US equity futures slipped ahead of key GDP and PCE data. As of 8:00am, S&P 500 futures are down 0.3% while Nasdaq 100 contracts lose 0.5%, with Mag 7 names mostly lower (NVDA -1.4%, TSLA -1.1% and META -0.6%) as weak earnings weighed on risk sentiment after Super Micro plunged 16% ahead of Microsoft and Meta numbers later on Wednesday. Bond yields are lower by 1bps to 4.15% while the USD is higher. Overnight, China’s factory PMI slipped into the worst contraction since December 2023 (49 vs 49.7 cons) due to the negative impact of higher US tariffs, while Trump at a rally in Michigan renewed his criticism of Powell, noting he is "not really doing a good job" and that he knows more about interest rates. This morning, Euro Area flash CPI has been mixed, while Q1 GDP data was slightly firmer than expected at 1.2% YoY (vs 1.1% cons). Commodities are mixed: oil is 1.8% lower; previous metals are lower, while base metals are mostly higher. After yesterday’s close, earnings were modestly negative. Particularly, SBUX fell 6.7% on missed earnings amid margin pressure and top-line growth. BKNG commented that there is a moderation in inbound travel into the US, but so far the global leisure travel demand has been stable. Looking ahead today, we have ADP employment, Q1 GDP, PCE and employment cost index. There are no Fed speakers scheduled given blackout ahead of May's FOMC meeting.

In premarket trading the Mag7 stocks were mostly lower (Alphabet -0.1%, Amazon -0.6%, Apple -0.4%, Meta Platforms -0.9%, Microsoft +0.1%, Nvidia -2%, Tesla -1.3%). First Solar tumbled 12% after the maker of electricity-producing solar modules cut earnings guidance for this year due to tariffs imposed by the Trump administration. Norwegian Cruise Line dropped 7% after warning that cruise demand, which has long defied worrying travel trends, is beginning to weaken. Snap plunged 13% after the company declined to issue a sales forecast for the current period, saying it is navigating macroeconomic “headwinds” for its advertising business. Starbucks slumped 8% after weaker-than-expected results in the latest quarter amped up pressure for the company’s new management to deliver. Here are some other notable premarket movers:

Investors have been cautiously optimistic, with the Nasdaq 100 close to erasing all of its losses this month, after tariff U-turns and speculation the Federal Reserve will cut interest rates to prevent a recession.

“Perhaps we are past peak uncertainty,” Kim Crawford, global rates portfolio manager at JPMorgan Asset Management, told Bloomberg TV. “The administration has a more conciliatory tone on tariffs and to an extent as well, Fed independence.” Benchmark 10-year Treasuries steadied after six days of gains, with the yield at 4.16%. Gold dropped.

Four of the so-called Magnificent Seven — Microsoft, Apple Inc., Meta and Amazon.com Inc. — are reporting earnings this week. Analysts expect the group — which also includes Google-parent Alphabet Inc., Tesla Inc. and Nvidia Corp. — to deliver an average of 15% profit growth in 2025, a forecast that’s barely budged since the start of March despite the flareup in trade tensions.

“Even if you take out the tariff story outcome I think there is an issue for Big Tech and the market will probably start to refocus on that when we get this earnings season,” Christopher Wood, global head of equity strategy at Jefferies, told Bloomberg TV. “We still have the issue of the massive amount of capex being spent on Big Tech, they’re overspending on this AI story.”

Economic barometers of US economic health are also due with inflation and GDP data Wednesday that will give a snapshot of activity just before President Donald Trump unleashed country-specific levies on April 2. US real GDP growth likely cooled to a standstill in the first quarter amid disruptions from policy shifts, according to Bloomberg Economics.

Veteran emerging-markets investor Mark Mobius said he’s keeping 95% of his funds’ holdings in cash as he waits out the trade-related uncertainty. Hedge funds are reluctant to make major bets amid the turmoil, with the only significant shift in positioning in April being increased bets against US stocks, Bloomberg reported.

In the latest pivot in Trump’s trade strategy, the US president signed an executive order easing the impact of his auto tariffs, preventing duties on foreign-made vehicles from stacking on top of other levies and lessening charges on parts from overseas used to make vehicles in the US. The news supported sentiment toward European auto stocks Wednesday, with Mercedes-Benz Group AG and Stellantis NV rising even after withdrawing their outlooks for this year, citing the uncertainty of trade barriers.

