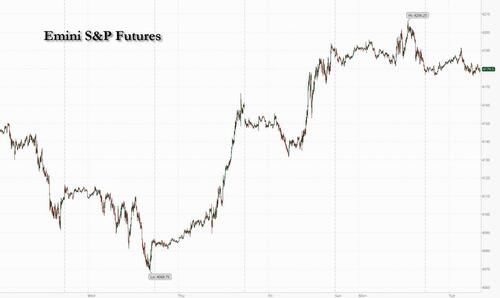

US index futures saw modest declines on Tuesday as investors braced for this week’s Federal Reserve meeting where policymakers are expected to deliver another rate increase, and then pause the hiking cycle. S&P 500 contracts slid 0.1% as of 8:00 a.m. ET after earlier swinging between small gains and losses. Nasdaq 100 futures traded little changed. Both benchmarks closed steady on Monday after data showed that US factory activity contracted for a sixth-straight month in April, the longest such stretch since 2009.

In premarket trading, Chegg fell over 40% after the online education company warned that ChatGPT was threatening growth of its homework-help services. Sprouts Farmers Market gained 8% after the grocer published better-than-expected results and guidance. Uber rallied as much as 11% after the ride-hailing firm reported earnings and revenue that beat analysts’ estimates. Shares of peer Lyft also rose 2.9%. Here are the other notable premarket movers:

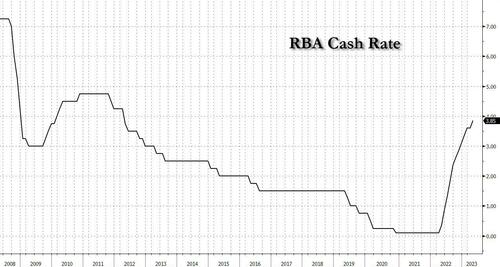

Global sentiment was subdued ahead of tomorrow's (final) 25bps rate hike by the Fed, especially after Australia unexpectedly hiked rates showing central banks remain in inflation-fighting mode, and renewing concerns about a deeper US economic slowdown.

JPMorgan strategists predicted stocks would remain under pressure for the rest of the year as monetary tightening cools the economy and earnings weaken after a strong first quarter. Still, a deal on Monday for JPMorgan to acquire the troubled First Republic Bank boosted optimism that the recent banking turmoil “could well be in the rear-view mirror,” said Michael Hewson, chief analyst at CMC Markets in London (narrator: it's not).

“This would be extremely welcome to jittery markets at a time when yields are rising again and recent economic data suggests that central bank may well have to continue to raise rates,” he said.

And while the rescue of First Republic Bank drew a line for now under US banking turbulence, investors now fear lending will be crimped, slowing an economy already under pressure from the most aggressive rate-hike campaign in decades. Euro-zone data reinforced these fears, showing banks had curbed lending more than anticipated.

“The banking crisis appears to have been dealt with, now it’s again all about inflation,” said Fahad Kamal, chief investment officer at SG Kleinwort Hambros Bank Limited. “Markets are wobbly because of the dichotomy between reasonably strong data and weak forward expectations, as there is concern over what may happen to corporate earnings due to the delayed effects of monetary policy.”

Attention now turns to the Fed, whose two-day policy meeting kicks off Tuesday. The central bank is expected to raise rates by a quarter percentage point and potentially signal a willingness to hold off on further increases. Focus is also on policymakers in Washington after Treasury Secretary Janet Yellen said the government might run out of money to pay its bills as early as June. Investors will also watch US JOLTS job openings, factory and durable goods orders today. Earnings will also garner attention, with more than 35 S&P 500 firms slated to report Tuesday, including Starbucks and Uber Technologies. Apple Inc.’s report is due Thursday.

European stocks traded in the red after coming back from Monday's holiday following a busy day of corporate earnings, economic data and central bank policy speculation. The Stoxx 600 is down 0.3% with real estate, energy and media the worst performing sectors. Banks have outperformed, led by HSBC after the UK lender announced a new $2 billion share buyback plan. Here are the biggest European movers:

Earlier in the session, Asian stocks were little changed, with investors digesting a slew of economic data from China for clues on the strength of the nation’s recovery, as most of the region’s markets resumed trading after a holiday. The MSCI Asia Pacific Index swung in a narrow range, with declines in industrials and consumer staples moderating gains in utilities stocks. Hong Kong equities also fluctuated, while key gauges rose in South Korea and were mixed in Japan. The Hang Seng China Enterprises Index wiped out an early gain of 2.1% as traders assessed China’s shrinking manufacturing activity. The official manufacturing purchasing managers’ index unexpectedly fell to 49.2 in April from 51.9 in March. Mainland markets are shut through Wednesday.

