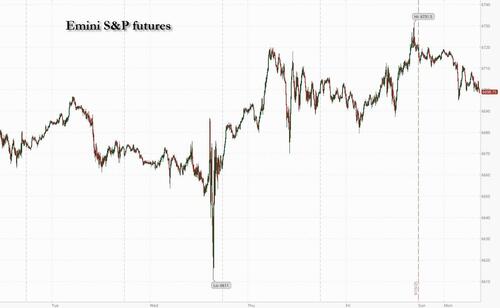

US futures are weaker after all major indexes closed at ATHs on Friday. As of 8:10am, S&P and Nasdaq futures are down 0.3%; the S&P is now notably overbought, but that may not stop the overall uptrend according to bullish analysts, with earnings expectations rising and the market betting on almost two more rate cuts this year. Pre-market, Mag7 names are lower ex-AAPL, TSLA; NVDA is -88bp dragging Semis lower as we start the week with a slight defensive tone. Bond yields are flat with the 10Y trading at ~4.13%; the USD is slightly weaker as gold hit a fresh record high above $3700 at the start of a macro-data light week which will focus on the Fed’s preferred inflation gauge release on Friday. In commodities precious metals are the upside standouts with Gold +1%, Silver +1.5% with crude flat and Ags mostly weaker. Cryptocurrency traders saw more than $1.5 billion in bullish wagers liquidated on Monday, triggering a sharp selloff that hit smaller tokens hardest. This week’s macro data is not expected to be market-moving but there are 16 Fed speakers this week including 4 today. Keep an eye on the yield curve where Jay Barry and team like tactical shorts in the 10Y, which may pressure Equities into quarter-end.

In premarket trading, Mag 7 stocks are under pressure with just TSLA and AAPL green (Tesla +0.8%, Apple +0.4%, Alphabet -0.4%, Amazon -0.3%, Meta Platforms -0.4%, Microsoft -0.6%, Nvidia -0.6%).

In other corporate news, MediaTek is launching a mobile processor more capable of handling agentic AI tasks on devices, positioning to better compete with Qualcomm. BYD shares dropped after CNBC reported that Berkshire Hathaway offloaded its stake in the Chinese EV maker. Samsung Electronics shares jumped after local media reported that it won approval from Nvidia for the use of advanced memory chips.

After the Federal Reserve cut rates for the first time this year, this week’s data calendar looks thin, with Friday’s release of policymakers’ preferred gauge of underlying inflation the main item. With the central bank’s dovish stance largely shaped by a weakening labor market, next week’s payrolls report looms as the bigger catalyst, alongside the start of the earnings season next month.

“This week is overall the calmest week of the month on the macro front and with the earnings season over, markets will likely drift on hearsay and sentiment,” said Panmure Liberum strategist Joachim Klement. “Investors are increasingly bullish on the six-month outlook for US stock markets as the Fed has restarted its cuts, but we think this is a case of collective overconfidence.”

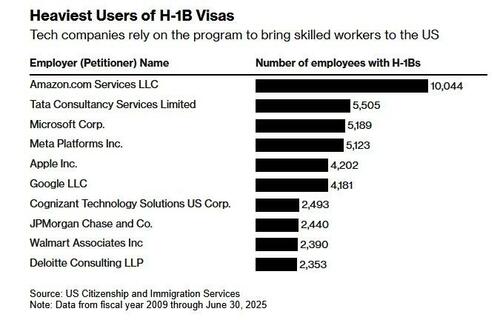

The tech sector will be in focus after Trump’s move to slap a $100,000 application fee on new H1-B visas. The fee is set to push more IT-services work offshore, or spur big price hikes for end-users.

Deutsche Bank’s strategy team wrote that pockets of exuberance are appearing as equity positioning in the US keeps climbing. Goldman’s David Kostin changed his S&P 500 target for the fifth time, raising his three-month projection to 6,800.

Bloomberg Intelligence equity strategists Gillian Wolff and Michael Casper caution that the US is entering an easing cycle “amid a troubling trend.” Inflation is hot and accelerating, a stark contrast to most major economies where consumer prices are falling. This creates a dilemma for the Fed and investors: rate cuts should support stocks but could ultimately backfire by fueling inflation — a risk that tariffs would worsen.

