US futures are lower as we enter the "last hike" day, with European stocks slumping after ugly results from LVMH (which tumbled 4.5%) and Asian markets also closing in the red as investors brace for more tightening from the Federal Reserve, even as results from some of the biggest European and American companies hinted at slowing economy and declining earnings. As of 7:30am ET, S&P eminis dropped 0.1% at 4,589 while Nasdaq futures were down 0.3%, pressured by disappointing results from some top constituents.

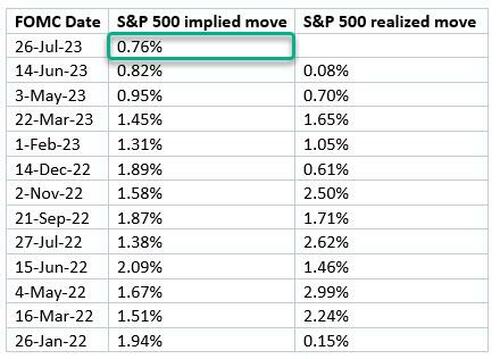

The market is pricing in just a 0.76% move after today's FOMC, the lowest implied move on a Fed day since at least 2021.

Meanwhile, solid earnings from Boeing have propelled the Dow higher: the Dow Jones Industrial Average has risen 12 days straight — the longest winning run in over six years — and a 13th day of gains will extend the record to the longest since 1987.

Treasury yields were 1-2bps lower; the USD was weaker and commodities are mixed with base metals leading and Ags lagging. Today, focus will be Fed’s decision at 2pm ET and Powell’s Press Conference at 2.30pm ET. A 25bp hike is fully priced in, with consensus expecting (i) little meaningful changes to the post-meeting statement and (ii) Powell pointing to the June dots as the best guide as to the forward direction of policy (our full preview is here).

In premarket trading, Microsoft fell 4%, having posted tepid sales growth and amid missed Azure growth guidance while Snap sank 19%. Analysts, however, note that the unit’s deceleration is starting to moderate and they were positive about demand for the company’s new artificial intelligence-powered products and services. Chipmakers also mostly lost ground, after a subpar outlook from Texas Instruments, the biggest maker of analog semiconductors, indicated a demand slump for key types of electronics. On the other end, GOOGL jumped 7% after posting forecast-beating revenue. Meta rose ahead of its own report later Wednesday. Overall, tech earnings so far are still largely in line with expectation. Here are the most notable premarket movers:

Here is a summary of the most notable earnings reports:

Fahad Kamal, chief investment officer at SG Kleinwort Hambros Bank, noted that Wednesday’s market pullback comes after a broad stretch of gains, with the S&P 500 less than 5% off record highs. “The bigger picture is that this quarter is probably the low point for earnings, this year will end up positive both in Europe and US,” he said, while cautioning of risks from “the effect of central bank policy tightening.”

“We are going to see some deceleration in corporate earnings, deceleration in economic growth, softening of demand, all of this will have a higher impact on equities,” Aarthi Chandrasekaran, director of investments at Shuaa Asset Management said on Bloomberg TV. Still, “the US economy is weakening but it’s not weakening enough to price in a full rate cut next year,” she said. Still, despite some disappointments, roughly 80% of US companies have thus far beaten profit estimates, as have half of European names. This is largely due to a steady trimming of expectations before the season kicked off.

Later on Wednesday, the Fed is expected to raise rates by 25 basis points, and swap contracts are factoring some additional rate increases by year-end as well. The expected Fed rate increase would be 11th since March 2022, cycle in which rates were raised at each scheduled meeting until last month’s, when policy makers said a pause was warranted to assess the impact of their cumulative actions on the economy and banking system. The European Central Bank should also deliver a quarter-point increase on Thursday. With those hikes baked in, investors will focus on signals on how much more policy tightening might be warranted (full preview here).

