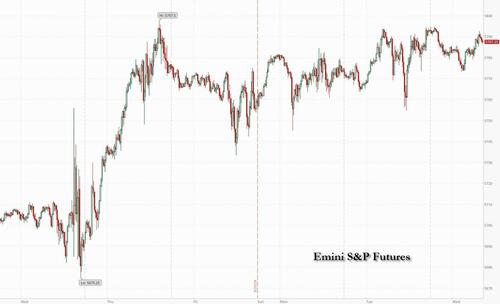

US futures are weaker but off overnight lows, as euphoria over China's latest monetary bazooka stimulus fizzles with Asian shares paring gains into the close (traders now await the far more important fiscal bazooka) and as attention turns to the deteriorating US economy. As of 8:00am, S&P futures are down 0.1% after the index finished with its 41st record closing high on Tuesday, while Nasdaq futures drop 0.2% with weakness in Semis as US-listed Chinese tech stocks fell in premarket trading. Bond yields are mixed, and the USD has a slight bid as the yen trades just off a 3-week low. Commodities are mostly lower as it appears there is muted follow-through to China’s stimulus-induced buying. Today’s macro focus is on New Home Sales, Fed speakers scheduled Kugler at 4pm followed by Chair Powell tomorrow (slated to make pre-recorded opening remarks at the 10th annual US Treasury Market Conference Thursday at 9:20am with a text release expected) and the 2Y and 5Y bond auctions.

In premarket trading,Chinese stocks listed in the US were set to decline following a stimulus-driven rally. General Motors shares fell in premarket trading as did KB Home. Here are some of the biggest US movers today:

Traders are seeking fresh catalysts with growth concerns lingering after last week’s half-point Federal Reserve interest-rate cut. Wednesday’s policy moves from China failed to ripple beyond Asian markets and investors are looking to a speech by Fed Chair Jerome Powell and price-growth data at the end of the week.

“We’ve been here before with China,” said Guy Miller, chief market strategist at Zurich Insurance Co. “Really potent fiscal as well as monetary policy is needed to change the direction of travel. So far that direction of travel has not changed.”

Meanwhile, China’s stocks rallied for a sixth day after the central bank lowered the interest rate charged on its one-year policy loans by the most on record. That followed its wide-ranging stimulus package announced the day before. Iron ore climbed and gold hit another record earlier in the session.

Meanwhile, Europe’s Stoxx 600 index paused a two-day rally, with German software developer SAP SE dropping 4% on news that it and other companies are being probed by the US. Healthcare and personal-care subindexes were the best performers, while the automotive and tech subgroups lag. Stoxx 600 was little changed, slipping 0.1% to 519.25. Here are the biggest movers Wednesday:

Europe’s darkening economic outlook has fueled bets the ECB will cut rates again next month, while economists at HSBC Holdings Plc predict policy makers will start cutting interest rates at every meeting between October and April. “The worry has been that all the economic data is looking quite shaky,” said Anwiti Bahuguna, global asset allocation CIO at Northern Trust Asset Management, where the region’s stocks have been cut to market weight from overweight. “At the beginning of the year we did think we would see a nice uptick but it started to slow down way more than any of us anticipated,” she told Bloomberg TV.

Earlier in the session, Asian stocks were little changed after jumping earlier in the day, as a policy-driven rally in China started to lose momentum after skepticism kicked in. The MSCI Asia Pacific Index edged up only 0.1% after gaining as much as 1%. TSMC, BHG Group and Tencent were among the biggest boosts. The gauge was still set to gain for a fifth day and reached its highest level since Feb 2022. Benchmarks in Sri Lanka, mainland China and Taiwan rose the most, while other markets took a breather after gains in the previous session.

Investors are cautiously optimistic that the policy barrage announced Tuesday has put a floor under China’s stock slump, with expectations that more fiscal support will follow. The CSI 300 Index rose 1.5% at close after climbing as much as 3.4% on the day. The gauge remained 0.9% lower for the year. A slowdown in the world’s second-largest economy had been a major overhang for Asian stocks, and a meaningful recovery as a result of the policy support may help drive gains across the region.

“We believe the concerted effort should put a floor to market sentiment in the near term,” James Wang, head of China strategy at UBS Investment Bank Research, wrote in a note. “While the immediate measures would benefit A-share companies, we believe the regulator’s desire to improve company governance would benefit all MSCI China companies.”

