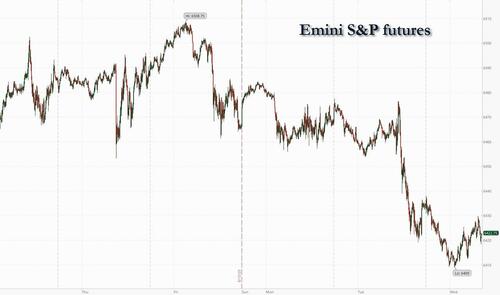

US equity futures are down and headed for a 4th day of losses, but trade well off session lows as markets assess if the sharp momentum selloff we have discussed for the past week will extend into today's session: the JPM Momentum Basket (JPMPURE Index) is down more than 7% since the CPI print while Goldman said it's time to resume buying momentum factor. As of 8:00am S&P futures are down 0.2%, after dipping 0.5% earlier in the session; Nasdaq futures are also down 0.2% after the index logged its second-biggest decline since April on Tuesday, with Mag7 names lower premarket ex-NVDA/MSFT; Defensives are outperforming Cyclicals. According to JPM "today feels like a test for the dip-buyers, as Flash PMIs tomorrow and Powell at Jackson Hole on Friday may prove to be market movers/narrative changers." The yield curve is twisting flatter with the USD not flat. Commodities are seeing a bid across all 3 complexes highlighted by WTI. The macro data today is mortgage applications and Fed Minutes with tomorrow delivering Flash PMIs, jobless data, leading index, and existing home sales.

In premarket trading, Mag 7 stocks are mostly lower (Nvidia +0.05%, Microsoft +0.1%, Tesla -0.3%, Alphabet -0.5%, Meta -0.4%, Amazon -0.4%, Apple -0.5%). Target plunged 10% after saying management still sees a sales decline of low-single digit percentage. The company also named veteran Michael Fiddelke as its next chief executive officer, betting that the insider will rejuvenate sales and help the storied retailer regain its footing. Here are the other notable premarket movers>

Investors pared back positions in tech amid growing concern that the S&P 500’s recent record-breaking rally has run too far, too fast and has leaned heavily on a few growth leaders. That momentum will get a further test this week as focus turns to Jackson Hole, Wyoming, where Fed Chair Jerome Powell is set to speak on Friday with traders betting on a September cut in interest rates.

“This was a textbook case of profit-taking after a powerful tech rally,” wrote Bjarne Breinholt Thomsen, head of cross-asset strategy at Danske Bank A/S. “Yesterday’s move does not alter our tactical stance. On fundamentals alone, we would likely overweight tech. But when factoring in stretched positioning and valuations, we remain neutral.”

Investors are also waiting to hear whether Powell will validate current market expectations or counter them by stressing that fresh economic data arriving before the next policy meeting could alter the outlook. They’re also scanning for hints about how the Fed foresees the pace of rate cuts extending into next year.

“If we get an indication that they are more inclined to cutting interest rates, that will be more supportive again,” HSBC Head of APAC Equity Strategy Herald van der Linde said in a Bloomberg TV interview.

Europe's Stoxx 600 is slightly higher after erasing an earlier drop, and edges closer toward a new high after erasing losses. Personal care stocks outperform, while industrials and construction shares are the biggest laggards. European tech stocks also decline. In the UK, money markets kept wagers on Bank of England interest-rate cuts broadly steady, seeing around a 40% chance of another reduction by year-end after inflation climbed for a second month in July. A full quarter-point cut had been expected earlier this month. Gilts rose, with the two-year yield falling four basis points at 3.93%. The pound fluctuated. Here are the biggest movers Wednesday:

Earlier in the session, Asian stocks fell, as technology shares tracked declines in US peers amid valuation concerns ahead of upcoming key events. The MSCI Asia Pacific Index dropped 0.7%, falling for the third consecutive session, with TSMC and Softbank among the biggest drags. Taiwan led declines, with South Korea and Japan also notably in the red. Risk-off mood has gripped markets ahead of the Jackson Hole symposium, with Federal Reserve Chair Jerome Powell expected to speak on Friday. Investors also await Nvidia’s earnings next week for indications on the health of the artificial intelligence boom that has driven gains in global tech shares. Meanwhile, New Zealand stocks climbed after the nation’s central bank lowered its benchmark interest rate by 25 basis points. Indonesian stocks gained as the central bank surprised markets by cutting its benchmark rate for a second straight month and signaling more easing was on the table. Shares in India, Australia and China rose.

