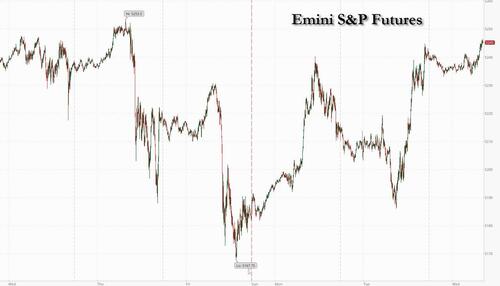

US futures are flat after Tuesday’s record-high cash close, having rebounded from overnight session lows ahead of the Fed meeting where nobody expects any rate change and where some (but not consensus) expect a hawkish move in the dots to signal 2 rate cuts instead of 3 (Goldman and most big banks still expect 3 cuts) as well as gleaning some insight on what the Fed's QT tapering will look like. As of 8:00am, S&P futures were up 0.1%, reversing an earlier loss of 0.3%, while Nasdaq futures gained 0.3%.

In Europe, most markets are lower with Germany/Italy in the green and the France the biggest laggard as Kering’s Gucci APAC profits fall ~20%, dragging all China-related names down. UK inflation prints dovish to expectations. Intel shares jumped after the chipmaker won almost $20 billion in chips incentives to expand US plants. Meanwhile, the Biden administration is also considering blacklisting a number of Chinese semiconductor firms linked to Huawei after the telecom giant notched a significant technological breakthrough last year. Bond yields are down 1bps as USD strength and yen weakness continues after the cartoonish BOJ's first rate hike in 17 years paradoxically sent the USDJPY above 151.50, its highest level this decade. Commodities were sold across the board including Ags, Energy, and Metals.

In premarket trading, Mag7 names are mixed and Intel was the standout in Semis space after it won almost $20 billion in federal grants and loans to help fund an expansion of its semiconductor factories on American soil thanks to the Chips Act. Here are some other notable premarket movers:

The focus today is firmly on the FOMC decision and the path for US interest rates (full preview here). While the central bank is expected to hold, investors will be parsing commentary to assess how quickly it might start to ease. The decision and economic forecasts will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later. The Fed’s dot plot of rates projections will be in focus as investors gauge how many cuts policymakers are expecting this year.

“The risk of those dots shifting has grown and if we do see that median move higher, then obviously you’d expect a knee jerk rally in the dollar and a knee jerk move lower in Treasuries and equities,” said Michael Brown, senior research strategist at Pepperstone Group Limited. “With that risk on the horizon, no one has particularly much conviction to do anything much this morning.”

Europe's Stoxx 600 dropped 0.1% having earlier fallen as much as 0.4%, while the CAC 40 loses 0.6%, led lower by luxury shares after Kering warned that sales at Gucci have fallen about 20% in the first quarter in Asia-Pacific, fueling worries about high-end consumer spending in China. Kering was one of the biggest drops in the Stoxx 600 Index, with LVMH, Burberry Group Plc and Christian Dior SE also seeing losses. Here are some of the biggest European movers Wednesday:

Earlier in the session, Asian stocks inched higher as Korean shares rose and Chinese stocks shook off earlier losses. The MSCI Asia Pacific Index gained less than 0.1% with Tencent and Samsung Electronics rising, while SK Hynix and AIA Group declined. Stocks rebounded in Korea after Tuesday’s selloff led by strong gains in some technology and financial services companies. Stocks were closed in Japan for a public holiday. Chinese stocks moved higher after banks left five-year and one-year prime lending rate as expected. Traders are looking for fresh catalysts to extend a rally that is now into its sixth week. Investors await the earnings from Tencent Holdings for further cues on the nation’s corporate earnings trajectory.

“We have seen a base forming” in China markets because of government action, Audrey Goh, head of asset allocation at Standard Chartered Wealth Management, told Bloomberg TV. “Overall the backdrop for Chinese equities still remains quite lackluster. We need a bit more in terms of policy support from the government to entice investors back to the market.”

In FX, the Bloomberg Dollar Index was up for a fifth day for the first time since early January; the pound whipsawed after Britain’s inflation rate fell more sharply than expected. The Bank of England meets on rates on Thursday, but a move is unlikely as policymakers say they need further evidence that price pressures will fall back sustainably. The yen is again one of the weakest of the G-10 currencies for a second day, falling 0.6% versus the greenback, and about to hit a decade low against the greenback.

