S&P 500 futures are flat, holding near Wednesday’s record high, with WTI futures bouncing around after OPEC+ agreed to delay output hikes for 3 months. As of 8:00am, futures were flat in a quiet trading session ahead of NFP after closing at a new all-time high for the 56th time in 2024; Nasdaq futures are down 0.1% as Mag7 names are mostly lower premarket with Semis underperforming. Bond yields are 1-2bps higher. Financials indicated higher. Bitcoin topped $100,000 for the first time after President-elect Trump named crypto proponent Paul Atkins to head the SEC. Microstrategy, which has become a proxy for crypto in the world of stocks, was up 8% crushing the latest onslaught of shorts. French assets rose slightly as investors debated the implications of the collapse of Michel Barnier’s government. The CAC 40 stock index climbed 0.1% in Paris, tracking Europe’s regional Stoxx 600 gauge. Commodities are mixed while the USD extends losses for a third consecutive day. It is a relatively light macro data day with jobless claims, which is not thought to be catalytic given tomorrow's NFP print.

In premarket trading, cryptocurrency stocks jumped on Thursday after Bitcoin rallied past $100,000 for the first time, boosted by President-elect Donald Trump’s embrace of digital assets. Microstrategy, Coinbase, Riot Platforms and MARA Holdings were among those sharply higher in premarket trading. Here are some other notable premarket movers

S&P 500 contracts were steady after the 56th record close of 2024 put the index on course for its best year since 2019. Fed Chair Jerome Powell buoyed sentiment on Wall Street by saying the US economy is in “remarkably good shape.” The dollar and Treasuries were lower. Attention turns next to today’s US jobless claims numbers before key non-farm payrolls data Friday.

In comments at the New York Times DealBook Summit in New York, Fed Chair Powell said downside risks from the labor market had receded. He also said Fed officials could afford to be cautious as they lower rates toward a neutral level — one that neither stimulates nor holds back the economy. Powell’s comments on the US economy did little to alter expectations implied by market pricing that the Fed will cut rates again when it meets later this month. Meanwhile, two surveys showed that US executives turned significantly more optimistic about the economy and prospects for their own businesses after Trump won the election.

France’s far-right leader Marine Le Pen teamed up with a left-wing coalition to topple Barnier’s administration on Wednesday, pitching the country into further political turbulence. President Emmanuel Macron now needs to find another premier who can pass a budget for 2025 through the deeply divided parliament.

“The markets have partially anticipated this development, but repercussions can be expected,” said Alexandre Hezez, chief investment officer at Group Richelieu. “Any political or budgetary misstep could punish France much more severely on the markets.”

French assets rebounded slightly as investors debated the implications of the collapse of Michel Barnier’s government. The CAC 40 stock index climbed 0.1% in Paris, tracking Europe’s regional Stoxx 600 index which rose for a sixth straight session and French equities outperform in early Thursday trading amid optimism that tax hikes proposed by the toppled government will not materialize. French aerospace firm Safran was lagging behind as analysts didn’t approve of its new targets. Aurubis rose on a higher-than-expected dividend. Here are the biggest movers Thursday:

In Asia, the MSCI Asia Pacific index was little changed as technology shares advanced while Korean stock losses extended amid a political turmoil with the country’s ruling party looking to prevent President Yoon Suk Yeol’s impeachment by voting against a motion to initiate proceedings that may take place Saturday. The MSCI Asia Pacific Index traded in a narrow range, with TSMC and other chip shares in the region tracking the sector’s gains on Wall Street overnight. Shares in Hong Kong declined, while Chinese equities listed in the city also snapped a four-day winning streak with traders awaiting a key policy meeting later this month. South Korean stocks slid for a second day, with the ruling and opposition parties set to clash over an impeachment motion to unseat

