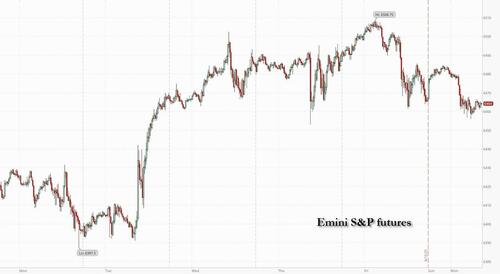

US equity futures are down a touch, after closing in the red on Friday having tagged a new all time high earlier in the day, with small caps outperforming to start the week. As of 8:00am ET, S&P futures are down 0.1% and Nasdaq futures drop 0.2% after the benchmarks closed last week near an all-time high, with Ukraine's Zelenskiy and his European allies arriving at the White House today to find out what US President Donald Trump committed to at his summit with Vladimir Putin. Pre-mkt, Mag7 names are all lower with Semis and Cyclicals lagging Defensives. European stocks also fell 0.2%. Bond yields are lower as the curve bull flattens and the USD catches a bid. Commodities are higher with strength from crude and precious metals. Cryptocurrencies retreated. This is a light macro data week with a focus on Retailer earnings and geopolitics, though the latter is unlikely to move US markets, into Friday’s Powell presentation at Jackson Hole.

In premarket trading, Mag 7 stocks are mostly lower (Microsoft +0.07%, Alphabet +0.09%, Apple -0.2%, Meta Platforms -0.2%, Nvidia -0.3%, Amazon -0.2%, Tesla -0.6%).

Traders will be on edge today, following the latest developments in the White House where Ukrainian President Volodymyr Zelenskiy and his allies will meet with President Trump to find out what the US President committed to at his summit with Vladimir Putin. Bloomberg Economics chief geo-economics analyst Jennifer Welch says questions remain about what the US and Russian leaders discussed and how much progress was made toward ending the war.

Besides today, traders are also staying cautious ahead of the Federal Reserve’s annual retreat at Jackson Hole later this week, with Chairman Jerome Powell’s speech keenly watched for guidance on a September interest-rate cut. Investor expectations for monetary easing next month fluctuated in recent days, pricing in more than a quarter-point cut at one point, amid mixed signals on inflation and the strength of US consumers.

Under a scenario where the Fed begins cutting later this year, combined with resilient corporate earnings, “the S&P 500 is likely to maintain its medium-term uptrend,” noted Linh Tran, market analyst at XS.com. “Nevertheless, caution is warranted in the face of unexpected political shocks, the risk of renewed trade tensions, and historically stretched valuations.” As a reminder, BofA's Michael Hartnett sees a dovish Jackson Hole as a sell-the-news event.

Elsewhere, Wall Street will also get a closer look at how American consumers are holding up in the early days of Trump’s tariff regime. Some of the biggest retailers report earnings in coming days, including Walmart, Target and Home Depot. So far, S&P 500 firms have posted a much better-than-expected increase in quarterly profits, while margins have proved more resilient to tariffs than feared, according to Goldman's David Kostin.

In Europe, the Stoxx 600 is little changed with gains in utility and health care shares offset by losses for banks and miners. Vestas Wind Systems jumps the most in three years as new US tax credit rules were better than feared, while Novo Nordisk gained after its obesity drug Wegovy won US FDA approval to treat a liver disease. Here are the biggest movers Monday:

In the UK, money markets trimmed bets that the Bank of England will cut rates this year, as signs of faster inflation and a more resilient economy reduce the case for more easing. Swaps are implying a less-than-50% chance of a quarter-point cut by December. A reduction was fully priced earlier this month.