In rates, Treasury yields are lower across the curve, led by gilts after benign UK CPI data drove a dovish re-pricing in Bank of England rate-cut expectations. Yields are down 1bp-2bp across the curve with 10-year yields falling 1bp to 4.275% after reaching weekly low. Gilts are ~3.5bp richer vs USTs in 10-year sector, after UK inflation slowed more than expected in February. For Fed communications, focus is on potential for changes to policy members’ median projections for fed funds through 2026 and longer run, with traders broadly holding a hawkish set-up to the meeting. Treasury auctions resume Thursday with $16b 10-year TIPS reopening.

In commodities, oil dipped after a two-day gain as an industry group flagged a fall in US crude stockpiles, while gold traded in a narrow band ahead of the Fed.

Bitcoin reversed an overnight loss to trade flat around $64,000.

Today's US economic data calendar is empty before the Fed rate decision and economic projections at 2pm New York time and Powell’s new conference at 2:30pm

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded cautiously and mostly rangebound ahead of the FOMC and with Japanese markets closed. ASX 200 struggled for direction as strength in energy was offset by losses in the tech and consumer sectors. KOSPI outperformed as South Korea plans to cut corporate and dividend income tax to encourage a higher shareholder return, while index heavyweight Samsung Electronics (005930 KS) rose over 5% and was helped by reports that NVIDIA looks to procure high-bandwidth memory chips from the Co. Hang Seng and Shanghai Comp. were indecisive as participants digested the latest earnings releases, while Prada (1913 HK) shares slipped in early trade after Gucci owner Kering (KER FP) issued a luxury sector warning amid Asia-Pacific weakness, while the mainland was kept afloat following the lack of surprises from the PBoC's benchmark LPRs which were maintained at their current levels

Top Asian News

European bourses, Stoxx600 (-0.2%) are mostly lower, with clear underperformance in the CAC 40 (-0.8%), with Luxury names hampered by Kering (-14.4%). European sectors are mostly lower; Consumer Products and Services is slumped at the foot of the pile after Kering issued a profit warning, which has weighed on peers such as LVMH (-2.9%)/Hermes (-1.9%). US equity futures (ES -0.1%, NQ -0.1%, RTY -0.5%) are softer, with clear underperformance in the RTY, as it pares back yesterday's gains; Intel (+2.2% pre-market) gains after being awarded approx. USD 20bln in grants by the Biden Administration.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As we arrive at another Fed decision day, markets have posted further advances ahead of the announcement, with both the S&P 500 (+0.56%) and Europe’s STOXX 600 (+0.26%) moving higher. However, there were growing warnings under the surface, particularly on the inflation side, as Brent crude oil prices closed above $87/bbl for the first time since October. So it’s clear there are several price pressures in the pipeline, which has led to fresh doubts about whether we’ll get rate cuts by the summer after all. Moreover, there are increasing signs that investors are pricing this in, with US 1yr inflation swaps inching up to 2.64%, their highest level since October, even as bond yields eased off from Monday’s 3-month highs.

When it comes to the Fed’s decision, it’s widely expected they’ll keep rates on hold today. So the main focus will instead be on the latest Summary of Economic Projections, including the dot plot for where officials see rates moving over the next few years. As a reminder, the last dot plot in December pencilled in three rate cuts for 2024, which led to a significant multi-asset rally as investors grew confident that rate cuts were on the horizon. But since then, the inflation reports for both January and February were stronger than expected, with core CPI running at a monthly +0.4%.

Given those developments on the inflation side, there’s been growing speculation about whether the Fed might signal fewer than three cuts in today’s dot plot. Indeed, it’s worth noting that back in December, 8 of the 19 officials already had two rate cuts or less for 2024, so it would only take two other officials to shift hawkishly for the median dot to move up to two cuts. In their preview (link here), DB’s US economists expect the median dot to remain at three cuts in 2024, but they think the Fed will raise their 2025 and 2026 dots slightly to show less easing further out. That will be significant if so, as the post-pandemic dot plots repeatedly moved the dots up or held them steady at every meeting, up until December, when the dots finally moved lower compared to the meeting before. So if this March dot plot does move the dots higher again, it will make the dovish shift in December look more like a blip than a turning point.

