US stock futures are lower, but off session lows, in line with declines seen across Europe and Asia, while yields, the dollar and oil rise as the risk of escalating conflict in the Middle East damps risk appetite. As of 8:00am ET, S&P futures are down 0.1% after closing up 0.01% on Wednesday; Nasdaq futures slide 0.3% with MegaCap Tech mixed: NVDA is up +0.7%, while TSLA extends yesterday selloff and is down -1.6% pre-market. Bloomberg’s dollar index gained for a fourth day, bolstered by a rise in Treasury yields; market snapshot: RTY -70bps // UST10yr +2.5bps @ 3.80bps // WTI +2% @ $71.50 // Bitcoin unch @ $60,900 as global equities trade mixed with escalating geopolitical tensions/ the awaiting of the size/scale Israel’s response to Iran weighs on markets, which has pushed oil prices up another 1.9% this morning; elsewhere in commodities base metals are also higher, while precious metals and ags are lower: Jobless claims, factory orders and the ISM services reading (est 51.7, Last 51.5) are all on the slate as traders prepare for Friday’s jobs report, while the Federal Reserve’s Jeff Schmid, Neel Kashkari and Raphael Bostic are all scheduled to speak.

In premarket trading, Levi Strauss shares plunged 11% after the apparel company lowered its revenue growth outlook for the full year. Here are some other premarket movers:

Global equities are on course for their first weekly loss in four as the world awaits Israel’s response to a missile strike by Iran. Israel’s warplanes bombed Beirut overnight, after eight of its soldiers were killed in southern Lebanon in battles against Hezbollah. Amid the geopolitical uncertainty, investors are also bracing for a raft of US data, including jobless claims today, for signals on the health of the economy. In other news, Warren Buffet’s sales of Bank of America shares slowed, fetching some of the lowest prices since he began a spree of liquidations in mid-July. Meanwhile, OpenAI has raised $6.6 billion in a new funding round that gave the company a valuation of almost $160 billion

International conflict has returned as a driver for markets, which have lately been directed mainly by the US economic cycle, said Michael Metcalfe, head of macro strategy at State Street Global Markets. “There might be a pressure to rebalance, because markets are stretched and I don’t see that as being particularly positive for US equities,” he said.

Richmond Fed President Tom Barkin on Wednesday noted progress on inflation and added the labor market is in “good shape,” but cautioned it’s too early for the central bank to declare victory. Stronger-than-expected ADP jobs data on Wednesday led traders to pare bets on aggressive Fed rate cuts. Swaps traders were penciling in some 34 basis points of policy easing at the central bank’s November meeting, down from 44 basis points just last week.

Fed officials will see fresh labor market data Friday. The unemployment rate is forecast to hold steady at 4.2% in September while payrolls are expected to rise by 150,000.

“I am of course nervous heading into tomorrow’s jobs report,” Kallum Pickering, chief economist at Peel Hunt, said on Bloomberg TV. “If the unemployment rate ticks up, I wouldn’t be surprised that markets would shift back toward expecting 50 basis points and then it is a question of how the Fed may react.”

European stocks fall for the third time in four sessions with the Stoxx 600 down 0.9%. Auto, mining and construction shares are underperforming in Europe; utilities was the only sector in the green. The Stoxx 600’s automotive subindex was the biggest underperformer, weighed down by a number of bearish cuts in the sector from Barclays. France’s CAC 40 stock benchmark underperformed, falling as much as 1%, after French President Emmanuel Macron endorsed a temporary tax on the country’s largest companies. German software maker SAP SE dropped after US prosecutors broadened a probe of potential price-fixing. Stellantis NV shares were down more than 3% after the company slashed vehicle production in its key Italian market. Here are the biggest movers Thursday:

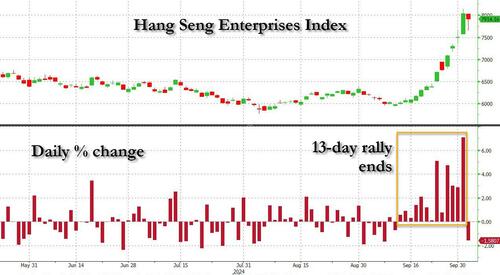

Asian stocks also fell as Hong Kong shares took a breather after a record rally fueled by Beijing’s stimulus blitz. Japanese equities rose boosted by the plunge in the yen. The MSCI Asia Pacific Index dropped as much as 0.9%, weighed down by Chinese tech shares including Alibaba and Tencent. A gauge of Chinese stocks in Hong Kong fell 1.6%, snapping its 13-day winning streak.

