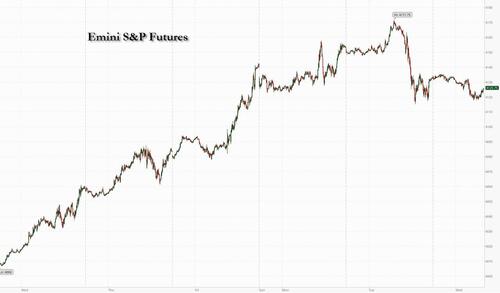

US stock futures edged lower on Wednesday, extending Tuesday's post-JOLTs declines into a second day ahead of even more employment data including the ADP private payrolls report, as hawkish messages from New Zealand and Australian central banks signaled a prolonged fight against price pressures and revived concerns about a deeper economic slowdown. Gold extended a 13-month high. The two-year Treasury yield rose for the first time in four days and the dollar fluctuated.

Contracts on the Nasdaq 100 and the S&P 500 were both down by about 0.1% as of 7:30 a.m. in New York. The indexes had dropped on Tuesday following soft labor market data. In Europe the FTSE100 is up 0.5%, boosted by AstraZeneca gains after positive drug trial results.

Among notable premarket movers, Johnson & Johnson was set for its biggest gain in nearly a year after the drugmaker agreed to pay $8.9 billion to resolve all cancer lawsuits related to its talc-based powders. Nvidia Corp. slid 1.6% in US premarket trading as traders weighed Japan’s decision to join a US alliance to restrict chip-making exports to China. Western Alliance Bancorp dropped 4.8% after the lender’s quarter-end update, with analysts saying that the lack of an explicit deposit balance was frustrating for investors, and the rise in insured deposits also raised questions.Here are other notable premarket movers:

US stocks slumped on Tuesday after the latest jobs data yesterday showed a drop in job vacancies, boosting recession fears; economists expect data Wednesday to show private employers added a more modest number of jobs in March. The crucial non-farm payrolls report is due Friday.

Economic data are “pointing toward a potential recession, but the upside might be a pause in interest rates, which would typically be a positive for stocks,” said Danni Hewson, head of financial analysis at AJ Bell. “The concern is the Fed might have to sound the retreat before its war on inflation is truly done. This could leave us with the worst of all worlds – the dreaded stagflation where the economy is shrinking but prices are continuing to surge higher.”

With worries about a recession driving bets on lower interest rates, growth stocks and tech names have rallied in recent weeks but UBS Global Wealth Management strategists said they still preferred more defensive sectors such as consumer staples and utilities as growth valuations remain expensive. They also recommend non-US assets.

Meanwhile, on the inflation-fighting front, the Reserve Bank of New Zealand surprised markets with a half-point interest rate hike, twice as much as forecast. Governor Adrian Orr said inflation is too high and that expectations for price increases may also remain elevated despite a weaker economy. Meanwhile, Reserve Bank of Australia Governor Philip Lowe pushed back against bets its tightening cycle is ending, saying policymakers still expect a need for higher rates.

“The battle against inflation looks far from won,” said Ivailo Vesselinov, chief strategist at Emso Asset Management Ltd. in London. “Notwithstanding the latest signs of softening economic activity, should disinflation hit a wall later this year, major central banks would struggle to validate the current market pricing for rate cuts.”

European stocks followed US futures and Asian markets lower as investors fret over a stuttering global economy and the prospect of additional monetary tightening. The Stoxx 600 is down 0.2% after hitting its best level in almost four-weeks on Tuesday. The FTSE 100 has outperformed with gains of 0.4%, boosted by AstraZeneca which has rallied after positive drug trial results. Sodexo SA, a provider of catering services, jumped 11% in Paris after announcing plans to spin off its benefits and rewards business. Here are the biggest European movers:

Asian stocks fell, led by a slump in the heavyweight Japanese market, as investors remain concerned about the impact of higher borrowing costs on the world economy. The MSCI Asia Pacific Index fell as much as 0.5% with Toyota Motor and Daiichi Sankyo among the biggest drags on the gauge. New Zealand’s equity benchmark erased gains to fall 0.3% while its currency jumped after the central bank unexpectedly raised interest rates by 50 basis points. Markets in China, Hong Kong and Taiwan were shut for a holiday. Japan’s Topix slid 1.9% with the yen’s recent strength also weighing on local shares. The currency has climbed about 5% from its March low against the dollar and a renewed focus on the narrowing gap between US and Japanese yields has opened up the door for further gains, some traders say.