In FX, the Bloomberg dollar index is flat; the pound adds 0.1% on modest CPI support. The kiwi lags, down more than 1% after the RBNZ cut rates and flagged further easing. The krona is little changed after the Riksbank held policy as expected.

In rates, treasuries are steady, with 10-year yields flat at 4.30%. Gilts lead a rally in European bonds even as UK inflation topped forecasts, sending 10-year yields 4 bps lower to 4.70%.

In commodities, Brent crude rose more than 1% to around $66.60 a barrel while spot gold climbs $10.

Today's US economic data calendar features FOMC minutes; the Fed speaker slate includes Governor Waller on payments at blockchain symposium at 11am and Atlanta Fed President Bostic at 3pm.

Market Snapshot

Top Overnight News

Shipments of phones within China -9.3% Y/Y at 22.6mln handsets in June (prev. -21.8% Y/Y at 23.72mln in May), via CAICT; shipments of foreign phones incl. Apple (AAPL) iPhones within China -31.3% at 1.97mln (prev. 9.7% at 4.54mln in May).

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after a lacklustre performance stateside, where mega-cap tech led the declines amid AI-related concerns, while the region digested earnings and central bank updates including the RBNZ's dovish rate cut. ASX 200 was led higher by outperformance in the top-weighted financials sector and with strength also seen in defensives, while participants also reflected on a slew of earnings updates. Nikkei 225 retreated beneath the 43,000 level amid continued profit taking from recent record highs and after mixed data in which Machinery Tools topped forecasts but trade data mostly disappointed and showed Japanese Exports suffered the largest decline in four years. Hang Seng and Shanghai Comp were varied as participants digested earnings releases including from Xiaomi and XPeng, while there was a lack of surprises from China's benchmark Loan Prime Rates which were maintained at the current levels, although the PBoC continued with its firm liquidity efforts via 7-day reverse repo operations.

Top Asian News

European bourses (STOXX 600 -0.2%) are trading on the backfoot in a reversal of some of Tuesday's upside and following on from the tech-led selling pressure seen Stateside. Stocks have been attempting to clamber higher as the morning progressed, with a few indices now holding around the unchanged mark. European sectors are overall mixed with a slightly defensive tilt given the current risk environment. Food, Beverage and Tobacco sits at the top of the leaderboard with Nestle (+1.2%) leading some of the upside, other sectors outperforming include Utilities, Telecoms and Insurance. To the downside, Basic Resource names lag.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

Central Bank speakers

DB's Jim Reid concludes the overnight wrap

Markets have put in a divergent performance over the last 24 hours, with a pretty big contrast on either side of the Atlantic. In Europe, there was a fairly positive tone as speculation grew about some kind of breakthrough on a peace deal in Ukraine, with the STOXX 600 (+0.69%) reaching a 5-month high. But in the US, a sharp tech selloff gathered pace through the session, with the S&P 500 (-0.59%) posting its biggest decline since the underwhelming jobs report at the start of the month. And there’s been little sign of that relenting overnight, with nearly all the major indices in Asia moving lower this morning, whilst S&P 500 futures are down another -0.28%.

We’ll start with Europe, where markets saw a clear reaction amidst the latest developments about Ukraine. In part, that was a reaction to the White House meeting on Monday, which occurred after European markets had closed. But yesterday also saw Trump suggest that the US could be involved in security guarantees, and he said that “We’re willing to help them with things, especially, probably you could talk about by air, because there’s nobody that has the kind of stuff we have” though he again ruled out sending US troops to Ukraine. Trump also continued to encourage a deal, saying that “I hope President Putin is going to be good, and if he’s not, it’s going to be a rough situation”, and that Zelenskiy “has to show some flexibility also.” Meanwhile, Moscow remained non-committal on a potential Putin-Zelenskiy meeting that has been proposed by Trump, with Russia’s Foreign Minister Lavrov saying that such a meeting would have to be prepared "gradually... starting with the expert level and then going through all the required steps”.

This speculation about a diplomatic breakthrough meant that European assets saw some sizeable moves, particularly those most affected by the conflict. Indeed, it was notable that defence stocks really struggled yesterday, and Rheinmetall (-4.85%) posted the worst performance in the German DAX (+0.45%) yesterday, despite being the strongest performer over 2025 as a whole given the wider ramp up in defence spending. There was a positive reaction from Ukraine’s dollar bonds, with the 10yr yield down -8.4bps yesterday to a 4-month low, though the move partially reversed as the day went on with yields having been over -30bps lower intra-day. And the reaction was also clear among oil prices, with Brent crude (-1.22%) falling back to $65.79/bbl, having risen the previous day after investors viewed a ceasefire as increasingly unlikely.

