US equity futures were flat erasing, a modest earlier gain, while European stocks and oil retreated as bonds rallied after the latest Chinese data dump delivered more evidence of a slowdown in the world's second largest economy, where Q2 GDP rose just 6.3%. below the 7.1% consensus forecast. At 7:30am, S&P futures were down 0.1% to 4,531 while Nasdaq 100 futures were fractionally in the green. Bond yields are 3-5bp lower, with the benchmark 10Y at 3.78%; the USD is weaker again; commodities are mixed with wheat pricing spiking after Russia terminated the Black Sea Grain deal; base metals are lower after the soften China GDP print. Yellen said US should further de-escalate US-China tension, but lifting tariffs may be premature. Fed entered its blackout period ahead of its July 26th FOMC. On the calendar today, we get the Empire Mfg. index data today at 8.30am ET (-3.5 survey vs. 6.6 prior).

In premarket trading, mega cap tech stocks are mostly higher, led by shares in Microsoft and Activision Blizzard which rose after a US appeals court denied the FTC’s bid to pause the deal. Separately, Microsoft also says it has a binding agreement to keep the “Call of Duty” franchise on the Sony PlayStation platform. Activision Blizzard rose 4.2% in US premarket trading on Monday; Microsoft rose as much as 0.9%. Here are some other premarket movers:

The MSCI ACWI of stocks worldwide dipped 0.1% on Monday after surging 3% last week. Shares in mainland China were the worst performers in Asia. After a week of historic stock-market gains, investors started Monday on a downbeat note after data that showed China’s growth for the second quarter missed estimates and its youth unemployment rose to a fresh, and dangerous, record high of 21.3%.

Indeed, the narrative that Chinese shoppers coming out of Covid lockdowns would be able to carry the global economy, despite rising US and European interest rates is dead and buried as economic reports continue to signal slowing momentum, sparking growing speculation that Beijing will have to put some action behind its endless words of "imminent" stimulus.

“China growth weakness has been brewing in the background for months,” said Pooja Kumra, senior European rates strategist at Toronto Dominion Bank. “Clearly growth has not been able to keep pace with expectations.”

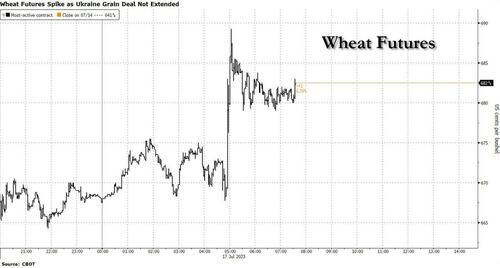

While oil prices slumped as usual on the latest Chinese economic mess, wheat futures jumped after Russia terminated a grain-export deal, jeopardizing a key trade route from Ukraine, one of the world’s top grain and vegetable oil shippers.

With its heavy dependence on the Chinese import market, European stocks are especially vulnerable. Companies tied to energy and raw materials together make up about 12% of the Stoxx Europe 600, and consumer discretionary industries account for 11%. Indeed, European stocks are on the back foot after disappointing economic data from China hit risk sentiment. The Stoxx 600 is down 0.4% and set for its largest drop in almost two weeks. Luxury goods stocks are leading declines after Richemont signaled slowing demand in its quarterly update. JPMorgan strategists expect further weakness in the region driven by lower bond yields as well as earnings disappointments. Here are some other notable premarket movers:

Earlier in the session, Asian stocks declined as a slower-than-expected growth in China’s economy weighed on mainland equities. Trading in Hong Kong was delayed due to a typhoon. The MSCI Asia Pacific excluding Japan Index fell as much as 0.4%, on course to end the gauge’s five-day winning streak. Shares in mainland China and Taiwan, such as TSMC, were the biggest drags on the index. Japan was closed for a holiday while Hong Kong canceled morning trading and will likely scrap the afternoon session as well because of typhoon Talim. The second-quarter GDP data showed that China’s economy grew slower than expected with consumer spending easing notably in June. The disappointing growth data further dented sentiment after the central bank scaled back its injection of medium-term policy loans despite weak growth. The key stock benchmark in the mainland dropped as much as 1.1%, the most in three weeks.