In FX, the Bloomberg Dollar Spot Index rises 0.2% having reversed course after falling earlier to the lowest since January. The yen is the worst-performing major currency, falling 0.7% against the greenback. The Swiss franc is not far behind. The Swedish krona falls 0.3% after the Riksbank cut borrowing costs by a quarter point and raised the possibility of a bigger move in coming months.

In rates, treasuries edge lower, with yields higher by 2bp-3bp vs Tuesday’s close, following similar price action in core European rates during London morning. US 10-year yields around 3.76% are ~3bp cheaper on the day, keeping pace with bunds and gilts; 5s30s spread is flatter by around 1bp as 5-year sector underperforms ahead of the auction. An auction of new 5-year notes during US afternoon follows good demand for Tuesday’s 2-year note sale. The $70b 5-year note auction at 1pm New York time, second of this week’s three coupon sales, has WI yield near 3.51%, about 14bp richer than last month’s, which tailed by 0.3bp

In commodities, oil prices are down ~0.3%, with WTI trading around $71 a barrel.

Looking at today's US economic data calendar, we get Mortgage applications (up 11.0%, vs 14.2% last week) and August new home sales at 10am. Fed speakers scheduled include Kugler at 4pm; Chair Powell is slated to make pre-recorded opening remarks at the 10th annual US Treasury Market Conference Thursday at 9:20am with a text release expected

Market Snapshot

S&P 500 futures down 0.2% to 5,782.00

Brent Futures down 0.1% to $75.07/bbl

Gold spot up 0.0% to $2,657.41

US Dollar Index little changed at 100.41

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as Chinese markets continued to rally following the stimulus boost. ASX 200 was rangebound with strength in mining and materials offsetting the underperformance in financials and tech, while the latest monthly CPI data from Australia matched estimates and slowed to a 3-year low although core inflation remained above the 2%-3% target. Nikkei 225 swung between gains and losses and traded both sides of the 38,000 level with little fresh catalysts, while Services PPI data was firmer than expected but slowed from the prior month's revised print. Hang Seng and Shanghai Comp rallied amid ongoing optimism following the stimulus announcements, while the PBoC also conducted an MLF operation with the rate cut by 30bps to 2.00% which it had flagged during Tuesday's press briefing.

Top Asian news

European bourses, Stoxx 600 (-0.2%) are almost entirely in the red (ex-SMI), with indices taking a breather/giving back some of the hefty gains seen in the prior session. European sectors are mixed vs initially holding a negative bias at the open. Healthcare tops the index alongside Travel & Leisure; the latter benefiting from gains in Air France (+7%) following a double broker upgrade at JP Morgan. Tech lags, hampered by losses in SAP (-3.5%) amid a US probe. US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.1%) are modestly lower across the board, with slight underperformance in the NQ following on from the gains seen in the prior session.

Top European news

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

Government agenda

DB's Jim Reid concludes the overnight wrap

Morning from Paris where the last time I was here 7 weeks ago I was trying to get away from Mickey Mouse giving me a hug on the hottest day of the year. This time a hug from Mickey would have warmed me up on a cold wet evening last night.

Markets are more adhering to a Disney script at the moment and have continued to push higher over the last 24 hours, with the S&P 500 (+0.25%) inching up to its 41st record high this year, even as weak US data hit risk appetite and investors dialled up the chances of more aggressive rate cuts. However it was a difficult day for a one-size-fits all narrative, with a fairly divergent performance across different asset classes. To be fair there was plenty of good news, and China-exposed stocks did very well globally after their initial stimulus announcement just over 24 hours ago. This has carried on overnight with the PBoC cutting the medium-term lending facility from 2.3% to 2%, the largest cut since they started using the tool to guide policy in 2016. Chinese equities are again outperforming this morning. Meanwhile gold prices (+1.08%) have hit another all-time high of $2,657/oz as more US rate cuts are priced in. But the weak US numbers prevented a more aggressive advance in US equities as they played on lingering fears about a potential downturn given the jobs numbers over recent months.

In terms of that US data, the main point of concern was the Conference Board’s consumer confidence print for September, where the headline reading slipped back to 98.7 (vs. 104.0 expected), and the monthly decline of -6.9pts was also the largest in just over three years. And if that wasn’t enough, the much-followed differential between those saying jobs are plentiful versus hard to get fell back to 12.6, which is the narrowest it’s been since March 2021. At the same time, we also had the Richmond Fed’s manufacturing index for September, which fell to its weakest level since May 2020 at -21 (vs. -12 expected).

