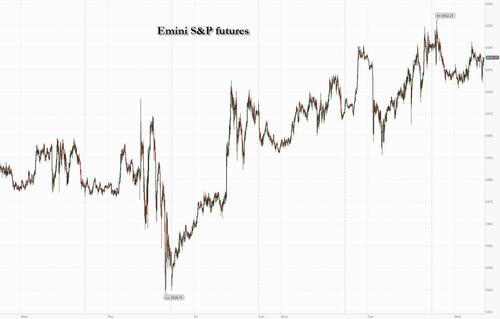

US equity futures dropped into today's CPI print after traders weren't moved by the US-China trade talks, which saw the two two sides agree on a framework to implement last month’s Geneva deal with few actual details. There’s also nervousness ahead of inflation data: a hot reading would be a big risk factor for a market near record highs (see full preview here). As of 8:00am ET, S&P and Nasdaq 100 futures traded 0.2% lower but were off session lows; pre-market Mag7 names are mostly higher with TSLA (+2%) the standout after a contrite Elon Muskusk tweeted "I regret some of my posts about President @realDonaldTrump last week. They went too far." Semis and Cyclicals are poised to outperform. In other trade news, US/Mexico were close to a deal on steel tariffs by using import caps, which would be higher than the previous cap, and would remove the 50% tariff on steel below said cap; this looks like a reversion to 2018 levels and may be a template for talks with Canada. The G7 summit will carry additional weight as we are a month away the expiration of the 90-day tariff delay, with only a US/UK framework on the tape. Elsewhere, the EU is said to see talks with the US going beyond a July 9 deadline. The yield curve is twisting steeper with 10Y yields higher, the USD is slightly higher and commodities rise with crude and gold higher after Trump told the NY Post that he’s getting “less confident” about nuclear talks with Iran; natgas and base metals also rallied with Ags are down. The key event today is the CPI report at 8:30am ET where economists expect a relatively tame number, with core inflation up 0.3% in May. Positioning suggests a hotter print will be punished more than a dovish one will be rewarded, according to JPMorgan.

In premarket trading, Tesla rose over 2% in, outperforming Magnificent 7 counterparts after Elon Musk expressed regret over his recent social-media outburst directed at Trump.

Other Mag7 moves: Alphabet -0.1%, Microsoft -0.4%, Apple little changed, Nvidia little changed, Amazon -0.4%, Meta Platforms -0.3%. Steel stocks fell as the US and Mexico close in on a deal that would remove 50% tariffs on steel imports up to a certain volume — seen to erode the advantage US steelmakers would have benefited from if imports from Mexico faced higher rates. (Cleveland-Cliffs drops 5%, Nucor -3%, Steel Dynamics -1.6%). Here are some other notable movers:

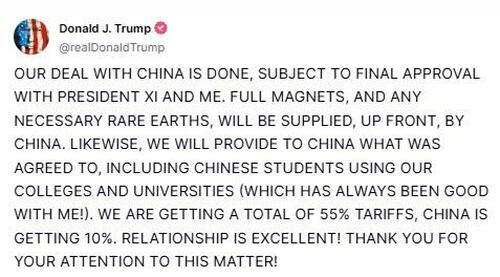

Tuesday’s thinly detailed outcome of the Trump administration’s trade talks with China in London left traders and investors underwhelmed. Markets were watching whether the world’s top two economies could damp down tensions that economists say have tipped the global economy into a downturn. After some 20 hours of negotiations, US officials said both sides had established a framework to revive the flow of sensitive goods, even though the plan still needs sign-off from Trump and Xi Jinping.

“A preliminary agreement doesn’t fill me with enthusiasm in terms of this being resolved,” Guy Miller, chief market strategist at Zurich Insurance Co., told Bloomberg TV. “This is going to continue to be pushed down the line.”

On Wednesday morning, Trump tweeted that the "deal with China is done" and that "we are getting a total of 55% tariffs, China is getting 10%."

In other trade news, a Federal Court of Appeals extended an earlier, short-term reprieve for the administration as it presses a challenge to a lower court ruling last month that blocked tariffs. Steel stocks are trading lower after Bloomberg reported the US and Mexico are closing in on a deal that would remove 50% tariffs on steel imports up to a certain volume.

