US equity futures are flat, erasing a modest earlier gain, as yesterday’s rotation continues this morning with RTY rallying +0.8% pre-mkt even as megacap tech stocks are higher (NVDA +93bp, AAPL +39bp, AMZN +19bp). As of 8:45am, S&P futures were little changed after the index fell almost 1% in the previous session. The yield on 10-year Treasuries was unchanged at 4.21% and the USD is lower despite a PPI report that came in hotter than expected. Commodities are mixed: oil is higher, base metals are lower. Today, the key focus will be PPI (which beat across the board) and banks earnings (which were mixed).

In premarket trading, Wells Fargo sank 5% after warning it won’t be able to whittle away costs as fast as forecast amid higher-than-expected expenses. JPMorgan swung between gains and losses after reporting record profit, while missing on a few key metrics, like net interest income. Citigroup climbed 3% as equity trading beat estimates even as the lender said costs for the year are likely to be at the high end of the range previously provided. Here are some other notable premarket movers:

US producer prices climbed in June more than forecast as a pickup in margins at service providers more than offset declines in the cost of goods. Investors are also eager to hear from the largest banks about the state of the US economy and expectations for the rest of the year, including the potential impact of the presidential elections in November.

In Europe, the Stoxx 600 is up 0.2% - rising for a third day - led by gains in energy and consumer product shares. Here are the biggest movers Friday:

Earlier, Asian stocks declined as tech shares tracked their US peers lower after slowing inflation data. Equities in Hong Kong bucked the selloff amid prospects of lower borrowing costs. The MSCI Asia Pacific Index fell as much as 1.1%, the most in over a month, with TSMC, Samsung Electronics and Tokyo Electron among the biggest laggards. Tech-heavy markets such as Taiwan, Japan and South Korea led declines in the region. Equities in mainland China fluctuated as traders rebalanced their holdings ahead of next week’s Third Plenum. Property stocks climbed amid rising expectations for more support for the sector at the meeting. Meanwhile, shares in Hong Kong rose as soft US consumer price print boosted hopes for potential interest rate-cuts in the city. Here are the most notable movers:

In FX, the yen initially weakened against the dollar, paring some of the sharp rally seen in the prior session, before resuming its trek higher. An analysis of Bank of Japan accounts suggests authorities did step into the markets to prop up the yen on Thursday. USD/JPY was flat at ~158.90. The Bloomberg Dollar Spot Index is down 0.1% and set for a third day of declines. The Swedish krona is the weakest of the G-10 currencies, falling 0.5% against the greenback after underlying inflation slowed more than expected.

In rates, treasuries edged lower, with US 10-year yields rising 1bps to 4.22%. Long-end yields are higher by ~1bp with 2s10s spread steeper by ~1bp; US 10-year around 4.225% outperforms bunds by ~4bp, gilts by ~6bp. European government bonds underperform their US peers.

In commodities, oil prices advance, with WTI rising 1% to trade near $83.50 a barrel. Spot gold falls $12 to around $2,404/oz.

Bitcoin is incrementally softer and holds just above USD 57k, after briefly dipping below the level earlier. Ethereum remains firmly above USD 3k.

Today's economic data slate includes June PPI (8:30am, which beat across the board) and July preliminary University of Michigan sentiment (10am). No Fed members are scheduled to speak

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newquawk

APAC stocks took their cues from the mixed performance stateside where softer-than-expected CPI data boosted Fed rate cut bets and spurred a stock rotation out of large-cap tech into small-cap cyclicals. ASX 200 gained amid lower yields with gold miners, real estate, and consumer stocks leading the advances. Nikkei 225 underperformed after recently sliding back from record highs and amid speculated FX intervention. Hang Seng and Shanghai Comp. diverged as the former rallied back above the 18,000 level with strength seen in property and tech, while the mainland was lacklustre after mixed Chinese trade data in which Exports topped forecasts but Imports surprisingly contracted.

