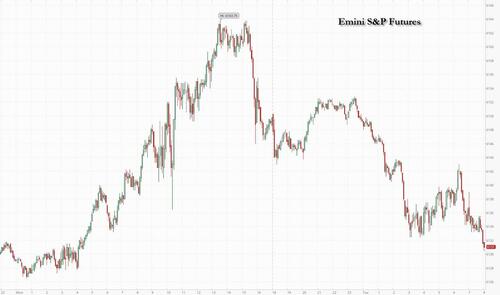

There is only so much the US can "exceptionally" decouple from the rest of the world, and on Tuesday US futures finally succumbed to the persistent selling in markets around the world, as traders awaited the Federal Reserve’s final interest-rate decision for 2024 and its monetary policy forecasts. As of 8:00am, S&P futures dropped 0.3%, while Nasdaq 100 futs eased back 0.2% after the relentless rally in tech stocks pushed the gauge to a fresh all-time high on Monday as AAPL/GOOGL/AMZN/TSLA/AVGO all reached new ATHs. TSLA (+3% pre-mkt) on an u/g away while NVDA (-1.5% pre mkt) continues to be under pressure. Europe’s Stoxx 600 fell 0.4% as weaker crude prices weighed on oil-related stocks (FTSE -70bps/DAX +15bps/CAC +30bps). A key Asian gauge dropped 0.5% after erasing gains as concerns over China’s economy persist (Shanghai -73bps/Hang Seng -48bps/Nikkei -24bps). US rates rose with 10Y TSY yields rising +4bps @ 4.43%. The Bloomberg Dollar Spot Index adds 0.1%. The Aussie dollar is the weakest of the G-10 currencies, losing 0.5%. The yen outperforms with a 0.2% gain. Crude oil extended its drop as WTI dropped 0.8% to $70.15. Meanwhile, Bitcoin adds another +90bps to $107,040 as global equities chop around ahead of a slew of central bank rate decisions the next few days (FOMC tomorrow). There is a busy macro calendar today with retail sales, industrial/mfg production, business inventories and the NAHB housing index all on deck.

In premarket trading, Pfizer rose 2% after the company forecast 2025 sales and earnings in line with analysts’ projections, a step toward fending off an activist investor’s claims that the drugmaker is being mismanaged. Here are some other notable premarket movers:

As equity markets head into the final weeks of 2024, US stocks have significantly outperformed their peers for the year as optimism about artificial intelligence and falling rates fuel investor confidence. Traders are now focusing on Wednesday’s Fed announcement, with Chair Jerome Powell widely expected to deliver a quarter-point of easing.

What happens in the following months remains less clear. While the US economy is resilient, the prospect of inflationary import tariffs threatened by the incoming administration of Donald Trump may give Fed officials pause about the pace of further moves. Money markets are seeing an 80% chance of three cuts next year, compared to the small probability of a fourth reduction seen at the start of the month. “There is also the Fed, which stirs some uncertainty,” said Alexandre Baradez, chief market analyst at IG in Paris. “My scenario is for a hawkish cut with a much more cautious narrative.”

Bank of America strategists cautioned that fund managers have been reducing cash holdings to a record low and pouring money into US stocks, triggering a metric that could be a signal to sell global equities. Cash as a percentage of total assets under management fell below 4%, a move that in the past has been followed by stock market losses.

In Europe, the Stoxx 600 fell for a fourth consecutive session, as political upheaval in the region weighs on sentiment, with traders also bracing for Eurozone inflation data and a US rate decision due tomorrow. Technology and automakers are among gainers while energy and telecom sectors lead declines. Here are some of the biggest movers on Tuesday:

Earlier in the session, HK/China closed lower despite a midday spike following a Reuters headline that placed China’s 2025 GDP growth and fiscal deficit targets at the upper bound of investor expectations. Small caps caught the most weakness today, suggesting that retail investors are taking a breather after being better buyers over the past few sessions. Meanwhile, Samsung Electronics 00597230 KS caught selling after GIR cut its price targets, while ASIC names in Taiwan were well bid after Broadcom AVGO US rallied again overnight.

