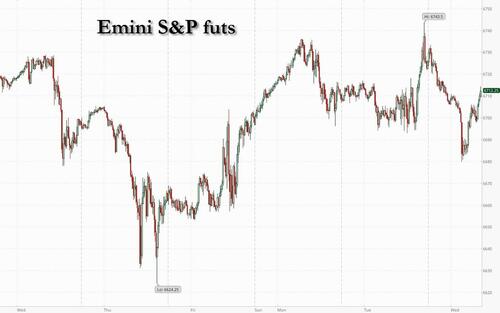

US stock futures are weaker to start the new quarter but have cut overnight losses by more than a third, as the first US government shutdown in nearly seven years begins. The first shutdown during Trump 1.0 lasted 3 days and the second shutdown 35 days: how long will this one last? As of 8:00am ET, S&P futures are down 0.4%, but well off session lows while Nasdaq futures drop 0.5%. Gold futures, up almost 1%, continue their advance toward $4,000. Pre-mkt, we are seeing a risk-off tone in US assets, including USD weakness, helping buttress international markets where Eurostoxx 50 set a new intraday ATH led by health care and communication sectors. Mag7 names are mostly lower with Semis also pressured; NKE gains 3% post solid earnings. The yield curve is twisting steeper. Commodities are weaker ex-Precious Metals with silver outperforming gold. With Friday's NFP release all but certain to be delayed, ADP takes on heightened importance today; we also receive ISM-Mfg, construction spending, vehicle sales, and mtge applications.

In premarket trading, Magnificent Seven stocks are all lower (Apple -0.3%, Amazon -0.7%, Tesla -0.3%, Nvidia -0.5%, Alphabet -0.7%, Meta Platforms -0.7%, Microsoft -0.7%)

In corporate news, Apple says it did nothing wrong in choosing to partner with OpenAI — rather than Musk’s xAI — when it added generative AI to its iPhone operating system. Goldman Sachs is said to be among a cohort of financial firms planning to open offices in Kuwait. Lithium Americas shares surged after Secretary of Energy Chris Wright told Bloomberg TV that the US government agreed to acquire a stake in the company.

The US government shut down after a midnight funding deadline as Trump and Congressional Democrats clashed over health-care spending. With important economic reports now on hold, traders fear the loss of visibility will leave markets in the dark on the outlook for monetary policy. Fiona Boal, global head of equities at S&P Dow Jones Indices, said investor concern would focus on how long the shutdown may last, the disruption to economic data and potential job cuts.

The Congressional Budget Office estimates that about 750,000 employees will be furloughed at a cost per day of $400 million in lost compensation. The Trump administration’s plan to fire federal workers outright could also drive jobless claims higher at a time when employment already looks fragile.

“Government shutdowns in the US are rarely market-moving in and of themselves, but the timing matters,” said Nina Stanojevic, investment specialist at St James’s Place. “This one comes at a point where the Fed is data dependent. The absence of clean data can increase volatility.”

While the next Federal Reserve meeting is still four weeks away, policymakers might have to make decisions on an unclear picture, with the labor market softening and inflation hovering above target.

“In that case, a rate cut is likely to happen, but the uncertainty may lead to a change in expectations and increased volatility,” said Daniela Sabin Hathorn, senior market analyst at Capital.com. Money markets are currently pricing in a 90% chance of a quarter-point cut this month, and almost a 70% probability of another by year-end.

Shutdown aside, which according to many won't have a negative impact on risk assets, traders will be wondering if technology can continue to provide upside momentum for the overall market as the final quarter of 2025 begins. Compared to earlier this year, the Magnificent 7 have had less of a role in recent gains, with some investors looking to the AI supply chain rather than the major names.

Still, the AI buzz is alive and well. There’s about $7 trillion of investment needed to finance the rapid growth of AI, according to Hadley Peer Marshall, CFO at Brookfield Asset Management. The equity buying spree has left aggregate positioning just above neutral, meaning there is still dry powder for more chasing or dip buying into typically positive fourth-quarter seasonality, according to Barclays strategists.