“Data brought back risks that China’s recovery is losing steam, and built the case for further policy support,” Saxo Capital Markets strategists wrote in a note. On the other hand, “travel demand during the Golden Week has started on a positive note,” they said. Investors also awaited the Federal Reserve’s rate decision scheduled for Wednesday. The US central bank is widely expected to hike interest rates again.

Australian stocks fell after the country’s central bank unexpectedly raised interest rates by a quarter-percentage point and signaled further policy tightening ahead. The S&P/ASX 200 index fell 0.9% to close at 7,267.40; the Aussie and bond yields surged. “A potential higher terminal rate is a risk and negative for equities,” said Matthew Haupt, a fund manager at Wilson Asset Management in Sydney. “It’s becoming a credibility issue now, these shocks to markets, and we need to add discount due to policy uncertainty,” he said. Read: RBA Shock Hike Spurs Strategist Clash About Global Rate Bets In New Zealand, the S&P/NZX 50 index rose 0.3% to 12,037.81.

Japanese stocks ended mixed in thin trading as investors geared up for a US rate decision and a domestic holiday this week. The Topix Index fell 0.1% to end at 2,075.53, while the Nikkei advanced 0.1% to 29,157.95. Toyota Motor Corp. contributed the most to the Topix Index’s decline, decreasing 0.5%. Out of 2,160 stocks in the index, 768 rose and 1,257 fell, while 135 were unchanged. “Although the yen has weakened after the BOJ decision and interest rates have fallen, making it easier to take risks,” the holiday-shortened week and the upcoming FOMC meeting make it hard to take a position, said Hiroshi Matsumoto, a senior client portfolio manager at Pictet Asset Management. Japan’s financial markets will be closed Wednesday through Friday for holidays.

India’s benchmark stocks gauge gained for the eighth straight session, supported by foreign buying while banks led earnings outperformance. The S&P BSE Sensex rose 0.4% to 61,354.71 in Mumbai on Tuesday, its highest close since Dec. 20, while the NSE Nifty 50 Index advanced 0.5%. The Sensex is now trading at 14-day RSI of 71, a level that some traders see as overbought, for the first time since it peaked all-time high in early December. However, India VIX Index - a measure of volatility expectations - continues to trade near its lowest level in three years. Banks in India, including top lenders such as HDFC Bank and Kotak Mahindra have reported strong earnings for the March quarter amid sustained loan growth. Out of 21 Nifty companies, which have so far reported earnings, 11 have matched or exceeded average analyst expectations, while eight have trailed. Two companies didn’t have comparable estimates. Tata Steel will be releasing its numbers later Tuesday. Infosys contributed the most to the Sensex’s gain, increasing 2%. Out of 30 shares in the Sensex index, 16 rose, while 14 fell.

In FX, the Bloomberg Dollar Spot Index is up 0.1% while the Australian dollar was the clear outperformer among the G-10s, jumping with local yields after the Reserve Bank unexpectedly resumed policy tightening. AUD/USA climbed as much as 1.3% to 0.6717 while Australia’s 3-year yield rose as much as 25bps to 3.26%, the highest since March. The RBA lifted the cash rate by 25 basis points to 3.85% while economists expected the rate to be left unchanged after data last week showed growth in consumer prices slowed more than expected in the first quarter. “The RBA is clearly still focused on inflation and feels it is still too high,” said Nick Twidale, chief executive Asia Pacific at FP Markets. “You’ve got to look to get long Aussie for the short to medium term, and it’s much more preferable to do it on the crosses than the dollar because we have so much uncertainty coming up with the Federal Reserve”

In rates, treasuries were richer across the curve, paring a portion of Monday’s sharp rate-lock driven selloff (courtesy of FB's massive $8.5 billion new bond offering) as stock futures extended a retreat from Monday’s highs. During Asia session the Reserve Bank of Australia hiked its benchmark rate by 25bp to 3.85%, saying inflation remained too high and further tightening may be required. US yields are richer by 1bp to 4bp across the curve with gains led by intermediates, tightening the 2s5s30s fly by 3bp on the day; 10-year yields around 3.53%, lower by 4bps vs Monday’s close. Bund futures gapped lower but have pared some of that drop after the ECB bank lending survey and euro-area CPI data supported the view that the central bank will slow the pace of rate hikes this week. German 10-year yields are still up 5bps on the day. US session features 10am data raft including JOLTS job openings — which sparked gains last month — and factory orders.