European stocks are lower and set to snap a six-session win streak after a flurry of corporate earnings dented investor sentiment. The Stoxx 600 is down 0.5%, led lower by the luxury-goods sector as LVMH tumbled as much as 4.5% after Europe’s biggest company provided further evidence of a slowdown in spending by US wealthy consumers. Miners are also under pressure after Rio Tinto cut its dividend following a fall in first-half profit. Here are the most notable European movers:

Earlier in the session, Asia’s key stock gauge snapped a two-day wining run as investors trimmed their positions ahead of the Federal Reserve’s monetary policy outcome, while Chinese stocks declined after Tuesday’s rally. The MSCI Asia Pacific Index declined as much as 0.3% with markets in Japan, South Korea and Hong Kong leading the losses. Stocks in Australia extended gains after consumer prices rose at a slower than expected pace for the three months ended June, fueling bets for a continued pause by the Reserve Bank next week.

The Fed is poised to hike interest rates by another 25 basis points, with investors keeping an eye on commentary by Chairman Jerome Powell. Asian stocks have, on average, reacted positively after a rate hike in 10 of the previous instances, data compiled by Bloomberg showed. Stocks in Asia have generally held their gains this month, buoyed by the receding odds of a recession in the US as well as China’s pivot toward a more friendly approach to the private sector and pledge of support for the economy.

Chinese stocks in Hong Kong fell after Tuesday’s surge as investors await more concrete policy decisions by Beijing following the politburo meeting. Policymakers have signaled that they intend to ease monetary policies and boost property markets. “It is really important that in the coming days and weeks, we see continued strong messages coming from different parts of the government,” Winnie Wu, China equity strategist at BofA Securities told Bloomberg Television in an interview.

Japan's Nikkei 225 swung between gains and losses with the mood indecisive as softer Services PPI data from Japan added to the second-guessing surrounding this week’s BoJ meeting. ASX 200 outperformed with gains led by the mining industry and the top-weighted financials sector, while participants also reflected on the mostly softer-than-expected inflation data which showed headline CPI Q/Q was at its slowest pace of increase since 2021. Key stock gauges in India snapped a two-day losing run to outpace most regional peers Wednesday, boosted by gains in index heavyweights Reliance Industries, ITC, and Larsen & Toubro. The S&P BSE Sensex rose 0.5% to 66,707.20 in Mumbai, while the NSE Nifty 50 Index advanced by the same magnitude. Larsen & Toubro closed at record high after better-than-expected first quarter earnings and announcing a $1.2 billion buyback plan. The infrastructure company’s results gave boost to stocks of its peers as well with BSE Capital Goods index rising 1.6%. Reliance Industries, which contributed the most to the Sensex’s gain, rose 1.6% after Financial Times reported that QIA is mulling investment in company’s retail unit. Out of 31 shares in the Sensex index, 19 rose and 11 fell, while 1 was unchanged

In FX, the Bloomberg Dollar Spot Index was little changed. The euro rose as much as 0.2% against the US dollar to 1.1078, halting a six-day streak of declines. It also rose as much as 0.2% against the pound to 0.8586. The pound was little changed against the US dollar at around $1.29, while it weakened slightly against the euro. The Australian dollar declined as much as 0.9% to 0.6731 before trimming that drop after slower-than-expected inflation in the last quarter strengthened bets for the Reserve Bank to pause again next week. USD/JPY fell 0.5% to 140.24, heading for a third day of declines. One-week risk-reversals for dollar-yen, a gauge of the expected direction, fell to the lowest level since early March. The Aussie is the worst performer among the G-10s, falling 0.4% versus the greenback after Australian CPI slowed more than expected. The yen is the strongest.

Treasuries edged higher and yields are mixed as short- dated Treasury yields edged lower and 10-year yields were little changed to begin the US session focused on a Fed rate decision at 2pm New York time. Yields are within 1bp of closing levels from Tuesday, when most tenors traded at their highest levels in more than a week as expectations for another rate increase this year after July edged higher. Euro-area yields rose across the curve. The Treasury supply cycle pauses for Fed decision, is set to conclude Thursday with $35b 7-year auction. A 25bp increase in the fed funds band to 5.25%-5.5% is fully priced into swap contracts, along with about half of an additional 25bp hike by year-end.

In commodities, crude futures decline with WTI falling 0.7% to trade near $79.10. Spot gold rises 0.3%.

Bitcoin is relatively contained and resides well within, but at the lower-end, of Monday's $28842 to $30342 range. Thus far, specific drivers have been a touch limited with markets generally focused on the upcoming FOMC meeting and Powell's presser.

