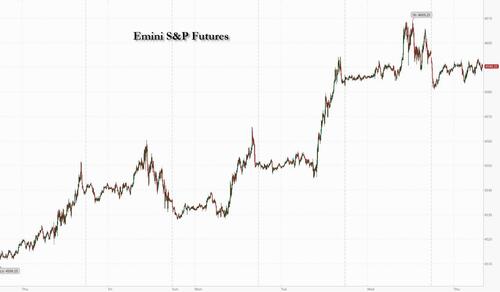

US equity futures are lower as tech stocks struggle after some disappointing earnings updates from the sector. At 7:30am ET, S&P futures are down 0.2% while Nasdaq futures slide 0.8% as Tesla drops 3% in the premarket after Q2 profitability shrank, and Elon Musk said Tesla will have to keep lowering the prices if interest rates continue to rise. Months of markdowns have already taken a toll on automotive gross margin, which fell to a four-year low in the second quarter. Netflix tumbled over 6%, its biggest intraday decline since December, after missing sales estimates and projecting third-quarter revenue that fell short of Wall Street estimates suggesting a crackdown on password sharing and a new advertising tier aren’t yet delivering the sales growth analysts anticipated. The rest of the Magnificent Seven are also lower while premarket bright spots includes airlines and banks. European chipmakers are also on the back foot after a cautious outlook from TSMC. Elsewhere, Treasury yields have climbed across the curve, while the dollar has drifted lower. Gold, oil, iron ore and bitcoin prices all increased. The macro data focus is on Leading Indicators, Jobless Claims, Philly Fed, and Existing Home Sales.

In premarket trading, Taiwan Semiconductor’s US shares declined 2.7% in premarket trading after the main chipmaker for Apple and Nvidia cut its annual outlook for revenue and postponed the start of production at its signature Arizona project to 2025. shares of electric-vehicle makers dropped after Tesla warned of more hits to its already-shrinking profitability, saying it may need to keep lowering the prices of its vehicles. Lucid -1.2%, Rivian -2.1%. Carvana shares rose 1.6%, set for a more muted gain for the massively shorted online used car retailer, which has soared more than 1,000% this year. The rise was tempered as RBC Capital Markets downgraded the stock to underperform from sector perform. Catalent shares rose 8.8% in extended market trading Wednesday after Bloomberg News reported that Elliott Investment Management has built a significant stake in the drugmaker and is pushing for changes to the company’s board. Here are some other notable premarket movers:

Traders are hitting the pause button on a blistering rally that has taken the tech-heavy Nasdaq 45% higher this year, outpacing the S&P 500’s 19% rise, on irrational exuberance about the potential for artificial intelligence. Such returns on the back of a handful of tech stocks are “overdone” and may be the precursor to a downturn, Aegon Asset Management strategist Cameron McCrimmon warned. “The breadth of returns on the S&P 500 has become increasingly narrow, driven by a few mega-cap tech stocks on AI optimism, which is a classic sign of an ageing bull,” he wrote in a note adding that a US recession is likely this year as central banks persist in tightening policy, and strangling economies, until inflation returns to their 2% targets.

US Treasuries fell, pausing a rally sparked by speculation that easing inflation would give the Federal Reserve room to wind down its rate tightening cycle. Investors also weighed the potential for agricultural commodities to drive inflation higher. Wheat prices extended their biggest daily surge in a decade on Wednesday after Russia warned that any ships to Ukraine would be seen as carrying arms.

In Europe, European tech stocks including ASML Holding NV slumped after Taiwan Semiconductor Manufacturing Co. cut its outlook. However, gains in mining stocks such as Anglo American whose second-quarter beat helped the Stoxx 600 rise 0.2%. Here are the most notable European premarket movers:

Earlier in the session, Asian stocks traded mixed as Beijing’s latest vow (it's now a daily thing) to support private businesses failed to provide a significant boost to investor sentiment. The MSCI Asia Pacific Index closed in the red, paring an earlier rise of as much as 0.5%. Tech was the biggest drag as disappointing earnings reports from Tesla and Netflix pulled Nasdaq 100 futures lower. Also, chip giant Taiwan Semi slashed guidance and said it expects full-year sales to decline 10% in USD terms, a bigger decline than the company guided earlier. Japanese benchmarks led losses around the region as the yen strengthened. Hong Kong gauges pared gains while key Chinese measures swung to losses as Beijing’s pledge to treat private companies the same as state-owned enterprises underwhelmed the market. Investors await more concrete support measures after the slower-than-expected second-quarter growth figures.

While Beijing’s latest overture is a positive sign, “the actual impact really takes time to see and the confidence of the private sector can’t be changed overnight,” said Willer Chen, senior research analyst at Forsyth Barr Asia. Benchmarks rose in Taiwan, the Philippines and Indonesia, while South Korea’s Kosdaq small-cap stock index was among the region’s biggest gainers after renewing its year-to-date high. Thai stocks dipped after capping their longest winning streak since the start of the year on hopes the nation will soon have a new premier and government. Japan's Nikkei 225 was the worst performer after the latest trade data showed weaker-than-expected exports and a wider contraction of imports, although the trade balance returned to a surplus for the first time in almost 2 years. Australia's ASX 200 was positive with the mining industry underpinned after the world’s largest miner BHP reported higher quarterly iron ore output and with its full-year production at a record high, while the latest jobs data topped forecasts but could also be seen as a double-edged sword with further scope for the central bank to hike rates.

