US equity futures are slightly lower to close out a blowout week for risk assets. As of 8:00am S&P futures are down 0.1% after the index reached its new ATH on Thursday, the first of the year; Nasdaq futures are unchanged with megacap tech flat this morning (TSLA +57bp) while Russell futs are also down 0.1%. European flash PMIs were mixed with mfg beats for UK/France/Germany/EZ while services were mixed: FTSE -35bps, CAC +95bps, DAX +30bps, Nikkei -7bps, Hang Seng +1.86%, Shanghai +70bps. Trump overnight hinted at a softer approach toward tariffs telling Fox News he’d rather not impose them on China which sent the yuan and Chinese stocks higher. Bond yields are flat around 4.64%, and the USD is modestly lower on the back of EUR strength. Commodities are mixed; precious metals; Ags are mostly lower, while WTI is up 30bps at $74.85; Bitcoin is up 2% to $105,300 after Trump unveiled his much anticipated executive order. Overnight, BOJ hiked 25bp as expected with an on the margin hawkish surprise as no downgrades to economic outlook and inflation outlook was revised higher. However, after initially sliding, the USDJPY has since rebounded and is flat. Today, the key focus will be global PMIs and earnings, with AXP and VZ being the most important ones to provide further color on consumer demand and economic growth. Wall Street estimates PMI-Mfg and PMI-Srvcs to print at 49.8 and 56.5, respectively; we also get the U of Mich (10am), Existing Home Sales (10am), and Kanas City Fed Services (11am).

In premarket trading, Texas Instruments fell 4% after the chipmaker gave a disappointing earnings forecast due to sluggish demand and higher manufacturing costs. Despite the disappointing results, Mag7 stocks were modestly higher: Alphabet (GOOGL) +0.2%, Amazon (AMZN) +0.1%, Apple (AAPL) +0.6%, Microsoft (MSFT) flat, Meta Platforms (META) +0.4%, Nvidia (NVDA) -0.3% and Tesla (TSLA) +0.8%. NVO is up 10% after an experimental shot delivered as much as 22% weight loss in an early-stage trial. Boeing slips 1.6% after the planemaker suffered another quarter of fresh charges and losses, highlighting the long road ahead for Chief Executive Officer Kelly Ortberg as he tries to stabilize the US aircraft manufacturer.; VZ +3% on rev/eps beat; Burberry (BRBY LN) +12.5% on better comp sales (could help luxury retail sentiment). Here are some other notable pre-market movers:

Global stocks are closing the week at record highs after President Trump appeared to soften his approach toward tariffs on China. In an interview with Fox News, Trump said that he would “rather not” use tariffs against the world’s second-largest economy (which he has said before and he will flipflop again, but algos as usual took this as gospel and hammered the USD). He has also, so far, held back from imposing tariffs on Europe, though he warned of levies against Canada and Mexico. Signs that Trump is open to negotiation has helped lift assets around the world under the shadow of a trade war, from stocks to currencies. Emerging-markets currencies are on course for their best week since July 2023. Europe’s benchmark Stoxx 600 index is on track for a fifth weekly advance after hitting a record. The dollar dropped to a one-month low as investors switched to higher-yielding assets.

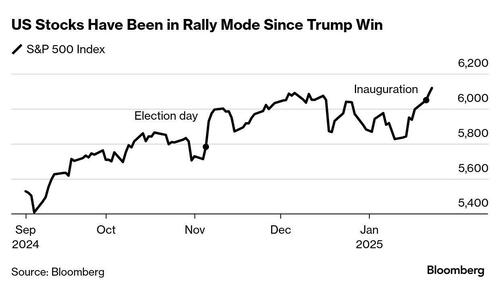

As for the the, the S&P 500 is up 2% this week so far, and is poised for the best start for a new president since Ronald Reagan was sworn in to power in 1985.

“It is early days but nothing that President Donald Trump has said or done has caused a bad reaction in financial markets,” said Chris Iggo, chief investment officer of core investments at AXA Investment Managers. “Quite the contrary. It is paying to stay invested.”

And anyone who is surprised by this outcome is an idiot: Trump has long declared that the stock market is the best, if not only, barometer by which his performance is to be measured. As such, he will redline the market - telling OPEC to cut oil prices and telling Powell to cut rates - until something breaks. For now, the upbeat data, including signs that inflation is easing, is helping both bonds and stocks, according to Goldman Sachs strategist Lilia Peytavin.

“This is adding to the positive earnings we’ve got so far,” she said.

In Europe, the Stoxx 600 added 0.4% as it rose for the eighth consecutive session, benefiting as Asian shares did from hopes US President Trump could take a softer-than-feared stance on tariffs. Sentiment was boosted as traders pared bets on how fast the ECB will lower interest rates this year after the euro area’s private sector returned to growth in January, surprising analysts, with the Composite Purchasing Managers’ Index rising to 50.2. Burberry Group Plc jumped after the maker of upmarket trench coats reported better-than-expected sales. Banca Monte dei Paschi di Siena SpA shares slumped after the Italian lender launched a takeover bid for Mediobanca SpA, whose shares rose.

