US equity futures are flat as the market struggled for traction ahead of today's core PCE report and as investors ponder the Fed's next policy move following a raft of much stronger than expected US data. As of 8:00am, S&P futures are unchanged while Nasdaq futures drop 0.1% leaving stocks poised to extend their recent run of losses once the cash market reopens; in premarket trading Mag 7 names are mixed with NVDA (-0.8%) being the largest underperformer. Bond yields are also flat as is the USD which set for its biggest weekly advance since the start of August. Brent crude reversed an earlier drop and was trading at session highs not far from $70. Overnight, the biggest headline was a series of 232 tariffs announced by Trump, including 100% on branded pharma, 50% on housing products, 30% on furniture and 25% on heavy trucks, which sent truckmaker PACCAR up more than 5%, while shares in several European peers dropped. However, the details on the pharma tariff suggest easier conditions on the exemptions. WSJ also released an article suggesting the possible chips tariff from the White House to boost domestic production. Today's economic data slate includes August personal income and spending, the PCE price index (8:30am), the final U. of Michigan sentiment and inflation expectations (10am), Kansas City Fed services activity and Bloomberg US economic survey (11am).

In premarket trading, Mag 7 stocks are mixed (Amazon +0.3%, Microsoft +0.5%, Alphabet +0.3%, Meta Platforms -0.08%, Apple -0.9%, Tesla +0.4%, Nvidia -0.5%).

After a $15 trillion rebound in global equities from April’s lows, traders now face a wall of uncertainty as tariff headlines return to unsettle markets and investors fret about inflated valuations for big tech companies. Fed policy, the upcoming earnings season, and the threat of a US government shutdown are also weighing on sentiment. Attention now turns to Friday’s inflation report and key monthly jobs data next week.

“Excitement on AI and Fed rate cuts turbo-charged the bull market and sent global and US equities to new highs,” Barclays Plc strategists led by Emmanuel Cau wrote in a note. “But with much of the Goldilocks narrative arguably in the price now, and positioning higher, investor fatigue is palpable as we hit an air pocket ahead of next week’s non-farm payrolls report and third-quarter earnings.”

There shouldn't be any big surprises in today's core PCE print: economists are predicting core PCE rose 2.9% y/y in August, the same pace as the previous month. Goldman estimates that "both personal income and personal spending increased by 0.4% in August. We estimate that the core PCE price index rose 0.21% in August, corresponding to a year-over-year rate of +2.92%. Additionally, we expect that the headline PCE price index increased 0.25% in August, or increased 2.72% from a year earlier."

Truckmaker PACCAR Inc. climbed more than 5% in premarket trading after President Donald Trump levied new tariffs on imports of heavy vehicles. Shares in several European peers dropped. However, market expectations for the real-world impact of a 100% product-based drug tariff remain low, given the large spending commitments already made by large-cap pharma over the next five years (AZN $50 bn, ROG $50 bn, GSK $30 bn, NOVN $23 bn, UCB $2 bn, SAN $20 bn). In some respects, this could be seen as a positive if there is a line in the sand over Section 232, particularly given the exemptions many products could see.

Europe's Stoxx Europe 600 index edged higher by 0.3% as investors look past President Trump’s latest tariff announcements (including a 100% duty on branded or patented pharmaceuticals starting Oct. 1), but is still set for back-to-back weekly declines for the first time since June. Daimler Truck Holdings AG and Volkswagen AG’s Traton SE declined, while Sweden’s Volvo AB, which manufactures trucks in the US, gained. Healthcare stocks underperformed following new US duties on pharmaceutical products. Here are the biggest movers Friday:

Asian stocks fell, with a key regional benchmark falling by the most in over three weeks, as chipmakers and Chinese tech shares pulled back after recent gains. The MSCI Asia Pacific Index fell 1%, with TSMC, Xiaomi and Alibaba among the biggest drags. Equities declined in South Korea, Hong Kong, mainland China, Taiwan and India. Health-care stocks slipped after US President Donald Trump unveiled 100% tariffs on branded or patented pharmaceutical products effective from Oct. 1. A gauge of Asian tech hardware stocks followed US peers lower amid valuation concerns after recent rallies. Korea’s Kospi fell more than 2%, the most in nearly two months, as foreigners sold chip shares. The Hang Seng Tech Index dropped by a similar measure, its worst decline since May. India’s Nifty 50 declined for a sixth-straight session, poised for its longest losing streak since March.

In FX, the Bloomberg Dollar Spot Index falls 0.1% with muted price action across the G-10 complex. The dollar is on track for its best week since early August as a run of data showing resilience in the US economy forced traders to reassess the Federal Reserve’s scope for cuts

In rates, treasuries are a touch stronger with yields richer on the day, although remain within a basis point of Thursday’s close, after trading in a narrow range overnight with modest selling flows in the long end. Treasury 10-year yields remain near Thursday’s closing levels, trading at around 4.17% with European bonds slightly firmer over the early London session. European government bonds edge higher.

In commodities, WTI crude futures are little changed near $65 a barrel. Gold is unchanged around $3,748/oz. Bitcoin is flat around $109,000.

