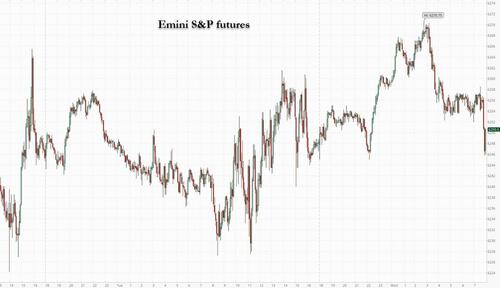

US equity futures are flat, after trading in a narrow overnight range, with small caps outperforming as we see more signs of a Value rotation as H2 kicks off and after yesterday's dramatic momentum plunge. As of 8:00am ET, S&P futures are fractionally in the red, reversing an earlier 0.3% gain as President Donald Trump’s July 9 tariff deadline gets ever closer — Trump said on Tuesday he won’t delay the date for imposing higher levies on trading partners; Nasdaq futures drop 0.1% with Mag7 names mixed in premarket trading. Futures for the small-cap Russell 2000 rose 0.9% to outperform as Tuesday’s rotation out of high-momentum stocks extended, which helped Cyclicals led by Financials continue to outperform. European equities advanced 0.4%. Bond yields are higher as the curve bear steepens and USD catches a bid which accelerates as US traders walk in. Commodities are rallying across all 3 complexes, with Brent trading back over $68. Yesterday, stocks fell into the bell on Trump comments about not extending the July 9 deadline and possibly not reaching a deal with Japan but recovered their initial losses. Today’s macro data focus is on ADP though it has not been a reliable predictor of NFP.

In premarket trading,Apple climbs 0.7% following an upgrade at Jefferies (from Sell to Hold) while Tesla (TSLA) rises 0.8% as the company saw its first increase in vehicle deliveries from its Shanghai factory this year. The rest of the Mag 7 is mixed (Amazon -0.2%, Meta -0.1%, Alphabet -0.9%, Nvidia -0.6%, Microsoft -0.2%). Here are some other notable movers:

The stocks of US banks including JPMorgan, Goldman and Bank of America all rose in premarket trading after boosting their dividends. Wall Street’s largest lenders passed this year’s Federal Reserve stress test, with regulators softening some requirements set in previous years.

As the US continues talks with key trading partners, Trump has turned up pressure on Japan and reaffirmed he won’t delay his tariff deadline, now just a week away. While markets swung wildly on trade headlines in April, equity indexes are now signaling diminished concern with stocks near record highs. The following comment helps explain why: Trump’s warning to Japan “is a non-event,” said Karen Georges, equity fund manager at Ecofi in Paris. “The next two possible catalysts for the markets will be the jobless claims and the deadline for tariff negotiations.”

Elsewhere, data so far this week has affirmed the resilience of the US economy in the face of Trump’s tariff agenda. Wednesday’s ADP Research employment numbers and tomorrow’s non-farm payrolls will offer investors additional insight into the labor market and the likely path of interest rates.

In Europe, the Stoxx 600 rises 0.4%, set for its first gain this week, with mining, bank and energy shares leading the advance. Here are the biggest European movers:

Earlier in the session, Asian equities traded in a narrow range as fresh tariff threats from President Donald Trump weighed on sentiment. The MSCI Asia Pacific Index declined as much as 0.5% before paring most of the losses, with Nintendo, Mitsubishi Heavy and Advantest among the biggest drags. Japanese shares slid after Trump threatened to impose levies of 30%-35% on imports amid dim prospects for a deal before next week’s deadline. Benchmarks also declined in South Korea, India, and Indonesia. Trump’s comments spurred caution over a recent rally driven by anticipation of progress in trade deals, hopes for dollar-driven foreign inflows and prospects for interest-rate cuts by the Federal Reserve.

“There is a lot more risk of things falling apart than is being priced in by the market,” said Zuhair Khan, a fund manager at UBP Investments. “There is always the risk of a policy blunder by either side.”

In FX, the Bloomberg Dollar Spot Index rises 0.2%. The yen is nursing the largest decline against the greenback among the G-10 currencies, falling 0.5% which takes USD/JPY above 144. The pound also underperforms as it weakens 0.4%.

“The dollar usually loses value when the global economy is in decent shape and the Fed is cutting rates,” noted Nicholas Colas, co-founder of DataTrek Research. “Both factors are relevant now.”

