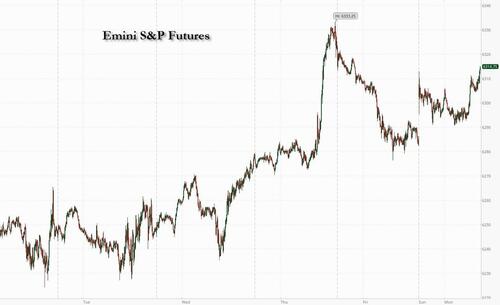

US equity futures are weaker with investors on edge about the potential for more tariffs from the Trump administration as we head into the July 9 deadline which appears to have been rolled to Aug 1. As of 8:15am ET, S&P 500 contracts declined 0.2% although well off session lows after Treasury Secretary Bessent indicated that some countries may get a three-week extension to trade negotiations. Nasdaq 100 futures dipped 0.4% with small caps underperforming but tech is being dragged by TSLA sliding 6% after Elon Musk announced he will form a new political party. Apple (-1.0%) after phone shipments from China in May were down 9.7% Y/Y for the tranche that includes iPhones. Semis/Cyclicals under pressure. Trump said either a deal will be done, or a country will get a letter on Monday with 12 letters set to be sent today. Additionally, the president said late on Sunday that Anyone aligning with BRICS "Anti-American" stance is subject to an additional 10% tariff. Oil was flat, rebounding from session lows after OPEC+ did another supply hike, this time for 548k bpd. Yield curve is twisting steeper, USD stronger, and cmdtys declining (Ags, metals). This is a light macro data week into next week’s CPI and kick off to earnings season.

In premarket trading, Mag7 stocks were mixed: Tesla was the biggest drag among Magnificent 7 stocks, falling 6%, as President Donald Trump slams Elon Musk’s bid to form a new political party (Microsoft +0.1%, Amazon +0.09%, Meta Platforms -0.3%, Apple -0.5%, Alphabet -0.5%, Nvidia -0.7%).

Trade tensions are back on investors’ radar, with Trump pledging to impose unilateral rates on dozens of countries in the coming days. US officials have signaled Aug. 1 as the start date for higher levies, while Treasury Secretary Scott Bessent indicated some countries may be offered a three-week extension. The deadline “will create near-term uncertainty,” noted Mohit Kumar, chief European strategist at Jefferies International. “But the letters are meant as an incentive for other countries to agree to come to a deal quickly. Any dips in risky assets should be used as a buying opportunity.”

The dollar rose 0.4%, putting the greenback on course for its biggest advance in three weeks on growing trade fears. Emerging-market currencies fell, with the South African rand sliding 1%, after US President Donald Trump warned he would add extra tariffs on any country that aligns with “the Anti-American policies of BRICS.”

European stocks gained with the Stoxx 600 climbs 0.2% with insurance, travel and financial services as the strongest-performing sectors. DAX outperforms peers, adding 0.6%. Shell and Capgemini are the day’s most notable movers, the former falling on a second-quarter update while the latter retreats after announcing it will acquire US firm WNS. Here are the biggest movers Monday:

Earlier in the session, Asian stocks fell as investors remained on edge ahead of the deadline for President Donald Trump’s pause on reciprocal tariffs, even after the administration hinted at possible extensions. The MSCI Asia Pacific Index dropped as much as 0.8%, the most in two weeks, with TSMC and Samsung Electronics among the biggest drags. Benchmarks in Taiwan and Japan underperformed. Stocks dropped in Malaysia and Thailand after news that the US plans to restrict shipments of AI chips to these nations. Trump’s latest threat to charge an additional 10% tariff on any country aligning themselves with “the Anti-American policies of BRICS” caused further uncertainty Monday. Still, investors are waiting to see what actually happens. “Reactions are often short-lived, especially as he usually fails to deliver on his threats,” said Vey-Sern Ling, a managing director at Union Bancaire Privee.