And speaking of easing cycles, gold soared past $3,700 an ounce as ETF inflows hit a three-year high. Silver rose to the highest since 2011. With lower rates typically boosting non-interest bearing precious metals, market bets for almost two more cuts this year — alongside haven demand from geopolitical risks and trade tensions — have fueled a rally of more than 40% in bullion for 2025.

“As the world’s oldest inflation hedge and with the Fed poised to embark on another monetary policy loosening cycle, gold is likely to remain well supported,” said Kathleen Brooks, research director at XTB Ltd.

European stocks opened in the red, pared the decline, and are now lower again. Automobile and banking shares are leading the declines dragged down by a guidance cut from Porsche as it pulls back from its EV strategy; mining and technology stocks are the biggest outperfromers. Here are the biggest movers Monday:

Earlier in the session, Asian stocks rose, supported by regional tech shares and a rally in Japan, where easing concerns over the Bank of Japan’s unwinding of exchange-traded funds boosted sentiment. The MSCI Asia Pacific Index jumped 0.2%, led by gains in TSMC. Samsung Electronics shares surged the most in nearly two months, leading South Korea’s advance on a report that its chip passed Nvidia’s quality test. Apple Inc.’s suppliers in Asia climbed after the latest iPhone release was met with high shopper turnout. In Japan, traders returned to the market to pare Friday’s losses, focusing on the Bank of Japan’s century-long, very gradual plan to unwind its massive holdings of ETF holdings. Sentiment across the region also got a boost from President Donald Trump touting progress on issues with China after a highly anticipated call with Chinese leader Xi Jinping. China’s CSI 300 Index rose 0.5%.

In FX, the dollar reverses its earlier gain. Norwegian krone and Swedish krona leading G-10 currencies, Canadian dollar the laggard.

In rates, 10Y treasury yields are unchanged at 4.13% while bund yields edge lower; gilts are outperforming in bond markets, with two-year yields down about two basis points. US futures are also lower. Treasury auctions this week include $69 billion 2-year notes Tuesday, $70 billion 5-year notes Wednesday and $44 billion 7-year notes Thursday

In commodities, gold hits another record high, rising by $35 to $3,720/oz as investors bet on an extended Fed rate-cutting cycle and as flows roll into ETFs. Silver is also rising to the highest since 2011. Oil prices gain, with WTI sitting around $63/barrel and Brent just below $67. Cryptocurrencies sink following the liquidation of a series of bullish wagers.

This week’s macro data is not expected to be market-moving but there are 16 Fed speakers this week including 4 today. Friday’s personal consumption expenditures price index, excluding food and energy, is expected to slow down in August, giving the Fed more room to address labor market weakness. Traders will also parse remarks from several Fed officials, including Chair Jerome Powell on Tuesday and new Governor Stephen Miran. The speakers will likely “give their own spin on a complicated FOMC last week where the dots were a little all over the place,” wrote Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG. “The global flash PMIs tomorrow will be the other main highlight, but it’s not likely to be a major mover with most main economies seemingly fairly stable at the moment.”

Market Snapshot

Top Overnight News

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed after sentiment from Wall Street initially reverberated to the region before dissipating. Chinese markets failed to benefit from the phone call between US President Trump and Chinese President Xi on Friday, with some citing a lack of concrete progress. ASX 200 was lifted by the metals and mining sector, with gold names spearheading the upside following the recent rise in the yellow metal, offsetting underperformance in energy names. Nikkei 225 was boosted at the open amid a softer JPY and as the index digested Friday commentary from BoJ Governor Ueda, with the BoJ’s surprise ETF and J-REIT selling seen as too incremental to impact markets. Focus now turns to the LDP election as the 12-day official campaign period began ahead of the October 4th polls. KOSPI was supported amid Samsung Electronics shares surging ~5% after clearing the NVIDIA hurdle for 12-layer HBM3E supply. Hang Seng and Shanghai Comp initially bucked the trend and failed to benefit from upbeat mood elsewhere, with traders unconvinced despite the “productive” Trump-Xi call, although the mainland later eked mild gains. Meanwhile, US lawmakers made a rare visit to China on Sunday in an effort to stabilise ties. Overnight, the PBoC maintained its LPRs as expected and injected CNY 300bln via 14-day reverse repo after an eight-month hiatus. In Hong Kong, participants brace for a “Super” typhoon with Hong Kong airport weighing a 36-hour closure, according to Bloomberg. Nifty 50 fell at the open with losses attributed to US President Trump's H-1B visas update. India is said to be the primary beneficiary of H-1B visa which allows US employers to hire foreign workers in "speciality occupations".

