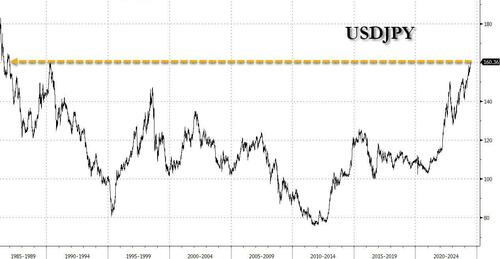

Futures are trading modestly in the red near sessions lows, erasing earlier gains of as much as 0.2% even as gigacap tech stocks continue their meltup. At 8:00am ET, S&P futures were down 0.1%, while Nasdaq futures were still green, rising 0.1% but also fading their earlier gains in another quiet start to the day (volumes this week have been tracking down 10-15% vs 10dma), with the snapback in momentum yesterday looking to continue its rally this am (NVDA +2% in premarket). Bond yields are 2-4bp higher after Fed Governor Michelle Bowman reiterated her view that borrowing costs should remain elevated for some time; USD is higher as the yen plunges below 160 vs the USD, the lowest since 1986 with another BOJ intervention now imminent. Commodities are mixed: oil and Ags are higher, while base metals are lower. Today, the key macro focus will be on MBA Mortgage Applications (up 0.8%), New Home Sales (10am, est 633k), $70bn UST 5yr note auction, Fed will release bank stress test results after the close today; Micron, Jefferies and General Mills are among companies reporting results.

Pre-mkt, Tech/Semis are continuing yesterday’s rally: Nvidia climbed more than 2% in US premarket trading, adding to Tuesday’s 7% gain. Rival Micron Technology Inc. rose more than 3% ahead of its third-quarter results later Wednesday (WTD +4.3%). Other tech names rising are QCOM +70bp, AMZN +65bp, AAPL +32bp. Here are the most notable premarket movers:

The volatility in Nvidia shares, which account for one third of the S&P's advance this year, has raised renewed concern about the concentration of megacap technology stocks in equity indexes.

“Nvidia’s volatility has weighed on market sentiment, but we think the structural investment case for artificial intelligence remains intact,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “We also hold a constructive outlook for broader equities amid solid fundamentals.”

Among other premarket movers, FedEx Corp. surged more than 13% after an upbeat profit forecast. Cruise operator Carnival Corp. gained after posting a surprise quarterly profit and raising its earnings outlook. Southwest Airlines Co. fell as much as 6.7% after cutting guidance.

Fed officials recently forecast just 25 basis points of reductions by the end of this year and a total of 125 basis points by end-2025, while market participants are pricing in about 75 basis points by the first quarter of 2025. But some are starting to hedge against deeper and more rapid easing: positioning in the rate options market shows an increase in bets that stand to benefit if the Fed reduces its key rate to as low as 2.25% over the next nine months — a whopping 3 percentage points of cuts.

The Stoxx Europe 600 index reversed an early advance and slipped 0.4% as declines for car makers and travel and leisure stocks offset gains in the tech sector. Among individual movers in Europe, Danske Bank A/S rose as much as 2.4% after lifting its full-year outlook. Just Eat Takeaway.com NV and Delivery Hero SE fell as much as 4% each after JPMorgan forecast tepid growth for the food delivery sector. Here are the most notable European movers:

In the absence of major data from the euro zone on Wednesday, traders are taking their cues from policy signals. Investor expectations for the European Central Bank to loosen monetary policy twice more this year are fair, according to Governing Council member Olli Rehn, who added that officials shouldn’t overly dampen economic activity.

Earlier, in Asia equities advanced for a second day as tech shares rebounded after Nvidia drove a rally in US peers. The MSCI Asia Pacific Index rose as much as 0.4%, with TSMC and SK Hynix among the biggest boosts. A gauge of the region’s tech shares advanced after a three-day decline. Benchmarks gained in Japan, South Korea and mainland China. Australian stocks slid as a hotter-than-expected inflation data print bolstered the case for the Reserve Bank to resume raising interest rates.

Wall Street’s tech rally overnight helped lift chip-related stocks in the region, though any bullish sentiment may be contained as uncertainties remain on the Federal Reserve’s monetary policy path. Investors are watching the central bank’s preferred inflation gauge due Friday for more clues on its path to easing. China’s 10-year bond yield fell to a more than two-decade low as investors flocked to fixed-income securities amid concern about the slowing economy and expectations for further stimulus.