“The US economy itself may be a principal factor for the decline” in Japanese shares, said Ikuo Mitsui, fund manager at Aizawa Securities Group. “The domestic market began the day with a selloff due to concerns about the US and global economies.” The decline in Asian equities came after US peers ended a four-day winning streak amid a selloff in bank shares and softer data on job openings. Federal Reserve Bank of Cleveland President Loretta Mester said policymakers should move their benchmark rate above 5% this year and hold it at restrictive levels for some time to quell inflation. Stocks in India gained as trading resumed after a local holiday. The nation’s central bank will likely increase borrowing costs for a seventh straight time on Thursday.

Japanese equities fell, following US peers lower, as the yen strengthened and a dip in US job openings fanned investor concerns about the global economy. The Topix fell 1.9% to 1,983.84 at the close in Tokyo, while the Nikkei declined 1.7% to 27,813.26. Toyota Motor Corp. contributed the most to the Topix’s decline, decreasing 2.4%. Out of 2,160 stocks in the index, 83 rose and 2,048 fell, while 29 were unchanged. “The yen appreciating and the US economy worsening is the most unfavorable pattern for Japanese stocks,” said Kiyoshi Ishigane, chief fund manager at Mitsubishi UFJ Kokusai Asset Management. The recent surge in Japanese stocks may have been “too rapid, which made profit-taking more likely,” Ishigane said

India’s key stock indexes were the best performers in Asia Pacific, led by stronger financial services, fast-moving consumer goods, and information technology companies. The S&P BSE Sensex rose 1% to 59,689.31 in Mumbai, while the NSE Nifty 50 Index increased 0.9% to 17,557.05. In contrast, the MSCI Asia-Pacific Index ended 0.6% lower, while MSCI Emerging Markets Index climbed just 0.2%. The Nifty rose for a fourth session, it’s longest streak since early December. Sub-gauges of consumer staples, IT and financial services companies closed more than 1% higher. HDFC Bank, up 2.7%, contributed the most to the Sensex’s rally as the lender’s deposit growth in the three-month period ended March surpassed Citigroup’s estimate. HDFC, Larsen & Toubro and ITC were other major contributors to the benchmark index’s gains. Out of 30 shares in the Sensex index, 22 rose and 8 fell.

In rates, treasury futures were lower, following wider losses in core European rates during London morning, erasing a portion of Tuesday’s gains; shorter-dated maturities have taken the brunt of selling in the bond markets with US two-year yields rising 5bps to 3.88% after declining 14 basis points on Tuesday following softer jobs-opening data. Euro-area government bonds also fell, sending the yield on Germany’s two-year note higher by 7 basis points to 2.67%. Yields are cheaper by up to 5bp across front-end of the curve, flattening 2s10s, 5s30s spreads by 2bp and 3bp on the day; 10- year yields around 3.34%, unchanged on the day after erasing a move higher in yields, with bunds and gilts underperforming by 2bp and 4bp in the sector.

In FX, the Bloomberg Dollar Spot Index is up 0.1% while the Swiss franc is the slight outperformer among the G-10’s while the Australian dollar and Norwegian krone are the weakest. . Swap contracts downgraded the odds of a quarter-point rate hike at the Fed’s May meeting, easing to around 50% from a peak of 70% on Tuesday

In commodities, crude futures declined with WTI falling 0.4% to trade near $80.40. Spot gold rises 0.2% to around $2,025.

Bitcoin is modestly firmer within narrow and familiar parameters that have been in play for several weeks; currently, holding at the mid-point of USD 28.08-28.76k boundaries.

