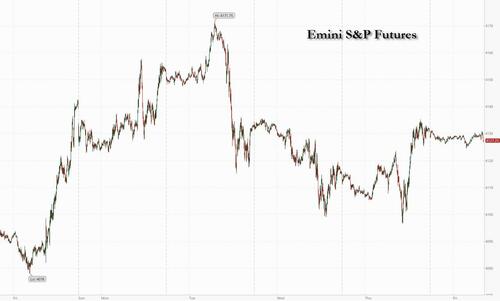

While US cash markets are closed for the Good Friday holiday, futures are open but judging by the lack of action they may as well be closed. As of 7:45a ET, index futs were little changed after underlying indexes rose modestly in already thinned trading ahead of a three-day weekend that will see a crucial jobs report. S&P eminis were down 0.13% to 4,127 while Nasdaq futures dipped -0.08%. The yen fluctuated after declining Thursday against the dollar for the first time this week. Gold traded around $2010 while bitcoin drifted lower, sliding to $27800.

The cash S&P 500 index concluded its first losing week in the past four as data Thursday showed filings for jobless claims surpassed estimates last week, a day after a private payrolls report indicated hiring slowed more than forecast.

Speaking of closures, here is when the various futures markets will close today:

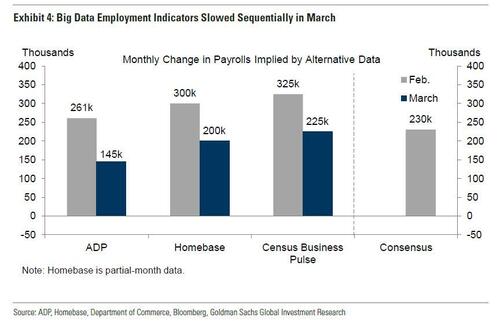

Normally, nobody would be active today but this is no garden variety holiday because at 8:30am the BLS will report the March payrolls number. While our full preview can be found here, here is a snapshot of what key banks expect:

While most banks expect another slowdown in payroll growth, the notable forecast is from Colm Fitzgerald of Paragon Research who forecast -10,000 jobs; as we said last night a negative print can not be discounted now that the BLS has finally stopped lying about how "strong" the jobs data are. NewEdge agrees and writes that “based on a linear regression of jobless claims, ISM employment, NFIB hiring, ADP, JOLTs, conference board, and Indeed/ZipRecruiter surveys that predict a negative 49K.” One thing is pretty much certain: the March print will come well below the 230K forecast (if it comes in hot then the BLS will have lost its last shred of credibility).

According to Goldman, here is the market reaction matrix:

The best case scenario for stocks is a small headline miss...call it 175k – 200k range. Stocks don’t want a surprising print in either direction (big beat investors will stress over inflation and continued rate hikes / big miss investors will stress the HARD LANDING).

Most European markets are mostly shuttered for the Good Friday holiday.

Similarly much of Asia including Australia, Hong Kong and Singapore was closed for holidays, but financial markets in Japan and mainland China were open. Japan’s benchmark Topix edged higher, ending a two-day slump, and shares in China and South Korea advanced. Overall, Asian stocks gained, on course to snap two days of losses, as Samsung Electronics’ plan to reduce output boosted semiconductor peers and the South Korean market amid holiday thinned-trading around the region. The MSCI Asia Pacific Index rose as much as 0.4%, with Samsung and fellow memory maker SK Hynix the biggest boosts. South Korea’s Kospi rose 1.3%, while benchmarks in Japan and mainland China posted moderate gains. Markets in Hong Kong, Australia, New Zealand, Singapore, India, Indonesia and the Philippines were closed for holidays.

Samsung said it would cut its production of memory chips to a “meaningful level,” triggering hopes that memory prices will recover quickly as high inventory levels caused by weak consumer demand decline. Investors cheered the decision, ignoring the Korean chipmaker’s weaker-than-expected quarterly profit. Samsung to Cut Memory Chip Output After Worst Profit Since 2009 Even with Friday’s rise, the key Asian stock gauge was on course for its first weekly loss in three weeks as recession worries and a recent rebound in oil prices complicate the future rate-hike path for the Federal Reserve.

In rates, US Treasuries traded as usual in Tokyo, were closed during London hours and reopened at 6 a.m. in New York for a shortened session, with the recommended close at noon. Treasury futures remain toward bottom of Thursday’s range. SIFMA recommend early 12pm close, allowing three and a half hours of trading after the data. Treasury futures are lower by as much as 6 ticks across Ultra Bonds, with 2-year note futures down less than 1 tick on the day.

JPMorgan strategists note that historically the Treasury market is approximately 20% to 50% more volatile, for a given magnitude of surprise, in the two hours following the jobs data release when it falls on Good Friday 12pm early-close sessions than on normal days.