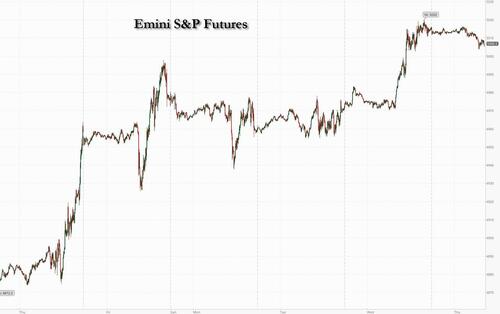

US equity futures dropped on Thursday after hitting a fresh all time high in the previous session, and bond yields rose as investors analyze a slew of earnings reports and also prepared for the sale of 30Y treassuries. As of 8:00am ET, S&P futures were down 0.2%, but even with the decline the S&P remains within striking distance of the 5,000 level and a small gain of just 5 points would take it there today. The MSCI World Index of developed-market stocks also rose to a record. The Stoxx 600 traded flat on the busiest day of the European earnings season. The dollar gains after the yen tumbled following dovish comments from BOJ Deputy governor Uchida who said the BOJ won't aggressively hike rates even after ending negative rates (unclear who expected the BOJ to unleash a hiking spree). Commodities are the standout pre-mkt as the energy complex leads the group higher and strength across metals. It's another busy day for earnings: the lineup in the US today includes Expedia, Philip Morris, ConocoPhillips, S&P Global and cereal maker Kellanova. On the macro side we get jobless claims and wholesale trade and inventories.

In premarket trading, Arm Holdings jumped 25% after a bullish forecast from the chip designer. Disney rose 7% after reporting disappointing revenue and a miss on subscriber growth offset by better-than-expected Q1 earnings, unveiling a new buyback and issuing an upbeat profit outlook for the year, citing cost-cutting benefits and the strong performance of its international theme parks. A.P. Moller-Maersk A/S tumbled after predicting a slowdown in the shipping industry. Here are some other notable premarket movers:

As DB's Jim Reid notes, markets put in a solid performance over the last 24 hours, with the S&P 500 (+0.82%) reaching an all-time high and closing just shy of the 5,000 mark at 4995.06. Indeed, at the intraday peak it had been even closer than that, with an intraday high of 4999.89. In the meantime, US Treasury yields saw a modest increase (+2.1bps) but there was strong demand at a 10yr auction that was the biggest ever, at $42bn.

Yet despite the decent performance in markets, yesterday also saw continued concerns about regional banks and commercial real estate, which means futures are still pricing a 21% chance that the Fed will cut rates next month. So even as several Fed officials have said they want to see more evidence on the inflation side, it’s clear that markets are still pricing in a risk that they may end up needing to move quicker than that. Meanwhile, markets have continued to shrug off fears around the commercial real estate sector and absorbed a run of warnings from Fed policy makers that a cut isn’t likely until May at the earliest. And so, traders have continued to pile into big tech stocks, helping propel the S&P 500 index to a fresh high on Wednesday — taking it closer to the 5,000 level.

“We think this rally has legs and we think it has room to run,” BlackRock Investment Institute head Jean Boivin, who’s overweight US equities, said in an interview with Bloomberg TV. “This soft landing narrative is pretty powerful and it’s going to take time for it to be challenged.”

Minneapolis Fed President Kashkari said that he thought 2-3 cuts would be appropriate for 2024, and that “We’re not looking for better inflation data, we’re just looking for additional inflation data that is also at around this 2% level”. So he said that if they “see a few more months of that data, I think that will give us a lot of confidence.” Later on, Governor Kugler said that she was “pleased by the progress on inflation, and optimistic it will continue”. And after that, Boston Fed President Collins said that “it will likely become appropriate to begin easing policy restraint later this year.” Finally, Richmond Fed President Barkin said he was “very supportive of being patient to get to where we need to get”.

Elsewhere, while the US Treasury had successful sales of three- and 10-year bonds this week, its latest auction on Thursday of longer-maturity debt could prove a tougher test. “This week’s government bond auctions have generally been well received, with the latest selloff in rates likely helping the case,” said Evelyne Gomez-Liechti, a multi-asset strategist at Mizuho in London.

European stocks gained as investors digest a slew of corporate earnings on the busiest day of the season. The Stoxx 600 rose 0.6%, trading at a fresh 23 year high. Unilever and British American Tobacco both rally after their respective updates. AstraZeneca falls on a disappointing outlook. Some 37 companies in the Stoxx 600 are due to release results today, according to data compiled by Bloomberg.