Earlier in the session, Asian stocks advanced, led by gains in India on government plans to cut consumption taxes, and in China on optimism over easing trade tensions with the US. The MSCI Asia Pacific Index rose 0.1%, with Recruit Holdings and Toyota among the key drivers. A gauge of Shanghai-listed stocks closed at its highest level in a decade, as local investors continued to pour in cash. Stocks also advanced in Australia, Taiwan, and Japan. In contrast, shares fell in South Korea, weighed by a selloff in chipmakers Samsung Electronics and SK Hynix. Donald Trump said he will hold off on raising tariffs on Chinese goods over the country’s purchases of Russian oil following his weekend meeting with Vladimir Putin. Buzz is building over mainland Chinese shares, which have underperformed Hong Kong stocks this year amid concerns over trade and the health of the economy. Shares in India jumped after Narendra Modi’s Independence Day speech, which included plans to cut the consumption tax for the first time since it was introduced nearly a decade ago. Consumer electronics and auto makers led gains.

In FX, the Bloomberg Dollar Spot Index rises 0.1%. The kiwi is the best-performing G-10 currency, rising 0.3% against the greenback.

In rates, treasuries slightly richer across the curve, following similar gains across European bonds as investors weigh potential impact of Monday’s political talks on the Russia-Ukraine war, ahead of Jackson Hole later in the week. Treasuries’ Monday gains were concentrated at the longer end of the curve, diverging from August’s steepening. The two-year yield slipped one basis point to 3.74%, while the 10-year yield fell three basis points to 4.29%. Money markets are pricing in around an 80% likelihood of a quarter-point cut next month and at least one more by the end of the year. Treasury yields richer by 1bp to 2bp across the curve with 2s10s spread flatter by around 1.2bp as 10-year outperforms. In Europe, 30-year German yields drop around 3.5bp with the German 2s10s spread tighter by almost 3bp on the day in a wider bull flattening move. The long-end of the German curve outperforms, partially retracing Friday’s move to the highest yields since 2011. Duration events this week also include 20-year bond sale Wednesday and long-end TIPS auction Thursday.

"Close focus for many falls on moves in bond markets, and notably on the slope of the yield curves,” wrote Chris Weston, head of research at Pepperstone Group in Melbourne. “Powell’s guidance at Jackson Hole will therefore be important in showing how he balances the focus on inflation versus growth and labor markets.”

In commodities, Brent crude futures rise 0.6% to near $66.20 a barrel ahead of a meeting between US President Trump and Ukrainian President Zelenskiy. European natural gas futures are also up more than 1%. Spot gold rises about $13. Bitcoin falls more than 2% amid a retreat in major cryptocurrencies which pushed the market’s total capitalization under $4 billion after it scaled record peaks last week. Bitcoin trades just under $115k; Ethereum sinks below USD 4.3k, and underperforms vs peers, even as news hits that both Strategy at Bitminer were busy adding to their BTC/ETH treasuries, respectively.

Today's economic data slate includes New York services business activity (8:30am) and NAHB housing market index (10am). Fed speaker slate includes Bowman at 12:45pm, speaking on Bloomberg TV. On Friday at 10am Chair Powell speaks at the 2025 Jackson Hole Economic Policy Symposium on the subject of economic outlook and framework review

Market Snapshot

Top Overnight News

Russia-Ukraine: US Headlines

Russia-Ukraine: Ukraine Headlines

Russia-Ukraine: Russia Headlines

Russia-Ukraine: European Headlines

Trade/Tariffs

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mostly higher following the recent Trump-Putin summit which was said to have made great progress, although some of the gains were capped as the attention turned to President Trump's meeting with Ukrainian President Zelensky and various European leaders later today. Focus this week will also be on Fed Chair Powell's speech on Friday at the Jackson Hole Symposium. ASX 200 was ultimately little changed following a choppy performance and after having pulled back from an early fresh record high, with earnings releases remaining in the spotlight including the latest results from big four bank NAB. Nikkei 225 resumed its rally to fresh record highs with little fresh drivers to derail the current momentum for Tokyo stocks. Hang Seng and Shanghai Comp conformed to the mostly constructive mood in the region with sentiment also helped after President Trump said he will hold off on raising tariffs on Chinese goods over the country's purchases of Russian oil, while the PBoC Q2 Monetary Policy Implementation Report on Friday noted that China’s economic operation still faces many risks and challenges, but made numerous pledges including to further improve the monetary policy framework, implement and refine moderately loose monetary policy.