Trade (non) deal aside, CPI is top of mind today. Economists expect a relatively tame number, with core inflation up 0.3% in May. Positioning suggests a hotter print will be punished more than a dovish one will be rewarded, according to JPMorgan (full CPI preview here). Economists expect a modest impact from tariff pass-through for goods that are mostly imported. They see inflation rising 0.3% from April after increasing 0.2% the previous month, excluding the volatile food and energy categories. The core CPI, which is regarded as a better indicator of underlying inflation, is seen accelerating for the first time this year — to 2.9% — on an annual basis.

The CPI report, along with producer price data due Thursday, will offer Federal Reserve officials a final look at inflation and the impact of high tariffs before they gather next week Traders are increasingly betting that policymakers will cut rates only once this year.

“It is not expected to be market-moving for now but that could increase the scope for an impact from a big surprise,” said Geoff Yu, FX and macro strategist at Bank of New York Mellon Corp. “We expect a more data-driven session as some repositioning is needed ahead of a key central bank week.”

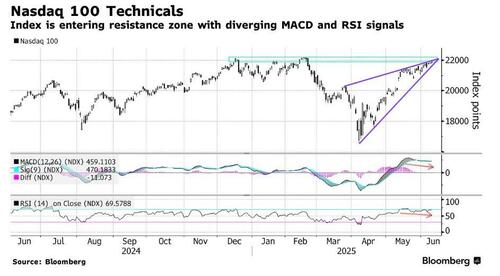

Investors have been shifting to under-owned, riskier pockets of the market like small caps and high-beta stocks, with Nomura strategist Charlie McElligott citing a “right-tail” risk. Nasdaq has led the recent US equity gains, while technicals are becoming tricky with RSI and MACD indicators showing a bearish divergence.

Global stocks are likely to rally another 3% into the end of the year, while in Europe, there’s scope for corporate earnings to see more upgrades, according to Citigroup.

Concerns about a ballooning US budget deficit and demand for long-end bonds have caused the yield on 30-year Treasuries to spike in recent weeks. A downgrade of US sovereign debt by Moody’s Ratings last month has prompted Hong Kong pension fund managers to form a preliminary plan to sell down their holdings if the US loses its last recognized top credit rating, Bloomberg News reported Wednesday.

In Europe, the Stoxx 600 is flat as banking and basic resources lead stocks, while the retail sector is the biggest laggard, with Inditex SA falling 6.4% after Zara owner’s sales missed estimates. Here are the most notable European movers:

Asian stocks rose, with sentiment lifted by a preliminary deal between the US and China to de-escalate trade tensions. The MSCI Asia Pacific Index rose as much as 0.4%, on track for a third day of gains. Chip stocks provided the biggest boost after TSMC posted a 40% increase in May revenue, in a sign of resilient AI demand. Most regional gauges were in the green. Chinese equities led gains in the region, with the onshore benchmark CSI 300 Index climbing 0.8%, the most in nearly a month. The Hang Seng China Enterprises Index gained as much as 1.4%. South Korea’s Kospi rose 1.2%, capping a sixth-straight daily advance. Risk-on trades got a lift after negotiators from the world’s two largest economies said they had agreed on a framework on how to implement the consensus reached in their prior round of discussions. Officials at the talks in London are expected to take the latest proposal back to their respective leaders in Washington and Beijing.

In FX, the Bloomberg Dollar Spot Index is little changed. The euro and Swiss franc are the best performing G-10 currencies, rising 0.2% each. The kiwi is the laggard with a 0.2% fall.

In rates, treasuries decline ahead of CPI data, following a bigger drop for UK gilts, where focus is on fiscal policy ahead of Chancellor Rachel Reeves’ spending review. US session includes May CPI data and 10-year note auction. US yields are 1bp-4bp cheaper across a steeper curve, with 2s10s and 5s30s spreads unwinding most of Tuesday’s flattening move. 10-year near 4.50% is ~3bp cheaper on the day; German counterpart is comparable; Gilts lead a selloff in European government bonds, pushing UK 10-year yields up ~6 bps to 4.60%. Bunds pare declines after solid demand at a 10-year auction.

In commodities, spot gold climbs $14 to around $3,337/oz. Oil prices swing, with WTI now up 0.9% to around $65.50.

Bitcoin finds itself in the red this morning, specifics for the space light after a handful of equity-related updates for the complex overnight.