In commodities, crude futures decline with WTI falling 0.4% to trade near $75.40. Spot gold is flat around $1,981.

Bitcoin is modestly firmer though is yet to convincingly extend above the USD 28k mark and as such remains well within the parameters of recent action.

Now looking at the day ahead, in the US we will get the March JOLTS report, factory orders, and April total vehicle sales. Meanwhile in Europe the main datapoints are the UK April Nationwide house price index, German March retail sales, and a bevy of Italian releases including April CPI, budget balance, new car registrations, manufacturing PMI, and March PPI. Additionally, this morning we will learn the Eurozone April CPI and March M3 level. In terms of central banks, we will get the important Eurozone bank lending survey. On earnings we will hear from Pfizer, HSBC, AMD, Starbucks, BP, Uber, Marriott, and Ford amongst others.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded with a slight positive bias as many of the regional participants returned to the market from the long weekend albeit with gains capped ahead of this week's upcoming risk events. ASX 200 was pressured after the RBA surprised markets with a 25bps rate increase, while the central bank's language remained hawkish with the Board expecting some further tightening of monetary policy will be needed. Nikkei 225 was indecisive and pulled back after briefly touching its highest level since January last year. Hang Seng initially surged on reopening from the holiday weekend and was led higher by strength in tech and casino stocks with the latter buoyed after a jump in Macau gaming revenue, although the index later faded most of its gains while the mainland remained shut for golden week.

Top Asian News

European stocks mostly decline after a long weekend, Euro Stoxx 50 -0.2%, with traders keeping an eye on various upcoming risk events; US equity futures hold a downward bias, ES -0.1%. In earnings, HSBC +4.5% beat expectations while BP -4.5% missed on revenue and guided towards lower Q2 refining margins. Stateside, futures are modestly softer but have picked up off lows as the European session progresses with the focus remaining firmly on the Fed, debt ceiling and earnings.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

So welcome to a belated start to May in Europe after a surprisingly dull April. Indeed it’s quite ironic that a month which culminated in the second largest US bank failure in history was also the least volatile for global assets since the pre-pandemic days by at least one measure. In less than 2 months, SVB’s place as the second largest US bank failure was eclipsed yesterday as First Republic Bank was seized by the FDIC. Shortly thereafter a deal was brokered for JPM to buy the embattled regional lender. However, at the same time we’ve just closed an April where in our monthly performance review only 5 out of 38 assets in our study moved by more than 3% in either direction for the first time since pre-pandemic days and the VIX fell back to November 2021 levels mid-month. See Henry’s monthly performance review here for more on this.

Even with the FRC situation resolved (see more below), this week’s FOMC meeting – which concludes on Wednesday – will likely include continued discussion of the banking system going forward. However the details of that discussion may not be revealed until the minutes are released later this month. The main focus of the Fed tomorrow will be on whether they give any hints of forward guidance at all. Our base case is that the FOMC will maintain a hawkish bias and signal that a June hike is on the table, but with no pre-commitment to act on it. One important note will be how much Fed Chair Powell previews the very important Senior Loan Officer Survey that comes out next week. The Chair will be aware of the results. See our economists’ preview of the FOMC here.

The also very important European bank lending survey comes out this morning so that will play a part in Thursday’s ECB decision where our economists expect +25bps but with finely balanced risks versus a +50bps hike. In terms of the ECB hiking, the market sees it as a bit more clear cut as it prices in just over a 25bps hike (+28bps) and 50bps of hikes by the June meeting. We get the Eurozone CPI print today which may also have an influence, but the regional prints last week didn’t suggest any big hawkish surprises. The median Bloomberg estimate is a +0.7% m/m increase, after a 0.9% rise in March. See our economists’ preview of the ECB meeting here.

When that central bank excitement is over, attention will turn to another payrolls’ Friday. DB expects +150k with consensus at +180k and +236k last month. JOLTS today is arguably a better gauge of US labour market tightness but is always a month behind. Claims (Thursday) is one to watch given the recent flirtation with 18-month highs even if we’re still at historically low levels. Another notable piece of US data will come from productivity numbers on Thursday, as inflationary and wage pressures remain strong. Our economists expect +0.6% growth in productivity (v +1.7% in Q4) and a +3.4% reading for unit labour costs, an increase from +3.2% in Q4.