Top Asian News

European bourses, Stoxx 600 (+0.3%) are entirely in the green, continuing the price action seen in the prior session. Indices initially opened tentatively higher and continued higher as the morning progressed, though has edged off best levels in recent trade. European sectors hold a strong positive bias; Energy takes the top spot, benefiting from underlying strength in the crude complex. The Telecoms sector has been lifted by post-earnings strength in Ericsson (+7.2%). US equity futures (ES +0.1%, NQ U/C, RTY +0.7%) are mixed with the ES and NQ taking a breather from yesterday’s hefty selling pressure; the RTY continues to advance and holds at highs, with the rotation narrative remaining firm. Bank earnings today: BNY Melon, JPMorgan, Wells Fargo, Citi. Intel (INTC) exec. says they are on track for cumulative software sales of USD 1bln by end-2027

UBS has downgraded Tesla (TSLA) to Neutral from Sell with a price target of USD 197

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

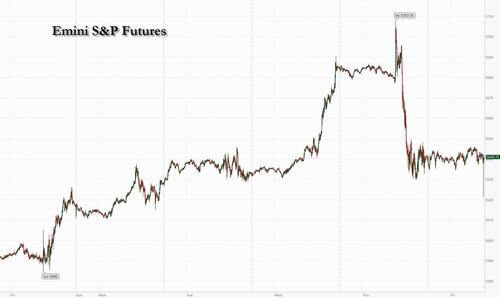

Markets got another boost yesterday, as the latest US CPI print surprised on the downside once again, which led to growing hopes that inflation was finally being tamed. Of course, it’s worth remembering that one report doesn’t make a trend, but recent months have brought some of the weakest inflation numbers since the current surge began in 2021, and it’s led to growing expectations that the Fed will finally be able to start cutting rates in the months ahead. In fact, investors are now fully pricing in a rate cut by the September meeting, and yesterday saw the 2yr Treasury yield (-10.6bps) post its biggest daily decline since January. Equities also put in a strong session for the most part, and the small-cap Russell 2000 (+3.57%) had its best daily performance of 2024 so far. That said, one very notable exception were the Magnificent 7 (-4.26%), which put in their worst performance since October 2022, and their concentration meant that the S&P 500 (-0.88%) ended its run of 7 consecutive daily gains, even though nearly 80% of the index’s members were actually higher on the day.

In terms of the details of that CPI report, headline CPI for June actually fell by -0.1% on the month (vs. +0.1% expected), which was the biggest outright decline in prices since May 2020 during the Covid-19 pandemic. Other details in the report were also very promising, as core CPI came in at just +0.1% (vs. +0.2% expected), which is the weakest month for core inflation since January 2021. The declines were driven by several factors, but there was a meaningful step lower in shelter inflation, with Owners’ Equivalent Rent up just +0.28% in June, which was its weakest month since April 2021, and down from +0.43% in May. Bear in mind that the OER category alone makes up more than a quarter of the CPI basket, and around a third of core CPI, so if that shift lower is durable, then that’s very good news in terms of keeping inflation low.

Markets were also reassured that the latest print followed a series of softer inflation numbers in Q2, raising hopes that it wasn’t simply one good month. In fact, on a 3-month annualised basis, core CPI is up just +2.1% now, which is the lowest since March 2021. To be fair, the 6-month core CPI is still at +3.3%, which reflects the stronger prints from Q1, but that’s also on a downward trajectory, and similar prints to the last two would cement the idea that inflation is on a clear path lower. On the back of the print, our US economists have lowered their 2024 core CPI forecast by three tenths to 3.0% (on Q4/Q4 basis). See their full reaction note here.

