Futs are starting flat for a second consecutive day, having reversed earlier losses, after China reported a bigger-than-expected drop in exports and OECD warned of a weak global economic recovery. Shares are trying to build on Tuesday’s gains as a rally in megacap stocks that had propelled the S&P 500 to the edge of a bull market continued to fizzle. As of 8:00 am ET, S&P futures were modestly in the green at 4295 while Nasdaq 100 futs were up 0.2%The Bloomberg Dollar Spot Index traded near the day’s lows, boosting most Group-of-10 currencies. Treasury yields were little changed amid listless trading global bond markets. Oil and gold were flat, while Bitcoin retreats a day after climbing more than 5%. Today’s macro data includes mtge applications, trade balance, and consumer credit. Ultimately, the macro data prints are light for the balance of the week.

In premarket trading, Apple was set to extend Tuesday’s decline, falling in premarket trade along with Nvidia and Microsoft in a signal that more air is coming out of the rally in tech shares. Tech stocks continued to decline amid growing expectations that central banks will keep rates higher for longer (at least until the next big macro print), disappointing hopes they will pivot to rate cuts later this year. Here are some other notable premarket movers:

“One of the things I’m a little nervous about is that the rates market got a little too carried away about the central banks being able to quickly pre-emptively cut rates,” said Karen Ward, chief market strategist for EMEA at JPMorgan Asset Management, in an interview with Bloomberg TV. With rates markets pricing out some expected cuts, “that to me puts some of those growth, those megacap tech valuations, a little at risk,” she said.

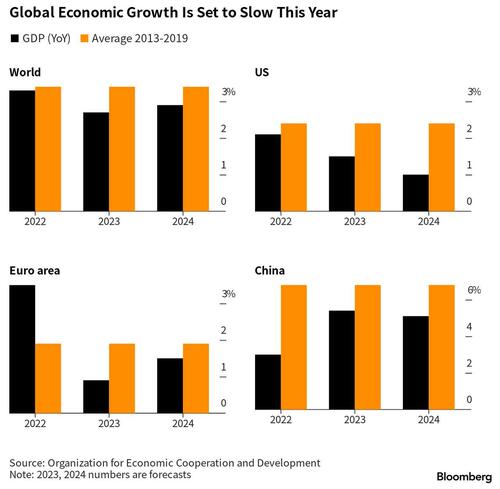

European shares wavered, with sentiment damped by a bigger-than-expected drop in Chinese exports and an OECD warning that the global economy is set for a weak recovery, dogged by persistent inflation and restrictive central bank policies. Specifically, the OECD said a global recovery that will be weaker than expected, +2.7% for FY23 and +2.9% for FY24 vs. +3.4% average over the 7 years preceding COVID; this comes amid elevated global inflation

Euro Stoxx 50 falls 0.5%. FTSE MIB lags regionals, dropping 0.9%. Autos, insurance and chemicals are the worst-performing sectors. The FTSE 100 fluctuated after UK lender Halifax said the nation’s house prices posted their first annual decline since 2012. Hermes International was among the biggest drags on the benchmark, and was set to decline for the third straight session on Wednesday. Despite some hopes over potential stimulus, conviction on the China reopening trade has faltered, with sectors such as luxury goods among the hardest-hit. Here are some notable European movers:

“Weaker global trade is not a new story but it is surprising how quickly China’s reopening boost has faded,” said Craig Erlam, a senior market analyst at Oanda. “Pressure is set to intensify on the leadership to announce new stimulus measures in a bid to revitalize the economy again.”

Earlier in the session, Asian shares were mostly stronger following the positive handover from Wall St where the S&P 500 posted its highest close YTD and the Russell 2000 rallied amid strength in regional banks, although advances were capped as the attention in Asia turned to softer-than-expected Chinese trade data.

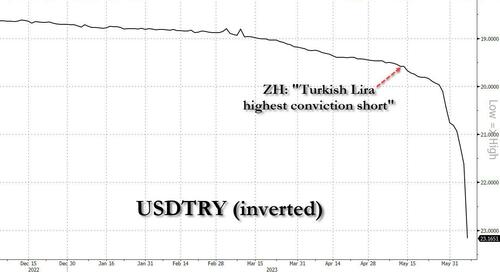

In FX, the Bloomberg dollar spot index gives up earlier gains. NZD and DKK are the weakest performers in G-10 FX, NOK and AUD outperform. the Turkey lira plunged to a record low, and is the worst-performing currency against the dollar versus expanded majors, as traders said state lenders had halted dollar sales to defend it.