Monday’s weakness came after the MSCI Asia Pacific Index capped its best weekly rally since November last week, thanks to big gains in North Asia. Analysts said Asian stocks will likely resume gains after Monday’s breather, driven by the recovery in tech cycle and China’s stimulus hopes.

“We remain tactically positive on Asian stocks,” Nomura analysts including Chetan Seth said, adding that “the positive momentum in stocks can continue at least in the very near term.” They said that Korean markets will be the main beneficiary of a softer dollar and a resilient US economy due to their exposure to tech and artificial intelligence. South Korea’s benchmark index fell Monday after its best weekly gain since mid-January. Investors are also monitoring a slew of corporate earnings this week as the quarterly reporting season begins.

The relentless bubble that is Indian stocks advanced for a consecutive third session as benchmark Sensex posted its biggest surge this month to extend its record run, supported by gains in banks and software firms. The S&P BSE Sensex rose 0.8% to 66,589.93 as of 03:45 p.m. in Mumbai, its biggest single-day gain since June 30, while the NSE Nifty 50 Index advanced 0.8% to 19,711.45. HDFC Bank contributed the most to the index gain, increasing 2.1%, as the lender said net income rose 30% to 119.5 billion rupees ($1.45 billion) for the three months ended June 30, compared with 92 billion rupees a year ago. That surpassed analyst expectations for 114 billion rupees in a Bloomberg survey. Out of 30 shares in the Sensex index, 18 rose, while 12 fell

In FX, the US Dollar was pressured against the yen and the euro, while the soft China data also impacted currency markets, where the Aussie and Kiwi are the worst performers among the G-10s; the yuan also declined. The yen and franc outperform on haven demand. “EUR/USD appears a bit overstretched in the short term and could face a correction this week,” ING strategists wrote in a note. Traders are almost fully discounting a 25 bps hike by the Fed later this month, and price roughly a one-in-three chance of a final tightening in November.

“Commodity currencies are weighed by weaker-than-expected China activity data, while the precipitous USD decline last week has also given them scope to retrace lower,” said Fiona Lim, senior currency analyst at Malayan Banking Berhad in Singapore. “However, there could still be some hopes for a more significant stimulus package to be announced for China that could keep” commodity-linked currencies such as AUD and NZD from declining too sharply, she said

In rates, treasuries advanced with 10-year note futures testing Friday session highs and yields richer by 5bp-6bp across belly of the curve into early US session. Stocks slip, supporting gains in Treasuries, which are outperforming core European rates. US 10-year yields around 3.79%, richer by 4bp vs Friday close; belly-led gains in Treasuries steepen 5s30s by 2bp on the day while 2s5s30s fly is richer by almost 3bp in early session. Bonds extended a rally as investors looked to hedge any downturn in stocks and the economy. The yield on the 10-year Treasury fell five basis points to 3.77%. A busy week of dollar issuance is expected -syndicate desks are forecasting between $25 billion and $30 billion in new bond sales this week with banks leading the way coming out of earnings reports - and the resulting rate locks set to push TSY yields higher.

In commodities, crude futures declined with WTI falling 0.5% to trade near $75 as traders weighed disappointing Chinese economic data and restarting Libyan supplies against signs of a tightening market. Wheat futures jumped after Russia said it will not be extending the Ukraine grain deal.

While earnings season resumes in earnings tomorrow, today's calendar only sees the Empire Manufacturing report for July (exp. -3.5%, last 6.6)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks began the week subdued as participants digested mixed economic growth and activity data from China with conditions also thinned due to the holiday closure in Japan and typhoon disruption in Hong Kong. ASX 200 was rangebound with gains in healthcare and tech counterbalanced by losses in consumer and commodity-related industries, while Australian Treasurer Chalmers provided a glum outlook in which he expects a substantial economic slowdown and unemployment to increase as inflation eases. KOSPI was constrained by a sombre mood after the deadly floods in South Korea and lingering US concerns that North Korea will move forward with another intercontinental ballistic missile test. Shanghai Comp underperformed in the absence of Stock Connect flows owing to the unscheduled closure in Hong Kong and as participants reflected on the mixed bag of tier-1 releases from China which showed economic growth was firmer than expected QQ but disappointed on the YY reading, while Chinese Industrial Production topped estimates in June and Retail Sales missed. Furthermore, the data was seen to be distorted by the effects of the lockdowns in China last year and attention was also on the PBoC which maintained its 1-year MLF rate unchanged at 2.65%, as expected. TSMC (2330 TT) may reportedly cut FY23 guidance to a decline of 10% Y/Y from a previous low-to-mid-single digit decline Y/Y, citing weaker than expected demand for traditional servers, high chip inventories and slow demand for non-Apple (AAPL) smartphones, via money.udn.