Looking to the day ahead now, the main highlight will be the Fed’s policy decision and Chair Powell’s press conference. Otherwise, data releases include US new home sales for June and the Euro Area M3 money supply for June. Finally, today’s earnings releases include Meta, Coca-Cola, Union Pacific, Boeing and AT&T.

Market Snapshot

Top Overnight News

A More detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed with most bourses lacking firm direction heading into the looming major central bank policy decisions beginning with the FOMC later today. ASX 200 outperformed with gains led by the mining industry and the top-weighted financials sector, while participants also reflected on the mostly softer-than-expected inflation data which showed headline CPI Q/Q was at its slowest pace of increase since 2021.Nikkei 225 swung between gains and losses with the mood indecisive as softer Services PPI data from Japan added to the second-guessing surrounding this week’s BoJ meeting. Hang Seng and Shanghai Comp were weaker after the prior day’s stimulus boost lost steam but with downside limited owing to wide expectations for further support measures and after the PBoC upped its liquidity efforts, while China also replaced the head of its central bank amid the increasing challenges facing its economy.

Top Asian news

European bourses are primarily in the red but with some more mixed performance, Euro Stoxx 50 -1.0%; action which comes after numerous key earnings incl. LVMH, -4.4% which is weighing on the Euro Stoxx 50 & CAC 40 -1.4%. Sectors are largely reflective of the corporate updates, Consumer Products & Services lags given LVMH while Basic Resources slip after earnings/production updates from Rio Tinto and Fresnillo. While the Banking sector is torn between two-way corporate updates and an ongoing NatWest story. Stateside, futures are slightly mixed but yet to differ markedly from near-unchanged levels, ES -0.1%, ahead of the FOMC and further corporate heavyweights after digesting the likes of MSFT and GOOGL after-hours on Tuesday.

Top European news

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

Markets put in another resilient performance over the last 24 hours, as all eyes turn to the Fed’s latest decision today. The positive mood was supported by another strong round of US data, which included the Conference Board’s consumer confidence index hitting a 2-year high. That offered a fresh boost to risk assets, with the S&P 500 (+0.28%) rising to its highest level in 15 months yesterday, Brent Crude oil prices closing above $83/bbl for the first time since April, and US HY credit spreads reaching their tightest level in 15 months too. In addition, there was a significant milestone for the Dow Jones (+0.08%), which recorded a 12th consecutive gain for the first time since 2017. If we get a 13th today that would be the longest run since 1987, so one to watch out for.

When it comes to the Fed today, they’re widely expected to hike rates by 25bps. That’s in line with market pricing, which sees a 97% chance of a hike, as well as the overwhelming consensus of economists. In turn, that would take the target range for the federal funds rate up to 5.25%-5.50%, marking its highest level since 2001. But since a hike today is almost fully priced in, the bigger question for markets will be if the statement and the press conference signal anything about the likelihood of further rate hikes ahead.

In their preview of today’s meeting (link here), our US economists think that there’s limited downside from Chair Powell delivering a hawkish-leaning message. Even after the very positive CPI print, he’s likely to emphasise that further evidence is needed to be confident that inflation will be tamed. Furthermore, the FOMC themselves signalled in their June dot plot that two further hikes were their baseline by year-end, implying one more after today. Remember as well that there are still two jobs reports and CPI reports ahead of the next meeting – as well as the Jackson Hole gathering – so our economists think Powell is unlikely to provide strong guidance about the outcomes of upcoming meetings.

When it comes to market pricing, fed funds futures are currently pricing just a 44% chance of a second hike after today’s. In other words, the central expectation is that this will be the last hike of the current cycle. But it’s worth remembering that we’ve been here before. In fact, after the two most recent hikes in March and May, market pricing by the close that day was that the Fed were most likely done hiking. So they’ve shown themselves willing to adjust in recent months, particularly as the ramifications from the regional bank crisis weren’t as bad as many feared at the time.