In rates, treasuries are slightly cheaper across the curve with losses led by front-end and belly, flattening 2s10s, 5s30s spreads on the day. Stock futures remain inside Tuesday session range, while WTI crude oil futures advance over 1%. US session quiet for scheduled events, with minimal data, supply (except 17-week bills) and no Fed speakers expected. Yields cheaper by up to 3bp across front-end of the curve with 2s10s, 5s30s spreads flatter by 0.8bp and 2bp on the day; 10- year yields around 3.685%, cheaper by 2.5bp vs. Tuesday close with bunds and gilts outperforming by 1.5bp and 3bp in the sector

In commodities, WTI traded about 1% higher around $72.50 while ags appear to have caught a bid from the escalation of hostilities in Ukraine. Spot gold is little changed at $1,962/oz.

Looking at today's calendar, at 7 a.m., we got the latest mortgage applications data (another drop, this time -1.4%), followed by April trade figures at 8:30 a.m and a consumer credit report at 3 p.m. The Bank of Canada will deliver a rate decision at 10 a.m. New York time. President Joe Biden will meet with his UK Prime Minister Rishi Sunak in Washington.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly gained following the positive handover from Wall St where the S&P 500 posted its highest close YTD and the Russell 2000 rallied amid strength in regional banks, although advances were capped as the attention in Asia turned to softer-than-expected Chinese trade data. ASX 200 was just about kept afloat but with the upside limited by the weaker-than-expected Australian GDP and hawkish adjustments to peak rate forecasts. Nikkei 225 wiped out its initial gains in an early 700-point swing and briefly dipped beneath the 32,000 level where it found some support. Hang Seng and Shanghai Comp. were positive after reports that China asked the largest banks to cut deposit rates to boost the economy and with Hong Kong led by tech strength, while price action was less decisive in the mainland after the latest Chinese trade data mostly disappointed including the wider-than-expected contraction in dollar-denominated exports.

Top Asian News

European bourses are softer, Euro Stoxx 50 -0.3%, with the complex drifting after the cash open amid a relative lack of fresh catalysts/drivers. Though, attention remains on the soft Chinese trade figures and German industrial output, on the latter ING writes that unless there is a significant pickup Germany could continue into a Q2 recession. Sectors are similarly softer though Retail names outperform amid strength in Inditex post earnings while Danske Bank is the Stoxx 600 outperformer after providing FY26 targets and a dividend update. Stateside, futures are slightly softer in-fitting with the above in similarly limited trade with the region entirely focused on next week's CPI/FOMC; though, today's BoC might provide an interim focal point, ES -0.1%. US lawmakers are reportedly attempting to curb Mastercard (MA) and Visa (V) fees, via WSJ.

Top European news

FX

Fixed Income

Commodities

Crypto

Geopolitics

US Event calendar

DB's Jim Reid concludes the overnight wrap

Today is the day where I see whether I need to start the training clock for the 2036 Olympics as my daughter Maisie has her first ever swimming gala. It's only against a couple of schools so if she wins her race the dream is still on and if she doesn't I'll conclude that unless we have all the global medalists for 2036 in the same 5 mile catchment area in Surrey then it's probably not going to happen. Last week she swam 6 times!! If anyone can explain how you can have any kind of life with a full time job and 3 kids with various sporting commitments and parties then I'd love to know. I didn't see my wife in the evenings last week or last weekend with all the ferrying. All answers gratefully received.

Markets are generally swimming slightly against the tide this week, with the S&P 500 (+0.22%) still not quite able to break out into bull market territory that it crossed intra-day on Monday. Having said that the index did just about close at a high for 2023 so the momentum is still there to some degree. In a week of limited data and a Fed blackout there have been a few stories swirling around in the background that have dampened sentiment without reversing it. That has included geopolitical risks, weak data releases, as well as growing scepticism that the Fed would end up cutting rates this year. In fact, by the close yesterday, the 2s10s curve had inverted to a post-SVB low of -82.3bps, which just demonstrates how various recessionary indicators are still flashing with growing alarm.

The newsflow was pretty subdued from the outset yesterday, and shortly after we went to press German factory orders unexpectedly contracted by -0.4% in April (vs. +2.8% expected). This echoed the signals in the latest manufacturing PMI for May, which hit a 3-year low of 43.2, as well as the data revisions a couple of weeks ago that Germany did experience a winter recession after all.

