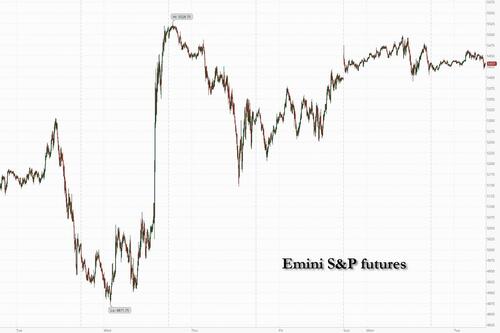

US stock futures swung between gains and losses after a two-day advance as traders focused on signs that the Trump administration may add more tariff exemptions to ease the economic turmoil of the trade war. As of 8:00am S&P 500 were down -0.3% and Nasdaq futures dipped -0.2%, although both indexes were in the green just minutes earlier with moves now happening so fast and jittery, it has become meaningless to keep tabs. Boeing sank 4% in premarket trading after China ordered airlines not to take any further deliveries of the company’s jets; elsewhere, Mag7 and Semis are leading TMT higher with Fins higher into earnings. Other Cyclicals like Energy/Industrials are mixed with Materials higher led by gold miners. In Europe, stocks pushed higher after Trump floated a pause in auto tariffs. Bond yields are +/- 1bp as the curve twists flatter; USD is flat as it looks to ease 5 consecutive days of losses. The commodity complex is weaker with crude and base weaker, gold up, and Ags mixed. The macro data focus is on import/export prices and Empire Mfg plus earnings from GSIB Banks, transports, and a HC (and Defensives factor) bellwether, JNJ.

In premarket trading, Mag7 stocks are mixed (Apple -0.5%, Nvidia -0.2%, Amazon +0.07%, Meta +0.2%, Tesla -0.4%, Alphabet +0.5%, Microsoft +0.2%). Boeing falls 3% after Bloomberg reported that China had ordered its airlines not to take any further deliveries of the planemaker’s jets.Here are some other notable premarket movers:

Tuesday’s market moves were milder than the big swings of late, reflecting hopes that there may be room for negotiations over Trump’s reciprocal levies. Investors were also watching the early stages of the earnings season, with Bank of America topping analysts’ estimates.

"The overall market mood is set on de"escalation,” said David Kruk, head of trading at La Financiere de L’Echiquier. “We got caught out last week with Trump’s reversal of fortunes, and this weekend as well, so we’re waiting before reacting now.”

The Fed’s President Raphael Bostic emphasized officials must wait for further clarity on President Donald Trump’s policies before adjusting interest rates. They will not get it: underscoring the uncertainty surrounding the trade war, China ordered its airlines not to take any further deliveries of Boeing jets, Bloomberg News has reported. The planemaker’s shares fell more than 3% in premarket trading. Rare earth mining stocks TMC and MP Materials are set to extend their gains.

The latest Bank of America fund manager survey struck a cautious tone, showing that a record number of global investors plan to cut their holdings of US equities. Among the respondents, 73% said that US exceptionalism has peaked. Elsewhere, Deutsche Bank CIO Christian Nolting says they will buy the dip if the S&P 500 falls closer to a recessionary level of 5,000.

And speaking of Bank of America, its shares rose in premarket after its stock traders posted a record quarter, as the company reaped the benefits of volatile markets. Elsewhere, Johnson & Johnson helt its profit outlook steady despite the potential for tariffs.

In Europe, the Stoxx 600 rose 0.9%, off session highs, led by gains in automakers after US President Donald Trump said he is exploring possible temporary exemptions to his tariffs on imported vehicles and parts. Luxury names provide a drag as LVMH shares plunge 7% after sales fell more than expected in the first quarter; as a result LVMH was overtaken by Hermes as the world’s most valuable luxury company. Here are the biggest movers Tuesday:

Earlier in the session, Asian stocks rose, with automakers helping to lead the charge after US President Donald Trump indicated a temporary reprieve from tariffs on imported vehicles and parts, adding to investor hopes for relief on some levies. The MSCI Asia Pacific Index gained as much as 1.3%, with TSMC and Toyota among the top contributors. Benchmarks in Japan, Singapore and Taiwan rose 1% or more. Stocks in China and Hong Kong fluctuated in the session, bucking the regional advance amid continued concerns over decoupling from the US, but ended higher. The MSCI regional gauge was on track for its first back-to-back daily gains since Trump announced the reciprocal tariff plan on April 2. Asian stocks have held up better than US peers in that span. Indian stocks rallied as trading resumed after a long weekend, with the benchmark equity index erasing all the losses triggered by US President Donald Trump’s reciprocal tariffs earlier this month.