In FX, Bloomberg’s dollar gauge was little changed. An index of Asian currencies fell to the lowest in more than two years amid pessimism over China’s economic outlook and expectations that Trump policies will drive gains in the greenback. The yen snapped a six-day losing streak after weakening beyond the 154 level versus the dollar overnight. The yen’s rapid decline in the past week had strategists warning that further weakness may trigger verbal intervention from authorities and add pressure on the Bank of Japan to hike rates. Traders are pricing in a less than 20% chance of a rate hike in December, according to swaps market pricing. The pound erased a small loss while gilt yields rose as traders scaled back bets on Bank of England rate cuts after UK wage growth accelerated for the first time in more than year. The implied chance of three quarter-point cuts in 2025 fell to around 55%, down from 90% before the report. The yuan was little changed in both onshore and overseas trading, as markets shrugged off news that Chinese leaders were planning to set an annual growth goal of about 5% for next year and raise the budget deficit.

In rates, yields on US Treasuries advanced across the curve, with the US 10-year yield rising 3bps to 4.432%, cheapest since Nov. 21. UK government bonds fall as traders pare bets on interest-rate cuts by the Bank of England after UK wage growth accelerated for the first time in more than a year. UK 10-year yields rise 6 bps to 4.50% although the pound has given back its earlier advance versus the dollar. OIS swaps price in about 60bps of easing through December 2025 vs around 75bp at Monday’s close. The US Treasury sells $13 billion of 20-year bonds in a reopening at 1pm New York time; WI yield near 4.72% is ~4bp cheaper than November’s new-issue sale, which tailed by 1.5bp.

The 10Y yield may climb to 6% as US fiscal woes worsen and Trump’s policies help keep inflation elevated, according to T. Rowe Price. “Is a 6% 10‑year Treasury yield possible? Why not? But we can consider that when we move through 5%,” Arif Husain, chief investment officer of fixed-income, wrote in a report. “The transition period in US politics is an opportunity to position for increasing longer‑term Treasury yields and a steeper yield curve.”

In commodities, oil prices dropped with WTI falling 1% to $70 a barrel. Spot gold drops $11 to around $2,641/oz.

The US economic data calendar includes November retail sales and December New York Fed services business activity (8:30am), November industrial production (9:15am), and October business inventories and December NAHB housing market index (10am)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed after the region initially showed a positive bias, taking cues from Wall Street, and in the absence of macro newsflow with looming risk events. ASX 200 firmed with banks underpinning the index, with Westpac among the gainers while its CFO announced plans to retire. Nikkei 225 trimmed earlier upside as traders were cautious ahead of the BoJ, with the decision contingent on the FOMC's announcement hours beforehand. Hang Seng and Shanghai Comp traded within narrow parameters in uneventful trade amid quiet newsflow, with participants remaining non-committal ahead of major risk events.

Top Asian News

European bourses began the session entirely in the red and have mostly resided in negative territory throughout the European morning, but have attempted to edge a little higher in recent trade, with some indices managing to climb incrementally into the green. German Ifo data confirmed the dire situation in the region, whilst ZEW surprised to the upside; metrics which sparked little price action. European sectors are almost entirely in the red, given the slip in risk sentiment in today’s session thus far. Tech is marginally in positive territory, alongside Consumer Products and Services. Energy is the clear underperformer joined by Basic Resources, attributed to the losses seen in underlying commodity prices today. US equity futures are modestly in negative territory, in-fitting with the losses seen in Europe and the general risk tone; a slight turn in fortunes in comparison to the gains seen in the prior session.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

In what should be a quiet week given the time of year there is still a lot going on in markets as we build up to the FOMC that concludes tomorrow. The S&P 500 (+0.38%) ended the session just beneath its all-time high from earlier in the month but with the number of decliners (321) in the index exceeding advancers (182) for a remarkable 11th session in a row. On my calculations this is the longest such run for 40 years. Elsewhere French assets under-performed a touch after the Moody’s downgrade on Friday night, whilst the Canadian Dollar hit its weakest intraday level in four-and-a-half years after the country’s finance minister resigned heaping pressure on Trudeau as the political instability in several G7 countries seen over the last few months continues.

Talking of which, the other main story of the day centred around Germany as the government lost a no-confidence vote as expected that paves the way for an early election to happen. By way of background, Chancellor Scholz had led a three-party coalition of his own SPD, the Greens and the FDP. But the coalition collapsed after Scholz fired the FDP leader and finance minister Christian Lindner because of a budget dispute. Under the German system, the Chancellor can’t simply call an early election at the time of their own choosing. However, they can ask the President for an early election if they lose a vote of no confidence, so this one was tabled deliberately by the government in order to bring forward the election date. The election is expected to take place in February, and the conservative CDU/CSU bloc currently have a clear lead in opinion polls. Today they will release their manifesto with the leaks suggesting no plans to reform the debt brake. However part of this is likely to help ensure they have a stronger negotiating position in coalition talks. See Robin Winkler's latest piece yesterday looking at DB's latest thoughts.

