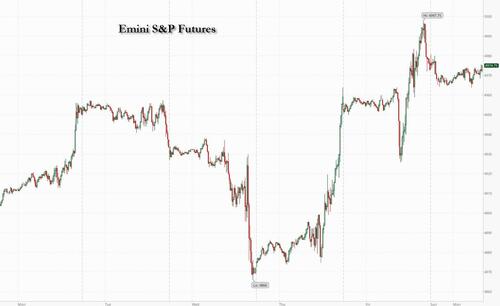

US equity futures and bonds fell while the dollar rose after Fed Chair Jerome Powell again pushed back against any hopes of lower interest rates during his 60 Minutes interview, saying it's "not likely" the Fed would cut in March (which was to be expected after Friday's blowout jobs number). As of 7:40am ET S&P futures dropped 0.1% after closing at an all time high on Friday when they rose as high as 4998. Meanwhile, European shares edged higher, supported by strong earnings from Italian lender UniCredit SpA while Asia closed red after a rollercoaster session in China which first plunged then saw another stabilization bid from the plunge protection team. 10-year Treasury yields climbed nine basis points to 4.11%, extending a move that started after Friday's blockbuster jobs report as yields on debt from Australia to Germany rose. Meanwhile, the Bloomberg Dollar Index traded near a two-month high and oil and gold prices retreated, and bitcoin reversed a weekend selloff

In premarket trading, Caterpillar gained 3.2% after posting fourth-quarter profit that exceeded analysts expectations. On the other end, McDonalds dropped 2% after the fast food giant reported revenue and comparable sales for the fourth quarter that missed the average analyst estimates:

Boeing shares dropped 2.1% after the cursed company found more misdrilled holes on its 737 Max jet, which could further delay deliveries. Fuselage supplier Spirit AeroSystems was also down 3.0% as the latest manufacturing slip originated with a supplier and will require rework on about 50 undelivered 737 jets to repair the faulty rivet holes, Boeing commercial chief Stan Deal said in a note to staff. Here are some other notable premarket movers:

In a highly anticipated interview on CBS's 60 Minutes, Powell said that the “danger of moving too soon is that the job’s not quite done." The comments add evidence to a view that traders have been over-eager in pricing in interest rate cuts and now need to dial back those expectations. Brom Goldman to Barclays are among those that have pushed back their predictions for the timing of the Fed’s first reduction.

“There’s still a lot of uncertainty as to how quickly they cut,” said James Rossiter, head of global macro strategy at Toronto Dominion Bank. “It’s a quiet week for data, so we’ll be watching central bankers very closely.”

After March rate cut odds tumbles after last week's FOMC, the chance of a quarter-point of easing in March fell to just 10% after Powell’s comments. Compare this to just four weeks ago, when a move by then was considered a near certainty by investors.

Investors said they’ll be paying close attention to the line up of central bank speakers this week for more clues about the direction of monetary policy. Chicago Fed President Austan Goolsbee is scheduled to speak on Bloomberg TV later today, while Cleveland Fed President Loretta Mester and Minneapolis Fed President Neel Kashkari are due to provide remarks on Tuesday.

European stocks bucked the global selling, and the Stoxx 600 rose 0.2%, near session highs, with food and beverage and personal care sectors are the best performers while automakers underperformed. UniCredit soars as profit beat estimates, allowing the bank to boost shareholder returns, while Nordea Bank falls after reporting fourth-quarter earnings and giving new profitability goals. Here are some of the biggest movers on Monday:

In Asia, Chinese stocks saw another volatile session as investors assessed the latest pledges by policymakers to stabilize the slumping equity market. The benchmark CSI 300 index swung between losses of 2.1% and gains of 1.7%. The MSCI Asia Pacific Index declined as much as 0.7%, with Tencent, Samsung and BHP among the biggest drags. Benchmarks declined more than 1% in Australia, South Korea and Singapore. Japanese equities climbed after the yen weakened. The China Securities Regulatory Commission vowed on Sunday to prevent abnormal fluctuations, though the plan was short on specifics and sparked another early liquidation in China. The CSI 300 Index slumped 4.6% in chaotic trading last week to its lowest level in five years.

“Whether or not today marks the floor to Chinese equities is yet to be seen, but it sure feels as though we’re bumping along the bottom,” said David Chao, a strategist at Invesco Asset Management in Singapore.

In FX, the Bloomberg Dollar Spot Index rose 0.3% to its highest level since Dec. 12, while Treasuries bear-flattened, as traders moved to pricing only a 10% chance of a quarter-point Fed cut in March following Powell’s CBS interview.

In rates, treasuries bear-flattened with two-year yields climbing as much as 10bps to a one-month high of 4.46% while the 10Y rose 9bps to 4.12% after Powell said Americans may have to wait beyond March for the central bank to cut interest rates, adding to gains seen on Friday after the blockbuster jobs report. European bonds have followed suit. Treasury auctions resume Tuesday with $54b 3-year note sale, followed by $42b 10-year and $25b 30-year on Wednesday and Thursday.

