Futures are flat with Tech/Small-caps big higher as the market looks to recover from Monday’s tech plunge. As of 8:00am S&P futures are unchanged, erasing a modest earlier gain during the European session; Nasdaq futures extend their Tuesday rebound and rise 0.4% after rising 2.0% on Tuesday; Mag7 names are mixed (GOOGL +0.5%, AMZN +0.9%, AAPL -1%, MSFT flat, META +0.5%, NVDA -0.7% and TSLA -0.2%) with semis rallying but this may not mean the end of the Semis-to-Software rotation which is +10% this week. Europe's Stoxx 600 index rose 0.6% after chip giant ASML soared 11% after order bookings beat estimates, spurring gains for semiconductor stocks. Bond yields are flat to down 2bps to 4.52% ahead of what is expected to be a dovish pause by the Fed today (full preview here). USD strength continues, given the likelihood of new tariffs announced this week or weekend. Commodities are mixed as Ags and Metals are bid. Looking to the day ahead, the main highlight will be the Federal Reserve’s policy decision, along with Chair Powell’s subsequent press conference, while the Bank of Canada will also be making their own policy decision. Data releases include December advance goods trade balance and wholesale inventories (at 8:30am ET). Finally, today’s earnings releases include tech giants Tesla, Microsoft and Meta.

In premarket trading, T-Mobile jumped 8% after reporting fourth-quarter results that beat analysts’ projections, benefiting from continued growth in wireless subscribers and home internet customers. Starbucks rose 2% after the coffee chain reported better-than-expected quarterly results, luring back lapsed customers with coffee-focused ads and by removing extra charges for nondairy milk. LendingClub plunged 21% after the operator of peer-to-peer loan website gave a first-quarter forecast that missed estimates. A Piper analyst said higher provisions drove a miss to his estimates. Here are some other notable movers:

It's a busy day today when not only the Fed is expected to keep rates on hole in a "dovish pause" but we get three of the Mag 7 names report. Indeed, traders will be scouring results from Microsoft, Meta and Tesla later for signs of weakness after Chinese startup DeepSeek’s cheaper AI model rattled markets. While the Fed is widely expected to hold rates, Chair Jerome Powell is likely to be pressed on the inflationary impact of potential trade tariffs and other policies from President Donald Trump’s White House. See our preview here.

“I don’t think there’s any great desire for the Fed to become overly hawkish in their messaging, nor do I think they’re going to pre-commit to dovish loosening,” Guy Miller, chief strategist at Zurich Insurance Co., said. “They’ll say ‘look, we need a period to take stock of things.’

Traders have ratcheted up bullish bets in the hope that Powell signals a cut in March is firmly on the table. JPMorgan's latest client survey released Tuesday shows the biggest net long position in US government debt in almost 15 years. Open interest in futures — or the amount of new risk held by traders — is increasing in 10-year note contracts. Meanwhile, central banks elsewhere remain on an easing path, with the Bank of Canada likely to reduce rates by a quarter point Wednesday. The European Central Bank is also expected to cut tomorrow.

While profits from the Magnificent Seven tech companies are still rising — and far outpacing the rest of the market — growth is projected to come in at the slowest pace in almost two years. After the DeepSeek news, Microsoft’s AI spending will be in tight focus when the company reports. The company is expected to update investors on its progress in selling artificial intelligence products — and the massive infrastructure buildout making that possible. Separately, Microsoft and OpenAI are investigating whether data output from OpenAI’s technology was obtained in an unauthorized manner by a group linked to DeepSeek, according to people familiar with the matter.

"DeepSeek was a welcome reminder that there are risks, but “the way for equities is still up,” Miller said. “Investors still have a buy-the-dip mentality.”

In Europe, the Stoxx 600 index rose 0.6% with tech leading gains, while luxury shares dropped after LVMH reported underwhelming sales compared to peers. European semiconductor stocks are soaring Wednesday after Dutch chip giant ASML booked more than twice as many orders as analysts expected in the fourth quarter, sending its stock 11% higher. Here are some of the biggest movers on Wednesday:

ASML shares soar 12% after the chip-equipment maker reported quarterly bookings well above analyst estimates, easing concerns over potentially weaker demand due to challenges at key clients including Samsung and Intel.