Top Asian News

European bourses (STOXX 600 -0.1%) opened modestly lower across the board, and the risk tone continued to deteriorate as the morning progressed, with all major indices falling into negative territory; currently at lows. European sectors are split down the middle, in quiet trade. Utilities takes the top spot, joined closely by Real Estate and Health Care; the latter has been buoyed by upside in heavy-weight Novo Nordisk (+5.2%). The Co. benefits after receiving accelerated US FDA approval for liver disease MASH. Elsewhere, Vestas Wind Systems (+16%) gains after the US provided new guidance on renewable tax credits, essentially clarifying that projects can qualify under the One Big Beautiful Bill’s safe-harbor provision if they show physical work and not just early spending, to then access the Inflation Reduction Act credit.

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

Central Banks (All Times ET):

DB's Jim Reid concludes the overnight wrap

As we arrive at a new week, the focus is still on Ukraine this morning, as the world reacts to the Trump-Putin summit in Alaska last Friday. The main headline was that no deal was reached on a ceasefire, but multiple outlets reported that Putin wanted Ukraine to withdraw from the Donetsk and Luhansk regions, and he offered Trump a freeze across the rest of the frontline in return. Moreover, Trump himself posted that he now wanted to “go directly to a Peace Agreement, which would end the war, and not a mere Ceasefire Agreement, which often times do not hold up.”

After the summit, Trump then spoke with European leaders, although the joint statement from the European leaders made clear that “It will be up to Ukraine to make decisions on its territory.” Then today, Trump is meeting President Zelensky at 13:15 ET, before a multilateral leading with European leaders at 15:00 ET. That group will include UK PM Starmer, French President Macron, German Chancellor Merz and Commission President Von der Leyen. In his post, Trump also said that “If all works out, we will then schedule a meeting with President Putin.”

Clearly, we’ll have to wait and see what happens today, but Trump was saying yesterday morning that there had been “BIG PROGRESS ON RUSSIA. STAY TUNED!” And separately, Trump’s envoy Steve Witkoff said on CNN that “We got to an agreement that the US and other nations could effectively offer Article 5-like language to Ukraine”, which is the NATO article which says that an attack on one member will be considered an attack on all. Trump has also been calling on Zelensky to make a deal, and just a few hours ago, he posted that Zelensky “can end the war with Russia almost immediately, if he wants to, or he can continue to fight.” However, US Secretary of State Marco Rubio downplayed expectations of a deal yesterday, saying that “We are not at the precipice of a peace agreement.”

Aside from the geopolitical situation, markets find themselves in an interesting position as we begin the week. On the one hand, there’s been incredible buoyancy across risk assets that’s seen valuations become increasingly stretched. Indeed, the S&P 500 hit another record last Thursday, whilst US IG credit spreads ended last week at their tightest level since 1998. But at the same time, futures are pricing in over 100bps of Fed rate cuts over the next 12 months, even with inflation widely expected to pick up given the tariffs. So that’s contributed to a significant curve steepening, with the US 5s30s curve ending last week at its steepest since 2021. And long-end yields have continued to creep higher more broadly, with the German 30yr yield reaching its highest since 2011 on Friday, at 3.35%. So those fiscal concerns from earlier in the year haven’t gone away either.

Overnight in Asia, that risk-on move has continued for the most part. For instance, Japan’s Nikkei (+0.77%) is currently on track for a record high, the Shanghai Comp (+1.18%) is on course for its highest close since 2015, whilst the CSI 300 (+1.50%) is on track for its highest close since July 2022. South Korea is the exception, as the KOSPI is down -1.16% this morning amidst losses among chipmakers. But futures in the US and Europe are pointing towards modest gains too, with those on the S&P 500 (+0.11%) and the DAX (+0.16%) both up this morning.

In terms of the week ahead, the main focus away from the White House will be the Fed’s symposium at Jackson Hole, where we’ll hear central bankers including Fed Chair Powell and ECB President Lagarde. Bear in mind that the Fed Chair’s speech at Jackson Hole has often been used to send important policy signals, and it was last year that Powell said the “time has come for policy to adjust” before they then cut rates at the next meeting for the first time since the pandemic. This time around, we don’t have the full agenda yet, but the subtitle for Powell’s speech on the Fed’s website says “Economic Outlook and Framework Review”, so we can expect some insight on those topics.