In rates, treasuries fall for a second day heading into a double whammy of labor data, following an unexpected jump in US job opening numbers. US 10-year yields rise 5 bps to 4.29%. European bonds also decline, with gilts faring slightly worse than their German counterparts. UK 10-year borrowing costs rise 4 bps to 4.50%. Swaps now imply about 63 basis points of Fed policy easing by year-end, down from 67 basis points on Tuesday before data unexpectedly showed that US job openings rose to the highest since November.

In commodities, spot gold is steady around $3,342/oz. WTI rises 0.8% to near $66 a barrel.

Looking at today's calendar, US economic data slate includes June Challenger job cuts (7:30am) and ADP employment change (8:15am); no Fed speakers are scheduled

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed following a similar handover from the US where participants digested data, trade commentary and a slew of central bank rhetoric. ASX 200 gained as strength in the mining, materials and real estate sectors offset the losses in tech and financials, but with further upside contained by disappointing Australian Retail Sales and Building Approvals data. Nikkei 225 declined amid trade uncertainty after President Trump noted doubts about a deal with Japan and suggested Japan could pay 30% or 35% tariffs. Hang Seng and Shanghai Comp traded mixed with the Hong Kong benchmark underpinned on return from the holiday closure as gambling stocks surged owing to the jump in Macau gaming revenue for June, while the mainland was contained after the PBoC's open market operations resulted in a net CNY 266.8bln drain.

Top Asian News

European indices opened in the green, shrugging off a mixed APAC lead. Euro Stoxx 50 +0.5%; newsflow has been a little light, primarily focussed on trade. European sectors were entirely in the green, Banks outperforming initially, bolstered by numerous equity specifics; however, strength has faded with sectors now mixed, Real Estate lags given the elevated yield environment.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US event calendar

DB's Jim Reid concludes the overnight wrap

My rain dance continues as it's so hot the kids can't sleep, my wife can't sleep, Brontë the dog can't sleep and I can't sleep. The kids have come in to our bedroom a few times this week, waking us up just to tell us they have an itchy bite on their legs. That then leads to a 10 minute conversation about there being nothing we can do about it but ultimately leads to a trip downstairs for some bite cream. An hour later we may get back to sleep. Meanwhile I've had more diet cokes to help cool me down over the last few days than the fridge can hold in the Oval Office.

Markets also seemed to wilt a little in the heat yesterday and struggled to keep up their recent momentum, with the S&P 500 (-0.11%) slipping back from its record high even if it did get a small boost from news that the tax bill finally passed the Senate with VP JD Vance providing the casting tie-break busting vote (51-50). The bill now goes on to the House of Representatives, and both chambers have to pass the same version of the bill before it can reach President Trump’s desk. Remember that the first House vote was also very tight, with just a 215-214 margin, and the Republicans only have a 220-212 majority to start with. So there’s not much room for manoeuvre if they want to pass this by Trump’s July 4 deadline. There is a vote scheduled for later today, but already a handful of GOP lawmakers who voted for the first version of the bill are signaling opposition to the Senate changes. So it's not going to be easy. If it ultimately passes, the bill would extend the Trump tax cuts from the first term, and it also includes a $5tn increase in the debt ceiling, so it would remove that risk coming up later in the summer too.

One of the most important developments of the last 24 hours was the latest JOLTS report of job openings in the US, which pointed to a tighter labour market than previously thought. On one level, it demonstrated continued resilience and strong labour demand, but investors responded by lowering the likelihood of rate cuts this year, which led to a small spike in Treasury yields across the curve. So the 10yr Treasury yield (+1.4bps) ultimately pared back its early decline (4.185% at the lows) and moved back up to 4.24% after getting as high as 4.275% as London went home. The 2yr yield (+5.3bps) moved up to 3.77% from a low of 3.696% before the data.

In more detail, the JOLTS report showed job openings were up to a 6-month high of 7.769m in May (vs. 7.3m expected). So that pushed back against the narrative of a softening labour market, and it raised the ratio of vacancies per unemployed individuals to 1.07. Moreover, the details pointed in a similar direction, with the quits rate of those voluntarily leaving their jobs back up to 2.1%. So collectively, that countered the dovish trend of recent days, where Fed cuts were looking increasingly likely, particularly after a few speakers floated the idea of a cut as soon as the next meeting in July. But with that JOLTS report, investors dialled back the likelihood of aggressive cuts, with the amount priced in by the December meeting down -2.2bps on the day to 64bps. Admittedly, there was some other data yesterday, including the ISM manufacturing. But the numbers were broadly as expected, with the headline index at 49.0 (vs. 48.8 expected), so they didn’t really shift investors’ perception of the outlook.

