scenario seen as very bullish for stocks. That outlook will be tested when focus again turns to employment data.

Investors still see plenty to keep equities climbing after a stellar rally, with looser policy adding to the buoyant mood from upbeat earnings and a resilient economy. Fed Bank of Minneapolis President Neel Kashkari, a prominent dove, said Friday he supported this week’s rate decision and penciled in two additional cuts this year.

“It’s clear the Fed is willing to support growth and the jobs markets, versus caring too much about inflation, though we have to see how that translates into the economy,” said Andrea Gabellone, head of global equities at KBC Global Services. “Financial conditions are now easier.”

Both global and US equity funds enjoyed their biggest week of inflows since December, according to BofA's Michael Hartnett citing EPFR Global data. That said, sentiment could reverse if earnings from AI companies end up being disappointing; these pose a bigger risk to the tech-driven global stock rally than ongoing geopolitical tensions, according to JPMorgan Asset Management. Ray Dalio warned that the US is unable to cut back on runaway spending that is risking monetary order.

In Europe, the Stoxx 600 is little changed, erasing a gain, with autos the top sub-sector after Stellantis NV was upgraded at Berenberg and auto supplier Aumovio was listed on the Frankfurt Stock Exchange on Thursday. Man Group rises as much as 5.4% after an upgrade from UBS. Here are some of the biggest European movers today:

The pound and long-end gilts slide after the UK’s budget deficit blew past forecasts, intensifying fiscal fears. Sterling falls around 0.5% and is the worst performer in the G-10. UK 30-year yields rise as much as five basis points before paring. European bonds and Treasuries are falling too.

Earlier in the session, Asian equities wiped out earlier gains to fall on Friday, as investor sentiment weakened following the Bank of Japan’s plan to offload its exchange-traded fund holdings. The MSCI Asia Pacific Index fell as much as 0.5%, with TSMC, Sony Group and MediaTek among the biggest drags. Equities in Japan dropped following the BOJ’s decision to leave the interest rate unchanged and announcement of the plan to sell its stockpile of ETFs valued at more than 75 trillion yen. Stock benchmarks in South Korea and Taiwan also fell, while those in the Philippines and Australia edged higher. The ETF sales announcement “led to worsening sentiment, on expectation that selling pressure will rise particularly among large-cap tech stocks where the BOJ holds a high ownership ratio,” said Hiroki Takei, a strategist at Resona Holdings Inc. “In addition, with two policy board members voting against holding rates, speculation about a rate hike has quickly emerged, further weighing on the market.” Despite Friday’s decline, MSCI’s regional benchmark was still on track for a third consecutive weekly gain — the longest streak since May — supported by optimism around the tech sector outlook and hopes for easing trade tensions.

In FX, the dollar rose 0.2%, setting it on course for its longest winning streak since July and extending a rebound from a 2022 low. The pound and long-end gilts slide after the UK’s budget deficit blew past forecasts, intensifying fiscal fears. Sterling falls around 0.5% and is the worst performer in the G-10. UK 30-year yields rise as much as five basis points before paring.

In rates, Japanese two-year yields hit the highest since 2008 after the Bank of Japan’s ETF sales plan and rate hold in a contested vote. Gold is higher by about $12 to $3,655/oz. European bonds and Treasuries are falling too. Treasury yields cheaper by 1bp to 2bps across the curve with spreads trading broadly within a basis point of Thursday’s close. US 10-year yields trade around 4.125% with bunds and gilts trading broadly inline. On the UK curve, long-end yields underperform, steepening the UK curve following the borrowing overshoot

In commodities, oil prices are falling, with Brent slipping below $67 and crude’s weekly gain on a knife-edge.

US economic data slate empty for the session. Fed speakers scheduled include Miran (11 a.m. and 4 p.m.), Daly (2:30 p.m.).

Market Snapshot

Top Overnight News

Tariffs/Trade

BOJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as the region only partially sustained the momentum from Wall St, where the S&P 500, DJIA and NDX climbed to fresh record highs as risk sentiment was supported by encouraging data, while participants digested a surprise announcement by the BoJ to begin selling its ETF and J-REIT holdings. ASX 200 climbed higher with a couple of the defensive sectors leading the advances and with most industries in the green aside from telecoms. Nikkei 225 rallied at the open after the latest CPI data mostly matched estimates but softened from the previous, although the index has slightly pulled back from all-time highs with some jitters seen as participants awaited the 'delayed' BoJ announcement, while downside accelerated after the BoJ decided to begin selling ETF and J-REIT holdings. Hang Seng and Shanghai Comp were rangebound amid tentativeness ahead of the scheduled Trump-Xi call and with ongoing trade-related uncertainty, while the US House Select Committee on the CCP urged action in a letter to US President Trump in response to China's weaponisation of critical minerals supply chains.

Top Asian News

European bourses (STOXX 600 +0.3%) are mostly firmer; outperformers in Europe today include the CAC 40 and FTSE MIB, whilst the AEX (pressured by a pullback in Tech names) and the FTSE 100 (UK assets shunned today) underperform. European sectors hold a slight positive bias, with only a few industries found in negative territory. Autos takes the top spot today, with gains driven by upside in Stellantis (+4.5%) which benefits from a broker upgrade at Berenberg. The Construction & Materials sector follows behind, and is buoyed by strength in Vinci (+1%) after the Co. received a EUR 885mln contract related to Rail Baltica Electrification. Tech is very marginally lower, seemingly scaling back some of the significant upside seen in the prior session after the IT sector surged more than 5.6% in the prior session. Much of Thursday’s upside was driven by ASML (-0.5%), which received a PT upgrade at BofA following the NVIDIA-Intel partnership

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event calendar

Fed Speakers

DB's Jim Reid concludes the overnight wrap