On the policy front, the Fed’s Logan said policymakers should be cautious about considering additional rate cuts while inflation remains above target and the labor market relatively balanced. Meanwhile, Taiwan has pushed back on a US request to move chip production stateside to cover half of America’s demand.

Unlike the US, European stocks gained 0.4%, driven mostly by pharmaceutical stocks as Pfizer’s drug pricing deal provides relief on the industry’s outlook. Here are some of the biggest movers on Wednesday:

Earlier in the session, Asian stocks were mixed, as gains in South Korea, India and Taiwan were overshadowed by declines in Japanese shares on concerns over the impact of a US government shutdown. Hong Kong and Chinese markets were shut for holidays. The MSCI Asia Pacific Index held steady, as gains in the likes of TSMC and Samsung balanced out declines in stocks like Mitsubishi UFJ Financial Group and BHP Group. Japanese and Australian blue chips weighed most heavily on the regional benchmark. Most other markets traded in the green. Japan’s monetary policy is moving in the opposite direction as the world generally moves toward easing. Stocks edged higher as the central bank left its benchmark interest rate unchanged, while signaling there may be scope to ease in coming months to support an economy taking a hit from US tariffs. Australian shares fell for a second day after the Reserve Bank left its key interest rate unchanged.

In FX, the Bloomberg Dollar Spot Index fell 0.1% to take losses into a fourth day. The shutdown threatens to delay key economic reports used to gauge the Federal Reserve’s path on interest-rate cuts; the yen is outperforming and the Swiss franc lagging.

In rates, treasuries are mixed with the curve steeper as US day begins after plying small ranges overnight. Treasury front-end and belly yields are about 1bp richer on the day with long end cheaper by about 1bp, steepening 5s10s, 5s30s spreads by 1.3bp and 2.4bp; US 10-year is 2bps lower near 4.13% with bunds and gilts in the sector trading slightly cheaper. European bonds weaker, with German 10-year yields up three basis points. US Treasuries are little changed. Eurozone inflation quickened in September, in line with economist expectations. IG dollar issuance slate is scant and a subdued session is expected amid the government shutdown. September’s $207.5 billion haul was the fifth-highest month on record and this year’s highest by a $21 billion margin. Focal points of US session include ADP’s private-sector payrolls data, which may hold more sway than usual as the shutdown threatens to delay the release of Thursday’s weekly jobless claims and the monthly jobs report slated for Oct. 3.

In commodities, oil prices wiped out an earlier rise to extend declines into a third session, Brent sliding below $66/barrel and WTI slipping under $62. Gold is extending its run, up by $34 and putting $3,900/oz in sight.

Looking at today's calendar, US economic data slate includes September ADP employment change (8:15am), September final S&P Global US manufacturing PMI (9:45am), September ISM manufacturing and August construction spending (10am). Fed speaker slate includes Barkin (12:15pm) and Goolsbee (5pm).

Market Snapshot

Government Shutdown

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following modest gains on Wall Street, with focus on the length of the US government shutdown after the Senate rejected the House-passed CR, whilst Chinese participants were away for Golden Week. ASX 200 fluctuated between small gains and losses, supported by gold miners at the top of the index, while Energy and Tech lagged. BHP came under pressure after China banned its iron ore cargoes amid a pricing dispute. Nikkei 225 underperformed as the regional laggard despite a relatively mixed BoJ Tankan Survey. KOSPI was modestly firmer after above-forecast trade data, whilst reports suggested the US and South Korea agreed to establish a visa desk for Korean firms investing in the US. The two sides also issued a joint statement on foreign exchange policy, though it did not mention a bilateral currency swap or South Korea’s state-run pension fund. Nifty 50 traded flat and was little changed as the RBI kept its repo rate unchanged at 5.50% as expected in a unanimous decision, maintaining a neutral policy stance. Hang Seng and Shanghai Comp were shut for Golden Week and will return next Thursday.