The last time the Fed had a review in 2020, that resulted in a shift towards average inflation targeting. In essence, they said that after periods when inflation had been persistently beneath 2% (like the 2010s), then monetary policy could seek to reach inflation a bit above 2% to counteract that. The Fed also reinterpreted their approach to full employment, in that a tight labour market alone wasn’t a reason to raise rates. So that implied a move away from the pre-emptive approach whereby the Fed would tighten policy to get ahead of future inflation as the labour market tightened. Of course, we now know that shortly after the framework review, there was then a major burst of inflation, and although it had many drivers, our US economists concluded in a Friday note (link here) that the new framework was a contributor to that overshoot. So this time around, they expect Powell’s speech to call for rolling back the 2020 modifications and restoring a primary role for pre-emption.

When it comes to the near-term path for policy, futures are still pricing in a September rate cut as the most likely outcome. But there was a clear shift last Thursday, as the PPI inflation release for July showed the fastest monthly inflation since March 2022. So that made it clear that a September cut still wasn’t a done deal, particularly with the emerging signs of tariff-driven inflation. And we still know there’s more to come on the tariff front, as Trump said on Friday that he'd be “setting tariffs next week and the week after, on steel and on, I would, say chips — chips and semiconductors, we’ll be setting sometime next week, week after”. So that’s one to keep an eye on, and Trump also suggested that the semiconductor rate could be as high as 300%.

Staying on inflation, we’ve got some more releases out this week, including from Japan, the UK and Canada. The UK will be an important one, as the June reading was unexpectedly strong, with headline inflation rising to +3.6%. Moreover, our UK economist expects it to take another step up in July to +3.8%. By contrast in Japan, our economist sees headline inflation easing a bit to +3.1% in July, down from 3.3% in June. Otherwise, the main data release will be the August flash PMIs on Thursday, which will offer an initial indication on the global economy’s performance this month, particularly with the latest tariffs that have been imposed.

Elsewhere this week, we’ve got a few more earnings releases coming out, although it’s very much the end of the current season with over 90% of the S&P 500 having reported by now. This week’s highlights include several US retailers, including Walmart and Target, which should offer a fresh insight into consumer spending. Last Friday, the US retail sales numbers were pretty robust in July, with the headline reading up +0.5% (vs. +0.6% expected), alongside an upward revision to June as well. However, the University of Michigan’s consumer sentiment index painted a weaker picture for August, with the headline index unexpectedly falling to 58.6 (vs. 62.0 expected), alongside an uptick for inflation expectations.

Recapping last week now, equities continued to push higher, and the S&P 500 moved up +0.94% for the week. The biggest gains happened on Tuesday after the US CPI report, as it was broadly in line with expectations, and kept the prospect of Fed rate cuts on the table for the months ahead. So that supported a broad-based advance, with the equal-weighted S&P 500 up by an even bigger +1.47%. Moreover, there was a global risk-on move that saw Europe’s STOXX 600 rise +1.18% last week, with outperformances from Italy’s FTSE MIB (+2.47%) and France’s CAC 40 (+2.33%). And in Japan, the Nikkei (+3.73%) closed at a record high as the country’s Q2 growth surprised on the upside.

Meanwhile on the rates side, there was a decent steepening in yield curves last week, with the 2yr Treasury yield down -1.2bps to 3.75%, whilst the 10yr yield rose +3.3bps to 4.32%, and the 30yr yield was up +6.9bps to 4.92%. That came amidst shifts in Fed pricing over the course of the week, with a more dovish path initially after the CPI report and suggestions from Treasury Secretary Bessent for lower rates, before that was pared back after the PPI reading and the higher inflation expectations in the University of Michigan’s survey. So, the amount of cuts priced in by the December meeting ultimately fell from 57bps to 54bps over the week. Meanwhile in Europe, government bonds also struggled, with 10yr bund yields up +9.9bps to 2.79%, whilst the 30yr German yield (+14.3bps) posted its biggest weekly jump since March, reaching a post-2011 high of 3.35%.