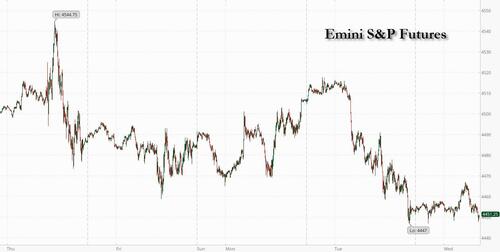

US equity futures and European stocks are little changed, having swung between gains and losses, following a broadly negative session in Asia where concerns surrounding the Chinese economy (home prices fell for the first time this year, fueling recession concerns despite increasing expectations for more stimulus) and the implosion of shadow banking giant Zhongrong (China's Blackstone) continued to weigh on sentiment with focus remaining on earnings.

As of 7:30am, S&P 500 and Nasdaq 100 futures were unchanged, with JPM's trading desk wondering if "there is enough momentum to stage a relief rally today" (full note available to pro subs). Commodities are rebounding across all three complexes with USD weaker. Government bonds in the US and Europe were broadly stronger, with US 10-year yields falling 3bps to 4.18%, halting a run of losses that was fueled by concern interest rates will be kept at high levels for longer than expected. The dollar rebounded from an early selloff while the pound strengthened as UK inflation topped expectations. Today’s macro focus is the Fed Minutes, housing data, Industrial Production, and Consumer-sector earnings.

In premarket trading, shares of Target jumped on a strong profit rebound at the retailer even as the company slashed its guidance, while electric-vehicle makers are lower again after Tesla cut its prices in China for the second time in three days, further fueling concerns of renewing a price war that had showed some signs of abating (Tesla -1.5%, Rivian -1.7% and Nikola -2.1%). Keep an eye on banks, which got hit on news of a potential sector-wide ratings downgrade; XLF and KRE are indicated flat pre-mkt. Here are some other notable premarket movers:

Market sentiment was dented by a renewed concerns about China’s economic woes despite a slew of stimulus steps by authorities, with the onshore yuan sinking toward its weakest in 16 years against the dollar and the MSCI China Index of stocks set to erase gains seen since a key policy meeting in late July.

China's central bank moved again on Wednesday to boost fragile sentiment with a stronger-than-expected reference rate for the yuan and the largest injection of short term cash to the financial system since February. So far the steps have failed to restore optimism and market moves suggest traders are looking for more aggressive supportive measures. “Market participants are watching the developments on the real estate markets in China and the US with growing concern,” said Andreas Lipkow, a strategist at Comdirect Bank. Realizing the futility of China's piecemeal interventions which do nothing, a PBOC central banker has now called for at least 3 trillion yuan in helicopter money to stimulate flagging consumer demand.

Meanwhile, money-market wagers for the Bank of England’s peak interest rate held steady at 6% after the UK inflation print came in hotter than expected as the cost of travel and holidays climbed. The numbers added to hot wage figures and US retail statistics that rattled markets on Tuesday, spurring bets tight central bank policy will be in place for longer. inneapolis Fed President Neel Kashkari warned that inflation was “still too high.”

European equities moved between modest gains and losses as growing pessimism around China’s economic outlook prompted caution among investors. Higher-than-expected UK inflation data also weighed on sentiment. The Stoxx Europe 600 was little changed after falling to the lowest level in a month on Tuesday. Retailers led gains while energy and travel and leisure stocks were the biggest laggards. Among individual stocks, Admiral Group Plc rallied after reporting results that Jefferies said showed that its UK car business had recovered well. Elsewhere, nutrition firm Glanbia Plc advanced after boosting its full-year adjusted earnings guidance. Here are the biggest European movers:

Asian equities retreat for fourth day as risk appetite remained low in the wake of growing economic concerns in China and prospects of the Federal Reserve keeping rates higher for longer. The MSCI Asia Pacific Index fell as much as 1.4%, set for its lowest close since May 31. Chinese equities weighed on the regional benchmark as disappointing economic data worsened the recent selloff, while South Korean gauges were the worst performers regionally as foreign investors sold shares amid a stronger dollar. Hang Seng falls 1.2% and mainland indexes lose ground. Japanese, South Korean and Australian stock indexes all decline.

“A recent set of disappointing economic data out of China has not been encouraging for the region,” Jun Rong Yeap, Market Analyst at IG Asia Pte. said in a note. The aggressive 15 bps cut by Chinese central bank to its one-year policy interest reflects the severity of the economic weakness that authorities foresee to drag on for longer, Yeap said.