Looking at today's calendar, US economic data slate includes August personal income and spending, the PCE price index (8:30am) U. of Michigan sentiment and inflation expectations (10am), Kansas City Fed services activity and Bloomberg US economic survey (11am). Fed speaker slate includes Barkin at 9am, delivering keynote remarks on the outlook for the economy, followed by a Q&A. Bowman at 1pm discussing the monetary policy with Q&A.

Market Snapshot

Top Overnight News

Trade/Tariffs

US-China

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly lower after being subdued for a bulk of the session following a similar performance stateside after hot US data, with traders now looking ahead to the Fed's preferred gauge of inflation. Sentiment in the region was hampered by US President Trump announcing tariffs of 100% on pharmaceuticals, 50% on kitchen cabinets, bathroom vanities and associated products, 30% on upholstered furniture, and 25% on all heavy trucks made outside the US. ASX 200 eventually eked out mild gains, but the healthcare sector was the biggest laggard after Trump’s 100% tariff announcement on pharmaceuticals. Tech also weakened, though losses were cushioned by outperformance in metals and mining. Nikkei 225 was modestly softer but held above the 45,500 level after briefly dipping below, with pharma stocks weighing following Trump’s tariff announcement, and with little follow-through from softer-than-expected but prior-matching Tokyo CPI data. Hang Seng and Shanghai Comp largely conformed to regional losses, with little follow-through from Trump signing the executive order on TikTok, in which he also noted he had good talks with Chinese President Xi, although the Mainland later oscillated on either side of the unchanged mark. KOSPI was the regional laggard, heavily pressured by the tech sector and pharma, whilst reports also suggested South Korea fired warning shots at a North Korean commercial vessel for crossing the maritime border, according to Yonhap. Nifty 50 was also subdued with the nation's pharma stocks pressured after President Trump's tariff announcement.

Top Asian News

European bourses (STOXX 600 +0.2%) are modestly firmer across the board and have traded with a slight upward bias throughout the morning. The region has seemingly shrugged off the latest barrage of tariff levies announced by Trump, but with some analysts suggesting that the pharma-specific ones are not as bad as feared. European sectors hold a strong positive bias, with only a couple of sectors marginally lower. Most of the focus this morning has been on the latest Trump tariffs, where he announced 100% tariffs on Pharma, 50% on kitchen cabinets, and 25% on heavy trucks.”; for the latter, Daimler Truck (-2.5%) moves lower, whilst Volvo (+3%) remains in the green. Bernstein writes that Daimler Truck could be most affected by these tariffs, given its high exposure to the US; analysts add that Paccar (+5% pre-market) stands to benefit the most. Delving into the pharma tariffs, some analysts have suggested the announcement may actually provide some relief for traders; focus is on the caveat that a Co. will not be subject to the tariff rate if they are building a pharma plant in the US. So, whilst the sector was initially underperforming, some heavyweights have managed to climb out of negative territory – namely those which have already announced plans for plants in the US; Roche (+0.2%), AstraZeneca (U/C). Jefferies writes that “overall, we think this is a win for Pharma and shouldn't have a material impact”. In US pre-market trade, the likes of Eli Lilly (+1.7%) and Viking (+1.4%) both move higher.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Nato

Geopolitics: Ukraine

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

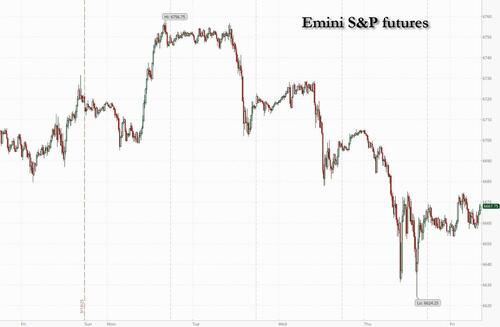

Markets continued to struggle yesterday, with a broad-based selloff that saw the S&P 500 (-0.50%) post a third consecutive decline. The main catalyst was a strong batch of US data, which meant investors dialled back their expectations for rapid Fed rate cuts, and pushed front-end Treasury yields higher. So that meant rate-sensitive sectors like tech took a hit, with the Magnificent 7 (-0.95%) dragging down the broader equity market. Moreover, that bond selloff carried over into Europe, and UK gilts underperformed as investor doubts grew about the country’s fiscal position, amidst calls from some within the governing Labour Party for PM Starmer to ease the fiscal rules. And tariffs were back in the spotlight too, as President Trump announced further sectoral tariffs, including on pharmaceutical products. So lots of themes for investors to digest.

That US data was the big market driver yesterday, as it painted a more resilient economic picture than previously thought, which undercut some of the calls for faster rate cuts. Most notably, the weekly initial jobless claims fell to just 218k in the week ending September 20 (vs. 233k expected), which was the lowest level since July, and pushed back against fears of a labour market slowdown. Moreover, quite a bit of the Q2 data got revised in a hawkish direction, with GDP growth revised up half a point to an annualised +3.8% rate. And core PCE inflation was also revised up a tenth to +2.6%. So again at the margins, that suggested that the US economy had been pretty resilient after Liberation Day. Indeed, the so-called “core GDP” measure of real final sales to private domestic purchasers was revised up a full point to a +2.9% rate.