Those releases saw investors dial up the chance that the Fed would deliver another 50bp rate cut at their next meeting in November, and futures raised the probability from 54% to 62% on the day. And in turn, that led to a fresh steepening of the yield curve, with the 2yr yield (-4.9bps) closing at a fresh two-year low of 3.54%, whilst the 10yr yield (-2.1bps) saw a smaller decline to 3.73%. That meant the 2s10s was up to 18.4bps by the close, which is the steepest it’s been since June 2022, just before it became apparent that the Fed would start hiking rates by 75bps.

That data weakness was also apparent in Europe yesterday, as the Ifo’s business climate indicator from Germany fell by more than expected in September, coming in at 85.4 (vs. 86.0 expected). That’s the weakest in 8 months, and the news contributed to a similar curve steepening in Germany, with the 2s10s curve (+4.3bps) up to 4.8bps by the close, which is the steepest since November 2022. The move happened as investors similarly raised their expectations for ECB cuts, with a growing probability priced in that they’ll accelerate the pace and start moving at every meeting rather than every other meeting. Indeed, the likelihood of an October cut has now risen from 26% on Friday, to 41% on Monday after the flash PMIs, to 63% by yesterday’s close, so there’s been a decent reassessment of the outlook. This came as we heard some mixed comments from the ECB’s Nagel who suggested that some factors weighing on growth are likely to be “temporary”, though Germany’s growth outlook “remains weak this year”. This backdrop led to a fresh rally among European sovereigns, with yields on 10yr bunds (-0.9bps), OATs (-2.2bps) and BTPs (-2.9bps) all moving lower.

While investors were concerned about the weak economic data, it wasn’t all bad news yesterday. In fact, China-exposed stocks did very well in the US and Europe after the stimulus announcement yesterday. For instance, the CAC 40 (+1.28%) was the biggest outperformer among the main European indices as it contains several luxury goods firms. The DAX (+0.80%) also put in a strong performance, lifted by automakers like BMW (+3.55%) given their exposure to Chinese markets. Meanwhile in the US, the NASDAQ Golden Dragon China Index (+9.13%) had its best daily performance since November 2022. That index is made up of companies which are traded in the US, but where a majority of business is done in China.

For equities more broadly, it was a fairly mixed performance, but ultimately the S&P 500 (+0.25%) still managed to reach another all-time high. Significantly, it also meant that the index is now up +20% on a YTD basis for the first time this year, and if it can maintain that into year end, it would be the first time that it recorded two back-to-back annual gains above +20% since 1997-98. The Philadelphia Semiconductor Index (+1.31%) was a significant outperformer, aided by a +3.97% gain for Nvidia. But there were also points of weakness, with 49% of the S&P 500 constituents lower on the day, as financials (-0.92%) and utilities (-0.76%) underperformed. Over in Europe, the gains were relatively strong, with the STOXX 600 (+0.65%) posting another advance.

Asian equity markets are largely continuing their upward trend this morning with Chinese markets notching outsized gains on the back of the MLF rate cut we mentioned at the top. This is the second cut to the MLF in recent months following a reduction to 2.3% in late July. As I check my screens, the CSI (+2.19%) is leading gains across the region having initially risen as much as +3.2% with the Hang Seng (+1.97%) and the Shanghai Composite (+1.74%) also among the top performers. Meanwhile, the Nikkei (+0.34%) is holding on to its gains with the KOPSI (+0.02%) swinging between gains and losses. Elsewhere, the S&P/ASX 200 (+0.08%) is also struggling to gain traction. S&P 500 (-0.16%) and NASDAQ (-0.23%) futures are edging lower.

Turning our attention back to Australia, consumer price inflation slowed to a three-year low of 2.7% y/y in August, down from a +3.5% gain in July, but aligning with market forecasts. Core CPI inflation remains elevated and above the RBA’s target range but did also ease. The trimmed mean inflation rate slowed to an annual 3.4%, from 3.8% in July.

In FX, the offshore yuan briefly hit its strongest level in over 16 months this morning, strengthening to 6.9951 before settling to trade at 7.0107 against the dollar.

To the day ahead, and data releases include French consumer confidence for September, along with US new home sales for August. Meanwhile from central banks, we’ll hear from the BoE’s Greene and the Fed’s Kugler.