We did hear from Fed Chair Powell at the ECB’s Sintra forum, but he stuck to his cautious mantra, saying on inflation that “We’re watching. We expect to see over the summer some higher readings”. He also added that if not for the worries about inflation rising due to tariffs, the Fed would likely already have lowered the policy rate further. Meanwhile, Trump continued his own attacks on Powell, saying that “Anybody would be better than Powell” and that he had “two or three top choices” to succeed the current Fed Chair but failed to expand further.

Otherwise, the big focus has been on trade, with just a week left until the 90-day reciprocal tariff extension runs out on July 9. There were optimistic noises around a trade deal with India, with Treasury Secretary Bessent saying they were “very close” to a deal, whilst India’s External Affairs Minister Subrahmanyam Jaishankar said in a Newsweek interview that "I believe it's possible, and I think we'll have to watch this space for the next few days”. Separately, Stephen Miran, who chairs the White House Council of Economic Advisers, said he was “optimistic” on an EU deal. President Trump again struck a negative tone on the trade deal with Japan in comments to the press, saying they should “pay 30%, 35% or whatever the number is that we determine, because we also have a very big trade deficit with Japan.” On whether the US would push back the July 9th deadline, the president noted he was “not thinking about the pause” and that he could be “writing letters to a lot of countries.”

This backdrop proved a trickier one for equities, and the S&P 500 fell -0.11% by the close. However, that was influenced by a sharp fall for Tesla (-5.34%), which fell after Trump posted that Elon Musk “may get more subsidy than any human being in history, by far” and “Perhaps we should have DOGE take a good, hard, look at this? BIG MONEY TO BE SAVED!!!” So that meant the Magnificent 7 fell -1.17% yesterday, which helped drag down US equities more broadly. Indeed, if you look at the equal-weighted S&P 500 (+1.10%), it was actually a very positive day and the index hit a 6-month high, so it wasn’t all bad news.

Over in Europe, the tone was generally more positive than in the US, with sovereign bonds rallying across the curve. That came as the flash Euro Area CPI print came in at +2.0% in June, exactly in line with the ECB’s target. Core was a little bit higher, at +2.3%, but that was also as expected. So that added to the sense that the ECB would still have the space to cut rates again this year. Moreover, ECB Vice President de Guindos commented that if the Euro moved above $1.20, then “that would be much more complicated. But $1.20 is perfectly acceptable.” So that again offered a potential justification for more rate cuts, particularly as a stronger appreciation for the euro would bring down import prices and dampen inflation. Indeed, the amount of further ECB cuts priced by the December meeting moved up +1.0bps on the day to 24.7bps. So that supported a bond rally across the continent, with yields on 10yr bunds (-3.3bps), OATs (-3.3bps) and BTPs (-2.7bps) all coming down. Nevertheless, equities still struggled and the STOXX 600 fell -0.21%. In addition, the Euro gained for a ninth straight session to its highest level since September 2021.

While much of the market is focused on US politics, here in the UK Prime Minister Starmer faced a tough vote on the government’s welfare reform last night. After a week of watering down the welfare cuts in the bill, the government decided at the last minute to offer more concesssions. This is remarkable for a government in its first year and with a huge majority. It potentially creates a £5bn funding black hole that may need to be closed with tax rises in the autumn, just as many countries launch tax cuts to combat the new tariff era.

Asian equity markets outside of China are on the weaker side this morning given a little more concern over trade. The KOSPI (-0.85%) stands out as the largest underperformer, while the Nikkei (-0.21%) is slipping on trade concerns although both indices have rallied back a fair amount as I've been typing this morning. By contrast, the Hang Seng (+0.77%) is defying the trend, with mainland Chinese equities broadly flat. S&P 500 (+0.27%) and NASDAQ 100 (+0.34%) futures having been edging higher while this paragraph has evolved.

To the day ahead now, and central bank speakers will include ECB President Lagarde, Vice President de Guindos, the ECB’s Cipollone and Lane, and the BoE’s Taylor. Otherwise, data releases include the ADP’s report of private payrolls in the US for June, along with the Euro Area unemployment rate for May.