Looking at today's calendar, the US economic data slate includes March ADP employment change (8:15am), February trade balance (8:30am), March S&P Global services PMI (9:45am) and ISM services index (10am)

Market Snapshot

Top Overnight News

A More detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed after the negative lead from Wall St where risk assets were pressured as weak JOLTS data stoked growth concerns, with trade also hampered by the closures in the Greater China region. ASX 200 was rangebound with early support from strength in healthcare, tech and gold-related stocks although gains were later pared amid weakness in the commodity-related sectors and confirmation of a contraction to PMIs. NZX 50 wiped out initial gains and was pressured after the RBNZ delivered a more aggressive than expected rate hike of 50bps and signalled a further rate increase to return inflation to its target. Nikkei 225 underperformed and fell below 28,000 amid broad weakness across sectors and as retailers including index heavyweight Fast Retailing failed to benefit from the recent monthly comparable store sales updates. Foxconn (2317 TT) March sales -21.1% Y/Y, Q1 +3.9% Y/Y; Q2 outlook expects to see aQ/Q and Y/Y decrease due to the seasonal off peak period and a high base from unseasonably strong pull-in in H1-2022.

Top Asian News

European bourses are mixed but with a modest negative skew overall, Euro Stoxx 50 -0.3%, in another session of sparse newsflow. Sectors are similarly mixed with defensive names faring incrementally better. Stateside, futures reside just below the neutral mark and by extension within Tuesday's parameters ahead of ISM Services and Fed speak.

Top European News

FX

Fixed Income

Commodities

Geopolitical

US Event Calendar

DB's Jim Reid concludes the overnight wrap

After a string of gains for risk assets over recent days, the last 24 hours have seen some steam come out of that rally, with investor nerves growing about the state of the economy once again. Equities lost ground, with US bank stocks leading the declines, and investors moved into sovereign bonds as doubts grew about whether the Fed would still go ahead with any more rate hikes. By the end of the session, that meant yields on 10yr US Treasuries had fallen -7.3bps to 3.339%, which is their lowest closing level since early-September, whilst the S&P 500 snapped a run of 4 consecutive gains to shed -0.58%.

Similar to the day before, the big turning point yesterday occurred following a US data release, with the retracement coming after the US job openings (JOLTS) report came out. That showed the number of job openings fell to 9.931m in February (vs. 10.5m expected), which marked the first time they’ve been beneath 10m since May 2021. The release added to the signs that the Fed’s tightening cycle was increasingly having an effect, and the historic levels of tightness in the labour market were finally beginning to ease. Furthermore, the ratio of job vacancies per unemployed individuals fell to 1.67, the lowest since November 2021, and that’s a measure that Fed Chair Powell himself has cited as something the Fed looks at.

On the back of that data release, investors immediately moved to downplay the chances that the Fed would keep hiking rates. According to futures, the chances of a hike at their next meeting in early May fell back to 47%, having been up to 63% at the close on Monday and as high as 70% in early morning trading yesterday. In the meantime, the rate priced in for their December meeting fell by -17.2bps to 4.130%, its lowest level in over a week. In turn, this sparked a big turnaround for Treasuries, with the 10yr yield having been up by +7.1bps ahead of the release, before turning around to end the day at -7.3bps at 3.339%. For 2yr Treasuries the decline was even more dramatic, with yields ending the day down -13.8bps at 3.825%.

Whilst the JOLTS report was the catalyst for a market shift, there were several details in the report that read in a less dovish light. First, it’s worth remembering that the number of openings and the ratio of vacancies per unemployed individual are still well above their peaks in previous cycles. So we’re talking about a labour market that remains very tight by historic standards. Secondly, the quits rate of those voluntarily leaving their jobs ticked back up a tenth in February to 2.6%, and that’s a measure that correlates well with wage growth and hence inflation. The private quits rate was similarly up a tenth to 2.9%.