Top Asian News

European bourses largely firmer, Euro Stoxx 50 +0.3%. Regional outperformance seen in the FTSE 100 +0.7% and SMI +1.5% on account of gains for Healthcare names after Pfizer's pricing deal. More broadly, sectors are mixed. Energy initially firmer but has succumbed to fresh pressure in the underlying benchmarks, Tech lags and drags on the DAX 40 +0.4%. Numerous individual movers of note, but not changing the macro picture: Puma & Adidas firmer after Nike (+3.2% pre-market); BNP Paribas hit by Bloomberg reports of changes to Basel rules - see European updates for more.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Russia-Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As it’s the start of Q4, Henry will shortly be releasing our latest performance review for Q3. It was a strong quarter overall, with global equities and bonds advancing. In part, that was driven by ongoing resilience on the growth side, as the tariff impact wasn’t as negative as many feared at the start of July. But the Fed’s move to cut rates in September offered further support, particularly for US Treasuries, which in turn pushed gold prices to their strongest monthly performance since 2011 and the S&P 500 to its best September in 15 years. However, it wasn’t all good news, and fiscal fears in Europe put long-end bonds under fresh pressure there, particularly in France. See the full report in your inboxes shortly.

With Q4 underway, all eyes are now on the US government shutdown, which has just begun as we go to press, marking the first in the US in almost seven years — and the third one during President Trump's administration. Last minute attempts at a funding deal that could muster the necessary 60 votes in the Senate failed yesterday, with a 55-45 vote on a stopgap bill that had been earlier approved by the Republican-controlled House. Three Democrats voted for the bill and all but one Republican. There are no signs of an imminent compromise between the White House and the Democrats, and the Republican leadership in the Senate suggested that any further votes may not take place until after the Yom Kippur holiday on Thursday. Earlier in the day, President Trump reiterated the threat of dismissing “a lot” of federal workers during the shutdown, though it’s not clear how well formed or implementable such plans are.

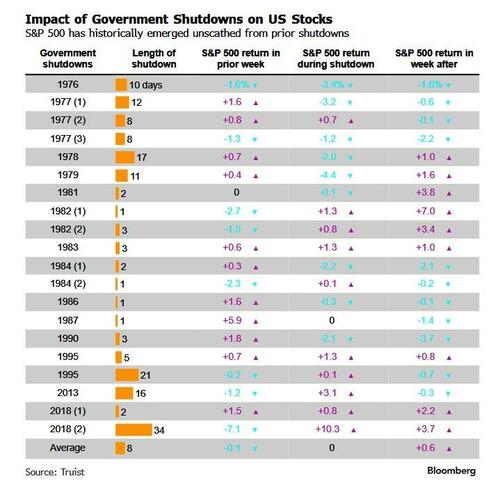

Interestingly, we looked in yesterday’s chart of the day at this (link here), and found that markets historically have taken shutdowns in their stride. In fact, the S&P 500 rose in the last 6 shutdowns, and 10yr Treasury yields came down in the last 5. Clearly there were other factors in operation as well in these periods, but it shows that for markets at least, the usual pattern is to look through what’s happening.

In practical terms, a big impact for this week is that we’re flying blind on the economic data front. So as it stands, we won’t get a jobs report on Friday, as the BLS aren’t releasing new data. Contrary to our prior expectations the Labor Department yesterday said we won't see US jobless claims in the shutdown either. We thought we might see it released as the States compile the data. The BLS produce the CPI report on October 15th too, so if we’re shut down for long, that could be affected as well. That isn’t out of the question, as the last shutdown in 2018-19 (also under Mr Trump) lasted for a record 35 days. So other measures, like the ADP’s report of private payrolls today, could well take on added significance until we get the BLS numbers again.

Markets brushed off some initial shutdown jitters yesterday, with the S&P 500 (+0.41%) recovering to close less than 0.1% from its all-time high, while the NASDAQ (+0.30%) and the Dow Jones (+0.18%) also advanced. So overall investors remained hopeful that the issues will be sorted over the coming days, with little wider impact on the economy or earnings. The Mag-7 (+0.11%) were mixed with Nivida (+2.60%) reaching another all-time high, but Meta (-1.21%) and Amazon (-1.17%) losing ground.