Top Asian News

European bourses (STOXX 600 U/C) opened mostly in the red, and then moved lower soon after the European cash open despite a clear driver, but alongside a broader slip in sentiment across markets. However, that downside has since pared, with some indices managing to climb back into the green. Some traders may focus on the lack of concrete progress between US President Trump and Chinese President Xi, following their call on Friday. European sectors were split down the middle but have followed benchmarks lower, with a very broad breadth to the market thus far. Basic Resources is by far and away the outperformer today, boosted by the continued strength in spot gold, which has made yet another ATH. Mining names such as Fresnillo (+4%), Rio Tinto (+2%) and Anglo American (+1%) all move higher. Tech follows in second place, albeit with gains of a much lesser magnitude. Strength which can be attributed to upside seen in ASML (+2.5%), which has been boosted following a broker upgrade at Morgan Stanley to Overweight from Equal Weight; its PT was also boosted to EUR 950 (prev. EUR 600). Autos is in last place, and by far the clear underperformer today. Pressure in Porsche SE (-5.2%) is driving the downside in the sector after the Co. cut guidance citing EV-launch delays and increased costs due to a revamp to its production lineup; Porsche AG (-6%) and Volkswagen (-6.5%) move lower as a result.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Russia/Ukraine

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Fed Speakers

DB's Jim Reid concludes the overnight wrap

The data highlight this week will be Friday's US core PCE deflator which should print softer than feared a few weeks ago given the recent inputs from other inflation releases. Perhaps the main events outside of this will be a series of Fed speakers who can give their own spin on a complicated FOMC last week where the dots were a little all over the place. Our economists tried to work out who was who in the latest dot plot here: “Who’s who in the Fed’s latest dot plot?”. The global flash PMIs tomorrow will be the other main highlight but its not likely to be a major mover with most main economies seemingly fairly stable at the moment.

Friday's personal income (+0.3% DB est. vs. +0.4% last) and consumption (+0.5% vs. +0.5%) data will include the all-important core PCE deflator which DB expects to come in at a relatively tame +0.22% vs. +0.27% last time. Thursday sees the final print on Q2 GDP (3.3% final vs. 3.3% prelim) and will also feature the annual update to the national accounts in which the BEA incorporates more complete and detailed source data covering the prior five years, allowing for revisions. So, another chance for history to be rewritten. Other notable US releases will include tomorrow's existing home sales; Wednesday's new home sales; Thursday's durable goods orders, and the advanced trade balance; and Friday’s University of Michigan consumer sentiment index.

In terms of those Fed speakers this week, we'll highlight the current voters. Today kicks off with Williams who should mirror the views of Powell last week. Musalem will also give an outlook speech later and new Governor Miran will be on the tapes with his thoughts likely to be fascinating to hear. Tomorrow, Chair Powell will give an outlook speech which will likely be similar to his FOMC rhetoric. Governor Bowman will also speak. Thursday sees Goolsbee, Williams, Governors Bowman and Barr, and Daly who votes next year. Governor Bowman also speaks on Friday. As our economists also point out, the Supreme Court has asked Governor Cook to respond by Thursday to President Trump’s appeal, which seeks to overturn lower court rulings preventing her immediate removal from office. Mr Trump will likely be in the news earlier in the week as he addresses the 80th UN General Assembly in New York tomorrow. We'll also get a better idea of where we are with US exceptionalism on Friday with the Ryder Cup starting in New York. It will also be interesting to see the reaction from corporate America to Trump's weekend plans to impose a $100,000 application fee for the widely used H-1B visa for foreign workers in speciality occupations. It's caused a huge amount of uncertainty over the weekend for those that rely on it.

Outside of the US, Sweden (tomorrow) and Switzerland (Thursday) central banks are meeting with markets pricing in a 30% chance of a cut from the Riksbank, but with only a 4% chance for the SNB. A cut for the Swiss would lead the country back into negative rate territory if it did happen. Staying in Europe, sentiment gauges out include the Ifo survey in Germany on Wednesday as well as consumer confidence across major European economies, including Germany and France on Thursday.

