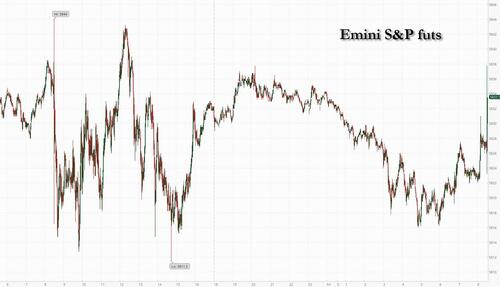

Futures are lower ahead of the last trading day of the week, but well off session lows as JPM earnings were solid enough to push the stock higher and reverse some of the market's losses as Q3 earnings season was officially launched. As of 8:45am, S&P futures are down fractionally, while Nasdaq futures dropped 0.2%, hammered by TSLA which is down -5.8% pre-market as the Robotaxi event failed to meet market expectations. Bond yields are higher with the 10Y rising 3bps to 4.09%, while the Bloomberg Dollar index reversed earlier losses. Commodities are mixed with Oil fractionally lower, base metals higher, and pPrecious metals mixed. Today’s macro focus will be banks earnings and PPI, which came in fractionally light MoM (headline 0.0% MoM, Exp. 0.1%; core 0.2%, exp. 0.2%), but hotter on a YoY basis (core 2.8% YoY, Exp. 2.6%). Over the weekend, key macro catalysts will be China finance minister’s press conference on stimulus package.

In premarket trading, JPMorgan rose 1% after the bank reported a surprise gain in net interest income for the 3Q and raised its forecast for the key revenue source. Wells Fargo also gained, rising 3% after posting 3Q profit that topped analyst expectations as a surge in investment-banking fees helped counter a dip in lending revenue as interest rates fall. Tesla fell 6% as Elon Musk unveiled prototypes of the automaker’s long-awaited robotaxi Cybercab. Analysts note that the event did give a clearer picture of the company’s autonomous plans, but it was “light on the details.” Here are some other notable premarket movers:

The producer price index for final demand was flat from August after rising 0.2% in the prior month, printing below estimates. From a year ago, however, it rose more than expected up 1.8% and 2.8% for headline and core, respectively, both above estimates of 1.6% and 2.6%.

European stocks reversed earlier losses and rose 0.2% with automobile and telecommunications shares leading the decline, while real estate and basic resources stocks are the biggest outperformers. Here are the biggest movers Friday:

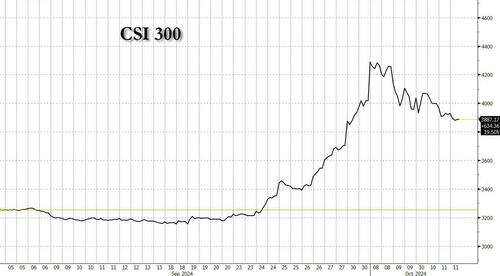

Earlier, Asian equities were headed for a second week of losses as the rally in China fizzled. The MSCI Asia Pacific Index pared earlier gains of as much as 0.4%. TSMC and Fast Retailing were among the biggest boosts to the regional benchmark. Japanese stocks were mixed, while China’s onshore gauge capped its worst week since July ahead of a policy briefing by the Ministry of Finance on Saturday. Chinese stocks have been volatile this week as traders digested weaker-than-expected holiday spending data and await further announcements from the key meeting this weekend. Investors and analysts are expecting China to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus, according to a majority of 23 market participants surveyed by Bloomberg.

“We have to expect some profit taking” after China’s sharp rally in the past few sessions, said Jessica Amir, market strategist at Moomoo. Meanwhile, “traders are also considering the risks should China not deliver a second bazooka stimulus package on the weekend.”

In FX, the Bloomberg Dollar Spot Index is little changed. The Bloomberg Dollar Spot Index dipped 0.1% as the greenback slipped against most Group-of-10 peers; the Norwegian krone led gains alongside the British pound, while the Japanese yen slumped.

In rates, treasuries are lower, with US 10-year yields rising 4bps to 4.10%, the highest since July 31. French government bonds dip after the government unveiled a budget for next year that aims to deliver €60.6 billion in spending cuts and higher taxes. The OAT-bund spread is steady around 77 bps.

Oil prices decline, with WTI down 0.7% as Israel’s government has yet to decide how to retaliate against Iran for a missile attack last week. Spot gold rises $8 to around $2,637/oz.

Today's data calendar includes September PPI (full summary here) and October preliminary University of Michigan sentiment (10am). Fed speakers scheduled include Goolsbee (9:45am), Logan (10:45am) and Bowman (1:10pm)

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the choppy price action stateside where markets reflected on disappointing data and hawkish-leaning comments from Fed's Bostic, while regional participants await the Chinese Ministry of Finance's press briefing. ASX 200 price action was lacklustre with the index contained by weakness in real estate, utilities and financials. Nikkei 225 eked marginal gains with index heavyweight Fast Retailing leading the advances post-earnings, while Seven & I was at the other end of the spectrum after it cut its guidance and announced a restructuring plan to fend off a takeover. KOSPI sits with marginal gains following the BoK's 25bps rate cut which Governor Rhee framed as a hawkish cut. Shanghai Comp was pressured in the absence of Hong Kong participants and stock connect flows, while participants await tomorrow's Ministry of Finance press conference and whether China will unveil large fiscal stimulus.