In FX, it was all about the continued disintegration of the yen, which breached 160 per dollar, a level that triggered a sharp reversal on April 29 due to suspected intervention, raising speculation Japanese authorities may take steps to support the currency again. As of 8:00am, the USDJPY rose to 160.36, the lowest since 1986.

In rates, treasuries are cheaper across the curve on Wednesday, holding on to losses seen during Asian trading hours amid a selloff in Australian government bonds after the country’s May inflation reading beat estimates, raising the odds that the Reserve Bank will resume raising interest rates at its next meeting. US yields are cheaper by 2.5bp to 3.5bp across the curve, with the front and belly of the curve broadly leading losses on the day. US 10-year yields trade at around 4.28%, cheaper by 3bp on the day with bunds and gilts trading broadly in line. Aussie 2-year notes climbed 18bp following CPI data. Treasury coupon issuance resumes at 1pm New York time with $70 billion in 5-year notes, which follows a 2-year sale on Tuesday which stopped on the screws. This week’s auctions conclude Thursday with $44 billion in 7-year notes. The WI 5-year yield at around 4.305% is ~25bp richer than May’s stop-out, which tailed the WI by 1.3bp

In commodities, oil rose ahead of a US government report on crude inventories and fuel demand following the release of mixed industry data. Iron ore climbed for a second day. Copper fell to the lowest in more than two months with prices facing sustained pressure from unusually weak Chinese demand. Gold was little changed. Bitcoin softer but essentially consolidating at the top-end of Tuesday's range which itself was a consolidation of Monday's marked Mt. Gox/technical inspired downside; at a base of USD 61.4k

The US economic data slate includes May new home sales at 10am. There are no Fed officials scheduled to speak for the session. The focus for the US session also includes a 5-year note auction, which follows solid demand for Tuesday’s 2-year sale.

Market Snapshot

Top Overnight Stories

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the mixed performance stateside where the major indices reversed Monday's price action and tech rebounded as Nvidia snapped its losing streak, while markets continue to await fresh catalysts. ASX 200 was pressured with sentiment not helped by a hot monthly CPI print which saw both Deutsche Bank and Morgan Stanley call for a 25bps hike at the next RBA meeting in August, Nikkei 225 outperforms following recent currency weakness and with tech names boosted after Nvidia's rebound. Hang Seng and Shanghai Comp. were mixed with the former kept afloat above the 18,000 level, while the mainland was subdued despite another firm liquidity injection by the PBoC with sentiment clouded by tech and trade-related frictions as OpenAI was reportedly taking steps to block China access to its AI tools.

Top Asian News

European bourses higher across the board following the tech-led upside on Wall St.; Stoxx 600 +0.2%. Sectors mostly in the green, Tech leads while Autos lag amid pressure in Volkswagen after their investment in Rivian. Stateside, futures firmer but only modestly so, ES +0.2% & NQ +0.3% as we count down to Micron earnings after-hours; Fedex leading in the pre-market +13% post-earnings. DigiTimes reported that Nvidia (NVDA) CEO Jensen Huang was reportedly concerned about the company's business development, with slow data centre expansion possibly impacting chip sales. Equity specifics between Volkswagen-Rivian & FedEx detailed below.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

I can safely say that this is the first time I have written the EMR from a castle. It’s in the Frankfurt countryside and quite an incredible place. This morning you need to look out at the market from the highest possible watchtower as the last 24 hours have seen a lot of differing trends from all directions.

On the plus side, tech stocks posted a decent recovery, with Nvidia (+6.76%) rebounding from its slump over recent days. But on the more negative side, several data releases were underwhelming, and multiple headlines leant on the hawkish side, i ncluding an upside surprise in both Canadian and Australian CPI. Indeed, DB have overnight changed their RBA call to a hike in August. Moreover, political events have also remained in focus, with the CAC 40 (-0.58%) and other European indices losing ground ahead of France’s election on Sunday.

