US index futures are down but well off session lows as Treasury yields stay at a two week high high this morning ahead of a flurry of economic data over the next two days which will help set the path for Fed policy. At 8:00am ET, S&P futures were down 0.1% as ugly earnings from Walgreens confirmed the consumer weakness is spreading, while Nasdaq futures dropped 0.2% after Micron’s disappointing sales forecast weighed on tech giants. Semis are mostly lower post MU’s earning as hedge funds continue to dump TMT/semi names to retail investors: NVDA -1.1%, AMD -47bp, QCOM -40bp. MU is down -5.4% pre-market, partially recovered from the initial 7% loss. Bond yields are flat while the USD is modestly lower. Commodities are mostly higher led by oil complex, ags and precious metals. Today, the key macro catalysts are Jobless Claims, Durable/Cap Goods Orders and the first presidential debate tonight, while tomorrow we get the closely watched core PCE figures. The figures come after Fed Governor Michelle Bowman yesterday tempered market expectations for interest rate cuts. We also receive WBA and NKE earnings.

In premarket trading, Micron slipped 5% after the largest US maker of computer memory chips provided a forecast that disappointed investors seeking a bigger payoff from artificial intelligence mania. Micron’s underwhelming outlook highlighted the risks of relying on artificial intelligence chip makers to fuel the stock rally. The shares slumped as much as 8% in premarket trading, dragging down a number of megacap tech peers including Nvidia (-1.1%), AMD (-47bp) and QCOM (-40bp). Walgreens Boots Alliance fell 12% after the drugstore chain cut its profit forecast for the full year, citing a “worse-than-expected” consumer environment. Here are some other notable premarket movers:

Reports on economic growth and weekly unemployment claims are on traders’ radar Thursday before tomorrow’s key inflation figures, after Fed Governor Michelle Bowman tempered market expectations for interest rate cuts. Treasury yields held yesterday’s rise and a gauge of the dollar hovered near an eight-month high.

“It’s all about the Fed — higher for longer is keeping the front end of rates very high, drawing money into the US and keeping the dollar strong,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC.

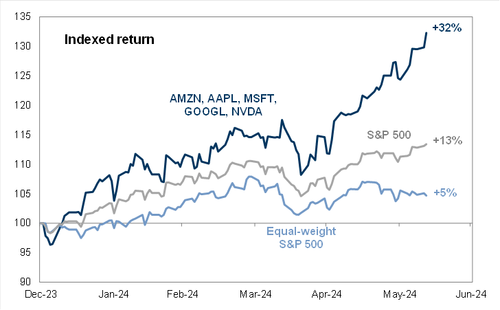

June has been a volatile month for Big Tech stocks after the meteoric rise of Nvidia, Microsoft, Amazon, Meta and Apple accounted for well over half of the 15% advance in the S&P 500 this year.

Micron is among the companies that have gotten a lift from the mania for AI-related stocks, with its shares more than doubling in the year prior to its Wednesday report. But even with an outlook roughly in line with the average of analyst estimates, it was punished for not outperforming elevated expectations.

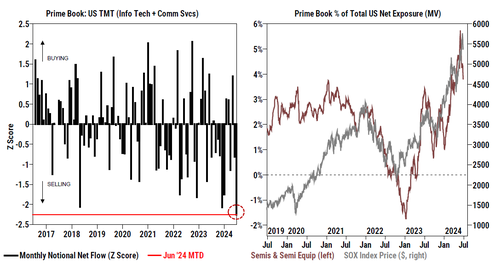

In another sign of investor concern about market concentration, we first reported that hedge funds “aggressively” sold tech stocks in June - the month in which Nvidia briefly became the world’s largest company - to retail investors. Semiconductor and semiconductor equipment stocks were the ones offloaded the most, according an analysis by Goldman Sachs Group Inc.