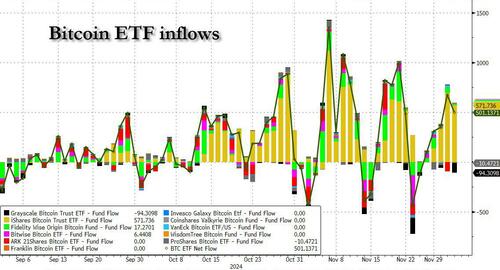

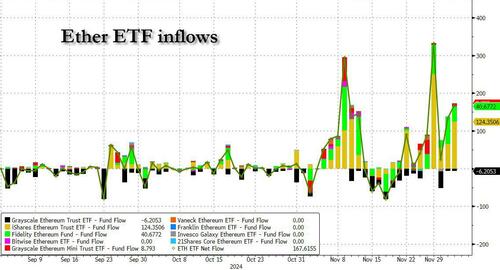

Bitcoin jumped as much as 6.1% to breach the $100,000 mark for the first time, boosted by Trump’s embrace of digital assets. Crypto tracking ETFs have seen huge inflows in recent days.

In FX, the Bloomberg Dollar Spot Index slipped 0.1%, falling for the second straight day; the yen extended gains after Bank of Japan Board Member Toyoaki Nakamura said he didn’t object to an interest rate hike later this month. EUR/USD edged up 0.2% to $1.0530 after France’s Prime Minister Michel Barnier was toppled in a no confidence vote, as widely expected

In rates, treasuries are slightly cheaper across maturities, underperforming core European rates ahead of weekly jobless claims and Friday’s broader US employment report. The US 10-year yield is higher by 3 bps to 4.21% with comparable bunds and gilts little changed, while French 10-year bond rise, trades around 5bp richer vs US, and outperforming their German peers and narrowing the 10-year yield spread to the lowest level this week despite the collapse of Michel Barnier’s government. President Macron is scheduled to make a statement at 8 p.m.

In commodities, oil prices edged higher as OPEC+ meets to discuss a further delay to its plans to revive oil production. WTI rises 0.5% to $68.90.

The US economic data calendar includes November Challenger job cuts (7:30am New York time) and October trade balance and weekly jobless claims (8:30am). Fed speaker slate includes Barkin at 12:15pm

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed and partially sustained the momentum from the fresh record levels on Wall St where tech led the advances with the help of earnings releases and softer yields following weak ISM Services data. ASX 200 eked slight gains with tech stocks taking inspiration from the outperformance stateside, while there was also an improvement in the latest trade and household spending data. Nikkei 225 gapped higher at the open but then gave back some of the initial spoils amid a choppy currency, while there was some intraday support seen after cautious rhetoric from BoJ's Nakamura although the momentum waned shortly after. Hang Seng and Shanghai Comp were mixed with sentiment clouded after the PBoC's operations resulted in another net liquidity drain and with a recent article in Chinese state media downplaying the pursuit of fast growth ahead of next week's Central Economic Work Conference.

Top Asian News

European bourses opened flat but started grinding higher shortly after the open despite relatively quiet newsflow but potentially as some of the optimism potentially emanating from the gains on Wall Street. European sectors kicked off the session with a mild positive bias which later expanded as sentiment continued to improve shortly after the cash open. CAC 40 shrugged off the vote of no confidence which played out as expected, while President Macron is reported to be looking to announce a replacement before Saturday as opposed to taking the country to the polls. In terms of US equity futures, mild downward bias seen in the ES and NQ after yesterday's session on Wall Street in which US stocks gained and the major indices printed fresh record highs with the Nasdaq leading advances amid outperformance in Tech and Consumer Discretionary and Communication names.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

It’s been a very eventful 24 hours for markets, with the French government losing a no-confidence vote for the first time since 1962, alongside ongoing political uncertainty in South Korea and some hawkish-leaning comments from Fed Chair Powell. But despite everything that’s happening, risk assets have been broadly unphased by the various developments, with the S&P 500 (+0.61%) closing at another record high yesterday, whilst Bitcoin has crossed the $100,000 mark overnight for the first time. Indeed, it now means the S&P 500 is up +27.6% so far in 2024, which is only a couple of points behind its 2013 gain (+29.6%) that still stands as the strongest annual advance of the 21st century so far.

In terms of the French situation, the National Assembly voted yesterday to oust the government of Michel Barnier, with 331 votes in favour out of 577. However, the result was broadly expected, so it’s little surprise that markets haven’t seen much of a reaction. Indeed, since Marine Le Pen’s announcement on Monday that her party would vote against the government, it was clear that the numbers were there to remove the government, so that was when the biggest market reaction took place.