Elsewhere, rounding out notable data releases, highlights include the Tokyo CPI for September in Japan and the July GDP report in Canada both on Friday, as well as the August CPI in Australia on Wednesday. For the Tokyo CPI, our Chief Japan economist sees an acceleration in core inflation ex. fresh food to 2.8% YoY (2.5% in August) and a slowdown in core-core inflation ex. fresh food and energy to 2.9% (3.0%). See his full week ahead here, including the details around the LDP presidential election campaign that has officially kicked off today. See the day-by-day calendar at the end as usual for the full week ahead.

Asian equity markets are largely comfortably higher with China risk the exception. Japanese stocks are seeing a significant recovery after Friday's post BoJ declines, with the Nikkei (+1.33%) leading the bounce back after the central bank stated its intentions to commence the reduction of its substantial ETF holdings at the end of last week. The KOSPI (+0.43%) is being buoyed by a notable rise in index leader Samsung Electronics, which is currently up around +4.0% after various reports indicated that it had received NVIDIA’s endorsement to provide advanced memory chips to the AI giant. Mainland Chinese markets are fairly flat, while the Hang Seng (-0.95%) is experiencing a decline due to ongoing profit-taking in local technology stocks. S&P 500 (-0.07%) and NASDAQ 100 (-0.04%) futures are a touch lower with 10yr USTs +1.7bps higher at 4.145% as I type and closing back in on the pre-payrolls level of around 4.16%.

Recapping last week now, US equities continued to surge ahead, with the S&P 500 up +1.22% (+0.49% Friday), the Nasdaq up +2.21% (+0.72% Friday), and the Magnificent 7 up +3.57% (+1.24% Friday) reaching new all-time highs. Stocks were buoyed by strong tech performances and renewed Fed easing, with Friday’s rally also supported by President Trump's statement about meeting Chinese President Xi Jinping at the APEC summit at the end of October. Intel led the week’s tech rally, up +22.84% after Nvidia’s $5 billion investment. Among the Mag-7, Alphabet (+5.78% on the week; +1.07% Friday) became the 4th company to reach a $3trn valuation, while Tesla advanced +7.61% (+2.21% Friday) after Elon Musk purchased around $1bn worth of shares.

Other risk assets also benefitted, with US IG credit spreads ending the week at 72bps, their tightest since 1998. And Gold reached another an all-time high mid-week before closing just below it at $3,685/oz (+1.16% on the week).

Central bank action was in focus with the Fed delivering an expected 25bps cut, with the median dot expecting another 50bp of cuts by year-end. However, Chair Powell characterized the move as a "risk-management cut" and signalled a "meeting-by-meeting situation", leaving investors less confident on the extent of the renewed easing cycle. Treasury yields moved higher across the curve, with the 2yr yield up +1.5bps (+0.8bps Friday) to 3.57%, while the 10yr was up by a larger +6.1bps (+2.2bps Friday) to 4.13%. Also driving the Treasury sell off were solid US data releases. Retail sales were up +0.6% in August (vs. +0.2% expected) and industrial production rose +0.1% (vs. -0.1% expected). Meanwhile, weekly initial jobless claims fell to 231k (vs. 240k expected), more than reversing the previous week’s sharp jump to 264k.

Over in Europe, the Bank of England kept the policy rate at 4% as expected, maintaining their forward guidance of a “gradual and careful approach” on further easing and voted to slow the pace of QT over the coming year. 10yr gilt yields ended the week +4.4bps higher (+3.9bps Friday). Elsewhere in Europe the 10yr bund yield rose +3.2bps (+2.2bps Friday), while OATs underperformed (+4.8bps on the week) as investors doubted the political prospects of passing a budget. European equities saw a muted week, with the Stoxx 600 (-0.13%) and the DAX (-0.25%) inching lower while the CAC saw a modest gain (+0.36%).

Elsewhere, Bank of Japan kept their policy rate at 0.5%, but the decision saw a split vote with two board members supporting a hike. That led to a large sell-off of Japanese government bonds, where the 2yr yield climbed +4.9bps (+3.3bps Friday) to 0.91%, the highest since 2008, and the 10yr yield was up +5.1bps (+4.1bps Friday) to a post-2008 high of 1.64%.