Ahead of the Fed, there was a fresh selloff for sovereign bonds thanks to another round of resilient data. Firstly, we had the Conference Board’s latest consumer confidence reading, which hit a 2-year high of 117.0 (vs. 112.0 expected). Second, housing inflation was more resilient than expected in May, with the S&P CoreLogic Case-Shiller index up by +0.99% over the month (vs. +0.70% expected). In fact, that’s the fastest monthly house price growth in a year, which is adding to the signs that housing inflation has now bottomed out and if anything is accelerating again.

That backdrop meant that yields on 10yr Treasuries rose by a modest +1.2bps to 3.88%, a two-week high. The sell-off was driven by rising real rates, while the 10yr breakeven (-1.2bps) retreated slightly after hitting hit a post-SVB high on Monday. And over in Europe it was much the same story, with yields on 10yr bunds (+0.5bps), OATs (+0.7bps) and BTPs (+3.5bps) all seeing a moderate increase.

For equities, yesterday brought another resilient performance, with the S&P 500 (+0.28%) hitting another 15-month high. We also had a 12th consecutive daily increase for the Dow Jones (+0.08%) for the first time since February 2017, and if we get a 13th gain today, that would be the longest run of gains since January 1987. Tech stocks were the main outperformer, with the NASDAQ (+0.61%) and the FANG+ index (+0.93%) seeing larger gains. Meanwhile in Europe, the STOXX 600 (+0.48%) advanced for a 6th day running for the first time since January.

After the US close, we received earnings releases from Microsoft and Alphabet, which both beat earnings estimates but received contrasting reactions. Microsoft was trading lower in after-hours trading (-3.7%) after reporting slowing growth in cloud computing. Conversely, Alphabet saw a positive reaction (+6.1%) amid revenue outperformance boosted by its search business. Elsewhere overnight, US equity futures are flat ahead of the Fed’s rate decision, with those on the S&P 500 up +0.01%.

There were some interesting other developments back in Europe yesterday, since we got the ECB’s latest Bank Lending Survey for Q2. That had evidence for both sides of the hard vs soft landing debate. On the downside, it showed the sharpest decline in demand for loans by enterprises in the survey’s history since 2003. The share of rejected corporate loans also rose. But on the upside, the pace of tightening in credit standards moderated, and banks expected credit conditions to improve closer to neutral settings in Q3.

The release comes ahead of tomorrow’s ECB policy decision, where another 25bp hike is widely expected. However, markets have continued to downgrade the chances of a second hike after tomorrow’s decision, with the probability now at 75% this morning, having been 88% at the end of last week. That also followed the release of the Ifo’s business climate indicator from Germany, which showed a larger-than-expected decline in July. The main reading came in at an 8-month low of 87.3 (vs. 88.0 expected), and the current assessment component fell to 91.3 (vs. 93.0 expected), which is the lowest since February 2021.

Asian equity markets are mostly losing ground this morning after yesterday’s rally. Across the region, the Hang Seng (-0.79%) is the biggest underperformer, with the KOSPI (-0.70%), the Shanghai Composite (-0.35%) and the CSI 300 (-0.34%) also edging lower. Otherwise, the Nikkei (-0.03%) is struggling to gain traction, but the S&P/ASX 200 (+0.88%) has seen a strong outperformance after Australia’s inflation eased for the second straight quarter.

In terms of that release from Australia, CPI only rose by a quarterly +0.8% in Q2, which was beneath the +1.0% reading expected by the consensus. The trimmed mean also came in beneath expectations, with just a +0.9% increase rather than the +1.1% gain expected. In turn, markets are pricing in a growing chance that the RBA will keep rates on hold at its next meeting, with the chance of an August hike down from 44% to 16%. Australian government bonds are also outperforming this morning, with their 10yr yield down -3.4bps to 3.99%.

There wasn’t much in the way of other data yesterday. However, we did get the IMF’s latest economic forecasts, which upgraded their 2023 global growth projection for this year to 3.0%, up two-tenths from April. The upgrades were fairly broad-based across countries, with Germany being the only G7 member to see a downgrade to this year’s projections, with the IMF now expecting a -0.3% contraction in 2023.

To the day ahead now, and the main highlight will be the Fed’s policy decision and Chair Powell’s press conference. Otherwise, data releases include US new home sales for June and the Euro Area M3 money supply for June. Finally, today’s earnings releases include Meta, Coca-Cola, Union Pacific, Boeing and AT&T.