Earlier in the session Asian stocks gained, led by advances in Australia, Japan and India while most markets were shut for the Lunar New Year. The MSCI Asia Pacific Index rose as much as 0.5%, with Sony and Toyota among the biggest boosts. Most of the shares listed on the regional benchmark were not trading Wednesday. Australia’s main equity gauge climbed nearly 1%, as data showing cooler-than-expected inflation was seen paving the way for an interest-rate cut as soon as next month. Japanese shares advanced as the DeepSeek-driven tech selloff subsided, following a rebound in Nvidia and other US AI stocks overnight. Equities in India extended their rebound from recent selloffs, fueled by gains in bank stocks and shares of software exporters Infosys and Tata Consultancy Services.

In rates, treasuries inched higher ahead of the Fed decision, with US 10-year yields falling 1 bps to 4.52%. Gilts and bunds outperformed following German 10-year bond sale that had highest oversubscription rate in eight months on a reduced allotment; as a result German and UK 10-year borrowing costs falling 3-4 bps each. Ahead of Fed decision, no change is priced in, putting focus on the outlook for March, with around 7bp of easing priced in; investors have been leaning bullish into the meeting, including Monday’s rally where a wave of new long positions were added in Treasury futures

In FX, the Bloomberg Dollar Spot Index rises 0.1%. The Aussie dollar is the weakest of the G-10 currencies, falling 0.4% against the dollar after core inflation eased by more than expected. The Swedish krona weakens 0.1% after the Riksbank cut interest rates 25 bps as expected.

In commodities, oil prices decline, with WTI falling 0.9% to $73.10 a barrel. Spot gold is steady near $2,760/oz. Bitcoin rises 2% and is above $102,000.

Looking to the day ahead, and the main highlight will be the Federal Reserve’s policy decision, along with Chair Powell’s subsequent press conference. The Bank of Canada will also be making their own policy decision. Data releases include December advance goods trade balance and wholesale inventories (8:30am). Finally, today’s earnings releases include Tesla, Microsoft and Meta.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher following the positive handover from Wall St where tech clawed back some of the DeepSeek-related losses, although the conditions were quiet in Asia amid mass closures for the Chinese New Year. ASX 200 was led higher by outperformance in tech and utilities, while softer-than-expected Australian CPI data for Q4 also spurred increased rate cut bets for the RBA's meeting in February (cut now priced at around 76% vs. 64% pre-release). Nikkei 225 took impetus from US counterparts but with gains capped amid few fresh drivers and after outdated BoJ minutes.

Top Asian News

European bourses (Stoxx 600 +0.5%) began the European session mostly firmer and traded rangebound, at elevated levels throughout the morning. The CAC 40 -0.1% is the clear underperformer in Europe today, with the index weighed on by post-earning losses in LVMH (-5%); the AEX is the day’s outperformer, with sentiment in the Tech sector lifted following blockbuster results in ASML (+8.7%). European sectors hold a slight positive bias. Tech is by far and away the clear outperformer in today’s session, lifted by post-earning strength in ASML (+11%). The Co. reported strong rev. for Q4, and its Bookings were exceptionally strong; it came in well above expectations at EUR 7.09bln (exp. 3.53bln). It also raised its Q1 net sales guidance above consensus. Consumer Products is underperforming today, weighed on by losses in LVMH (-6%). The Co. beat on its FY Revenue figure, though its Net Profit fell short of expectations. The Q4 figures were a little more positive, which generally topped expectations.

Top European News

Earnings Summary

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

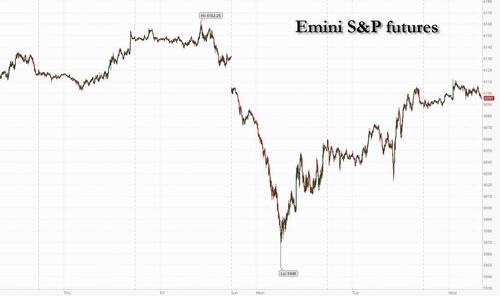

After the tech-led slump on Monday morning, markets continued to unwind those moves over the last 24 hours, with little sign of broader contagion from tech stocks to the rest of the market. That meant the S&P 500 recovered +0.92%, bringing the index back within 1% of its all-time high. And if you consider that S&P 500 futures were down -3% on Monday at the height of the slump, the index has effectively now unwound the bulk of that initial selloff. Tech stocks led the recovery, with the NASDAQ (+2.03%) and the Mag-7 (+2.70%) reversing most of Monday’s decline, whilst in Europe the STOXX 600 (+0.36%) and the DAX (+0.70%) even managed to hit another record high. So in terms of the headline moves, it’s clear that investors are feeling more optimistic, and we’re not seeing the sort of repeated selloffs that happened when the dot com bubble began to burst in early 2000.