In FX, the Bloomberg Dollar Spot Index was lower by 0.1%, on course for its longest losing streak in more than a year. The euro underperforms and is near flat versus against the greenback. The kiwi leads with a 0.7% gain while the pound adds 0.4%.

In rates, treasuries hold small losses across maturities, following bigger declines for German bonds after the oversubscription rate for a 5-year debt sale was the lowest since March 2023. And earlier in the day, the Japanese 20Yr bond sale drew the weakest demand ratio since Dec 2023, so slowly the global bond market is coming unglied. In the US, treasury yields are 1bp-2bp higher with curve spreads narrowly mixed, though 5s30s spread briefly exceeded Monday’s high; 10-year near 4.38% is higher by ~1bp vs 3.5bp increase for German 10-year. Gilts outperform their European peers, with UK 10-year borrowing costs falling 3 bps to 4.64% after UK businesses shed workers at the fastest pace since the start of the pandemic.

In commodities, oil prices are steady, with WTI near $61.50 a barrel. Spot gold rises $10 to around $3,221/oz. Bitcoin climbs 1.2% toward $86,000.

Looking at today's calendar, the US economic calendar includes April Empire manufacturing and March import/export price indexes (8:30am). Fed speaker slate includes Cook at 7:10pm. Chair Powell speaks Wednesday to the Economic Club of Chicago about the economic outlook

Market Snapshot

Top Overnight News

Tariffs/Trade

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a predominantly positive bias following on from the gains on Wall St where sentiment was underpinned by the recent US tariff exemptions and dovish comments by Fed's Waller. ASX 200 was led higher by strength in healthcare and financials but with the gains capped by a lack of fresh drivers and with very few clues from the RBA Minutes regarding when the next rate move will occur. Nikkei 225 outperformed with automakers among the best performers in the index after US President Trump suggested on Monday that he might temporarily exempt the auto industry from tariffs to give carmakers time to adjust their supply chains. Hang Seng and Shanghai Comp lagged with participants cautious after the US announced probes into pharmaceuticals and semiconductors, while local press noted domestic markets face liquidity pressures with more than CNY 570bln in reverse repo and MLF funds maturing this week, although the PBoC is expected to assist with liquidity.

Top Asian News

European bourses (STOXX 600 +1%) are almost entirely in the green, as the mostly positive risk tone in the APAC session reverberates into Europe. Price action so far has really only been one way today, and that’s up; as its stands, indices reside at highs. European sectors hold a strong positive bias, in-fitting with the positive risk tone. Consumer Products is the sole industry in the red today – thanks to the Luxury sector, which has been hampered by poor LVMH (-7.7%) results. Autos parks itself in top spot after US President Trump said he is looking to help car companies and that there will maybe be some things coming up.

Top European News

FX

Fixed Income

Commodities

Geopolitcs: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets continued to stabilise over the last 24 hours, with the S&P 500 (+0.79%) posting back-to-back gains for the first time since the reciprocal tariffs were announced on April 2. The recovery followed the weekend exemption of smartphones and other electronics from the tariffs, which added to investor hopes that the direction of travel would now be towards tariff reductions. On top of that, sentiment got a further boost thanks to positive noises about trade negotiations, which added to the sense that the administration is focused on making deals that could see the tariffs come down. So that newsflow helped multiple asset classes to unwind their tariff-related moves, with Treasuries recovering and HY spreads tightening as well.

That move towards potential tariff exclusions was supported by comments from President Trump yesterday, who said that he was looking at exemptions around autos, saying “I’m looking at something to help car companies with it”. Moreover, the administration is also sounding positive about trade talks, with NEC director Kevin Hassett, saying there were “more than 10 deals where there’s very, very good, amazing offers made to us.” That said, there was an indication of further sectoral tariffs, as the Commerce Department announced it had started trade probes on April 1 into semiconductors and pharmaceutical imports.