Earlier in the day, sentiment had taken a bit of a hit from some underwhelming US data. The Conference Board’s consumer confidence indicator fell by more than expected in September, down to a five-month low of 94.2 (vs. 96.0 expected). Moreover, the latest JOLTS report offered further momentum on that front, because it showed ongoing weakness in the labour market into August. For instance, the quits rate of those voluntarily leaving their job fell to 1.9%, which is the lowest since December, and suggests that people are less confident in their prospects. Plus the job openings number ticked up a bit more than expected, rising to 7.227m (vs. 7.2m expected). So that saw investors price in more rate cuts over the months ahead, with 83bps priced in by June 2026, up +2.2bps on the day. Front-end Treasuries rallied following the weaker data, with 2yr yields closing -1.3bps lower at 3.61%, but this was accompanied by a decent curve steepening with 10yr and 30yr yields up +1.1bps and +2.7bps to 4.15% and 4.73% respectively.

Those moves came as Fed speakers were mostly non-committal on the likely pace of rate cuts. Boston Fed President Collins “It may be appropriate to ease the policy rate a bit further this year – but the data will have to show that”, while Dallas Fed President Logan suggested that “there may be relatively little room to make additional rate cuts”. And Vice Chair Jefferson avoided any signal on the policy path, noting that “both sides of our mandate are under pressure”.

Over in Europe, the focus was on the latest inflation numbers, although they didn’t lead to a big market reaction.

Admittedly, the German numbers surprised on the upside, with the EU-harmonised measure ticking up to +2.4% in September (vs. +2.2% expected). However, that was counteracted by a downside surprise from France, where inflation rose by less-than-expected to +1.1% (vs. +1.3% expected). So in aggregate, the numbers didn’t have big implications for the Euro Area-wide print, which is out later this morning, and wasn’t seen as affecting the ECB’s reaction function.

That backdrop meant sovereign bond yields were little changed across Europe, with yields on 10yr bunds (+0.4bps), OATs (+0.2bps) and BTPs (+0.1bps) barely increasing. However, there was a stronger performance for equities, with the STOXX 600 (+0.48%) closing at one-month high, and the UK’s FTSE 100 (+0.54%) moved up to a record high.

In the commodity space, Brent oil prices fell by another -1.40% to $67.02/bbl amid reports that OPEC+ will discuss accelerating the reversal of remaining production cuts at their meeting on October 5. Reuters suggested that the next production increase in November could be 2-3 times larger than the +137kbbl/day due in October.

Asian equity markets are quiet, due to holidays in China and Hong Kong for National Day. Markets in mainland China will remain closed until the middle of next week. Throughout the region, Japanese stocks are underperforming, with the Nikkei and the Topix declining by -0.80% and -1.27% respectively, driven by concerns over potential interest rate hikes after a survey showed increasing confidence among the country’s largest manufacturers (details below). Elsewhere, the S&P/ASX 200 (-0.15%) is edging lower again after the RBA struck a hawkish tone on forward guidance yesterday. The KOSPI (+0.86%) is bucking the regional negative trend.

Coming back to Japan, sentiment among the country's major manufacturers has shown improvement for the second consecutive quarter, increasing by 1 point to +14 compared to the results from June. The index for large non-manufacturers has held steady at 34, close to its peak level since the early 1990s. In addition, large enterprises across various sectors intend to raise their business investments by 12.5% for the current fiscal year, an increase from the previously projected 11.5%. Markets are pricing in around a 70% chance of a hike in October with two big events to come later this week. A speech from Governor Ueda on Friday and the conclusion of the LDP leadership election over the weekend.

To the day ahead now, and data releases from the US include the ISM manufacturing, and the ADP’s report of private payrolls for September. In the Euro Area, we’ll get the flash CPI print for September. And globally, there’s the September manufacturing PMIs as well. From central banks, we’ll hear from ECB Vice President de Guindos, the ECB’s Kazimir, Kocher, Simkus, Nagel, the Fed’s Barkin, and the BoE’s Mann.