To the day ahead now, and as we previewed earlier, look out for the US May CPI release as well as the federal budget balance data. Also worth mentioning that the US 10-yr treasury auction will be held. We’ll also get the Canada April building permits. In terms of central bank speakers, we’ll hear the ECB’s Lane and Cipollone speak. Earnings include Oracle and Inditex

Top Overnight News

Market Snapshot

Trade/Tariffs

A more detailed look at global markets courtesy of Newquawk

APAC stocks were mostly higher amid the recent trade-related optimism stemming from the US-China trade talks in London which have now concluded and where officials reached a framework to implement the Geneva consensus and outcome from the recent Trump-Xi call. ASX 200 advanced to print a fresh record high in early trade before paring some of the gains amid little fresh catalysts. Nikkei 225 marginally benefitted from recent currency weakness and softer-than-expected PPI data. Hang Seng and Shanghai Comp gained following the progress in US-China trade talks, albeit with the upside in the mainland capped given the lack of solid details.

Top Asian News

European bourses are generally marginally firmer, EuroStoxx 50 +0.2%, defying indications for a slightly softer cash open. However, this comes with the exception of the IBEX 35 -0.8%, given marked pressure in Inditex (-3.3%).

Sectors are mixed with Retail -1.0% the laggard given the above Inditex action. Basic Resources, Tech, Consumer Products & Services all benefit from the US-China updates. Stateside, futures are modestly into the red with subdued trade despite the framework agreement between US-China officials as we now await the response from President's Trump & Xi; ES -0.3%. Attention in the meantime firmly on CPI. NVIDIA (NVDA) CEO Huang says there is an inflection point happening in Quantum computing.

Top European News

FX

Fixed Income

Commodities

Geopolitics

Economic Data

DB's Jim Reid concludes the overnight wrap

I have a dark secret I'm holding onto at the moment. It's my birthday tomorrow and over the weekend our family photo stream had pictures of one of my presents. My wife is not as tech savvy as she could be. A voucher for a round with Rory Mcllroy? No sadly, but instead a portrait for my office (I assume) of our dog Brontë swinging a golf club dressed in plus fours. It's very amusing and cute. I will show surprise and gratitude tomorrow. If I do a WFH webinar again no doubt I'll show you all and you can smile or shake your head with horror.

Overnight, US and Chinese negotiators have said they've agreed on a framework of how to implement the agreement reached at talks in Geneva last month. The main details came from Commerce Secretary Lutnick, who said that “We do absolutely expect that the topic of rare earth minerals and magnets” will be resolved and that export controls implemented by the US should come down as China approves relevant export licenses. China’s trade representative Li Chenggang said that the US and Chinese delegations will now take the proposal back to their respective leaders, with Lutnick noting that “once the presidents approve it, we will then seek to implement it”. At the same time, there was no evidence of progress on topics such as the fentanyl-related 20% tariffs on China that the US has implemented since February. So while the mood music has stayed positive, investors may be wary of the pattern that emerged during the previous US-China trade talks in 2018-19, when apparently constructive in person meetings seemed to take a step back as the negotiating teams returned to their capitals. So there's perhaps a little disappointment this morning that we haven't yet got a bigger announcement, even though there's time to hear the full conclusions of the meeting.

In other trade news last night, the US Court of Appeals extended its temporary reprieve for the administration’s tariffs that had been blocked by the US Court of International Trade in late May, as it scheduled arguments in the case for July 31. So that leaves wide-ranging tariffs imposed under the International Emergency Economic Powers Act in place, while confirming that the legal uncertainty over their use will remain unresolved until well after the July 9 deadline for the reciprocal tariff delay. Separately, Bloomberg reported yesterday that the US and Mexico are close to a deal that would remove 50% of steel imports from Mexico up to a certain quota, adding to the sense that sectoral tariffs are up for negotiation in US talks with trading partners.

Turning to yesterday’s market moves, given the focus on export controls that have affected chips and rare earth metals, and the hope the restrictions would be eased, semiconductor and technology stocks benefited, helping to lift US equities more broadly. For instance, the Philadelphia Semiconductor Stock Exchange (+2.06%) continued to rally on the hope for a positive outcome, advancing for the third consecutive day. Similarly, the Mag-7 also advanced +1.29% thanks to Tesla’s (+5.67%) continued recovery as well as decent gains for Alphabet (+1.43%) and Meta (+1.20%). And chipmaker TSMC was up +3.98% after the company reported monthly sales that climbed +39.6% in May.