For the time being, the existing government will remain in place, and if needed, they can use emergency legislation to collect taxes and spend money. So this doesn’t mean a US-style shutdown beckons. But it’s still not obvious what ends the impasse, as the National Assembly remains fractured between different groups, with no obvious majority capable of being assembled. After all, it took almost a couple of months before Macron chose Michel Barnier as PM in the first place. And under the French constitution, a new election can’t be held until a year after the last one, which isn’t until the summer. President Macron is set to make a statement this evening, so that’ll be in focus for the path forward. Macron has said he will serve out his presidential term until 2027, but Le Pen continued to pressure him to resign yesterday in order to break the gridlock.

Overnight, the Euro has seen little change in response to these developments, and is currently trading at $1.052. Otherwise, French assets closed ahead of the vote yesterday, but they put in a reasonably strong performance beforehand, with the Franco-German 10yr spread tightening another -1.3bps on the day to 83.8bps. Moreover, France’s CAC 40 (+0.66%) outpaced the Europe-wide STOXX 600 (+0.37%). That came as European risk assets did well across the board yesterday, with the Italian-German 10yr spread (-3.5bps) reaching its tightest in 3 years at 115.5bps. And over in credit, Euro IG spreads (-1bp) and HY spreads (-5bps) both tightened as well.

That strength among French assets was echoed in the US, with the S&P 500 (+0.61%) hitting another record high and posting its 11th gain in the last 12 sessions. That came as Fed Chair Powell said the US economy is “in remarkably good shape”, and the growth has been better than previously forecasted. He added that he feels “very good about where the economy is and where monetary policy is”, and said the FOMC “can afford to be a little more cautious as we try to find neutral.” In the meantime, several other Fed speakers made similar comments about moving slowly, with San Francisco President Daly saying that “We do not need to be urgent”, and St Louis Fed President Musalem saying that “the time may be approaching to consider slowing the pace of interest rate reductions or pausing”. Richmond Fed President Barkin, also said he was in favour of a slower rate cut path to get policy to a “somewhat restrictive level.”

But even as Fed speakers leant in a somewhat hawkish direction, US Treasury yields fell across the curve thanks to some weaker than expected data. In particular, the ISM services index was only at 52.1 in November (vs. 55.7 expected), ending a run of 4 consecutive monthly increases. And the employment component was down to 51.5, which dampened expectations ahead of tomorrow’s jobs report. There also wasn’t much optimism either from the ADP’s report of private payrolls, which came in at 146k (vs. 150k expected), but also contained a negative revision to the previous month of -49k.

In light of that, investors dialled up the likelihood of a December rate cut from the Fed, with futures taking the probability up to a three-week high of 77.5% by the close. So that helped to push down US Treasury yields, with the 2yr yield (-5.4bps) closing at a 1-month low of 4.13%, whilst the 10yr yield (-4.5bps) fell to 4.18%. In turn, that helped to lift US equities, particularly in some of the more cyclical sectors, and the S&P 500 ended the day up +0.61% at a new record. That was supported by a further gain for the Magnificent 7 (+1.58%) which also hit a fresh record.

Overnight in Asia, South Korean markets have lost further ground overnight, with the KOSPI down another -0.85%. The South Korean won did stabilise yesterday, strengthening +1.11% against the US Dollar, but it’s since fallen back a bit, weakening another -0.16% this morning. Otherwise though, there’s been a fairly steady performance across the region, with Japan’s Nikkei (+0.31%), China’s CSI 300 (-0.23%) and Australia’s S&P/ASX 200 (+0.15%) not seeing any big moves in either direction. The only exception to that is the Hang Seng, which is down -1.15% this morning. And looking forward, US equity futures are only very slightly lower, with those on the S&P 500 down -0.05%.

To the day ahead now, and data releases from the US include the October trade balance and the weekly initial jobless claims. Meanwhile in Europe, we’ll get Euro Area retail sales, German factory orders and French industrial production for October, along with the November construction PMIs from Germany and the UK. Central bank speakers include the Fed’s Barkin, the ECB’s Vujcic and the BoE’s Greene.