Earlier in the session, Asian equities climbed to a one-month high, with sentiment buoyed by Trump’s comment that he would rather not have to use tariffs against China. The MSCI Asia Pacific Index jumped as much as 1% to the highest since Dec. 18. The gauge has advanced 2.5% this week to head for its biggest weekly increase since September. Technology shares including Tencent, Alibaba and Xiaomi contributed the most to the gains on Friday. Trump’s reluctance to impose tariffs on Chinese goods sparked a risk-on tone, which helped make shares in Hong Kong and China the region’s best performers. The Hang Seng China Enterprises Index rallied 2.1%, while the CSI 300 Index jumped 0.8%. “Trump’s Lunar New Year gift to China is a sign that negotiations may be progressing well,” said Charu Chanana, chief investment strategist at Saxo Markets. “However, it remains hard to imagine that China will be let go of some hard concessions even if a deal is reached.”

In FX, the Bloomberg Dollar Spot Index falls 0.5%. The yen pared most of its earlier advance seen after the Bank of Japan delivered a widely expected interest rate hike that was accompanied by higher inflation forecasts. The euro climbs 0.7% and made a brief appearance above $1.05 as traders pared bets on how fast the ECB will lower interest rates this year after the euro area’s private sector returned to growth in January, surprising analysts, with the Composite Purchasing Managers’ Index rising to 50.2.

In rates, treasuries are slightly richer led by short maturities, extending Thursday’s pronounced steepening of 2s10s curve, after US President Trump appeared to soften his approach toward tariffs on China; 10-year treasuries are little changed at around 4.64%, is near top of its 4.528%-4.662% weekly range; 2-year TSY yields are 1.5bp richer on the day, steepening 2s10s curve by about a basis point following Thursday’s 4.1bp increase in the spread. In Europe bunds and gilts underperforming by 3bp in the sector after the euro-zone composite PMI beat estimate, lifting German front-end yields.

In commodities, oil prices advance, with WTI rising 0.4% to $74.90 a barrel. Spot gold climbs $18 to $2,773/oz. Bitcoin rises 2% above $105,000.

On today's economic calendar we have the January preliminary S&P Global US manufacturing and services PMIs (9:45am), January final University of Michigan sentiment and December existing home sales (10am) and January Kansas City Fed services index (11am)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher following the continued gains on Wall St and constructive comments from US President Trump related to China tariffs but with the upside capped as the attention turned to the BoJ which delivered a widely expected rate hike. ASX 200 edged mild gains with sentiment helped by the encouraging tariff-related rhetoric by Trump on China. Nikkei 225 initially extended above the 40,000 level but then pared its advances after the BoJ hiked rates by 25bps to 0.50% and raised its Core CPI forecasts across the board which disappointed those that were hoping for an overtly dovish hike. Hang Seng and Shanghai Comp were encouraged by the pre-taped comments from US President Trump that conversations with Chinese President Xi went fine and that he would rather not have to use tariffs over China, although risk sentiment in the mainland was somewhat tempered after the PBoC's MLF operation resulted in a CNY 795bln drain.

Top Asian News

European bourses (Stoxx 600 +0.3%) began the session almost entirely in the green and continued to gradually extend higher as the morning progressed. A slew of PMI metrics from within the EZ had little impact on the complex. European sectors hold a slight positive bias, with the gainers for the day generally attributed to comments via US President Trump overnight; he noted that that talks with Chinese President Xi went fine and added that he would rather not have to use tariffs over China in a pre-taped interview with Fox News. Basic Resources, Autos and Consumer Products all lead; the latter also benefiting from post-earning strength in Burberry (+15%). Telecoms is the underperformer today, stemming from particular post-earning weakness in Ericsson (-7.9%); the co. reported weak Q4 results and highlighted particular weakness in India. Novo Nordisk (NOVOB DC) has completed the phase 1B/2A trial with subcutaneous Amycretin in people with overweight or obesity. People treated with Amycretin achieved an estimated body weight loss of 9.7% on 1.25mg over the course of 20 weeks, 16.2% on 5mg over 28 weeks and 22% on 20mg over 36 weeks.

Top European News

FX

Fixed Income

Commodities

BOJ

Ueda presser

Geopolitics: China

Geopolitics: Middle East

Geopolitics: Ukraine

Geopolitics: Other

US Event Calendar

DB's Jim Reid concludes the overnight wrap

as was widely expected the BoJ have raised rates by 25bps this morning to 0.5%, the first since July when their unexpected hike seemed to kick start a huge but brief global sell-off. This follows CPI ex fresh food coming in at 3%, also inline with expectation but the first time since August 2023 that this measure had hit 3%. All other measures were inline. The BoJ have upgraded their inflation forecasts with the hike which is a bit hawkish but have also cited many uncertainties concerning the outlook. Much will depend on where the emphasis is in Ueda's press conference that starts just before this will hit inboxes.

