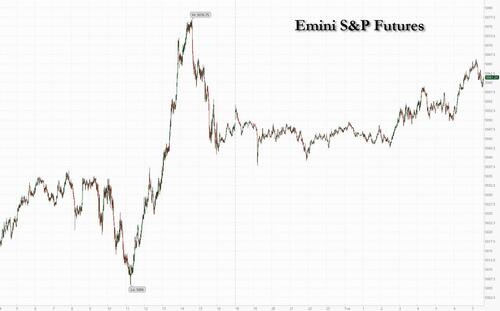

US equity futures are higher for the second day, even as small-caps underperform after bond yields rise about +4bps and trade near session highs. As of 7:40am S&P and Nasdaq futures were 0.3% higher after Wall Street’s rebound from a $2 trillion selloff; European stocks also rose on broad-based strength, with only commodity-related sectors in the red; the UK’s FTSE 100 index hit a record high as a rebound that took hold on Monday gathered momentum. Ahead of Tesla's earnings today, the Mag7 are mixed with semis higher pre-mkt after the recent rout. Commodities are stronger led by Ags and Energy with a flat USD. The macro data focus is on Flash PMIs, Home Sales, Regional Mfg Activity indicators; earnings are skewed towards the Industrials sector with TSLA the first Mag7 stock set to report. We will see if the last few trading sessions sufficiently squared positions and if realized stock moves can match the implied moves, expected to be the largest in 1.5 years.

Early results Tuesday were mostly positive, with shares of United Parcel Service and General Motors rising in premarket trading after earnings beats. PepsiCo slipped after reporting falling volumes in North America. But the main event will be the “Magnificent Seven” cohort of tech megacaps, with Tesla set to be the first to report after today’s market close. Next up is Meta Platforms on Wednesday, followed by Microsoft and Alphabet on Thursday. Here are some other notable premarket movers:

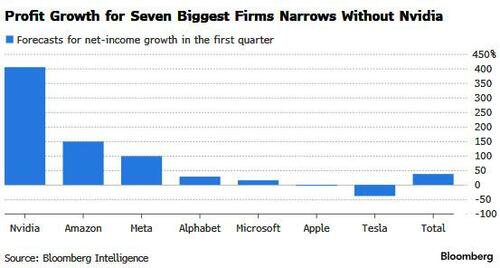

Earnings will stay front and center of investors’ minds this week with about 180 companies — over 40% of the S&P 500 market value — report results. The focus on corporate profits comes after a rout fueled by geopolitical fears and signals the Federal Reserve will be in no rush to lower rates. "Whether markets see further consolidation from here is likely to hinge on the assessment of the sustainability of AI demand ahead following the earnings releases," said Eddie Cheung, a senior strategist at Credit Agricole CIB.

The challenge to S&P 500 returns is that companies will have to produce earnings, and outlooks, that support the already elevated multiples. Profits for the Magnificent Seven are forecast to rise 38% in the first quarter from a year ago, dwarfing the overall S&P 500’s 2.4% anticipated year-over-year earnings growth, according to Bloomberg Intelligence. But excluding Nvidia, the leading chipmaker for AI technology, expected net income growth for the group falls to 23%. Nvidia, which Goldman Sachs Group’s trading desk dubbed “the most important stock on planet Earth,” doesn’t report its earnings for another month.

“We remain focused on the current earnings season, which could re-focus investor attention on solid underlying fundamentals,” Citigroup Inc. strategists Mihir Tirodkar and Beata Manthey wrote in a note. “We would view the recent pullback as a buying opportunity."

Meanwhile, Investor positioning on megacap growth and tech stocks continues to be cut, down from the 97th percentile in early March to the 77th percentile now, according to Deutsche Bank strategists. The group is still the only sector where positioning is above historical average, even if no longer extreme, the strategists wrote, countering the self-serving and incorrect observations by JPM's Marko Kolanovic.

In Europe, the Stoxx 600 index climbed 1%, with technology and retail shares leading gains, while the mining sector lagged. SAP SE jumped more than 4% as a boom in demand for artificial intelligence fueled the German software company’s growth. Drugmaker Novartis AG added as much as 5% after lifting full-year guidance. Here are some other notable premarket movers:

PMI data on Tuesday reinforced the positive mood in Europe. Private-sector activity advanced to the highest level in almost a year, driven by a buoyant services sector and Germany’s return to growth. And yet, barring any economic surprises, a rate cut in June is a “fait accompli,” European Central Bank Vice President Luis de Guindos said.