Europe’s stock benchmark dropped for a third day, with traders in holding mode ahead of Sunday’s French elections. The Stoxx Europe 600 index extended its decline after ECB Governing Council member Martins Kazaks said strong wage growth was standing in the way of faster rate reductions. Data earlier showed money supply in the euro region rose faster than expected in May, fueled by credit growth. Retailers are the worst performers on the Stoxx 600 as H&M tumbled 14% after it reported a slump in sales and said meeting a key profitability target had become tougher. GSK fell after US health officials delivered a fresh regulatory blow to its blockbuster RSV vaccine. Gucci owner Kering gained after a double-upgrade from Bank of America Corp. Here are all the notable European movers:

Earlier, Asian stocks dropped for the first time in three days, as sentiment in China soured with a major benchmark teetering on technical correction. Tech shares also dragged following declines in US peers. The MSCI Asia Pacific Index fell as much as 0.7%. Along with Chinese megacaps, chip stocks were some of the biggest drags after Micron Technology’s underwhelming outlook. Benchmarks in Hong Kong posted the biggest contractions in the region, while the markets in Japan, mainland China and South Korea also fell. A key Chinese stock gauge is poised for a technical correction — after falling on Thursday and taking declines from a May 20 high to about 10% intraday — as investors struggled to find catalysts ahead of a meeting of the nation’s top leaders next month. Beijing’s new measures to ease homebuying requirements did little to lift concerns about the nation’s tepid economic recovery.

In FX, the yen is up 0.2% against the greenback, taking USD/JPY down to ~160.50 after another warning from the Japanese Finance Minister. The yen pared some of the declines seen Wednesday after tumbling to 160.87 per dollar, the weakest level since 1986. The Swedish krona is the weakest of the G-10 currencies, falling 0.2% against the dollar, after the Riksbank signaled it may cut interest rates as many as three more times this year.

In rates, treasuries are little changed on the day, with overnight price action within a narrow range leaving yields within one basis point of Wednesday’s close. Core European rates underperform slightly vs. Treasuries. US 10-year yields trade around 4.33%, near Wednesday’s closing levels, with bunds and gilts lagging by additional 1.5bp and 2.5bp in the sector. Treasury spreads are steady, largely holding Wednesday’s steepening move. The focus for the US session includes a heavy data slate headed by GDP and durable goods orders alongside weekly jobless claims, while this week’s coupon auctions conclude with $44b 7-year notes. Treasury coupon issuance concludes with a $44b 7-year note sale at 1pm New York time following decent results from both 2- and 5-year auctions so far this week. The WI 7-year — at roughly 4.32% — is 33bp richer than May’s stop-out, which tailed the WI by 1.3bp

In commodities, oil prices advance, with WTI rising 0.9% to trade near $81.60 a barrel. Spot gold rises $15 to around $2,313/oz.

Bitcoin is flat and holds around USD 61k while Ethereum is incrementally softer and sits just below USD 3.4k.

Looking at today's calendar, the US economic data slate includes 1Q final GDP release, May’s advanced goods trade balance, wholesale inventories, durable goods orders, initial jobless claims (8:30am), May pending home sales (10am) and June Kansas City Fed manufacturing activity (11am). No Fed speakers are scheduled for the session; Barkin, Bowman and Daly are due Friday

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were negative amid this week's choppy tech performance with headwinds from higher yields. ASX 200 was pressured with real estate leading the declines amid higher yields and firmer inflation expectations. Nikkei 225 failed to benefit from stronger-than-expected retail sales with the mood dampened amid rate hike bets for the BoJ's July meeting. Hang Seng and Shanghai Comp. traded lower with underperformance in Hong Kong amid pressure in tech and consumer stocks, while the mainland was also pressured as China’s financial industry elites face USD 400k pay caps and bonus clawbacks under President Xi’s “common prosperity” campaign.

Top Asian News

European bourses, Stoxx 600 (U/C), are mixed in what has been a lacklustre and rangebound session thus far. European sectors are mixed, with Energy taking the top spot, benefiting from broader strength within the underlying crude complex. To the downside, Retail slumped after H&M (-11%) reported a miss across its results. US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.2%) are modestly softer across the board, with sentiment slightly more subdued than peers in Europe.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets have struggled over the last 24 hours, with sovereign bonds selling off and equities losing ground for the most part. To be fair, it wasn’t all bad news, and a renewed tech advance did see the Magnificent 7 (+1.60%) reach a new all-time high. But otherwise, a cautious tone was set from the outset, as the upside surprise in Australia’s CPI on Wednesday morning meant investors started to dial back the chance of rate cuts over the coming months. Other economic data also surprised on the downside, and after the US close, Micron fell by around -8% in after-hours trading as investors were disappointed by its forecasts, and futures on the S&P 500 are down -0.33% this morning. Alongside that, markets are still attuned to several political events, including the first round of the French legislative election on Sunday. So there’s multiple risks that investors are thinking about right now, which is making it difficult for markets to gain momentum.