That said, even as most indices posted a decent advance, it was far from a universally rosy picture. For instance, 70% of stocks within S&P 500 were actually lower on the day, with the equal-weighted version of the index down -0.47% as defensive stocks underperformed. And whilst all of the Mag-7 moved higher, semiconductor stocks were still feeling the aftershocks of Monday’s slump. Indeed, the Philadelphia Semiconductor Index (+1.11%) only pared back a fraction of its -9.15% slump on Monday. And even though Nvidia bounced back +8.93%, that’s still less than half of its -19.56% decline over the previous two sessions. So it’s clear there are still a lot of jitters, not least given the growing comparisons being made to the dot com bubble. However, it’s worth noting that when the dot com bubble began to burst from March 2000, the NASDAQ slumped by more than a third in the space of just over a month, so it was on a scale well beyond anything we’ve seen today. We should get plenty more on the tech side later, as there are earnings announcements from Tesla, Microsoft and Meta after the close tonight, ahead of Apple’s announcement tomorrow.

Shortly before those earnings announcements, today will also bring the Federal Reserve’s first policy decision of 2025, along with Chair Powell’s subsequent press conference. For the headline decision, it’s widely expected the Fed will keep rates on hold, ending a run of 3 consecutive rate cuts since September. That follows on from a hawkish rate cut in December, where they upgraded their inflation forecasts and only signalled two further cuts in their dot plot for 2025, which was fewer than expected. Indeed, the S&P 500 slumped by -2.95% that day, which was its second-biggest decline in the last two years, so the extent of their hawkishness came as a major surprise for markets. For today, our US economists are also anticipating the Fed will stay on hold, but think they’ll only provide limited guidance about upcoming decisions. As it stands this morning, market pricing is broadly in line with that dot plot for 2025, with futures pricing in 51bps worth of cuts by the December meeting. For more info, see our economists’ full preview here.

Ahead of the Fed, Treasuries largely held their ground yesterday. Initially, the pickup in equities had seen 10yr Treasury yields move +4bps high intra-day, as investors became less concerned that an equity correction and negative wealth effects would lead to a broader slowdown in consumer spending. However, this move reversed later on, in part thanks to a decent 7yr auction, with 10yr yields closing -0.2bps lower at 4.53%, their lowest level since Christmas. Similarly, 2yr yields (-0.2bps to 4.20%) fell to their lowest since December 12, before the last Fed meeting.

Over in Europe, the focus has also been on central banks ahead of the ECB’s decision tomorrow, and unlike the Fed, they’re widely expected to deliver another 25bp cut, taking their deposit rate down to 2.75%. We also received the ECB’s latest Bank Lending Survey yesterday, which showed that credit standards for firms tightened in Q4, with a net +7% reporting tighter credit standards, the highest in a year. In the meantime, sovereign bonds moved broadly in line with their US counterparts, with yields on 10yr bunds (+3.1bps) and OATs (+2.4bps) both moving higher. Yields on 10yr BTPs (+2.7bps) also saw a sharp move up towards the end of the session, which came after Italy’s PM Giorgia Meloni said she’d received a notice of investigation by prosecutors.

Overnight in Asia, that positive momentum has continued in markets, with gains for the Nikkei (+0.76%) and the S&P/ASX 200 (+0.57%), although several markets are closed for holidays, including in China and South Korea. Otherwise though, there’s been a rally in Australian government bonds after their CPI print for Q4 was a bit softer than expected, falling to +2.4% last quarter (vs. +2.5% expected). That was seen as raising the likelihood of a rate cut from the RBA in February, and 10yr government bond yields are down -4.5bps this morning. That’s also helped weaken the Australian Dollar, which is down -0.13% against the US Dollar. Looking forward, futures suggest that positive momentum should continue, with those on the S&P 500 (+0.01%) and the NADSAQ 100 (+0.09%) pointing modestly higher.

Looking at yesterday’s data releases, the US Conference Board’s consumer confidence indicator fell by more than expected in January, moving down to a four-month low of 104.1 (vs. 105.7 expected). The labour market indicators also weakened, and the difference between those saying jobs were plentiful and hard to get fell to its lowest level in four months.

To the day ahead now, and the main highlight will be the Federal Reserve’s policy decision, along with Chair Powell’s subsequent press conference. The Bank of Canada will also be making their own policy decision. Data releases include the Euro Area M3 money supply for December. Finally, today’s earnings releases include Tesla, Microsoft and Meta.