In the meantime, there were also big developments in Canadian politics yesterday, as Finance Minister and Deputy PM Chrystia Freeland resigned from the cabinet. In her resignation letter, she said that the threat of US tariffs meant Canada should be “keeping our fiscal powder dry today, so we have the reserves we may need for a coming tariff war.” The move came just hours before Freeland was set to deliver an economic update, and Canadian assets struggled following the resignation, with equities around half a percent lower and the Canadian Dollar weakening. Canada’s next election is due by October 2025, but the governing Liberal Party under Justin Trudeau are lagging well behind the opposition Conservatives, and CBC News’ poll tracker points to a high chance of a Conservative majority based on current polls. The question after this is whether Trudeau can ride this out until next October or will have to go to the polls earlier.

Moving on to France, there was an underperformance in the country’s markets following the credit rating downgrade from Moody’s on Friday. For instance, the CAC 40 (-0.71%) was the worst performer among the big European indices, well beneath the Europe-wide STOXX 600 (-0.12%). In addition, the Franco-German 10yr spread widened by +1.4bps to 79.9bps, which is its 5th consecutive move wider. Remember the downgrade only bring Moody's into line with S&P and Fitch so it aligns the main agencies rather than creates an incremental move away from the pack. Otherwise, there wasn’t much in the way of concrete political news, but the new PM François Bayrou met with Marine Le Pen, who said after the meeting that “It’s perhaps a little early to say if we were heard, but we were listened to.”

Elsewhere in Europe, there was a bit more optimism yesterday as the December flash PMIs were slightly better than expected. Now admittedly, the Euro Area composite PMI was still in contractionary territory at 49.5, so it was hardly a stellar performance. But that was stronger than the 48.2 print expected, and the services PMI was back in expansionary territory at 51.4 (vs. 49.5 expected). From a market perspective however, there wasn’t much to shift the dial for the ECB, who are still widely expected to keep cutting rates in 2025. And sovereign bonds were broadly steady yesterday, with 10yr bund yields (-1.0bps) coming down slightly to 2.24%.

The modest rally in European bonds also came as ECB President Lagarde followed through on some of the more dovish signals seen at last week’s press conference, saying that the ECB is looking to deliver an “appropriate” policy stance and that “If the incoming data continue to confirm our baseline, the direction of travel is clear and we expect to lower interest rates further”. Meanwhile, Schnabel, one of more hawkish ECB voices, noted that “lowering policy rates gradually towards a neutral level is the most appropriate course of action”, so some implicit pushback against the possibility of the ECB having to move rates below neutral.

Over in the US, the theme of American exceptionalism continued as the flash PMIs were notably stronger than expected. Indeed, the composite PMI was up to 56.6, which is its highest since March 2022 when the Fed started to hike rates again. In turn, that contributed to a selloff among US Treasuries, which pared back their initial gains to leave the 10yr yield little changed (+0.1bps) at 4.40%. At the same time, there was a notable outperformance from US equities, with the S&P 500 (+0.38%) ending the session just -0.27% beneath its all-time high. As mentioned at the top the breadth was again a negative as more stocks fell than rose for an eleventh day with the equal weight index down -0.36%. So the advance was driven by the Magnificent 7 (+2.07%), which hit another all-time high. Health care stocks (-1.24%) were among the underperformers as Trump commented that he plans to “knock out the middleman” in the sector during a wide-ranging press Q&A.

In Asia the main headline just coming through is Reuters reporting that China is set to announce a 5% growth target for 2025 along with a 4% budget deficit. There has been talk of such an expanded deficit number in the last couple of weeks but if that is the growth target the market will likely conclude that the authorities will have to be serious about stimulus. After the story's release Chinese equities have rallied several tenths of a percent with the Shanghai Comp now "only" -0.16% lower on the day. The Hang Seng is +0.2% higher having spent most of the session notably lower. The Nikkei (+0.20%) and the ASX (+0.78%) are higher but the KOSPI (-1.0%) is the biggest underperformer as the country continues to digest the weekend impeachment news. US futures are flat.

Bitcoin (+0.41%) is advancing for the third straight session, hitting a record high of $106,511 as the incoming Trump administration is seen as being far more friendly towards cryptocurrencies.

To the day ahead now, and data releases in the US include retail sales and industrial production for November, in Canada there’s the November CPI print, in Germany there’s the Ifo’s business climate indicator and the ZEW survey for December, and in the UK we’ll get unemployment for October. Central bank speakers include the ECB’s Kazimir and Rehn.