In commodities, oil prices declined, with WTI falling 0.5% to trade near $71.90 overlooking geopolitical tension after American forces launched attacks against the Houthis, following strikes on Iranian forces and militias in Syria and Iraq late last week. Spot gold falls 0.7%.

On today's calendar, we have January S&P services PMI (9:45am), ISM services index (10am); The senior loan officer opinion survey is scheduled for release at 2pm.Federal Reserve members scheduled to speak include Goolsbee (10am) and Bostic (2pm); busy week for Fed speakers also includes Mester, Kashkari, Collins, Harker, Kugler, Barkin, Bowman and Logan.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks were mostly subdued after last Friday's red-hot jobs report and the latest comments from Fed Chair Powell who reiterated the expectation that a March cut is likely too soon. ASX 200 was dragged lower by underperformance in the commodity-related sectors and as participants await tomorrow's RBA decision, while Australian Services and Composite PMI data improved but remained in contraction territory. Nikkei 225 was underpinned by recent currency weakness and with the biggest movers influenced by earnings. Hang Seng and Shanghai Comp were initially both pressured from early on in a continuation of the equity rout after Chinese stocks plunged to five-year lows despite the PBoC's previously announced RRR cut taking effect, while the securities regulator pledged to stabilise the market and prevent abnormal market fluctuations although refrained from announcing specific measures. As such, Chinese markets later recovered from their lows which saw both benchmarks briefly turn positive.

Top Asian News

European equities are mixed, Stoxx600 (+0.1%); though the FTSE MIB outperforms, lifted by gains in UniCredit (+8.7%), post-earnings. European sectors also hold onto a mixed footing; Optimised Personal Care and Grocery is lifted by Jeronimo Martin (+2.5%) whilst Energy lags in tandem with broader weakness in the crude complex given sentiment/USD strength. US equity futures (ES -0.2%, NQ -0.2%, RTY -0.8%) hold just below the unchanged mark and within a relatively tight range; with the exception of the RTY, which significantly underperforms in a continuation of Friday's price action.

Top European News

FX

US Headlines

Fixed Income

Commodities

Geopolitics - Middle East

Geopolitics - Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Well, that was some week we just had. To very briefly front-run our own regular full weekly recap at the end, 2yr US yields rose +16.1bps on Friday (the largest since March), a March Fed cut pricing fell to 22% (from 50% a week earlier), the Magnificent Seven rose +5.45% on Friday alone with Meta adding the most amount of daily market cap ever ($197bn), this sent the S&P 500 to a fresh all-time high even though 73% of the Russell 2000 fell on Friday, while the US Regional Bank index fell -7.23% on the week. That opening para is enough to wear anyone out.

Meta’s +20.3% increase on Friday after their results was the biggest micro story on Friday but the jobs report was also a big boost to market cap weighted indices, helping them shrug off the implications for monetary policy on smaller companies, and also the renewed Regional Bank fears.

Digging into that data, January’s strong payrolls report was driven by headline (+353k vs +185k expected) and private (+317k vs+170k expected) numbers massively beating expectations, alongside 126k of upward revisions to the prior two months. In addition, average hourly earnings surprised to the upside (+0.6% vs. +0.4%) but with a two-tenths drop in hours worked (34.1 vs. 34.3) which was the one inconsistent part of the report, even if bad weather could have been an influence. Elsewhere, the unemployment rate of 3.7% (3.8% expected) was a basis point from rounding down to 3.6%.

Fed Chair Powell wouldn’t have seen these numbers before the FOMC and before his taped interview aired last night on “60 minutes” where he indicated that the March meeting is likely too soon to have confidence in starting rate cuts. He added that the Fed will likely move at a considerably slower pace than the market expects. To be fair nothing much new here, but the confirmation that he wasn’t going to use the broadcast for a big dovish turnaround has caused 2yr and 10yr treasuries to back up 4-5bps overnight, adding to Friday’s big climb. Following this interview, there are lots of Fed speakers this week to give their take on the FOMC and payrolls. See the list in the calendar at the end.

Chinese stocks have been on a wild ride this morning with the small cap CSI 1000 down -8% at one point before halving those losses as I type. The Shanghai Composite was down over -3.5% but is now closing in on flat in a very volatile session. Small caps have been sold against large caps recently as the market views intervention as helping the larger indices. Perhaps some triggers or short covering came in to support the bounce back. This vol came even after the Chinese securities regulator (CSRC) vowed to maintain market stability on Sunday.

Elsewhere in Asia, the Nikkei (+0.52%) is outperforming with even the Hang Seng now up +0.49% after opening around -1.3% lower. S&P 500 (-0.27%) & NASDAQ 100 (-0.29%) futures are drifting lower. The impact of Treasury declines on Friday and this morning can be seen across Asian bond markets as well, with 10yr yields on Australian government debt up +12.3bps to 4.10% while 10yr JGB yields are +5bps at 0.72% as we go to press.

