Global stocks, already hammered by several days of relentless selling in mega-cap tech shares, struggled on Friday as an unprecedented, worldwide computer systems outage hit travel, trading and support services, threatening to exacerbate a pullback in technology stocks. As of 7:00am ET, S&P futures were flat, paring earlier losses, while Nasdaq futures dropped -0.1%. Global markets are also mostly in the red: FTSE -45bps, CAC -55bps, DAX -65bps, Nikkei -16bps, Hang Seng -2.03%, Shanghai +17bps. Cybersecurity firm Crowdstrike plunged as much as 21% in US premarket trading after warning its software was causing computer systems to crash. Its chief executive later said the issue was being fixed. Microsoft shares dropped 2%, though it said it had resolved the cloud-services outage that was blamed for disrupting flights and banks globally. Even the Russell is red this morning as the rotation takes a break. US Treasury yields were unchanged, with the 10Y trading at ~4.21% while the Bloomberg dollar index modestly higher as the yen reverses shallow overnight gains. There is nothing on today's economic calendar so attention will focus on the fallout from the global IT outage and Trump's RNC speech.

In premarket trading, IT outages across the globe weighed on several sectors on Friday, including airlines, insurers and stock exchange operators. Shares in Crowdstrike sank 14% after a widely used cybersecurity program crashed, while Microsoft fell 2.0% after separately reporting problems with its cloud services. Here are some other notable movers:

Today's tech disruptions come toward the end of a week that’s seen the Nasdaq shed more than 3%, as investors pulled out of high-flying megacap names and rotated into smaller companies. The Russell 2000 index has risen 2.3% this week. That said, market losses triggered by the outages are unlikely to last, said Rajeev De Mello, chief investment officer at Gama Asset Management, adding investors could “take advantage of such selloffs, especially in lower liquidity summer trading, and on Friday, to buy risk.”

“However, the equity sector rotation has been brutal and could continue somewhat longer,” he added.

The recent moves into smaller, lower-valuation sectors were precipitated by signs the Federal Reserve will cut interest rates in September, a view cemented by Thursday’s data showing the biggest jobless claims increase since early May, as well as the likelihood of more protectionism under a potential Donald Trump presidency.

“From a big-picture perspective, both the Fed moving towards a rate cut and Trump odds increasing should be risk positive,” said Mohit Kumar, a strategist at Jefferies International Ltd. “But it also meant that investors reconsider their asset and sector allocation as we head into the summer months. Sectors with heavier positioning suffered in the adjustment.”

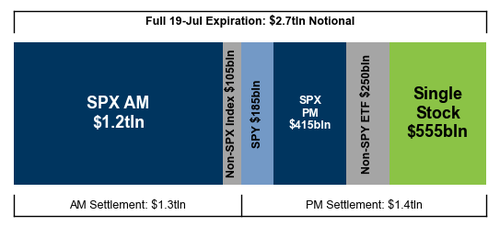

Aside for the global IT outage, it has been light news flow heading into the final day of the week. OPEX today will be the largest July expiry on record - GS estimates $2.7tn of exposure including $555bn of single stock options. This means gamma is about to tumble as the market unclenches.

In Europe, the Stoxx 600 index was down 0.6%, falling for a fifth day. Shares in Air France-KLM, Ryanair Holdings Plc and other airlines fell heavily as flights were either grounded or delayed. LSE Group Plc, which operates the London stock exchange, recouped some of its share-price losses triggered after it said technical issues were preventing news from being published. Sartorius AG plunged 13% after the German electronics maker lowered full-year guidance. Computer-games maker Ubisoft Entertainment SA slid more than 8% after mixed full-year targets, while gaming firm Evolution AB also tumbled after its earnings missed estimates. Here are some of the biggest movers on Friday:

Earlier, Asian stocks declined, with a key regional benchmark on course for its biggest weekly fall since mid-April, amid concerns over geopolitics and China’s economy. The MSCI Asia Pacific Index fell 1.3% Friday, with technology stocks TSMC, Samsung and Tencent among the biggest drags. Hong Kong was the region’s worst performer, with the Hang Seng Index down more than 2%. Equities also declined in South Korea, Australia, Japan and India. The MSCI Asian gauge was headed for a weekly loss of 2.4%.

China’s Third Plenum gave little reason for investors to buy, with few new measures to address weak domestic demand and the ailing property sector. That added to negative sentiment from prospects for tighter US restrictions on tech exports to Asia’s largest nation, as well as heightening tensions with the US as the presidential election looms. The region’s tech stocks have been the biggest losers after strong gains this year. Markets were not excited at the conclusion of China’s policy meeting, with the communique “giving little details on specific reforms, and no mention of any stimulus measures for the economy,” according to a DBS note. “On the positive side, there was agreement to leverage the role of the market, and to lift restrictions while ensuring effective regulation,” the note said.

In FX, the Bloomberg dollar spot index is near flat. JPY and CHF are the strongest performers in G-10 FX, SEK and NOK underperform.

In commodities, WTI drifts 0.1% lower to trade near $82.70. Brent flat at $85.08. Most base metals trade in the red; LME tin falls 2.7%, underperforming peers. Spot gold falls roughly $28 to trade near $2,417/oz. Spot silver loses 1.9% near $29.

In rates, treasuries were little changed amid modest losses in most European bond markets. Treasury 10-year yield is near flat on the day 4.20% with bunds and gilts lagging by 1bp and 3bp in the sector. Curve spreads also remain within a basis point of Thursday’s closing levels. The Bund curve bull-steepens with 2s10s widening 1.5bps. Treasury bull-flattens. Gilt bear-steepens. Peripheral spreads tighten to Germany. Australian 10-year yield rises 6bps, most in two weeks.

Looking at today's calendar, there is no econ data on deck; Fed members scheduled to speak include Williams (10:40am) and Bostic (1pm)

Market Snapshot

Top Overnight News

IT Outage

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly followed suit to the losses on Wall St where sentiment was dampened and the Trump trade was seen in play as President Biden's re-election chances dwindled further after top Democrats suggested he could be persuaded to drop out as soon as this weekend. ASX 200 fell below the 8,000 level with mining stocks leading the broad downturn seen across sectors. Nikkei 225 briefly retreated beneath 40,000 but then pared most of the initial losses to reclaim the key psychological level. Hang Seng and Shanghai Comp. conformed to the downbeat mood with the former pressured by weakness in the real estate industry, while losses in the mainland were stemmed after the PBoC liquidity efforts amounted to a net CNY 1.17tln for its largest weekly cash injection since January, while a CPC official noted the economic recovery is not strong enough and they need to implement macro policies more effectively.

Top Asian News

European equities, Stoxx 600 (-0.5%) are entirely in the red, with sentiment hit amid ongoing worldwide IT outages, which have affected banking transactions and flights. European sectors hold a strong negative bias, with the typical defensive sectors performing better, given the glum risk tone. Basic Resources underperforms, amid broader weakness in the metals complex, with Travel & Leisure also hampered by the ongoing IT outages; Lufthansa (-1.9%). US equity futures (ES -0.2%, NQ -0.3%, RTY -0.4%) are entirely in the red, with sentiment hit amid global IT outages following updates at Crowdstrike (-14%), which has impacted the likes of Microsoft (-2.2%) and Nvidia (-1%).

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Bank Speakers