However, this resilient data also meant investors priced out the likelihood of rapid rate cuts over the months ahead. In fact, only 39bps of cuts are priced in at the remaining two meetings this year, down -3.9bps on the day. So that’s almost half way between 25bps and 50bps, implying that markets think it’s almost a toss-up as to whether we get one or two more cuts this year. In turn, that led to a selloff in US Treasuries, with front-end yields seeing the biggest moves. So the 2yr yield (+5.1bps) moved up to 3.66%, and the 10yr yield (+2.3bps) rose to 4.17%.

Against that backdrop, we did hear from several Fed speakers yesterday, although they consistently stuck to their recent messages in each case. So Chicago Fed President Goolsbee sounded cautious on future cuts, saying that he was “a little uneasy with too much front-loading”. And Kansas Fed President Schmid continued to lean on the hawkish side, saying “inflation remains too high while the labor market, though cooling, still remains largely in balance”. But Vice Chair for Supervision Bowman was more dovish, and she said that recent data had shown “we have a more fragile labour market than we were expecting to see”. Otherwise, Governor Miran, who dissented in favour of a larger 50bp cut at last week’s meeting, said that “I would rather act proactively and lower rates as a result ahead of time, rather than wait for some giant catastrophe to occur”.

With investors pricing in slower rate cuts, that meant equities lost further momentum yesterday, and the S&P 500 (-0.50%) posted a third consecutive decline for the first time in a month. The decline was a broad-based one, and there were bigger falls for the Magnificent 7 (-0.95%) and the small-cap Russell 2000 (-0.98%). Sentiment also hasn’t been helped by the prospect of a government shutdown next week, as funding is due to expire on September 30, and there’s still no sign of a breakthrough between Republicans and Democrats. And over in Europe, the STOXX 600 (-0.66%) also fell back to its lowest level in nearly 3 weeks.

Elsewhere in Europe, UK gilts were back in the spotlight yesterday, with the 10yr yield (+8.7bps) posting the biggest increase in the G7 yesterday. That came amidst growing speculation around the country’s fiscal position, particularly after Greater Manchester Mayor Andy Burnham said in an interview that “We’ve got to get beyond this thing of being in hock to the bond market.” And in another interview, he called for £40bn of additional borrowing to build council houses. Although Burnham isn’t an MP, he’s considered a potential challenger to PM Starmer as Labour leader, so the headlines added to market speculation that the direction of travel would be towards higher borrowing in the years ahead, particularly if Starmer were replaced as leader. Indeed, the UK was the only G7 country yesterday where the 2s30s yield curve steepened, and the long end of the curve has usually been much more sensitive to fiscal concerns.

A similar pattern was evident across Europe yesterday, albeit to a lesser extent. Indeed, France’s 10yr yields (+3.3bps) closed at a post-2011 of 3.60%, which hasn’t been seen since the height of the Euro crisis. That left the Franco-German 10yr spread at 83bps, which is its highest closing level since January, with new PM Lecornu still trying to pass a budget that cuts the deficit, in a National Assembly fractured between different political groups. Otherwise, yields on 10yr bunds (+2.6bps) and OATs (+4.3bps) also moved higher, whilst the 2yr German yield (+1.7bps) got back to its level on Liberation Day again, closing at 2.03%.

Overnight, tariffs have come back into the headlines, as President Trump announced a new set of sectoral tariffs. So from this Wednesday October 1, the US will impose a 100% rate on branded or patented pharmaceutical products, 50% on kitchen cabinets, 30% on upholstered furniture, and 25% on heavy trucks. That meant investors got a fresh reminder about the trade war, and the impact has already been evident in Asian markets. For instance, pharmaceutical companies have been among the worst performers this morning in Japan’s Nikkei (-0.46%), with losses for Chugai Pharmaceutical (-5.12%) and Sumitomo Pharma (-5.21%).

Speaking of Japan, the Tokyo CPI print for September came out overnight, which showed a downside surprise of +2.5% in the headline CPI (vs. +2.8% expected). However, that was partly because the Tokyo government expanded the entitlement for free childcare, and that was a policy specific to Tokyo that won’t apply nationwide. So Japanese government bond yields have seen little change this morning, with the 10yr yield up +0.2bps. Elsewhere in Asia, equities have also lost ground, including the Hang Seng (-0.65%), the CSI 300 (-0.42%) and the Shanghai Comp (-0.18%), whilst South Korea’s KOSPI (-2.77%) is currently on track for its worst day in nearly two months. But looking forward, US equity futures have held broadly steady, with those on the S&P 500 up +0.02%.

To the day ahead now, and data releases include US PCE inflation for August, and the University of Michigan’s final consumer sentiment index for September. Otherwise, there’s Canada’s GDP report for July, and the ECB’s Consumer Expectations Survey for August. Meanwhile, central bank speakers include the ECB’s Cipollone and Escriva, along with the Fed’s Barkin and Bowman