Top Asian News

European bourses are pressured following the soft APAC handover given mixed China data and subsequent growth forecast downgrades by various desks, Euro Stoxx 50 -1.20%. The FTSE 100 and Energy names saw a bid on a since withdrawn Saudi report, with the complex reverting back to the initial downside following overnight data and the resumption of Libyan activity. Consumer discretionary names lag after Richemont's update with a particular focus on the demand impulses from US and China. Stateside, futures are little changed but with a slight negative bias given the above, ES -0.1%. The US session is a light one but earnings ramp up again on Tuesday, in the pre-market today the main updates have related to MSFT/ATVI.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

It's fair to say that if there was a soft-landing ETF it would have soared last week after soft Manheim auto prices, soft US CPI and PPI, and weekly jobless claims that are edging back down after a recent move higher. It would be crazy to deny the good news however it's worth highlighting that it's still very early in the Fed hiking cycle for a recession to occur and quite early in the yield curve window. There is plenty of time for the usual lags to work before you would say that this cycle is acting massively different to what you would expect given the tightening of policy. This time could indeed be different but it's far too early to say that with any confidence. Until there is something to dispute the soft-landing narrative though, it will undoubtedly be in the ascendancy.

In a week ahead where the Fed are on their pre-FOMC blackout period, US Retail sales (tomorrow), US housing starts (Wednesday) and US existing home sales (Thursday) are the main data highlights stateside. Housing starts unexpectedly spiked last month so there will be a lot of attention on this. Soft-landing proponents will suggest that it’s hard for there to be a hard landing if housing is recovering.

As US earnings season gathers momentum the standouts are Tesla, Netflix, ASML and IBM on Wednesday and TSMC (Thursday) in tech. Financials reporting including BofA, Morgan Stanley (both tomorrow), and Goldman Sachs (Wednesday), with around 60 of the S&P 500 reporting over the week. It was interesting that the big US banks to report on Friday gave back notable opening gains after strong headline results. As we showed in our CoTD on Friday (link here), earnings season sees a disproportionate amount of the annual return in the S&P so you would expect the next few weeks to have upward momentum all things being equal. However the potential headwinds are the strong rally leading up to it and also the fact that our equity strategist’s positioning measures moved to 18-month highs last week (77th percentile). See their latest report on this from Friday night here.

Elsewhere UK inflation on Wednesday has the potential to be a global bond mover given recent prints. A relatively quiet week in Europe sees PPI in Germany on Thursday, with Eurozone consumer confidence and business confidence in France also due. The retail sales data in France will round up the week on Friday.

In Asia, after today’s important China numbers that we review below, the next stop is the country’s loan fixings on Thursday as we wait to see what stimulus might be on offer in the weeks ahead. Over in Japan, the main highlight next week will be the June nationwide CPI report due Friday.

Talking of Asia, China's monthly data dump has been released this morning. GDP expanded +6.3% in Q2 from a year ago, falling short of +7.3% expectations (v/s +4.5% growth in Q1) as internal as well as the external demand remained tepid. For the June quarter alone, growth slowed to +0.8% (exceeding expectations of a +0.5% expansion) as against a +2.2% expansion in the March quarter. Additionally, retail sales grew +3.1% y/y in June (v/s +3.3% expected) compared with May’s +12.7% surge, highlighting that the post-COVID momentum is faltering rapidly in the world’s second biggest economy. Other data showed that industrial output grew +4.4% y/y in June (v/s +2.5% expected) up from the +3.5% growth in May. So a bit of a mixed bag but certainly soft enough for the stimulus cries to get louder as we approach the Politburo meeting at the end of the month.