In FX, the Bloomberg Dollar Index is down 0.1%, having pared most of an earlier drop. The Aussie is one of the best performers after jobs data came in better than expected, rising 0.9% versus the greenback. The offshore yuan advanced 0.7% against the dollar and was the best performing currency in Asia after the People’s Bank of China stepped in Thursday, setting its daily fixing of the yuan with the largest bias since November. China’s efforts to revive growth, from cutting rates to closing out a regulatory crackdown on tech firms, have so far done little to support growth in the world’s second-largest economy.

In rates, US Treasuries fell, pausing a rally sparked by speculation that easing inflation would give the Fed room to wind down its rate tightening cycle. US 10-year yields rose 4bps to 3.79 as the US trading day begins with yield curve flatter amid similar price action in many European bond markets and Australia, where strong jobs data sparked bear-flattening. Yields are higher by as much as 7bp at short end, ~3bp at long end; 10-year at 3.79% is back above 50-day average level after closing below it Wednesday for first time since mid-May; 30-year remains below the trendline. Inverted 2s10s curve is flatter for third straight day at -103bp; spread nearly reached -111bp twice this year, the most in decades, coinciding with peaking expectations for additional Fed rate increases. Fed swaps continue to fully price in a 25bp rate hike on July 26 and about a third of an additional quarter-point hike this year. Bunds and gilts are posting minor losses. Focal points of US trading day include 10-year TIPS auction at 1pm New York time.

In commodities, crude futures advance with WTI rising 0.3% to trade near $75.60. Spot gold adds 0.3%. Bitcoin is up 1.3%.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales and the Conference Board’s leading index for June, as well as the Philadelphia Fed’s business outlook for July. Over in Europe, we’ll also get German PPI for June, and the preliminary Euro Area consumer confidence reading for July. From central banks, we’ll hear from the ECB’s Villeroy. Finally, today’s earnings releases include Johnson & Johnson.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following on from the choppy performance stateside as participants digested the latest data releases, corporate earnings results and performance updates. ASX 200 was positive with the mining industry underpinned after the world’s largest miner BHP reported higher quarterly iron ore output and with its full-year production at a record high, while the latest jobs data topped forecasts but could also be seen as a double-edged sword with further scope for the central bank to hike rates. Nikkei 225 was the worst performer after the latest trade data showed weaker-than-expected exports and a wider contraction of imports, although the trade balance returned to a surplus for the first time in almost 2 years. Hang Seng and Shanghai Comp diverged with Hong Kong lifted by early strength in the property sector after the PBoC eased cross-border funding for firms and financial institutions, while the mainland was lacklustre after the central bank unsurprisingly maintained benchmark lending rates and despite the latest guidelines for the promotion of the private economy.

Top Asian news

European bourses are firmer aside from the Euro Stoxx 50 -0.1% and AEX -0.5% following TSMC and subsequent pressure in Chip names, such as ASM International -5.0% and ASML -3.2%; reminder, SAP reports after the European close. Sectors are mostly firmer, with the exception of Tech, featuring outperformance in Basic Resources after Anglo American's Q2 update with media names also performing well following Publicis. Stateside, futures are diverging with the NQ -0.8% lagging following after-hours updates from TSLA -2.9% and Netflix -6.7% ahead of data and more earnings.

Top European news

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

This week I’m celebrating two anniversaries. It’s my 1st anniversary to my wife, as well as my 5th anniversary at Deutsche Bank. Several people have asked me which is the most important, and whilst I’d like to say it’s the wedding anniversary, my wife managed to leave her wedding ring at a gym class this week and didn’t realise it was gone until she got back home. Well, that’s the story I heard at least. Fortunately, the ring was found safe and returned, so I’m just left to hope my marriage lasts at least as long as my career.

Whilst I hope for a long and happy marriage, markets were also happily extending their gains over the last 24 hours, with the S&P 500 (+0.24%) advancing for a 3rd consecutive day to another 15-month high. In the meantime, the 10yr Treasury yield also fell -3.8bps to 3.75%, having now declined by just over 30bps since its 2023 high on 7 July. Several factors were driving the rally, but the main one was growing optimism that central banks might finally be near the end of their current rate hiking cycle, particularly after some positive numbers on inflation over recent days. That idea then got further support from the latest UK CPI print yesterday, which saw its biggest downside surprise in almost two years. And even though the UK still has the highest inflation in the G7, the fact it came in beneath expectations helped to bolster the idea that global inflation was now durably coming down.