Japan’s 30-year yield surged 10 basis points to 2.96% on concerns that the outcome of this month’s upper house election may result in bigger fiscal spending. US Treasuries were little changed, with the 10-year yield at 4.35%

“Treasuries are starting to find their footing a bit, but the problem is if the tariff impact on inflation comes back and the Fed needs to back-pedal, at least temporarily, I think Treasuries, unfortunately, are also a bit vulnerable,” Christian Mueller-Glissman, head of asset allocation research at Goldman Sachs Group Inc., told Bloomberg TV.

In FX, the dollar extends gains, outperforming most of its G-10 peers in anticipation of US tariff letters from today. EM currencies slump, with the South African rand and Indian rupee among the session’s laggards after President Trump said any country aligning with BRICS’ “Anti-American policies” would face an additional 10% tariff.

In rates, treasuries are mixed with the yield curve steeper after US officials signaled that trading partners will have until Aug 1 before tariffs kick in, about three weeks beyond their July 9 deadline to reach agreements. Bonds are relatively muted versus other assets, with slight outperformance seen in gilts across the curve compared to Treasuries and bunds. Front-end yields are about 1bp richer on the day with long-end tenors cheaper by ~2bp, steepening 2s10s and 5s30s spreads by 2bp-3bp. 10-year near 4.3576% is 1bp higher, outperforming German counterpart by 1bp and lagging UK by 1bp. Japan’s 30-year yield surged 10 basis points to 2.96% on concerns that the outcome of this month’s upper house election may result in bigger fiscal spending. US Treasuries were little changed, with the 10-year yield at 4.35%. Treasury auction calendar resumes Tuesday with $58 billion 3-year notes, followed by $39 billion 10-year notes and $22 billion 30-year bonds Wednesday and Thursday.

In commodities, Brent crude futures erase losses, trading up 0.3% to above $68/bbl even after OPEC+ agreed to a bigger-than-expected production increase next month. Spot gold fell $28 to trade near $3,309/oz.

“OPEC’s production pivot, after years of cutting output, is a sign that they remain confident over demand,” wrote Kathleen Brooks, research director at XTB. “This is good news for inflation across the world.”

Looking at today's calendar, the US economic data slate is empty for Monday. Fed speaker slate also blank, with Musalem and Daly schedule later in the week

Market Snapshot

Top Overnight News

Corporate News

Tariffs/Trade

A more detailed look at global markets courtesy of Newquawk

APAC stocks were mostly subdued following a lack of bullish catalysts from over the weekend and with the region cautious ahead of upcoming key events, including central bank announcements and the July 9th tariff deadline. ASX 200 marginally retreated amid weakness in miners and as gold producers suffered due to a decline in the precious metal, although the downside in the broader market was limited by resilience in defensives and ahead of tomorrow's RBA announcement where the central bank is widely expected to deliver a consecutive 25bps rate cut. Nikkei 225 was pressured following softer-than-expected growth in Labour Cash Earnings which resulted in the largest decline in Japan's real wages in almost two years, while automakers were weighed on by the ongoing US tariff threat. Hang Seng and Shanghai Comp conformed to the uninspired mood amid trade uncertainty and frictions with China retaliating against the EU ban on public tenders for medical devices by imposing import restrictions on medical devices.

Top Asian News

European bourses began the session with modest gains but overall action is choppy/tentative as we await trade updates, Euro Stoxx 50 +0.3%; awaiting Trump to send the letters to 12-15 nations today and clarity on whether the July 9th tariffs have been pushed to August 1st, as commentary indicates. Sectors are mixed and split down the middle, Energy names show the deepest pressure after OPEC+ increased oil output more than expected at its weekend meeting, sources signalling further supply increases at the upcoming August meeting; furthermore, Shell (+2.8%) trimmed production guidance for Q2 across LNG and integrated gas. Insurance names outperform, benefitting from a broker upgraded to Generali (+1.5%) while Travel & Leisure names cheer lower crude benchmarks this morning, in the first part of the session at least.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Ukraine

US Event Calendar

DB's Jim Reid concludes the overnight wrap