Asian equity markets are fairly subdued this morning partially due to a Japanese holiday and not helped by a severe typhoon warning halting morning trading in Hong Kong. Mainland China stocks are leading losses with the CSI (-1.09%) and the Shanghai Composite (-1.19%) both trading lower while the KOSPI (-0.49%) is also down as I type. Outside of Asia, S&P 500 (-0.10%) and NASDAQ 100 (-0.12%) futures are edging lower ahead of the start of a busy week for corporate earnings.

Looking back on last week, the risk asset party finally lost some steam on Friday as the S&P 500 was down marginally (-0.10%) after four daily gains with the rates rally seeing a sizeable reversal (US 10yr +6.8bp), though these moves only partially offset the week’s strong cross-asset rally.

On Friday, we had the release of the University of Michigan consumer sentiment survey for July. US consumer sentiment soared to a two-year high, surprising significantly to the upside at 72.6 (vs 65.5 expected). During June and July, consumer sentiment saw the largest 2-month rise since 2005, which comes as inflation continues to ease, and the labour market remains robust in the face of Fed rate hikes. However, 1-year inflation expectations rose one tenth from June to 3.4% (vs 3.1% expected) and 5-to-10-year inflation expectations also ticked higher, up a tenth to 3.1% (vs 3.0% expected), although the latter often gets revised in the final number.

Following the data, markets partially reversed the downward revision of Fed rate expectations that occurred earlier last week following Wednesday’s CPI report. For example, the terminal rate priced in for November’s meeting gained +3.5bps on Friday off the back of the survey data but was down -2.6bps on the week at 5.40%. And the rate expected for December 2024 climbed a strong +20.3bps on Friday, in weekly terms it fell -16.6bps to 3.93%.

The bounce in Fed rate expectations saw US Treasuries reverse course on Friday, as 10yr yields gained +6.8bps to 3.83%, but this retraced only a fraction of the drop in yields that followed Wednesday’s CPI report, with 10yr yields down -23.4bps week-on-week, the largest weekly drop since the SVB crisis in mid-March. The Fed repricing saw the 2yr yield posting a larger rise of +13.5bps to 4.77% (-17.8bps in weekly terms). The short-end sell off on Friday was driven by real rates (+15.1bp for 2yr), while breakevens showed a continued decline of near-term inflation expectations. The 2yr breakeven was down -14.6bp on the week to 1.91%, its lowest since late 2020. In contrast, the 5y5y US breakeven was marginally on the week at 2.17%. Over in Europe, the Friday rates sell off was more moderate, as 10yr bund yields climbed +3.2bps, but fell back -12.5bps week-on-week. The Euro gained +2.38% on the week (flatish on Friday) as Fed rate expectations pivoted.

In US equity markets, both the S&P 500 (-0.10%) and the NASDAQ (-0.18%) saw slight declines on Friday despite initially opening higher again, though they were still up +2.42% and +3.32% respectively in weekly terms. Within the S&P 500, energy was the main underperformer on Friday (-2.75%), while healthcare outperformed (+1.50%). In the tech megacap space, the FANG+ index fell by -0.33% on Friday, despite at one point in the morning trading +1.7% above its all-time closing highs seen on Thursday. Still, it posted a solid +3.61% weekly gain. Across the Atlantic, the STOXX 600 gained +2.94% week-on-week, its largest weekly increase since the last week of March, but traded modestly lower on Friday, falling -0.11%.

Turning to commodities, WTI crude fell -1.91% on Friday to $75.42/bbl, breaking its three-day rally, but ended the week up +1.74% to its highest weekly close since the end of April. Brent crude likewise fell on Friday, down -1.83% to $79.87/bbl, ending the week up +1.78%. Base metals headed for their biggest weekly gain of the year amid the risk-on sentiment, with the Bloomberg Industrial Metals index gaining +4.68% week-on-week (and -0.14% on Friday). Aluminium stood out from the industrial metals pack, rallying +6.04% over the week, and copper closely followed, gaining +4.11%.