While there’s growing optimism that the current rally may be different from previous short-lived rebounds, some skepticism remains over the effectiveness of the government’s stimulus measures. The mainland Chinese market is closed through Oct. 7 for the Golden Week holiday.

“The stimulus momentum has stalled with China away on holiday,” said Charu Chanana, global markets strategist at Saxo Markets. “While undervaluation has helped, markets still remain uncertain about the impact of the announcements to address China’s structural headwinds.”

In FX, the pound tumbled over 1% against the dollar, on course for its worst day against the euro since 2022 after the Guardian reported Bank of England Governor Andrew Bailey saying the central bank could be a “bit more aggressive” with interest-rate cuts. Money markets fully priced in a quarter-point cut by the BOE in November and assigned a 70% probability to a reduction in December, an increase from about 40% Wednesday. The Bloomberg Dollar Spot Index rises 0.3%. The yen falls 0.4% to near 147 as PM Ishiba’s unexpected warning against raising rates is pushing back bets of another hike this year.

In rates, treasuries are under modest pressure as the US trading day begins, amid steeper declines for most euro-zone bond markets and rising oil prices. US yields are higher by 2bp-3bp, with intermediate sectors leading losses and curve spreads narrowly mixed; 10-year at 3.81% is about 2.7bp higher on the day vs increases of at least 5bp for most euro-zone 10-year yields. UK bonds outperform led by the short-end after BOE Governor hinted at more aggressive rate cuts; UK two-year yields dropping 5 bps to 3.96%. US session includes weekly jobless claims and September ISM services index (factory index released Tuesday showed notable weakness in employment and prices paid).

In commodities, oil prices rise for a third day as traders await Israel’s response against Iran. Brent crude climbed near $75 a barrel, on course for the longest run of daily gains since August, while West Texas Intermediate was above $71. Investors are concerned that, should Israel strike key Iranian assets, the Islamic Republic will lash out and escalate their conflict, dragging in more countries and potentially disrupting global energy shipments. Spot gold falls $13 to around $2,645/oz.

Looking at today's calendar, US economic data calendar includes September Challenger job cuts (7:30am), weekly jobless claims (8:30am), September final S&P Global US services PMI (9:45am), August factory orders and September ISM services index (10am). Fed speakers scheduled include Kansas City’s Schmid (10am) and Minneapolis’s Kashkari and Atlanta’s Bostic (together at 10:40am)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid the backdrop of several holiday closures and ongoing geopolitical tensions, while Hong Kong participants booked profits. ASX 200 lacked direction alongside varied data releases including downward PMI revisions and mixed trade figures. Nikkei 225 outperformed on the back of a weaker currency after yesterday's dovish-leaning remarks from Japanese PM Ishiba who said they are not in an environment for an additional rate hike following a meeting with BoJ Governor Ueda, while Ueda said the BoJ will adjust the degree of monetary easing if the outlook is realised, but will take careful steps to determine that as it takes time. Hang Seng suffered heavy losses amid profit taking and in a possible sign that the China stimulus euphoria has finally worn out.

Top Asian News

European bourses, Stoxx 600 (-0.7%), opened modestly in negative territory and continued to edge lower as the morning progressed, with indices now generally just off lows. The FTSE 100 (+0.2%) remains in positive territory after BoE Governor Bailey's dovishly-received comments. European sectors are negative across the board with Energy also turning red following a positive open. There is no clear theme or bias across European sectors. Autos and Parts once again lag. Basic Resources also resides as one of the losers amid the pullback in base metal prices. US Equity Futures (ES -0.4%, NQ -0.5%, RTY -0.7%) are softer across the board amid the broader risk-averse mood despite the lack of any fresh drivers during the session, but ahead of risk events including the weekly jobless claims and ISM Services PMI ahead of tomorrow's US jobs report. Barclays has upgraded the EU Autos & Parts sector to neutral from negative

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Morning from Amsterdam after a day in The Hague yesterday. Markets remained on edge over the last 24 hours, but better US jobs data than the previous day took the edge off fears of a potential escalation in the Middle East following Iran’s strikes on Tuesday. So far we haven’t seen any fresh escalation since those strikes, but Israeli PM Netanyahu has said they intend to retaliate, warning that Iran “will pay” for its actions. So the big fear is there could be a further ratcheting up of hostilities if you get repeated rounds of retaliation from each side, raising the risks of a broader regional conflict. However late in the day, we heard US President Biden urging Israel to not to attack Iran’s nuclear facilities. So there doesn't seem to be a desire from the US at the moment for a sizeable escalation.