We’ll start with the sovereign bond selloff, since that’s been the clearest move over the last 24 hours, and came as investors became increasingly conscious about inflationary risks. Indeed, this week has already seen upside inflation surprises from Canada and Australia, and we’ve still got the US PCE numbers tomorrow, as well as some of the flash CPI prints for June from Euro Area members. In turn, that’s seen investors price out the chance of rate cuts, and the amount priced in by the Fed’s December meeting fell by -3.3bps on the day to 43bps. The effects were particularly evident in pricing for the Reserve Bank of Australia, where the chance of a hike at the next meeting in August surged to 34% after the CPI release there, having been priced at just 1% on the previous day’s close.

With investors pricing in a more hawkish stance of policy, that meant yields rose on both sides of the Atlantic. Significantly, it meant that French 10yr yields (+6.5bps) were up to 3.23%, which is their highest closing level since November, and the Franco-German spread also widened again to 78bps (having stayed in the 75-80bps range for nearly two weeks now). Elsewhere in Europe, there was also a rise in yields, with those on 10yr bunds (+4.3bps), BTPs (+6.9bps) and gilts (+5.3bps) all moving higher as well. Meanwhile in the US, the 10yr Treasury yield (+8.1bps) rose to 4.33%, its highest level in two weeks. Treasury yields did see some stabilisation after a decent 5yr auction but still ended the day around the session highs. And with higher yields and the mostly risk-off tone, the broad dollar index rose +0.42% to its highest level since the end of April.

When it came to equities, the S&P 500 advanced +0.16%, leaving it within 0.2% of last week’s all-time high. But in reality it was another divergent performance between megacaps and the small caps. The Magnificent 7 (+1.58%) hit another all-time high, with Amazon closing above a $2tn market cap for the first time. But at the other end, the small-cap Russell 2000 (-0.21%) lost ground for a second day running. So even as the S&P 500 saw little change, the equal-weighted version of the index underperformed once again with a -0.36% decline, with energy (-0.86%) and financials (-0.47%) leading on the downside. That weakness was evident in Europe as well, where the STOXX 600 (-0.56%), the CAC 40 (-0.69%) and the DAX (-0.12%) all lost ground.

Overnight in Asia, the main story has been the weakness in the Japanese Yen, which closed beneath the 160 mark yesterday at 160.81 per US dollar. That is its weakest closing level since 1986 and means it’s now weaker than its levels earlier in the year that saw the authorities intervene. Yesterday saw Finance Minister Kanda say that “I have serious concern about the recent rapid weakening of the yen and we are closely monitoring market trends with a high sense of urgency”. He also said that “We will take necessary actions against any excessive movements”. This morning trading, the yen has slightly strengthened again to 160.39 per US dollar as we go to print.

Otherwise in Asia, the main story has been of further losses overnight, with declines for the Nikkei (-1.08%), the Hang Seng (-2.04%), the Shanghai Comp (-0.51%), the CSI 30 (-0.41%) and the KOSPI (-0.49%). In terms of data overnight, Japanese retail sales were up +1.7% in May (vs. +0.8% expected), and in China, industrial profits were up +0.7% in May on a year-on-year basis.

Looking forward, there’s plenty happening in the political sphere today, and tonight will see the first presidential debate of the US election, as Joe Biden and Donald Trump meet tonight at 9pm Eastern Time. Over in Europe, there’s also an EU leaders summit taking place today, at which they are expected to sign off on some of the EU’s most senior positions following the parliamentary election. And in France, there’s just three days until the first round of the legislative election on Sunday, and an Ifop poll found that Marine Le Pen’s National Rally remained ahead on 36%, with the left-wing alliance behind them on 28.5%, and President Macron’s centrist group on 21%.

Finally, there wasn’t much economic data yesterday, although US new home sales fell to an annualised rate of 619k in May (vs. 633k expected), which is their lowest level in 6 months. In Germany, the GfK consumer confidence unexpectedly declined to -21.8 (vs -19.5 expected) having risen for the four previous months.

To the day ahead now, and data releases from the US include the weekly initial jobless claims, preliminary durable goods orders for May, pending home sales for May, and the third estimate of Q2 GDP. Meanwhile in Europe, there’s the Euro Area M3 money supply for May. From central banks, we’ll hear from the ECB’s Muller and Kazimir, and the Bank of England will release their Financial Stability Report. Finally in the political sphere, EU leaders will be meet in Brussels for a summit, and a US election debate will take place between Joe Biden and Donald Trump.