Despite this, the sense among investors that inflation risks were beginning to ease was given further support from a couple of other sources. One was the ECB’s latest Consumer Expectations Survey for February. That showed inflation expectations at both the 12-month and the 3-year horizon falling to their lowest levels in a year, at 4.6% and 2.4% respectively. At the same time, oil prices stabilised after their big surge the previous day after the OPEC+ decision to cut output, with Brent crude seeing just a +0.01% increase to $84.94/bbl, although overnight it’s begun to tick up again, rising +0.49% to $85.36/bbl.

For equities, the main story was a further decline in bank stocks, with the KBW Banks Index down by -1.97%. All but one of the 22 banks in the index lost ground on the day, with the biggest underperformers including First Republic (-5.55%), KeyCorp (-5.17%), and Comerica (-5.14%). The bank losses were at the forefront of a broader equity decline, which left the S&P 500 down -0.58%. Defensives such as utilities (+0.52%) and telecoms (+0.85%) outperformed, while small-cap stocks were another big underperformer, leaving the Russell 2000 down by -1.81%.

European markets closed before the worst of the US losses, but they still saw an intraday turnaround after the JOLTS that meant the STOXX 600 gave up its intraday peak of +0.69% to close -0.08% lower. It was much the same story among sovereign bonds, with yields on 10yr bunds closing -0.7bps lower, but only after having been as high as +8.9bps higher earlier in the day.

Overnight in Asia, the tone has remained pretty negative, with the Nikkei (-1.62%) seeing a sharp fall, putting it on track for its worst daily performance in over three weeks. That’s in spite of some decent PMI numbers from Japan overnight, with the composite PMI rising to an 8-month high of 52.9 in March, whilst the services PMI rose to its highest since October 2013, at 55.0.

We’ve also had some pretty hawkish developments overnight, with the Reserve Bank of New Zealand making a surprise move to hike by a larger-than-expected 50bps overnight, which takes the Official Cash Rate up to 5.25%. Their statement said that “Inflation is still too high and persistent, and employment is beyond its maximum sustainable level”, and the decision has spurred a sharp rise in the New Zealand Dollar overnight, which is up +0.54% against the US Dollar. Alongside that, the Reserve Bank of Australia Governor Lowe said in a speech that their decision to keep rates on hold this month “does not imply that interest rate increases are over”, and that “the board expects that some further tightening of monetary policy may well be needed to return inflation to target within a reasonable timeframe.”

Elsewhere in Asia, the tone has actually been a bit more optimistic however, with the KOSPI up +0.48%, whilst the major equity indices in India, Indonesia and Singapore are all higher as well. Markets in China are closed today, and US equity futures are pointing to very modest gains after the previous day’s declines, with those on the S&P 500 up +0.02%.

Here in the UK, yesterday saw sterling close at $1.25, which was its highest level since June 9. The latest gains cement its status as the best-performing G10 currency of 2023 so far, having strengthened by +3.46% against the US Dollar this year. This marks a strong comeback for sterling, which fell to an all-time intraday low of $1.035 after the mini-budget last September. Separately, we did hear from BoE Chief economist Pill in a speech on inflation persistence. He didn’t offer any guidance on the immediate outlook for Bank Rate, but pointed out that “persistent deviations of inflation from target, even if stemming from what are fundamentally a series of transitory inflation shocks, might prompt changes in behaviour that generate more long lasting inflationary dynamics.”

Looking at yesterday’s other data, Euro Area PPI inflation came in at +13.2% in February (vs. +13.3% expected). That’s a 6th consecutive monthly decline from its peak of +43.5% back in August. Otherwise, US factory orders in February contracted by -0.7% (vs. -0.5% expected), and the previous month’s decline was revised to show a larger -2.1% contraction (vs. -1.6% previously).

To the day ahead now, and data releases include the US ISM services index for March, the ADP’s report of private payrolls for March and the trade balance for February. Elsewhere, we’ll get German factory orders for February, and the global services and composite PMIs for March. Otherwise from central banks, we’ll hear from the ECB’s Vujcic, Vasle and Lane, as well as the BoE’s Tenreyro.