Earlier in the session, Asian stocks also rose for a second day as sentiment toward China continued to improve, with easing fears of a wider Middle East conflict offering additional support. The MSCI Asia Pacific Index rose as much as 0.8%, with TSMC and Tencent among the biggest boosts. Most regional markets advanced, though mainland China stocks fell for a third day and Japanese shares trimmed gains as the yen strengthened after Finance Minister Shunichi Suzuki’s comments on possible intervention. Hong Kong stocks led the region’s gains after UBS upgraded Chinese stocks to overweight, citing resilient earnings and a growing focus on shareholder returns. Investors are turning more upbeat on the nation’s assets thanks to green shoots in the economy as well as signs of improving corporate performance.

“What makes us more positive now on earnings are the early signs of a pick-up in consumption,” UBS strategists including Sunil Tirumalai wrote in a note. “Any rebound in consumer confidence for us means the possibility of household savings flowing into consumption” and eventually markets.

In rates, treasuries are under modest pressure with front-end yields higher by ~2bp before a flurry of bond auctions that will test investors’ appetite after yields hit the highest in 2024: the latest weekly supply cycle (2-, 5- and 7-year auctions) is set to kick off with record $69b 2-year later today. US 10-year yields around 4.645%, higher by nearly 4bps on the day. In Europe, gilts underperform their German counterparts after the UK raised its planned gilt issuance for the fiscal year more than expected, as the government’s budget shortfall overshot forecasts; the belly of gilts curve cheapened after DMO announcement, with 5-year UK yields higher by around 2bp. Treasury coupon auctions resume at 1pm New York time with $69b 2-year, followed by 5- and 7-year notes Wednesday and Thursday. The WI 2-year yield at around 4.965% is ~37bp cheaper than last month’s, which tailed by 0.5bp

In commodities, oil prices advance, with WTI rising 0.4% to trade near $82.20. Gold extends Monday’s drop, down 1% on the day; Monday’s 2.7% drop was biggest in nearly two years. Bitcoin is modestly softer and holds around the USD 66k mark.

Looking at today's calendar, US economic data slate includes April Philadelphia Fed non-manufacturing activity (8:30am), S&P manufacturing and services PMIs (9:45am), March new home sales and April Richmond Fed manufacturing index (10am). From central banks, we’ll hear from the ECB’s Panetta and Nagel, and the BoE’s Haskel and Pill as Fed members have entered quiet period ahead of May 1 policy announcement. Finally, today’s earnings releases include Visa, Tesla, PepsiCo, General Electric, UPS and General Motors.

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a mild positive bias after the tech-led rebound stateside. ASX 200 was led by strength in real estate and tech, while the latest flash PMIs from Australia were varied. Nikkei 225 traded indecisively and on both sides of 37,500 after briefly wiping out all of its opening gains. Hang Seng and Shanghai Comp. were mixed with outperformance in Hong Kong due to tech strength, while the mainland lagged amid the PBoC's continued tepid liquidity operations and with the US drafting sanctions that threaten to cut some Chinese banks off from the global financial system for aiding the Russian war effort.

Top Asian News

European bourses, Stoxx600 (+0.6%) began the session on a strong footing, and has remained at elevated (albeit contained) levels throughout the European morning. There was little reaction to the EZ Flash PMI data. European sectors hold a positive tilt; Tech takes the top spot, benefiting from US tech gains in the prior session, and post-earning strength in SAP (+3.9%). Basic Resources is found at the foot of the pile, amid broader weakness in metals prices. US Equity Futures (ES +0.1%, NQ +0.2%, RTY U/C) are tentative ahead of a busy earnings slate and the key US PMI data.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event calendar

DB's Jim Reid concludes the overnight wrap

It may not be saying a lot, but markets had their best performance in some time yesterday, as investors became a bit more optimistic about the near-term outlook. Equities recovered, and the S&P 500 (+0.87%) finally managed to advance after a run of 6 consecutive declines. Adding to the positive sentiment were growing hopes that a further escalation in the Middle East would be avoided, and Brent crude oil prices (-0.33%) fell back to their lowest level so far this month, at $87.00/bbl. So there were several pieces of better news for investors, but there’ll be no let-up on the calendar today, as we’ve got lots of earnings reports, including Tesla after the US close. While the Magnificent 7 were up +0.94% yesterday, Tesla was down -3.40%, extending its decline this year to -42.8% and having halved since last July. It's maybe a slight warning for the darlings of the current AI boom that things can change quickly if profits don't follow very high expectations as new technologies grow. Talking of which Nvidia bounced back from their -10.0% decline on Friday and rose +4.35% yesterday.