In a rally celebrating his first 100 days in office, Trump defended his tariff policies as he marked his 100th day in office. He also renewed criticism of Fed Chair Powell, saying he is “not really doing a good job.”

In Europe, the Stoxx 600 rises for a seventh consecutive session, albeit only slightly, as disappointing earnings keep a lid on gains. Travel & leisure stocks are the worst performers. Energy and bank stocks also underperform with notable declines in TotalEnergies and Credit Agricole after their respective updates. Here are some of the biggest movers on Wednesday:

Earlier in the session, Asian stocks rose, on track for a fourth-straight day of gains, as investors were encouraged by a continued rally on Wall Street and optimism over potential trade deals with the US. The MSCI Asia Pacific Index gained as much as 0.7%. Sony was among the biggest boosts after Bloomberg reported it is considering spinning off its semiconductor unit, while AIA climbed on strong quarterly results. The regional benchmark is poised to close April more than 2% higher, wiping out a steep intra-month loss sparked by US tariffs. The market has been looking toward various concessions from Washington as well as individual nations’ negotiations with the US. President Donald Trump on Tuesday signed an executive order easing the impact of his auto tariffs, while news emerged of discussions with South Korea and Australia. China’s manufacturing activity in April saw its worst contraction since December 2023, exposing early signs of weakness in Asia’s biggest economy from the trade war with the US. Shares of Chinese banks were among the biggest drags on equity benchmarks in Hong Kong and mainland China after weak earnings.

In FX, the Bloomberg Dollar Spot Index is little changed. The Aussie dollar outperforms rising 0.2% against the greenback after core inflation rose more than expected. AUD/USD rose as much as 0.5% to 0.6418 before paring the move; the nation’s core inflation in the first quarter beat estimates, damping expectations of rapid rate cuts. The pound and the yen were among the worst performers, down 0.3% and 0.4% against the dollar respectively.

In rates, treasuries mixed with the long-end outperforming where yields are down around 2bp on the day, supported by wider gains seen across the long-end of Germany and UK bonds after a flurry of European economic data. Ahead of today's quarterly refunding announcement, the 10-year US yield are down 1bps to 4.16%. US yields slightly cheaper across the front-end while richer in the long-end of the curve, flattening 2s10s and 5s30s spreads by 1.8bp and 2.5bp on the day; US 10-year yields trade down to around 4.16%, richer by 1bp on the day with bunds and gilts outperforming by 2bp and 2.5bp in the sector. European government bonds gain with little reaction shown to a flurry of economic data releases, including a beat for euro-area first quarter GDP. European government bonds rose; German yields were up to 4bps lower across the curve, with gilts mirroring that move; UK 10-year yield down 4bps to 4.40%

In commodities, oil prices decline, with WTI falling 1% to $59.80 a barrel. Spot gold falls $36 to around $3,280/oz. Bitcoin is steady near $94,800.

US economic calendar includes April ADP employment change (8:15am), 1Q advanced GDP (8:30am), April MNI Chicago PMI (9:45am), March personal income/spending, PCE price index, pending home sales (10am). Fed’s external communications blackout ahead of the May 7 FOMC meeting

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newquawk

APAC stocks failed to sustain the positive handover from Wall St and traded mixed at month-end as the region digested a slew of data including disappointing Chinese official PMIs, while there was a muted reaction and very few surprises from US President Trump's speech to commemorate his first 100 days back in office. ASX 200 eked mild gains as strength in tech, healthcare and financials offset the losses in the utilities and commodity-related sectors but with the upside limited after firmer-than-expected CPI data saw money markets fully price out the chances of a larger 50bps RBA rate cut in May. Nikkei 225 was choppy with the upside contained following disappointing Industrial Production and Retail Sales, while the BoJ also kick-started its two-day policy meeting and there were some comments from a group representing major foreign automakers which noted that President Trump's latest tariff order for autos provides some relief but more must be done. Hang Seng and Shanghai Comp were indecisive after official Chinese Manufacturing and Non-Manufacturing PMIs disappointed although Caixin Manufacturing PMI topped forecasts, while the mainland heads into a five-day weekend owing to Labor Day holiday closures and participants also reflected on key earnings releases including disappointing results from China's Big 4 banks.