In FX, the Bloomberg Dollar Spot Index edged lower, falling as much as 0.2% after four-straight days of increases. The dollar was lower against all G10 peers.

In rates, treasuries are in the green with US 10-year yields falling 3bps to 4.18% on speculation the jump in yields is overdone; treasuries were richer across the curve by up to 4.5bps in a bull steepening move with front-end leading gains; 2s10s, 5s30s spreads are steeper by 1.7bp and 4.5bp on the day ahead of key US data and FOMC meeting minutes release later in the US session. 10-year yields around 4.18% after breaching 4.20% Tuesday, richer by 3bp on the day and outperforming bunds and gilts by 0.5bp and 6bp. The current TSY yield provides a good entry point for investors, according to Steven Major, global head of fixed-income research at HSBC Holdings. “Going up the US curve to 10 year-plus is now looking more and more interesting,” he said on Bloomberg Television. Bunds also rise but gilts are nursing small declines after UK inflation rose slightly faster than expected in July. The dollar IG issuance slate empty so far; three deals priced Tuesday for a combined $1.85b — at least three issuers elected against announcing transactions.

In commodities, crude futures are little changed with WTI trading near $81. Benchmark European natural gas futures rose as much as 10% — after gaining 13% on Tuesday — as traders weighed the prospect of disruptions against weak demand and high storage levels in the region. Gold prices edged 0.2% higher.

Looking to the day ahead now, and one of the main highlights will be the FOMC minutes from their July meeting. US data releases include July’s industrial production, capacity utilisation, housing starts and building permits. Elsewhere, there’s UK CPI for July and Euro Area industrial production for June. Lastly, earnings releases include Target and Cisco.

Market Snapshot

Top Overnight News from Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured following the declines on Wall St amid the broad risk-off mood, which was triggered by global macro headwinds, in particular, the recent slew of weak data from China. ASX 200 was led lower by the large industries, while participants also digested earnings and a softer leading index. Nikkei 225 dipped beneath the 32,000 level as all major bourses suffered from the falling tide across stocks. Hang Seng and Shanghai Comp remained pressured amid China growth concerns as recent poor data releases have prompted several banks to cut their growth forecasts for the world’s second-largest economy including JPMorgan which now anticipates 4.8% GDP growth for China this year, while the latest House Price data also showed a contraction Y/Y to add to the ongoing developer woes.

Top Asian News

European bourses trade mixed after opening after shrugging off mild broad-based opening losses with no obvious catalyst behind the move at the time. Sectors are mixed with Retail, Utilities, Consumer Produce & Services at the top of the bunch while Travel & Leisure, Media, Energy and Telecoms reside as the laggards. Stateside, equity futures are trading slightly firmer as some positive sentiment attempts to return following yesterday’s closes, with traders looking ahead to FOMC minutes.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Henry Allen concludes the overnight wrap

Markets have continued to struggle over the last 24 hours, with both the S&P 500 (-1.16%) and Europe’s STOXX 600 (-0.93%) hitting a one-month low. Several factors were behind the declines, including ongoing concern about China’s economy. But yesterday also brought a fresh round of concerns about inflation, not least after UK wage growth and Canadian CPI both surprised on the upside, whilst European natural gas prices (+12.89%) saw a fresh spike amidst a potential strike at Australian LNG facilities. All that put a dent in risk assets, but the inflation fears contributed to a decent bond sell-off as well, with yields reaching their highest level in months across several countries.

Markets had already started the day on the back foot after the weak China data we discussed yesterday and the mood didn’t improve much from there, starting with the latest UK labour market data. That showed regular annual pay growth (excluding bonuses) was running at +7.8% over the three months to June, which was the highest since comparable records begin in 2001, and some way above the +7.4% consensus. That added to fears about entrenched inflation, whilst there was also bad news on the unemployment side, which rose to 4.2% over the same period (vs. 4.0% expected). See our economists’ reaction note here for more details.

The UK print led investors to ratchet up the chance of further rate hikes from the Bank of England over the months ahead. Indeed, the size of the hike priced in for the next meeting in September went up by +8.3bps yesterday from 23.7bps to 32.0bps, and this morning markets are now fully pricing in a terminal rate of 6% by the time of the March 2024 meeting. So all eyes will be on today’s UK CPI print to see how that changes things, and our UK economist is looking for a +6.8% reading.