Another notable story yesterday was a Bloomberg report that Treasury Secretary Bessent was being considered as a potential successor to Powell as Fed Chair. However, the report acknowledged that formal interviews for the role have not yet begun, and later in the day the White House denied that Bessent was a contender for the Fed job. The story follows comments by Trump last Friday that the decision on the next Fed Chair may be “coming out very soon” and yesterday our US economists published a note with initial thoughts on the topic of Powell’s replacement.

Looking forward, the focus will now turn back to inflation, with the May CPI results coming out later. Our US economists have a full preview here, and their view is that weak seasonally adjusted gas prices should continue to keep monthly headline CPI (+0.20% expected) below core inflation (+0.31% expected). A critical thing to look out for will also be the tariff pass-through, so they’ll be focusing on core goods prices, especially in categories like household furnishings and supplies categories, which saw some preliminary impact in the April data. Bear in mind that even with the 90-day tariff extension, the baseline 10% tariffs have still been in place for the entire month, and the reduction in the China tariffs from 145% to 30% wasn’t announced until May 12, so there were plenty of tariffs in place in May.

Speaking of inflation, there were fresh signs of inflationary pressure from the NFIB’s small business optimism index. In particular, a net 31% said they were planning to raise average selling prices, the highest share in over a year. But there was some brighter news, as the headline index showed that for the first time in 2025, small business had grown more optimistic, with the headline gauge up to 98.8 in May (vs. 96.0 expected), and up from 95.8 the previous month. So that points to a rebound in sentiment as the administration have dialled back tariffs in recent weeks.

Ahead of the CPI print, US Treasuries were pretty stable yesterday with an ongoing flattening of the curve. For instance, the 2yr yield (+1.6bps) moved up to 4.02%, whilst the 10yr yield (-0.4bps) fell to 4.47%, marking the flattest level of the 2s10s slope in two months. Those modest moves came amid an uneventful 3yr auction that saw $58bn of notes issued +0.4bps above the pre-sale yield. This will be followed by a 10yr auction today, and then a 30yr auction tomorrow, which will be an important focal point given recent fiscal fears.

Over in Europe, the latest UK labour market data pointed to growing weakness in Q2. In particular, the number of payrolled employees was down -109k in May (vs. -20k expected). Moreover, average weekly earnings growth fell to +5.3% in the three months ending April (vs. +5.5% expected). So that led investors to dial up the likelihood of rate cuts by the Bank of England, with the probability of a rate cut by the August meeting up to 81%. In turn, that meant gilts outperformed their European counterparts, with the 10yr yield falling -9.0bps. By contrast, there were smaller moves elsewhere, including for 10yr bunds (-4.1bps), OATs (-3.7bps) and BTPs (-5.1bps). The latest move also means the 10yr Italian-German spread edged down again to just 91.3bps, the tightest since February 2021.

European equities saw a mixed performance, with the STOXX 600 little changed (-0.02%). Defence stocks saw some pullback after their strong performance so far this year, with Rheinmetall (-5.80%), BAE Systems (-2.63%) and Thales (-3.63%) dragging European markets down. That left Germany’s DAX (-0.77%) and Italy’s FTSE MIB (-0.65%) underperforming for a second day running. On the other hand, France’s CAC (+0.17%) and UK’s FTSE 100 (+0.24%) posted modest gains, with the FTSE having been briefly on track for a record closing high intraday.

In Asia, the Hang Seng (+0.95%), the CSI (+0.82%), and the Shanghai Composite (+0.54%) are all making gains, supported by hopes for improved trade relations with the US even if S&P (-0.32%) and NASDAQ futures (-0.32%) seem a little disappointed we haven't got more information so far. Elsewhere, the KOSPI (+0.91%) is also on the rise, reaching a new 11-month high, while the Nikkei (+0.46%) is being pulled up by tech stocks.

Early morning data showed that producer prices in Japan increased by +3.25% y/y in May, a deceleration from a revised +4.1% rise the previous month and falling short of the market consensus of +3.5%. This marks the 51st month of producer inflation, although it is the lowest annual rate observed since last September.

To the day ahead now, and as we previewed earlier, look out for the US May CPI release as well as the federal budget balance data. Also worth mentioning that the US 10-yr treasury auction will be held. We’ll also get the Canada April building permits. In terms of central bank speakers, we’ll hear the ECB’s Lane and Cipollone speak. Earnings include Oracle and Inditex