Overall, this created a positive backdrop for risk assets, and there were clear indications that market stress was easing back again. For instance, the S&P 500 rose another +0.79%, whilst Europe’s STOXX 600 saw a larger +2.69% increase. The S&P did give up some of its +1.79% early gain, mostly due to the Mag-7 (-0.07%) which posted a modest fall. But the tech stocks most affected by the tariff exemptions still outperformed, including Apple (+2.21%) and ASML (+2.20%). Overall, it was a day of broad gains as 85% of the S&P 500 constituents advanced on the day, with automakers including Stellantis (+5.64%), Ford (+4.07%) and GM (+3.46%) outperforming as well after President Trump’s auto tariff comments. Volatility continued to fall back too, with the VIX index coming down a further -6.67pts to 30.89pts, its lowest since April 3. And in another sign of easing financial conditions, US HY credit spreads tightened for a second day, coming down -10bps to 409bps.

With the latest advance for equities, that now means that the S&P 500 has recovered to -4.67% beneath its level at the tariff announcement, and -12.01% beneath its mid-February peak. That’s clearly a significant decline, but it’s still some distance from a normal recession decline, or even some of the larger non-recession bear markets of recent years like 2022, which saw a -25% peak-to-trough fall. So it’s clear that investors aren’t convinced that a recession is inevitable just yet.

Whilst equities were recovering, arguably a bigger relief for investors was the recovery in the bond market, which eased fears about some sort of serious financial turmoil developing. Investors had already been alarmed, and last week’s +49.5bp jump in the 10yr Treasury yield was the biggest weekly jump since 2001, with the yield moving higher every day last week. However, that began to reverse yesterday, with the 10yr yield (-11.6bps) down to 4.37%, and this morning it’s fallen a further -2.3bps to 4.35%. The moves got further support later in the session thanks to dovish comments from Fed Governor Waller, who said that although “the tariffs after April 9 were very large, I still believe they would have only a temporary effect on inflation.”

A further relief for Treasuries came from the New York Fed’s latest Survey of Consumer Expectations. It showed long-term inflation expectations were stable in March, with the 5yr measure actually coming down a tenth to +2.9%. So that will be a relief for the Fed, as the survey painted a very different picture to the University of Michigan’s survey, where long-term inflation expectations surged to multi-decade highs. Indeed, Chair Powell himself has spoken about how the Fed’s “obligation is to keep longer-term inflation expectations well anchored”, so it’s a crucial question for markets. It’s true that the NY Fed’s 1yr expectation measure rose half a point to 3.6% in the NY Fed’s survey, but even that was far more subdued than the University of Michigan’s number, where the 1yr measure was at +5.0% in March, and +6.7% in April.

Over in Europe, the sovereign bond rally also gathered pace, with 10yr bund yields coming down -5.8bps to 2.51%. So remarkably, the tariff developments have seen yields unwind nearly all of their rise after the German fiscal shift, as it was only just over a month ago (March 5) that 10yr bund yields saw their biggest daily jump (+29.8bps) since German reunification in 1990. Elsewhere, it was much the same picture, with yields on 10yr gilts (-9.7bps), OATs (-8.0bps) and BTPs (-13.3bps) all coming down as well. The moves also come ahead of this Thursday’s ECB decision, where it is widely expected to cut rates by another 25bps, which would take the deposit rate down to 2.25%.

Whilst most assets were unwinding their moves since Liberation Day, one exception to this pattern was the US Dollar, with the dollar index (-0.46%) falling to a 3-year low yesterday. So that was one sign that investors were still nervous about the outlook for US assets. But there were signs elsewhere that the tariff-related moves were unwinding in FX, as the Swiss Franc was the worst-performing G10 currency yesterday (having been the best performer since Liberation Day). Separately, gold (-0.82%) also fell back after seeing its strongest week since March 2020 last week.

Overnight in Asia, the major indices are mostly putting in a decent performance, following on from Wall Street’s gains yesterday. For instance, the Nikkei (+1.07%) and the KOSPI (+0.98%) have both posted decent advances. That’s been supported by several auto companies following the potential pause that was suggested, with strong gains for Toyota (+5.04%) and Honda (+4.02%). However, equities in mainland China have lost a bit of ground, with the CSI 300 (-0.06%) and the Shanghai Comp (-0.07%) posting a modest fall. And looking forward, futures on the S&P 500 (-0.06%) and the NASDAQ 100 (-0.09%) have also fallen back a bit, although in Europe, futures on the FTSE 100 (+0.32%) and the DAX (+0.38%) are in positive territory.

To the day ahead now, and data releases include UK unemployment and Euro Area industrial production for February, along with the German ZEW survey for April. From central banks, we’ll hear from the Fed’s Cook, and get the ECB’s Bank Lending Survey. Earnings releases include Citigroup and Bank of America.