Despite that weakness among defence stocks, the more positive sentiment meant European equities did very well more broadly. For instance, the STOXX 600 (+0.69%) was up to a five-month high, in a broad-based advance that saw almost every sector group move higher on the day. That was evident across the continent, and the UK’s FTSE 100 (+0.34%) hit a new record, whilst both Italy’s FTSE MIB (+0.89%) and Spain’s IBEX 35 (+0.34%) hit a post-2007 high as well.

But even as European markets had a strong performance, it was a different story in the US, where the S&P 500 (-0.59%) fell back for a third consecutive session. Indeed, it was the worst daily performance since August 1, back when the underwhelming jobs report meant investors grew more fearful about a US slowdown. That was driven by a slump among tech stocks, with the NASDAQ (-1.46%) seeing a larger fall, whilst the Magnificent 7 declined -1.67% with Nvidia (-3.50%) leading the moves lower. That said, apart from tech stocks, it was still a decent day for most US equities, with 70% of the S&P 500’s constituents still moving higher on the day. There was also a boost from Intel (+6.97%), which was the strongest performer in the S&P after the news that SoftBank had agreed to buy $2bn of Intel stock. Meanwhile, Home Depot (+3.17%) was the 7th-best performer after its own earnings release. So the equal-weighted S&P 500 was actually up +0.45% yesterday, even as the market-cap weighted index was down by a similar amount.

For sovereign bonds, the story was generally more positive as well, and 10yr US Treasury yields fell -2.7bps on the day to 4.31%. The move got support from the decision by S&P Global Ratings to keep the US’ AA+ credit rating, particularly after the Moody’s downgrade back in May. We also heard a bit more on the appointment of a new Fed Chair, as Treasury Secretary Bessent said he’d be meeting with the candidates “probably right before, right after Labor Day”, which is on September 1. He said the meeting would help “start bringing down the list” which is presented to President Trump. As a reminder, Powell’s term as Chair ends in late-May, and the new chair is usually announced in the months beforehand, pending confirmation by the Senate.

Elsewhere, Canada’s government bonds saw a particular outperformance after their CPI inflation data was softer than expected. Specifically, headline inflation came down to +1.7% (vs. +1.8% expected), which meant investors dialled up the probability of another rate cut from the Bank of Canada this year. Indeed, the probability of a rate cut at the next meeting in September went up from 26% on Monday to 35% by the close last night. By contrast, UK gilts underperformed ahead of their own CPI release this morning, with the 10yr yield up +0.3bps on the day to 4.74%. At one point, the 30yr gilt yield was on track for another post-1998 high as well, but it ultimately ended the session down -0.9bps at 5.60%. Elsewhere in Europe, 10yr yields moved slightly lower, with those on bunds (-1.3bps), OATs (-1.1bps) and BTPs (-0.1bps) all falling back a bit.

Overnight in Asia, the risk-off tone has continued with pretty much all the major indices moving lower. The Nikkei (-1.59%) has led the declines, which follows worse-than-expected export data for Japan showing the negative tariff impact. Specifically, export growth posted its biggest year-on-year decline since February 2021, with a -2.6% fall (vs. -2.1% expected). And exports to the US were down -10.1% year-on-year, so it’s clear the tariffs are having an impact. But there’ve been losses across the region, with the KOSPI (-1.36%), the Hang Seng (-0.57%), the CSI 300 (-0.12%) and the Shanghai Comp (-0.06%) all losing ground. The main exception to this has been in New Zealand, where the NZX 50 index (+1.44%) has surged after a dovish decision from the RBNZ overnight. They cut rates by 25bps, in line with expectations, but their forward guidance pointed to more rate cuts than before, with the Official Cash Rate seen falling to a low of 2.55% in early 2026, down from 2.85% back in May. So that’s led to a big reaction overnight, with their 10yr yields down -10.7bps, whilst the New Zealand dollar is down -1.05% against the US dollar.

Finally, there wasn’t much data yesterday, but we did get some US housing numbers. That included housing starts, which moved up to an annualised rate of 1.428m in July (vs. 1.297m expected), their highest in 5 months. However, building permits fell to an annualised 1.354m (vs. 1.386m expected), which is their lowest level since June 2020 as the economy was recovering from the initial wave of the pandemic.

To the day ahead now, and data releases include the UK CPI print for July. From central banks, we’ll hear from ECB President Lagarde, and the Fed’s Waller and Bostic. We’ll also get the minutes from the FOMC’s July meeting. Finally, earnings releases include Target, TJX and Lowe’s.