That weak data interacted with further geopolitical concerns, particularly after the Kakhovka dam in Ukraine was destroyed, which has led to serious flooding in southern Ukraine. A key concern is with regard to the Zaporizhzhia nuclear plant, which relies on water supplies to cool its reactors, but experts didn’t consider a nuclear incident likely. From a market perspective, the bigger concern could well be the impact on agricultural prices and hence inflation, with wheat prices (+0.52%) recording a 5th consecutive daily increase, although having pared back earlier gains when it had been up as much as +3.85%. As it happens, we flagged in our World Outlook on Monday (link here) that a widely-predicted El Nino event this year was a risk to the trend of declining food prices over recent months, so events like that and the Ukraine flooding could provide an additional inflationary impulse as growth slows. You could add in bubbling concerns about low water levels at the lake that feeds the Panama Canal to that list of supply side concerns. The Panama Canal Authority is predicting a record low water level for the end of July with weight limits and rising surcharges already in force. So one to watch in the weeks ahead.

On the theme of geopolitics/supply chains, this morning Marion Laboure and Cassidy Ainsworth-Grace on my team have published an update on the landscape for semiconductors and rare earth metals (link here). It’s a topical story, since yesterday saw Japan announce a revised chips strategy that has the goal of tripling sales of Japanese-produced semiconductors by 2030. And that follows China’s announcement in late-May that Micron’s products had failed its cybersecurity review, saying that it posed “relatively serious” cybersecurity risks. It also comes amidst a growing push towards more resilient supply chains, which was one of the themes at last month’s summit of G7 leaders.

Back to markets and risk assets were fairly steady on the whole, and the S&P 500 (+0.22%) posted only a very modest gain. Banks (+1.84%) were the main outperformer in the index, whilst the megacap tech stocks continued to strengthen, with the FANG+ Index (+0.56%) taking its YTD gains up to +67.53% by the close. With equities grinding higher, equity volatility hit a new local low as the VIX index closed under 14.0pts (13.96) for the first time since February 2020. Small cap stocks strongly outperformed with the Russell 2000 index +2.73% higher, which was its second best day since November with the only better day being last Friday. European equities also recovered from their Monday losses, with the STOXX 600 up +0.38%.

When it came to sovereign bonds, there was a mixed performance on either side of the Atlantic. US Treasuries were flat, with the 10yr yield unchanged at 3.683%. That comes with just a week to go until the Fed’s next decision, where markets are still pricing in a temporary pause as the most likely outcome, which would be a big milestone after a run of 10 consecutive rate hikes. But it was a different story in Europe, where yields on 10yr bunds (-3.0bps) and OATs (-0.6bps) both moved lower. In part, they were supported by the ECB’s latest Consumer Expectations Survey for April, which showed that median 1yr inflation expectations were down to 4.1%, which is their lowest since February 2022 when Russia’s invasion of Ukraine began.

Asian equity markets are mixed this morning after erasing their opening gains after China’s May trade data disappointed (more on this below). As I check my screens, the rally in Japanese stocks has paused for breath after recently hitting 30yr plus highs with the Nikkei sliding -1.44% and leading losses across the region. Mainland Chinese markets are also struggling with the CSI (-0.34%) trading in the red and the Shanghai Composite (+0.02%) surrendering its opening gains. Elsewhere, the Hang Seng (+0.94%) is moving higher with the KOSPI (+0.32%) also seeing a positive start after coming back from a public holiday. In overnight trading, US stock futures tied to the S&P 500 (+0.01%) are flat.

Coming back China, the data showed that exports (-7.5% y/y) fell in May for the first time since February, much faster than the market expected drop of -1.8%, after a gain of +8.5% in the preceding month. Meanwhile, imports declined at a slower pace, dropping -4.5% y/y in May (v/s -8.0% expected; -7.9% in April). The call for fresh stimulus is mounting.

Elsewhere in Australia, Q1 GDP expanded +2.3% y/y, slightly below market expected growth of +2.4% and against a downwardly revised expansion of +2.6% in the final quarter of 2022. On a q-o-q basis, GDP grew by just +0.2% in the March quarter, the smallest increase since the nation emerged from the Covid lockdown in September 2021 and compared with a rise of +0.3% expected before today's announcement.

Staying with growth, the World Bank released their latest global outlook yesterday, which pointed to growth of +2.1% in 2023, up by four-tenths relative to their January forecast. However, they revised down their 2024 forecast by three-tenths to 2.4%. Looking out to 2025, they then see growth accelerating back up to +3.0%. Otherwise, Euro Area retail sales were unchanged in April (vs. +0.2% expected), although the previous month’s contraction was revised up to show a smaller -0.4% decline.

To the day ahead now, and data releases include German industrial production and Italian retail sales for April, along with the US trade balance for April. Otherwise, the Bank of Canada will be making its latest policy decision, and we’ll hear from ECB Vice President de Guindos, and the ECB’s Knot, Panetta and Vujcic. Lastly, the OECD will be releasing its latest Economic Outlook, and UK PM Sunak will be visiting US President Biden in Washington.