We have argued for some time that central banks face an unenviable challenge in calibrating their policy this year given the long and variable policy lags and the extreme nature of the recent inflation shock and accompanying post-Covid structural shifts. In yesterday’s note here , looking at credit cycles across the US and Europe, Peter Sidorov argues that this calibration challenge is the toughest for the Fed, with the US seeing more resilient credit conditions than Europe, but with more of the delayed impact of rate hikes still to play out there. The note is a useful reminder of the challenges the Fed will face going forward so good context ahead of the conclusion of the FOMC today.

Leading up to their final deliberations, markets have managed to post further gains over the last 24 hours, with the S&P 500 recovering from a -0.35% decline after the open yesterday to close +0.56% higher. Energy stocks (+1.08%) led the advance amidst the rise in oil prices, with consumer discretionary (+0.86%) and industrials (+0.82%) also posting strong gains. The broad gains saw 76% of the S&P constituents up on the day, with the equal-weighted S&P 500 up +0.58%. Moreover, even as the Magnificent 7 (+0.36%) lagged the S&P 500, its gain was still enough to take the group up to a fresh all-time high. Finally in Europe, the story was also one of modest gains, with the STOXX 600 up +0.26%. However, both the CAC 40 (+0.65%) and the DAX (+0.31%) saw larger advances, which left both of them at new records as well.

Over on the rates side, US Treasuries rallied before the Fed’s decision, with the 10yr yield (-3.1bps) coming down from its YTD high the previous day to close at 4.29%, with the rally extending after a strong 20yr Treasury auction. But the rally was more prominent at the front end, with the 2yr yield (-4.8bps) down to 4.685% as investors priced in slightly more rate cuts for the remainder of the year. For example, the amount of cuts priced by the Fed’s December meeting rose +2.4bps to 73bps, having closed at its lowest of 2024 so far on Monday, at just 71bps. Still, the last three sessions are the first time since November that markets have priced less 2024 easing than the December median FOMC dot of 75bps.

Meanwhile in Europe, the main story was one of wider spreads, as yields on 10yr bunds (-1.0bps) and OATs (-0.6bps) fell back, whereas those on Italian BTPs (+2.3bps) and Greek bonds (+3.8bps) both moved higher.

Asian equity markets are mostly trading higher this morning led by the KOSPI (+1.30%) which is being propelled by a +4.81% rise in index heavyweight Samsung Electronics. Elsewhere the Hang Seng is reversing initial losses to gain (+0.18%) with the CSI (+0.20%) and the Shanghai Composite (+0.45%) also edging higher. Japan is closed for a public holiday which means no cash US Treasury trading. S&P 500 (-0.11%) and NASDAQ 100 (-0.12%) futures are edging lower.

In FX, the Japanese yen (-0.41%) is extending its losses and trading at a 4-month low of 151.45 and within touching distance of its weakest level since 1990 even after the BoJ moved away from negative interest rates and yield curve control yesterday. Against the euro it's now at a 16-year low of 164.60. The Yen is still a funder in the global carry trade and yesterday's inline policy meeting hasn't changed that yet.

Moving back across the world, over in Canada there was some brighter news on inflation yesterday, as CPI unexpectedly fell to +2.8% in February (vs. +3.1% expected). That helped support an outperformance in Canadian sovereign bonds, with the 10yr yield down -7.4bps on the day. The release also led investors to price in a significantly higher chance of a rate cut by the June meeting, with overnight index swaps moving up the probability from 49% on Monday to 79% by yesterday’s close. Looking forward, the next inflation release comes from the UK this morning shortly after we go to press, which will be in focus ahead of the Bank of England’s next decision tomorrow.

Elsewhere on the data side, US housing starts rose by more than expected in February, up to an annualised rate of 1.521m (vs. 1.440m expected), whilst building permits also rose to an annualised rate of 1.518m (vs. 1.496m expected). Over in Germany, the ZEW survey also came out for March, with the expectations component up to 31.7 (vs. 20.5 expected), which is its highest level since February 2022.

To the day ahead now, and the main highlight will be the Federal Reserve’s policy decision and Chair Powell’s subsequent press conference. Otherwise, data releases include UK CPI for February, Italian industrial production for January, and the European Commission’s preliminary consumer confidence indicator for the Euro Area in March. From central banks, we’ll also hear from ECB President Lagarde, and the ECB’s Lane, De Cos, Schnabel, Nagel and Villeroy.