With that inflation report in hand, there was immediate speculation that the Fed might accelerate the timing of their rate cuts and announce a first cut as soon as the September meeting. For instance, f utures are now fully pricing in a move by September, whereas beforehand it was only fully priced in by November. Likewise for the year as a whole, there were growing expectations that the Fed would deliver multiple rate cuts, with 61bps of cuts now priced in by the December meeting at the close, up from 51bps the previous day. When it came to Fed officials themselves, Chicago Fed President Goolsbee said that the latest data was “excellent”, and that his view “is this is what the path to 2% looks like”.

As investors priced in more rate cuts, the US Dollar index weakened -0.58%, and US Treasuries rallied strongly, with both the 2yr and 10yr yields falling to their lowest level since March. Specifically, the 2yr yield (-10.6bps) was down to 4.51%, in its biggest daily decline since January, and the 10yr yield (-7.4bps) was down to 4.21%. Treasuries did give up some of their initial post-CPI gains late on however, with the 10yr yield having traded as low 4.165% intra-day. And overnight, the 10yr yield (+1.0bps) has moved a bit higher to 4.22%. There were similar moves in Europe, with yields on 10yr bunds (-7.0bps), OATs (-6.3bps) and BTPs (-7.0bps) all falling as well.

For equities though, there was a much more divergent performance in the US, with small-caps surging whilst the Magnificent 7 slumped. That meant the small-cap Russell 2000 (+3.57%) had its best daily performance since December, rising to its highest level since March 2022. By contrast, the Magnificent 7 (-4.26%) had its worst performance since October 2022. Ultimately though, that meant the S&P 500 (-0.88%) fell back by a sizeable amount, even though more than three-quarters of the index’s members actually rose on the day. The equal-weighted S&P 500 (+1.17%) posted a strong advance, with the largest daily performance gap versus the main market cap-weighted index since 2020. Rate-sensitive sectors including real estate (+2.66%) and utilities (+1.83%) outperformed within the S&P 500. Meanwhile in Europe, there were more consistent gains, with advances for the STOXX 600 (+0.60%), the DAX (+0.69%) and the CAC 40 (+0.71%).

Speaking of Europe, there were some strong growth numbers from the UK yesterday, where monthly GDP was up by +0.4% in May (vs. +0.2% expected). The monthly GDP numbers can be a bit choppy, but if you look at the full three months leading up to May, the economy was +0.9% bigger than the previous three months, which is the fastest growth since January 2022. In turn, that meant that gilts underperformed, with the 10yr yield only down -5.2bps, and the weakness in the dollar also helped sterling reach its strongest level against the dollar in almost a year, at $1.2911. Staying on the UK, Luke Templeman and Galina Pozdnyakova published a piece yesterday on the country’s new listing rules, which you can read here.

Overnight in Asia, equity markets have lost ground across the region, with losses for the Nikkei (-2.23%), the KOSPI (-1.31%), the Shanghai Comp (-0.21%) and the CSI 300 (-0.20%). The main exception to that is the Hang Seng, which has surged +1.98% this morning. For the Nikkei, those losses have come amidst a sharp appreciation in the Japanese Yen, which strengthened by +1.79% yesterday against the US Dollar, reaching 158.83. In part that was down to the weakness of the dollar after the CPI print, but there was speculation about whether there’d been an intervention, and Japan’s current chief Masato Kanda said he was “not in a position” to comment on whether Japan had intervened. Looking forward, US equity futures haven’t seen much movement this morning, with those on the S&P 500 unchanged, and those on the NASDAQ 100 down -0.14%.

When it came to yesterday’s other data, the US weekly initial jobless claims for the week ending July 6 came in at a 6-week low of 222k (vs. 235k expected). Moreover, the continuing claims fell to 1.852m (vs. 1.860m expected) over the week ending June 29, which ends a run of 9 consecutive weekly gains.

To the day ahead now, and data releases include the US PPI reading or June, along with the University of Michigan’s preliminary consumer sentiment index for July. We’ll also get earnings releases from JPMorgan Chase, Citigroup, Wells Fargo and BNY Mellon.