We’ll start with the good news, as there was finally a bounceback for tech stocks after three consecutive declines, which helped to lift US equities more broadly. In particular, Nvidia was the second best performer in the entire S&P 500, which pushed its market cap back above the $3tn mark again. Those gains were seen amongst all the big tech stocks, with all of the Magnificent 7 (+2.40%) advancing on the day. In turn, that helped the NASDAQ (+1.26%) post a strong rebound, and it also lifted the S&P 500 up +0.39%.

But unfortunately, the good news mostly ended there, as even though the headlines pointed to a recovery for US equities, the move was dominated by the big tech stocks. In fact, over 75% of the S&P 500 actually fell yesterday, and the equal-weighted S&P 500 was down by a significant -0.72%. So as it stands with just a few days of the quarter left, the S&P 500 is up +4.09% in Q2 so far, whereas the equal-weighted index is down -2.89%. So a different story depending on which part of the market you look at, and this builds on the tech outperformance we already saw in Q1.

Matters weren’t helped by several hawkish headlines, with sovereign bonds coming under pressure after Canada’s CPI report for May. That showed headline CPI unexpectedly rising to +2.9% (vs. +2.6% expected), and the two core inflation measures followed by the Bank of Canada also rose. As it happens, the Bank of Canada did announce an initial cut at their meeting earlier this month, but after the inflation report, investors swiftly moved to dial back the chance of a follow-up move in July. Indeed, overnight index swaps had been pricing a 61% chance of a July cut on the previous day, but that was down to 16% by the close. Canadian government bonds also lost ground, with the 10yr yield up +5.0bps.

The inflation surprise has continued in Australia overnight with the latest CPI reading seeing it surge to its highest level this year. It printed at +4.0% y/y in May, above market expectations for a +3.8% gain and up from +3.6% in April. Our Aussie economist now believes the RBA will hike 25bps in August. See his report justifying the call here. Following the CPI data, the Australian dollar has risen +0.44% to trade at 0.6676 versus the dolla r while yields on the policy sensitive 3yr government bonds are currently +16.8bps higher at 4.09%, its biggest one-day gain since April, while yields on the 10yr are +11.7bps, standing at 4.32% as I type.

US Treasuries are also edging up around +1.5bps across the board after the Aussie CPI print after rising yesterday on the Canadian CPI beat. By last night’s close, 2yr Treasury yields were up +1.7bps to 4.74%, and the 10yr yield was up +1.6bps to 4.25%. Treasury yields did come slightly off their intra-day high seen around the European close following a solid 2yr auction which saw the highest bid-to-cover ratio since September. There was also some hawkish Fedspeak though, with Governor Bowman warning that “we are still not yet at the point where it is appropriate to lower the policy rate.” In addition, she said that cutting rates “ too soon or too quickly could result in a rebound of inflation, requiring further future policy rate increases to return inflation to 2 percent over the longer run.” Meanwhile, Fed Governor Cook maintained patience on rate cut prospects, saying these will be appropriate “at some point”.

Back in Europe, risk assets struggled, with the STOXX 600 (-0.23%), the CAC 40 (-0.58%) and the DAX (-0.81%) all posting losses. However, the Franco-German 10yr spread did tighten a bit, coming down by -1.1bps to 76bps, and yields came down across the continent, including on 10yr bunds (-1.1bps). With regards to politics, last night saw the debate between three potential French PM candidates though there are no immediate signs that this will materially alter the election race. Polls continue to put Marine Le Pen’s National Rally party in the lead, and yesterday’s Ifop poll had the National Rally on 36%, the left-wing alliance on 28.5%, and President Macron’s centrist group on 21%.

Asian equity markets are again mixed this morning with the Nikkei (+1.41%) sharply higher and with the KOSPI (+0.23%) edging higher. On the other hand, the S&P/ASX 200 (-0.80%) is the worst performer following the CPI data discussed above. Elsewhere Chinese stocks are also losing ground with the Hang Seng (-0.16%), the CSI (-0.39%) and the Shanghai Composite (-0.36%) all lower in morning trade. S&P 500 (+0.05%) and NASDAQ 100 (+0.08%) futures are slightly higher.

Finally on the data yesterday, the Conference Board’s consumer confidence measure for the US fell back to 100.4 (vs. 100.0 expected). The FHFA’s house price index was also up by +0.2% in April (vs. +0.3% expected).

To the day ahead now, and data releases include US new home sales for May. From central banks, we’ll hear from the ECB’s Rehn, Panetta, Lane and Kazaks.