UK markets were the most affected by that release, which showed CPI falling to +7.9% in June (vs. +8.2% expected). It was beneath every economist’s estimate on Bloomberg, and core CPI was also beneath expectations at +6.9% (vs. +7.1% expected). In turn, that downside surprise meant that investors dialled back their expectations for rate hikes from the Bank of England. For example, at the next meeting in a couple of weeks’ time, markets are still fully pricing in another 25bp hike, but they lowered the chances of a larger 50bp hike from 69% to 43% by the close, and down further to 40% this morning. Looking further out, they also pared back their terminal rate forecasts, with markets now much less confident that they’ll take rates to the 6% mark, which had been fully priced in before the release.

That backdrop led to a massive rally among UK gilts, with the 10yr yield down -12.7bps on the day to 4.20%. The front end of the curve saw even larger moves, with 2yr gilt yields down -20.0bps to 4.84%, and at the intraday low they were down more than -30bps, so this was a big reaction. In the meantime, sterling had its worst day in three weeks, weakening -0.74% against the US Dollar as investors expected fewer rate hikes. And the FTSE 100 surged by +1.80%, with property stocks such as Persimmon (+8.29%) and Land Securities (+7.65%) seeing the strongest outperformance.

Elsewhere yesterday, some of the biggest news came after the US close, with earnings releases from Tesla and Netflix leading a downbeat reaction in after-market trading. Netflix missed sales estimates and issued lower-than-expected Q3 guidance, while Tesla’s results showed shrinking profitability with squeeze on margins. That’s meant US equity futures are pointing lower in overnight trading, with those on the S&P 500 (-0.14%) and NASDAQ 100 (-0.46%) moving lower.

Ahead of those earnings releases, US equities had put in a decent performance, with both the S&P 500 (+0.24%) and NASDAQ (+0.03%) hitting fresh 15-month highs. US regional banks outperformed following a number of earnings releases, with their index rising +2.79% on the day (and up almost 30% from its low in mid-May). However, European equities were a bit weaker in general. For instance, although the STOXX 600 rose by +0.26% thanks to the UK outperformance, other indices didn’t do so well, with the DAX (-0.10%) seeing a modest decline.

That European underperformance was evident among other assets classes, with sovereign bonds struggling across the continent. Initially they’d done very well thanks to the UK CPI release, but by the end of the session, yields on 10yr bunds (+5.6bps), OATs (+5.7bps) and BTPs (+6.7bps) had all risen. In part, that was thanks to more negative inflation data from the Euro Area, where the recent core CPI print for June was revised up a tenth to 5.5%. So that echoes what we’ve seen in the US where headline inflation is coming down sharply thanks to energy price declines, but core inflation is proving stickier.

Elsewhere, another important story for inflation was what happened to wheat prices yesterday. They surged by +8.50% after Russia’s defence ministry said that ships heading to Ukrainian ports from today would be considered as potentially carrying military cargo. Other agricultural goods were also affected, with corn (+3.46%) and soybeans (+0.97%) rising on the day as well. That follows the news earlier in the week that Russia was pulling out of the Black Sea grain deal, which had enabled the continued export of millions of tonnes of food from Ukraine. This morning wheat futures are up a further +2.27%, on track for their 6th consecutive daily advance.

Overnight in Asia, equity markets are struggling to gain traction despite a pledge from China to support private businesses. That came yesterday in a joint statement from the Communist Party’s central committee and the state council, which promised to treat private firms equally to state-run firms. In terms of the specific moves, the Hang Seng (+0.26%) is slightly higher after two straight day’s of losses, whereas the the Shanghai Composite (-0.33%) and the CSI 300 (-0.10%) are losing ground. Meanwhile the Nikkei (-1.17%) has experienced a sharper loss, and the KOSPI (-0.18%) is also in negative territory.

In terms of data overnight, there was a strong employment report from Australia, which showed employment growth of +32.6k in June (vs. +15.0k expected), whilst the unemployment rate came in at 3.5% (vs. 3.6% expected). That’s led investors to dial up the chances of another hike from the RBA’s next meeting, which is now seen as a 40% chance, up from 28% previously. Furthermore, 10yr Australian government bond yields are up +8.9bps overnight.

In the political sphere, one story to look out for today are three parliamentary by-elections taking place in the UK. All three are in seats that the governing Conservative Party won at the last general election, but the opposition Labour Party and the Liberal Democrats are looking to make gains. Currently, the Labour Party are polling 20 points ahead of the Conservatives in Politico’s polling average, so the results could give a sense of whether the polls are accurate and if Labour are on track to return to government.

When it came to yesterday’s other data, US housing starts saw a decent fall to an annualised rate of 1.434m in June. That was beneath the 1.48m reading expected by the consensus, and the previous month’s reading was also revised lower from 1.631m to 1.559m. Building permits were beneath expectations in June as well, coming in at 1.44m (vs. 1.5m expected).

To the day ahead now, and data releases from the US include the weekly initial jobless claims, existing home sales and the Conference Board’s leading index for June, as well as the Philadelphia Fed’s business outlook for July. Over in Europe, we’ll also get German PPI for June, and the preliminary Euro Area consumer confidence reading for July. From central banks, we’ll hear from the ECB’s Villeroy. Finally, today’s earnings releases include Johnson & Johnson.