Top Asian News

European bourses (STOXX 600 +0.2%) opened mostly firmer and have traded tentatively within a tight range ahead of the day’s key risk events. European sectors hold a strong positive bias; Media (lifted by post-earning strength in UMG) and Telecoms takes the top spots, whilst Travel & Leisure and Basic Resources underperform. rnings include: Mercedes Benz (-0.8%) down Y/Y, high uncertainty noted; Volkswagen (U/C) miss, expects results at lower-end of guidance; UBS (+0.2%) beat; Stellantis (+1.5%) in-line, suspends guidance; Barclays (-0.3%) beat, upgrades NII guidance; GSK (+4%) beat; TotalEnergies (-3.2%) mixed, continue buybacks, confident in growth objective; ASM International (U/C) orders & margin beat; Air France (+1.6%) beat, confirms outlook; Iberdrola (-1.3%) mixed, expect strong performance ahead.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopoltiics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

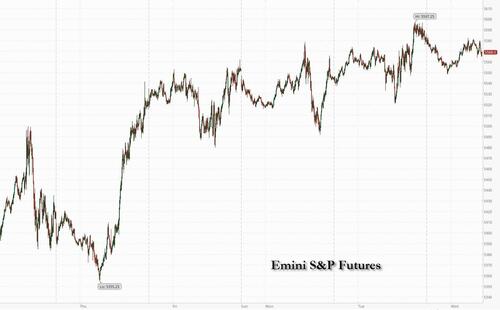

Welcome to the end of 100 days of Trump 2.0 with markets currently in a period of rare calm over this period. Indeed yesterday the S&P 500 (+0.58%) advanced for a 6th consecutive session and marking its best 6-day run (+7.81%) since March 2022. Interestingly, the latest gain means the index is now out of technical correction territory again, and now “only” stands -9.49% beneath its record high in mid-February and -1.94% below pre Liberation Day levels. This comes ahead of Microsoft and Meta’s earnings after the bell tonight and Amazon and Apple tomorrow. So these will go a long way towards dictating the sentiment of markets given we’re out of the most intense gravitation pull of Liberation Day now. It feels that in the last month or so AI has hardly been discussed as an investment theme after 2 years where it was the only game in town.

The main trigger for yesterday’s risk-on mood were headlines that Trump would announce some auto tariff relief ahead of tariffs on auto parts coming into force next weekend. The measures, signed later in day, prevent tariffs on autos and on steel and aluminium from stacking up on top of each other and provides partial rebates for domestic car makers on imported auto parts for the first two years. The President framed the move as giving companies “a little flexibility” at a rally yesterday evening, at which Trump also renewed his criticism of Fed Chair Powell, saying he's "not really doing a good job".

Those tariff headlines supported markets in spite of a weak batch of economic data. That included the Conference Board’s latest consumer confidence indicator, which fell to 86.0 in April (vs. 88.0 expected). Not only is that the weakest since May 2020 at the height of the pandemic, but the expectations component saw an even bigger slump to 54.4, marking its lowest since October 2011 when the post-GFC recovery was stalling and the Euro Crisis was escalating. In the meantime, the latest JOLTS report also showed job openings fell to a 6-month low in March of 7.192m (vs. 7.5m expected). Obviously that’s covering a period before Liberation Day, so markets weren’t too focused on that, but it still meant that the ratio of vacancies per unemployed individuals fell to 1.02, which is its lowest so far this cycle.

The read across for risk assets was probably limited by the fact that the Conference Board reading is still a survey and while the surveys have been consistently negative of late, hard data have been mostly holding up. So it didn’t lead to a major re-assessment about the growth outlook in the way that a negative jobs report might have done. On top of that, the details of the JOLTS report did include some more positive elements, as the quits rate of those voluntarily quitting their job hit an 8-month high of 2.1%. It also didn’t show an escalation in layoffs, as the layoffs and discharges rate fell back to a 9-month low of 1.0%. So it meant investors could still plausibly believe the narrative that a recession would be avoided, even if sentiment had taken a big hit.

However, the more negative data immediately led investors to price in more Fed rate cuts this year. For instance, the amount of cuts priced by December moved up to 97bps, which is the highest since April 8, just before Trump announced the 90-day tariff extension. In turn, that led Treasury yields to fall across the curve, with the 2yr yield (-4.4bps) falling to 3.65%, its lowest level since October, whilst the 10yr yield (-3.6bps) fell to 4.17%.