Early morning data showed that China's services activity expanded at a slightly slower pace in January, as the Caixin services PMI edged down to 52.7 from 52.9 in December as new orders fell.

There's not a huge amount of US data this week, as is usually the case post payrolls, but the highlight could be the annual BLS revisions to the seasonal factors for CPI on Friday. Both Waller (pre FOMC blackout) and Powell (at the FOMC) noted that these are an important landmark to get past before potential rate cuts can be better calibrated. Last year, these revisions lowered H1 inflation and increased H2 which changed the momentum profile of inflation.

Before we get there, today sees the services ISM (consensus 52.0) which negatively surprised a month ago (at 50.6 and below all estimates), with the employment series the lowest since July 2020 (down from 50.7 to 43.3). That clearly was completely at odds with payrolls on Friday, so we’ll find out today if that was an anomaly. Also anomalous has been the recent creep higher in initial jobless claims of late with continuous claims only having been higher for one week since November 2021. So another number to watch.

Today's Fed Senior Loan Officer's survey (SLOOS) should be very important but very tight bank lending in recent quarters hasn't so far translated into reduced activity as it has done in the past. We don't know why this is the case. It's possible that excess savings or cash are still high enough in the economy that business and consumers don't need much access to what would be very tight bank lending. This wouldn't be able to carry on forever so the survey results today are still important to see if banks are becoming less restrictive after some improvements last quarter. You can find the other US data in the diary at the end.

Outside the US, China inflation numbers on Thursday are worth watching. Current estimates on Bloomberg suggest the CPI is expected to fall further into negative territory from -0.3% YoY in December to -0.5% YoY in January. The PPI is seen marginally edging higher but staying in negative territory (-2.6% vs -2.7% YoY in December). The Chinese CSI index closed at 5-yr lows on Friday so marching to a very different beat to the US at the moment.

In Europe, the focus will be on economic activity in Germany with indicators due including industrial production (Wednesday), factory orders (tomorrow) and the trade balance (today). There will also be industrial production (Friday) and retail sales for Italy (Wednesday) and trade balance data for France (Wednesday). From the ECB, investors will keep an eye on the consumer expectations survey (CES) on Tuesday and the economic bulletin will be due on Thursday.

Elsewhere earnings season soldiers on but after the mega caps from last week, the main highlights this week, which we detail in the calendar at the end, are not going to move the macro needle.

Recapping last week in more detail now, the large beat in payrolls led to a sharp sell-off in US fixed income on Friday as 10yr yields rose +14.1bps. Investors responded by paring back expectations of Fed cuts in 2024, with the expected Fed rate for December rising +21.2bps on Friday, and +9.6bps over the week. The pricing of a 25bps cut by the March meeting fell to 22%, down from 50% a week earlier and a still sizeable 38% as of Thursday despite Powell’s pushback against a March cut at Wednesday’s press conference. This sent 2yr Treasury yields +16.1bps higher on Friday, their largest rise since last March. 2yr yields were up a marginal +1.6bps over the week after their earlier decline amid renewed concerns over the US regional banking sector. 10yr yields were down -11.6bps over the week to 4.02%. The dollar rallied off the prospect of a higher terminal rate, with the dollar index up +0.85% on Friday (+0.47% over the week).

Even as Treasuries sold off, the S&P 500 rallied +1.07% on Friday, and +1.38% in weekly terms. However, less than half of S&P 500 companies were actually up on Friday with gains led by tech megacaps as the Magnificent Seven index rose +5.45% (+4.87% on the week) after earnings from Meta, Amazon, and Apple the evening before. Meta posted a stunning +20.32% rise on Friday, with the $197bn rise in its market cap being the largest daily gain on record for any company. Amazon also gained a strong +7.87% on Friday. The NASDAQ rose by a more moderate +1.74% (+1.12% over the week). On the other hand, the US regional banking index slumped last week, falling -7.23% (+0.20% on Friday) after shares for the New York Community Bancorp dropped -42.03% (+5.04% Friday).

Equity markets were muted elsewhere in the world. The STOXX 600 traded flat on the week (+0.02%), whilst the German DAX and French CAC retreated -0.25% and -0.55%, respectively. In Asia, Chinese equities were very weak last week driven by property sector woes following the court decision to liquidate Evergrande. The Shanghai Comp fell -6.19% (and -1.46% on Friday), its largest weekly decline since October 2018. The CSI 300 slipped -4.63% (and -1.18% on Friday) to 5-yr lows, and the Hang Seng also retreated -2.62% (and -0.21% on Friday).

Lastly, in commodities, crude retreated after Exxon and Chevron announced their second-largest annual profits in a decade despite a fall in oil prices, alongside strong supply from the Permian Basin. This added to the bearish narrative that had begun earlier in the week after data showed that some OPEC+ members may be pumping above their agreed limits and amid reports that we could be getting closer to a cease-fire deal in Gaza. Brent crude futures retreated -7.44% (and -1.74% on Friday) to $77.33/bbl, and WTI crude fell -7.35% (and -2.09% on Friday), the worst weekly slump since October.