The Yen has rallied around half a percentage point since the decision which may reflect a couple of big trades rather than any market surprises especially as the Nikkei is trading pretty flat. 10yr JGBs are up +2.7bps as I type though.

Elsewhere in Asia Chinese equities are rallying overnight as Mr Trump has said in an interview with Fox News that the US has great power over China with regards to tariffs but that he would rather not have to use them. Clearly these are off the cuff remarks but it has left the overnight market feeling like there's a scenario where China escapes the worst of the tariff regime. I suspect there's plenty more time for a more aggressive approach but for now the Hang Seng is +2.21% and the Shanghai Comp +0.64%. Elsewhere the KOSPI is +0.71%. US equity futures are down around a tenth of a percent.

Ahead of all that, US and European markets put in a decent performance yesterday, with both the S&P 500 (+0.53%) and the STOXX 600 (+0.44%) advancing to record highs for the first time this year. Markets had initially been fairly quiet, with investors in a holding pattern before the Fed and ECB decisions next week, as well as earnings from 5 of the Magnificent 7. But there were then some larger moves in the US session after remarks from President Trump, who triggered a noticeable decline in oil prices after saying he’d “ask Saudi Arabia and OPEC to bring down the cost of oil”. Brent immediately fell more than -1.5% intra-day from being up for the day. It closed -1.44% lower in the session at $77.86/bbl, which marked a 6th consecutive decline to its lowest level since the US announced a package of sanctions against Russian oil on January 10. And in turn, that helped equities move higher, as the prospect of lower inflation cemented the view that the Fed would still cut rates this year. Just over a week ago we were at around 5-month highs so this fall (-5.7% from the intra-day peaks last Wednesday) has helped markets over the last week.

Trump was speaking virtually before the World Economic Forum’s meeting at Davos, where remarks covered a lot of ground. Aside from the oil comments, a big one from a market perspective was “I’ll demand that interest rates drop immediately”. The Fed independence angle got further attention after the US close, as Trump questioned the Fed Chair’s decision making on interest rates in comments to reporters, saying “I think I know interest rates much better than they do, and I think I know it certainly much better than the one who’s primarily in charge of making that decision” and adding that he planned to speak to the Fed Chair “at the right time”. Otherwise, Trump said he wanted to cut corporate taxes further, saying that “we’re going to bring it down from 21 to 15% if there’s a big if, if you make your product in the US”. And there were also critical remarks towards the EU, saying that “From the standpoint of America, the EU treats us very, very unfairly, very badly” and denouncing EU cases against US tech giants as “a form of taxation”.

With oil prices moving lower, that added some growing confidence that the Fed would be cutting rates this year. For instance, the amount of cuts priced in by the December meeting inched up +0.9bps on the day to 40bps. That saw 2yr Treasury yields fall also by -0.9bps on the day to 4.29%, having been on track to closer higher before Trump’s remarks. However, long-end yields weren’t affected as much, with the 10yr yield ticking up +3.3bps to 4.64%, which in turn led to the sharpest daily steeping of the 2s10s curve so far this year.

Aside from Trump’s remarks though, markets had been fairly subdued yesterday, with several factors restraining the advance. One was the US weekly jobless claims, where the continuing claims moved up to their highest level since November 2021, at 1.899m (vs. 1.866m expected). In addition, the initial jobless claims ticked up to a 6-week high of 223k (vs. 220k expected). While this created a bit of doubt about the state of the US labour market, the increases were predominantly driven by California, so likely reflecting the impact of the wildfires there.

Turning to equities, these saw a broad-based rise yesterday, with all 11 major sector groups in the S&P 500 moving higher. However, we did see a headwind from AI stocks, with semiconductors moving lower after SK Hynix’s results weren’t as stellar as some had hoped. On one level the results weren’t too bad, but given the hype around AI, the bar for a positive market reaction is so high that even beating expectations can lead to a pullback on the grounds that they didn’t beat by even more. In Europe , ASML (-4.38%) posted its biggest decline in two months, although over in the US a late rally helped Nvidia (+0.10%) recover after trading -2.3% down early on.

European markets generally saw a solid session yesterday, with both the STOXX 600 (+0.44%) and the DAX (+0.74%) moving up to all-time highs. For bonds, the German 10yr bund yield was only up +1.7bps on the day, a smaller increase than for US Treasuries, whilst the euro itself (+0.17%) ticked up slightly against the US Dollar. Increasingly in Europe, the focus is turning towards the ECB decision next week, who are widely expected to cut rates by 25bps. Ahead of that, our economists have put out a preview for Thursday’s meeting, where they stick to their view of 25bp cuts at each of the four Governing Council meetings in H1.

To the day ahead now, and data releases include the January flash PMIs from the US and Europe, and in the US there’s also the University of Michigan’s final consumer sentiment index for January, and existing home sales for December. Central bank speakers include the ECB’s Lagarde and Cipollone.