On top of earnings today, we’ll get an initial indication about how the global economy has performed in Q2, as the April flash PMIs are coming out for the major economies. These will be of particular interest for assessing the nascent recovery in the euro area economy. In March the composite PMI rose above the 50 level for the first time in 10 months. There will also be attention on the price components within the PMIs, especially in the US, where the composite output price index posted a 10-month high of its own last month.

We’ll have to see how those events pan out, but before all that, risk assets managed to post a strong recovery on both sides of the Atlantic. That made a change after three weeks of losses for global equities, with the major indices including the S&P 500 (+0.87%), the NASDAQ (+1.11%) and the STOXX 600 (+0.60%) all advancing. Information technology (+1.28%) and financials (+1.20%) outperformed within the S&P 500. Alongside that, the VIX index of volatility (-1.8pts) fell to 16.94pts, which is its lowest level since Iran launched their recent missile strike on Israel . And here in the UK, the FTSE 100 (+1.62%) even closed at an all-time high, aided by the weakness in sterling (-0.19%), which hit its weakest level against the US Dollar since November.

Henry did a piece yesterday (link here) looking at what happens next after the S&P 500 has seen 6 consecutive declines as we saw before last night's positive close. The subsequent 1-month and 6-month performances have mostly been positive in recent history. Moreover, if the S&P had posted a 7th consecutive decline yesterday, that would have taken us into unusual territory, as it’s something we haven’t seen since February 2020 as Covid-19 spread globally. Indeed, the examples of 7 consecutive losses for the S&P 500 (in the 21st century at least) have either been during a crisis (GFC, US debt ceiling crisis, Euro Crisis, Covid-19) or in anticipation of a pivotal event with significant uncertainty (2016 US election).

As discussed at the top, sentiment was bolstered by the lack of any further escalation in the Middle East. Indeed, yesterday saw Iran’s foreign ministry spokesman say that Israel had received the “necessary response at this stage”. The apparent easing in tensions helped oil prices fall back, and there was also a sharp move lower in gold (-2.59%), which had its biggest daily decline since June 2021. It's down another -0.90% this morning.

The more positive tone was evident across sovereign bonds too. They were supported by the drop in oil prices, which added to hopes that any spike in inflation would prove temporary, and the 1yr US inflation swap (-1.2bps) fell back for a 4th session to 2.71%. In turn, that meant investors grew a bit more hopeful about the prospect of rate cuts, and the amount of Fed rate cuts priced by the December meeting (+1.2bps) inched up to 40bps. Similarly at the ECB, the number of rate cuts priced by December’s meeting (+4.2bps) rose to 78bps.

With more rate cuts being priced in, that helped to push down yields, with those on 10yr bunds (-1.4bps), OATs (-2.7bps) and BTPs (-8.7bps) all moving lower. Admittedly, there was a decent intraday turnaround, as the 10yr bund yield had risen to 2.55% at one point, its highest level since November, before reversing course and ending the day lower at 2.48%. Meanwhile in the US, there was a decline in the 2yr Treasury yield (-1.5bps) to 4.97%, whilst the 10yr Treasury yield (-1.2bps) fell to 4.61%, as it also pared back its earlier losses, having still being above at 4.66% as Europe finished lunch.

In Asia the Hang Seng (+1.64%) is leading gains on a broker upgrade, with the Nikkei (+0.27%), the KOSPI (+0.20%) and the S&P/ASX 200 (+0.41%) seeing minor gains. Chinese stocks are the worst performers with the CSI (-0.56%) and the Shanghai Composite (-0.41%) both trading lower. US stock futures are broadly flat as I type.

Early morning data showed that key gauges of Japan’s manufacturing and service activity improved in April to its highest levels in nearly a year. The au Jibun Bank flash manufacturing PMI rose to 49.9 in April, as against a level of 48.2 in March. The services PMI advanced to 54.6 in April up from 54.1 in March indicating that the service sector continues to remain the primary driver of growth.

Elsewhere, Australia’s Judo Bank PMI data for April showed the manufacturing PMI rising to 49.9 from 47.3. Meanwhile, the service sector PMI came off slightly from 54.4 to 54.2, though still registering a decent growth environment. The composite PMI hit a 24-month high of 53.6 in April, an improvement from the previous month's 53.3.

To the day ahead now, and the main data highlight will be the April flash PMIs from Europe and the US. Elsewhere, we’ll get US new home sales for March, UK public finances for March, and the Richmond Fed’s manufacturing index for April. From central banks, we’ll hear from the ECB’s Panetta and Nagel, and the BoE’s Haskel and Pill. Finally, today’s earnings releases include Visa, Tesla, PepsiCo, General Electric, UPS and General Motors.