In Asia, stocks were mixed as mainland Chinese equities fluctuated on the final trading day before the Lunar New Year holidays. China’s CSI 300 Index swung between gains and losses after the nation replaced the head of its securities regulator Wednesday, a surprise move that may foreshadow more forceful steps to support the stock market. We also heard from Bank of Japan Deputy Governor Uchida, who said that even if they ended negative interest rates “ it is hard to imagine a path in which it would then keep raising the interest rate rapidly”. So that indicated a fairly dovish path, even if rates were hiked, which has helped the Nikkei (+2.18%) see a significant outperformance this morning. Yields on 10yr Japanese government bonds are also down -1.2bps.

In FX, the Bloomberg Dollar Spot Index rose 0.1%. The yen is the weakest of the G-10 currencies, falling 0.5% versus the greenback after BOJ Deputy Governor Uchida said it’s hard to see the bank raising its policy rate continuously.

In rates, treasuries are slightly cheaper on the day across long-end of the curve, holding a steepening move ahead of a $25BN 30-year bond sale at 1pm New York. US yields are higher on the day by up to 3bp across long-end of the curve with front and belly little change on the day, steepening 5s30s spread by 2bp vs. Wednesday close; 10-year yields around 4.135% with bunds and gilts slightly lagging Treasuries. Core European rates lag, led by weakness in gilts while JGB’s outperformed in Asia after BOJ Deputy Governor Uchida said it’s hard to see the bank raising its policy rate continuously. Treasury auctions conclude with $25b 30-year at 1pm, follows strong 3- and 10-year sales so far this week. Dollar issuance slate empty so far; Eli Lilly headlined a seven-deal, $13b calendar Wednesday, pushing weekly volume through $41b, above $25b to $30b expectations.

In commodities, oil prices advance, with WTI rising 0.7% to trade near $74.40 and near highs into early US session. Spot gold adds 0.1%.

Looking to the day ahead now, and data releases include the US weekly initial jobless claims. Otherwise from central banks, the ECB will publish their Economic Bulletin, and we’ll hear from the ECB’s Vujcic, Wunsch and Lane, the Fed’s Barkin, and the BoE’s Mann.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were ultimately mixed after the fresh record levels on Wall St where the S&P 500 touched just shy of the 5k level, while participants digested recent earnings releases and Chinese inflation data ahead of the Lunar New Year holidays. ASX 200 benefitted from strength in tech and property, while the utilities sector outperformed amid a surge in AGL Energy after it reported a four-fold increase in its core net and returned to a statutory profit for H1. Nikkei 225 outperformed and approached closer to the 37,000 level as earnings drove price action and with SoftBank among the biggest gainers after shares in unit Arm Holdings surged by around 20% post-earnings. Hang Seng and Shanghai Comp were mixed with the former dragged lower by weakness in tech after Alibaba shares slumped on disappointing earnings, while the mainland gained despite the soft inflation data with sentiment upbeat heading into the Lunar New Year holidays and after the PBoC injected liquidity. China also recently replaced CSRC Chairman Yi Huiman with Wu Qing who is nicknamed the “Broker Butcher” for his crackdown on traders. Nifty eventually weakened in the aftermath of the RBI rate decision where the central bank maintained its rates as expected and although there was a change in the vote split with MPC external member Varma the lone dissenter favouring a 25bps cut, the language from Governor Das remained hawkish in which he stated that monetary policy must be disinflationary and the MPC is to remain resolute in bringing inflation down to 4%.

Top Asian News

European bourses, Stoxx600 (+0.4%), began the session on a firmer footing and have extended modesty thereafter. The AEX is the European outperformer, led by post-earnings strength in Unilever (+2.9%), ArcelorMittal (+2.6%) and Adyen (+16%). European sectors are mixed; Food Beverage & Tobacco is lifted by strength in British American Tobacco (+7.5%) post-earning. Healthcare is hampered by losses in AstraZeneca (-2.3%). US equity futures (ES U/C, NQ U/C, RTY -0.3%) are mixed; the ES and NQ are within contained levels and meandering around the unchanged mark, whilst the RTY is softer, as the index continues the prior day’s underperformance. Disney (+6%) reported a mixed set of results though did boost its cash dividend by 50%.

Top European News

Earnings

FX

Fixed Income

Commodities

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Markets put in a solid performance over the last 24 hours, with the S&P 500 (+0.82%) reaching an all-time high and closing just shy of the 5,000 mark at 4995.06. Indeed, at the intraday peak it had been even closer than that, with an intraday high of 4999.89. In the meantime, US Treasury yields saw a modest increase (+2.1bps) but there was strong demand at a 10yr auction that was the biggest ever, at $42bn, and this morning they’ve since come down by -2.5bps, so are back at 4.10%. Yet despite the decent performance in markets, yesterday also saw continued concerns about regional banks and commercial real estate, which means futures are still pricing a 21% chance that the Fed will cut rates next month. So even as several Fed officials have said they want to see more evidence on the inflation side, it’s clear that markets are still pricing in a risk that they may end up needing to move quicker than that.