In terms of the market reaction, that’s already led to a further rise in oil prices, and early in yesterday’s session Brent crude had been on track for its biggest 2-day gain of 2024 so far. Those gains (+3.5% to above $76/bbl at the highs) were mostly pared back into the afternoon, but it rose slightly again late on and is a further +1.03% higher this morning at $74.66/bbl as I type.

Whilst investors awaited any geopolitical news, the other main story yesterday was a substantial bond selloff. That was primarily driven by the ADP’s latest report of private payrolls from the US, which came in at +143k in September (vs. +125k expected). So that was an important sign of strength in the US labour market, particularly ahead of tomorrow’s all-important jobs report, and it also ended a run of 5 consecutive months where the ADP reading had kept slowing down.

The stronger numbers in the ADP report led investors to dial back the chance of aggressive rate cuts over the coming months. For instance, the amount of cuts priced by December 2025 was down -4.4bps on the day to 188bps. This came also amid somewhat cautious comments from Fed’s Barkin, who noted that while progress has been made, “It remains difficult to say that the inflation battle has yet been won”. This backdrop helped to spark a decent selloff for US Treasuries, with the 10yr yield ending the day up +5.1bps at 3.78%.

Those moves were evident in Europe as well, where yields on 10yr bunds (+5.5bps) moved back up to 2.09%, having closed at their lowest level since January in the previous session. That went alongside a fresh round of curve steepening, as investors became increasingly confident that the ECB would cut rates again in a couple of weeks’ time, with overnight index swaps giving that a 96% probability by the close. ECB commentary did little to dissuade October rate cut expectations. Later on in the day, we heard from Schnabel, one of the most prominent hawkish ECB voices in recent years, who said that “we cannot ignore the headwinds to growth” and that “a sustainable fall of inflation back to our 2% target in a timely manner is becoming more likely, despite still elevated services inflation and strong wage growth”. Elsewhere in European rates, there was a slight tightening in the Franco-German 10yr spread, which came down by -1.0bps to 77bps.

Whilst bonds were selling off, for equities it was a pretty subdued session as geopolitical fears came up against the stronger-than-expected data, meaning that the major indices saw little change overall even if sentiment improved as the US session progressed. The S&P 500 (+0.01%) was essentially flat on the day, despite a drag from the Magnificent 7 (-0.66%). The latter came amid a -3.49% decline for Tesla, which posted slower than expected quarterly vehicle sales. More broadly, both the NASDAQ (+0.08%) and the small cap Russell 2000 (-0.09%) saw muted moves. In Europe, the STOXX 600 (+0.05%) was also little changed, with a decline for the DAX (-0.25%) but slight gains for the CAC (+0.05%) and FTSE 100 (+0.17%).

Over in Asia, yesterday brought a clear weakening in the Japanese Yen after new PM Shigeru Ishiba said that “I don’t think the environment is ready for an additional rate hike”. So among investors, that led to a bit more scepticism about the chances of another BoJ hike anytime soon, and it meant that the yen weakened by -1.97% against the US Dollar yesterday and is down another quarter percent this morning. But the weaker yen has also led to a sharp surge in the Nikkei overnight (+2.18%).

In contrast, the Hang Seng is down by -3.20% this morning as the rally from China’s stimulus has finally abated for now, while the S&P/ASX 200 is just below flat, down by -0.08%. Meanwhile, markets in Mainland China and South Korea are closed for holidays. S&P 500 (-0.18%) and NASDAQ (-0.30%) futures are lower even as Nvidia's CEO has said the demand for their Blackwell chip is "insane". They were up around +1.6% after hours.

Early morning data showed that Japan’s service sector activity expanded for the third consecutive month, although the pace slowed slightly in September. The final estimate of the au Jibun Bank services PMI fell to 53.1 in September from 53.7 in August. Additionally, Australia’s trade surplus was A$5.64 billion in August, slightly above the expected A$5.50 billion, compared to a downwardly revised A$5.63 billion surplus the previous month.

There wasn’t too much other data yesterday, but we did get the latest weekly data from the Mortgage Bankers Association in the US. That showed the average rate on a 30yr fixed mortgage ticked up to 6.14% in the week ending September 27, up from 6.13% in the previous week, which is significant as that ends a run of continuous weekly declines in mortgages rates throughout August and early September. Over in the Euro Area, we also found out that the unemployment rate remained at 6.4% in August, in line with expectations, and still its joint-lowest since the single currency’s formation.

To the day ahead now, and data releases from the US include the ISM services for September, the weekly initial jobless claims, and August’s factory orders. We’ll also get the final services and composite PMIs from around the world, and Euro Area PPI inflation for August. From central banks, we’ll hear from the Fed’s Schmid, Kashkari and Bostic.