Additionally, the ISM services tomorrow is important following the marginal upside surprise in manufacturing yesterday. Our US economists expect a 52.1 reading for services tomorrow (51.2 last month). The US April ISM manufacturing reading yesterday was stronger than expected while remaining contractionary, coming in at 47.1 (46.8 expected). That was up 0.8pts from last month’s cycle lows, and is on the back of higher prices paid (53.2 vs 49.2 last month), higher new orders (45.7 vs 44.3 last month), and stronger employment. The employment portion of the survey rebounded into expansionary territory – albeit just at 50.2 – after being down at 46.9 in March. Elsewhere, US construction spending in March rose 0.3% m/m (0.1% expected).

Moving on to earnings, the key highlights of the week will continue to be tech earnings, including Apple on Thursday. The company will round out what has been a string of above-expectation results from the rest of the big tech pack last week. These boosted American large cap indices while small caps have struggled a bit more of late. The key earnings and data releases are in the day-by-day calendar at the end.

Now to a US session yesterday where virtually all of Europe was on holiday. The main story of the day, as referenced above, was First Republic officially being seized by regulators on Monday morning and then sold to JPMorgan. This followed speculation of assets sales last week as well as reports of multiple bidding banks materialising over the weekend. JPMorgan will now have acquired the two largest US bank failures of all-time, having acquired Washington Mutual back in 2008. JPM’s stock gained +2.14% yesterday, and was one of only 2 members in the KBW index (-1.78%) to finish higher on the day. The two worst performing stocks in the index were Citizens Financial (-6.85%) and PNC (-6.33%) who were among the known bidders for First Republic.

The weakness in overall bank shares followed news that the FDIC wanted to overhaul the deposit insurance system, citing new technological challenges and high concentrations of uninsured depositors in specific “pockets” of the banking system. The plan would see business accounts treated separately and have a higher coverage cap than individuals. This would require congressional approval. Questions still remain on how the Deposit Insurance Fund will be replenished and who should foot that bill, and so there is likely to be more response from the government in the coming weeks and months amid discussions of the impending debt ceiling deadline.

Outside of the First Republic news, the US equity session was fairly quiet with attention on the busy upcoming macro calendar. The S&P 500 traded in a 0.5% range and finished just -0.04% lower on the day with a good deal of dispersion under the surface. Exactly half of the 24 GICS level 2 industry groups in the index were higher on the day with little discernible factor bias as growth industries like biotech (+0.85%) and semiconductors (+1.52%) did well as did cyclicals such as transports (+1.50%). However some of the worst performers were also cyclicals such as energy (-1.26%), consumer retail (-1.93%), and autos (-0.98%).

With the First Republic deal taking a slice out of the overall risk premium built into markets, as well as pre-positioning ahead of the FOMC there was a big selloff in rates. This came despite a risk-on tone and was also potentially aided by a large day of corporate issuance in the US, as corporate blackout periods have concluded for some of the bigger issuers. Overall, 10yr US Treasury yields were +14.6bps higher at 3.56%, with 2yr yields +13.4bps higher at 4.14%. Fed futures are pricing in a near certainty of a hike in 2 days (95%) and a 1-in-5 chance of an additional hike in June, before 50bps of cuts come through by year-end.

There was a bit of a rally in treasuries in the last hour or so of trading following US Treasury Secretary Yellen telling US lawmakers that the US could hit the debt ceiling as early as June 1. 10yr yields came in about 3bps following the announcement. Markets are still pricing more risk later into the summer but the White House took a step toward coming to a resolution with Republicans in the House yesterday. President Biden has invited congressional leaders from both parties to the White House on May 9.

In Asia, as we go to print the RBA have surprised the market by hiking +25bps after many expected a continued pause. The surprise is reflected in 3yr yields rising +22bps after the decision. At this stage it looks like a hawkish hike. In terms of equities in the region the Nikkei 225 is trading largely flat, up a modest +0.06% ahead of the Japanese public holidays for the rest of the week. The Hang Seng is up +0.12%, and set to secure a fourth consecutive day of gains after Hong Kong GDP for Q1 grew 2.7% year-on-year (vs 0.5% expected). Onshore Chinese markets are closed and are set to reopen on Thursday after a four-day public holiday that started on Monday, whilst the Korean Kospi relatively outperformed up +0.62%. US equity futures are pretty flat along with Treasury yields.

Now looking at the day ahead, in the US we will get the March JOLTS report, factory orders, and April total vehicle sales. Meanwhile in Europe the main datapoints are the UK April Nationwide house price index, German March retail sales, and a bevy of Italian releases including April CPI, budget balance, new car registrations, manufacturing PMI, and March PPI. Additionally, this morning we will learn the Eurozone April CPI and March M3 level. In terms of central banks, we will get the important Eurozone bank lending survey. On earnings we will hear from Pfizer, HSBC, AMD, Starbucks, BP, Uber, Marriott, and Ford amongst others.