Looking forward, we’ll get a key piece of data today with the Q1 GDP release. Obviously that’s backward-looking and covers the period before Liberation Day, but it will give a strong indication of the extent to which people might have tried to import goods to get ahead of the tariffs. Indeed, yesterday we found that the goods trade deficit hit a record $162bn in March (vs. $145bn expected). So that led to a decent hit in GDP trackers, given that imports subtract from GDP growth. Indeed, the Atlanta Fed’s GDPNow estimate for Q1 is now at an annualised contraction of -2.7%, and their alternative model that adjusts for imports and exports of gold is still at a contractionary -1.5%. And our own US economists have updated their expectation to a real GDP to contraction of -0.9% in Q1 due to the surge in imports (see their note here). If today’s number does show a decline, that would be the first quarterly contraction since Q1 2022.

For now at least, equities continued their rally, with the S&P 500 (+0.58%) moving up to its highest level since Liberation Day, led by financials (+0.97%) and materials (+0.93%). Energy stocks (-0.37%) underperformed as Brent crude oil fell -2.44% to $64.25/bbl. Over in Europe, there was also a strong performance, with the STOXX 600 (+0.36%) posting a 6th consecutive gain as well, whilst the DAX (+0.69%) outperformed. The DAX has now entirely erased its losses since Liberation Day, leaving the index +0.16% above its level on April 2 and +12.64% YTD as opposed to -5.45% for the S&P 500. Meanwhile in the UK, the FTSE 100 (+0.55%) posted a 12th consecutive gain, which made it the longest run of gains since 2017.

Overnight S&P 500 (-0.47%) and NASDAQ 100 (-0.64%) futures have fallen, not helped by a -17% after hours drop in Super Micro Computers after posting disappointing results. This is a company that was a darling of the AI world and peaked out at around 118 early in 2024 and will likely open in the low 30s today. The rest of Asia is largely consolidating with the S&P/ASX 200 (+0.24%), Nikkei (+0.17%) and Hang Seng (+0.22) seeing small gains but with mainland Chinese stocks broadly flat. Elsewhere, the KOSPI (-0.60%) is lagging behind its regional peers.

Coming back to China, the official manufacturing PMI contracted to 49.0 in April this morning, falling short of the expected 49.7 and significantly lower than the previous month's 50.5. This contraction is clearly being attributed to the escalating trade war with the US. The non-manufacturing PMI also disappointed, dropping to 50.4 in April, below the anticipated 50.6 and down from 50.8 in March. Consequently, China’s composite PMI decreased to 50.2 in April from 51.4 in March, barely remaining above the 50 expansion threshold.

Elsewhere, Australia's Q1 inflation edged up to +2.4% year-over-year (expected +2.3%), holding at a four-year low. The RBA's preferred trimmed mean inflation rate fell from a revised +3.3% to +2.9% in March (expected +2.8%). The data is likely to reinforce the central bank's cautious stance and dampen expectations for aggressive interest rate cuts in the near term. Against this background, the Australian dollar is holding on to its gains, strengthening +0.27% to trade at 0.6401 against the dollar. Meanwhile, yields on the 3yr policy sensitive government bonds are -0.7bps lower settling at 3.31% as we go to print.

Turning to back Germany, today is an important one in the process to forming a new government, as the vote of the SPD membership on the coalition treaty concludes. In light of this, our economists have put out a fresh note going through that vote (link here), as well as the fiscal timelines for the 2025 budget. Their view is that there is little event risk from the SPD vote, and that they don’t expect any additional fiscal support measures (beyond the coalition treaty) unless there are tangible signs of the trade shock materialising.

Finally in Europe, sovereign bonds put in a decent performance across the continent, with yields on 10yr bunds (-2.3bps), OATs (-1.9bps) and BTPs (-2.1bps) all falling back. That came as the European Commission’s latest economic sentiment indicator fell by more than expected in April, down to a 4-month low of 93.6 (vs. 94.5 expected). Separately, the ECB’s survey of consumer inflation expectations showed 1yr expectations up to +2.9%, the highest since April.

To the day ahead now, and US data releases include PCE inflation for March, Q1 GDP, the Q1 Employment Cost Index, and the ADP’s report of private payrolls for April. Meanwhile in Europe, we’ll get the flash CPI reading for April from Germany, France and Italy, along with German unemployment for April. From central banks, we’ll hear from the ECB’s Muller, Villeroy and Makhlouf. Finally, today’s earnings releases include Microsoft, Meta and Caterpillar.