That wage data served as the catalyst for a substantial sovereign bond sell-off that only came off slightly towards the day’s end. In fact, yields on 10yr bunds (+3.6bps) hit a post-SVB high of 2.67%, as did those on 10yr OATs (+4.0bps) which closed at 3.21%. 10yr gilts saw a more moderate rise (+2.3bps to 4.59%) but with a larger sell-off in the 2yr after the stronger pay data (+5.6bps). There were also sizeable moves at the long end of the curve, with the nominal and real 30yr gilt yield both rising to their highest level since the mini-budget turmoil last year, at 4.77% and 1.34%, respectively.

Inflation news elsewhere added further fuel to the sell-off. For instance, Canada’s CPI in July moved back up to +3.3% (vs. +3.0% expected), which similarly led investors to price in a growing chance of another Bank of Canada rate hike by year-end. And back in Europe, natural gas futures (+12.89%) closed at their highest level in over two months. That came as the potential strike among Australian LNG workers remained unresolved. If there is a strike, that could interrupt as much as 10% of global LNG exports, so it has significant importance to the global market.

The backdrop of weaker China activity data and higher inflation risks meant that risk assets put in a weak performance across the board, with the S&P 500 down -1.16%. Banks (-2.75%) saw their weakest day since early May, whilst energy stocks (-2.44%) also underperformed as oil prices retreated (WTI crude -1.84% to $80.99/bl). That said, the decline was broad-based, with all 24 industry groups of the S&P 500 down on the day. This came in spite of upbeat retail sales numbers out of the US, with headline sales up +0.7% in July (vs. +0.4% expected) and retail control up +1.0% (vs +0.5% exp.). Other indices saw a similar pattern, with the NASDAQ (-1.14%) and the Dow Jones (-1.02%) both losing ground. And back in Europe it was much the same story, with losses for the STOXX 600 (-0.93%), the DAX (-0.86%) and the CAC 40 (-1.10%).

Another asset that saw significant moves yesterday were US Treasuries, and the 10yr real yield (+5.0bps) closed at a post-2009 high of 1.88%. Nominal yields had an eventful day too, with the 10yr yield (+2.0bps) up for a 4th consecutive day to 4.211%, which was actually a slight pullback from the intraday peak of 4.268%. That went alongside a steepening in the yield curve, with the 2yr yield down -1.5bps to 4.952% as investors priced in a slightly more dovish path for the fed funds rate. For instance, futures for the December 2023 and 2024 meetings were down -1.2bps and -2.7bps, respectively. That also followed comments from Minneapolis fed President Kashkari, who commented that he wasn’t “ready to say that we’re done”, and that the Fed is “a long way from cutting rates”.

Overnight in Asia, that pattern of losses has continued, with sharp losses across the major indices. That includes the KOSPI (-1.52%) as it returns after a public holiday, as well as the Hang Seng (-1.39%), the Nikkei (-1.09%), the Shanghai Comp (-0.25%) and the CSI 300 (-0.18%). The moves come amidst further signs of property market weakness in China, with new home prices down by a monthly -0.23% in July. In the meantime, the People’s Bank of China injected a net 297bn yuan of cash through its 7-day reverse repurchase contracts overnight, which is the most since February. Looking forward, equity futures are pointing to further losses, with those on the STOXX 50 (-0.33%) and the DAX (-0.37%) falling back, whilst S&P 500 futures (-0.01%) have seen a modest decline.

Elsewhere overnight, the Reserve Bank of New Zealand held its benchmark policy rate at 5.5% as expected, whilst indicating that interest rates would need to stay high for some time yet to tame inflation. Their latest forecasts show the average official cash rate with a higher path than before, with a peak of 5.59% in mid-2024. However, Governor Orr played down the higher rate track, saying that they were in “watch, worry and wait” mode. This morning the New Zealand dollar is the best-performing G10 currency, and is up +0.17% against the US Dollar.

When it came to yesterday’s other data, the US Empire State manufacturing survey fell back to -19.0 (vs. -1.0 expected). Separately, the NAHB’s housing market index fell back to 50 in August (vs. 56 expected), which marked an end to a run of 7 consecutive monthly gains. Over in Europe, the German ZEW survey saw the current situation fall to its weakest since October at -71.3 (vs. -63.0 expected). However, the expectations component moved up slightly to -12.3 (vs. -14.9 expected).

To the day ahead now, and one of the main highlights will be the FOMC minutes from their July meeting. US data releases include July’s industrial production, capacity utilisation, housing starts and building permits. Elsewhere, there’s UK CPI for July and Euro Area industrial production for June. Lastly, earnings releases include Target and Cisco.