Starting with the good news, yesterday marked another solid performance for US equities that saw both the S&P 500 (+0.82%) and the Dow Jones (+0.40%) close at an all-time high. That rally was supported by the Magnificent Seven (+1.72%) also posting a new all-time high, whilst the NASDAQ (+0.95%) closed at a two-year high. And unlike some recent sessions, the gains were fairly broad-based, with the equal-weighted S&P 500 up +0.39%, even if it continued to lag the overall index.

In terms of the latest on the regional banks, it was a volatile day, and New York Community Bancorp was initially down by -14.29% at its intraday low, before recovering to close +6.67% higher, so there were some pretty sizeable moves. The initial decline followed the overnight news that Moody’s had downgraded NYCB to Ba2 from Baa3, with the recovery later on boosted by a Bloomberg report that the company was exploring a sale of some of its assets. The broader KBW Regional Banking Index closed -0.14% lower, having traded nearly -2.5% down early on after trading in NYCB was briefly suspended.

Those fears about regional banks and commercial real estate had supported a rally in US Treasuries around the US open. However, that reversed later in the session, with the 10yr yield moderately up on the day (+2.1bps to 4.12%) despite a solid 10yr auction. That came as several Fed officials continued to stick to the general consensus from Chair Powell’s remarks last week. So overall, the message was that some sort of easing was likely to happen this year, but they still wanted more evidence that inflation was back at target before shifting towards rate cuts.

When it came to the details, Minneapolis Fed President Kashkari said that he thought 2-3 cuts would be appropriate for 2024, and that “We’re not looking for better inflation data, we’re just looking for additional inflation data that is also at around this 2% level”. So he said that if they “see a few more months of that data, I think that will give us a lot of confidence.” Later on, Governor Kugler said that she was “pleased by the progress on inflation, and optimistic it will continue”. And after that, Boston Fed President Collins said that “it will likely become appropriate to begin easing policy restraint later this year.” Finally, Richmond Fed President Barkin said he was “very supportive of being patient to get to where we need to get”.

Against that backdrop, neater-term pricing of Fed rate cuts was little changed yesterday. By the close, futures saw a 21% probability of a cut by March and 81% odds of a cut by the May meeting. For May, that pricing was down from nearly 90% early in the US session when fears about regional banks were at their peak, but is still up from its intraday low of 69% on Monday, shortly after the ISM services print came out. By contrast in Europe, investors continued to pare back the chance of imminent rate cuts from the ECB, with the chance of a cut at the next meeting in March down to just 11% this morning, the lowest it’s been since October. In turn, sovereign bonds in Europe saw a moderate selloff, with yields on 10yr bunds (+2.3bps), OATs (+3.0bps) and BTPs (+3.3bps) all moving higher. That echoed a weaker performance for European equities as well, where the STOXX 600 fell -0.23%, with the STOXX Banks Index down -1.44%.

Overnight in Asia there’s been several important headlines driving markets as well. First, there’ve been fresh signs of deflation in China, with consumer prices down -0.8% year-on-year in January (vs. -0.5% expected). That’s their fastest decline since 2009 around the global financial crisis, whilst producer prices were also down -2.5% (vs. -2.6% expected). Nevertheless, there’s been a mixed reaction among Chinese equities ahead of the Lunar New Year holiday, with the Shanghai Comp (+0.71%) advancing, whereas the CSI 300 (+0.02%) has been broadly unchanged. Meanwhile, the Hang Seng has seen larger losses, with the index down -1.22%.

Separately, we also heard from Bank of Japan Deputy Governor Uchida, who said that even if they ended negative interest rates “ it is hard to imagine a path in which it would then keep raising the interest rate rapidly”. So that indicated a fairly dovish path, even if rates were hiked, which has helped the Nikkei (+2.18%) see a significant outperformance this morning. Yields on 10yr Japanese government bonds are also down -1.2bps.

Finally, there wasn’t much data out yesterday, but we did get German industrial production for December, which posted a -1.6% decline (vs. -0.5% expected).

To the day ahead now, and data releases include the US weekly initial jobless claims. Otherwise from central banks, the ECB will publish their Economic Bulletin, and we’ll hear from the ECB’s Vujcic, Wunsch and Lane, the Fed’s Barkin, and the BoE’s Mann.