Top Asian News

European bourses, Stoxx 600 (U/C) are bobbling around the unchanged mark in what has been a very lacklustre and indecisive session thus far. European sectors are mixed but with the breadth of the market fairly narrow; Real Estate takes the top spot alongside Basic Resources whilst Autos lags. US Equity Futures (ES, NQ, RTY) are very modestly on the backfoot, continuing the losses seen in the prior session. Tesla (-5.7%) slips in the pre-market after its event where it unveiled Cybercab and a driverless Model Y, but RBC said they heard much of what they expected to hear.

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Banks

DB's Jim Reid concludes the overnight wrap

It's yet another morning where I wake to social media posts of the most stunning Aurora Borealis pictures in my area last night. I stuck my head out the window at 9:30pm before I went to bed and it all looked pitch black. I think I need to work on my iPhone settings as that seems to be the trick. Talking of which, it's the annual new model arrival day today so maybe I can up my game.

There have been some strange lights shining in market skies in the last week with the way above expected payrolls last week and a slightly above expected US CPI yesterday. The narrative has certainly changed a bit. Maybe the full implication of yesterday's inflation number was offset by the much weaker than expected claims. However, we are in for a period of data heavily influenced by recent storms and strikes. So this will likely make it a complicated few weeks for markets and the Fed. Although I've struggled to work out which way things will go in recent weeks the view I've felt most certain of was that the market was massively overpricing the perfect scenario of smooth enough data that the Fed would be able to serenely cut rates back below 3% without a recession. If we don’t get a recession, it’s hard to see how rates can be cut anywhere near as aggressively as this.

Anyway there'll be more twists and turns in that argument but for yesterday the response in markets to the data was fairly muted but a confused one, complicated further as oil prices posted a fresh advance due to geopolitical tensions in the Middle East.

We’ll start off with the CPI release, as that set the tone for a day where investors grew a bit more concerned about inflation. It showed that headline CPI was stronger than expected in September at +0.18% (vs. +0.1% expected), meaning that the year-on-year number only came down to +2.4% (vs. +2.3% expected), even if it was still the lowest since February 2021. But what concerned investors more was the core CPI number, which came in at a monthly +0.31% in September (vs. +0.2% expected), pushing the year-on-year number up to +3.3% (vs. +3.2% expected). Now of course, that’s only one month’s reading, but it also meant the 3-month annualised rate for core CPI rose to +3.1%, having been at +2.1% in August. So the last couple of months have added to fears that inflation is proving a bit more persistent than the Fed would like, and there were fresh signs that investors were pricing this in as well. For instance, the US 5yr inflation swap (+6.5bps) was up to a three-month high of 2.51% yesterday (low of 2.14% on September 10), and it was a decent day for precious metals, which traditionally operate as an inflation hedge, with gold prices up around +0.7% and a further +0.6% this morning.

Ordinarily, an inflation release like that would have led investors to dial back their expectations for rate cuts. But just as that was coming out, we simultaneously had the weekly initial jobless claims, which were noticeably worse than expected. They moved up to 258k over the week ending October 5 (vs. 230k expected), which is the highest they’ve been since August 2023. Now to be fair, there are some weather-related factors that can help explain that, and the numbers are likely to remain volatile for several weeks as a result. But even so, the number was higher than expected, and given it’s quite a timely release, it pushed back against the more positive labour market narrative from last week’s jobs report. The chances are still high that it was heavily distorted though and with the current storms in Florida, getting a clean reading soon will be tough.

Nevertheless, with all that in hand, investors moved to increase the pricing of Fed rate cuts in the coming months, even as they priced in more inflation for the years ahead. The likelihood of a 25bp cut next month rose marginally from 83% the previous day to 85%, but having peaked at 95% intra-day after the data. The move was more sustained further out the curve, with the rate priced in for the December 2025 meeting falling by -8.2bps to 3.34%. The reversal in November pricing from the day's peaks came following a WSJ interview with the Fed’s Bostic, who left open the possibility of a pause in November, saying that “I am totally comfortable with skipping a meeting if the data suggests that’s appropriate”. On the other hand, comments from Williams, Goolsbee, and Barkin suggested they were largely unphased by the stronger CPI print.

The more dovish Fed pricing contributed to a rally in front-end yields that pushed the 2yr Treasury yield down -6.5bps to 3.96%, while the 10yr yield was down a more marginal -1.1bps to 4.06%. This comprised of sharply diverging moves in real yields and breakevens, especially at the front end. While 2yr breakevens (+9.8bps) rose to their highest since early July, 2yr real yields (-16.3bps) posted their sharpest daily fall since the December 2023 FOMC. So signs of market pricing turning in a slightly more stagflationary direction.

Whilst markets were digesting the latest US data, there were ongoing concerns about a potential escalation in the Middle East, and Brent crude oil prices moved up +3.68% yesterday to $79.40/bbl. That came as Israel’s security cabinet met last night to discuss how and when to retaliate against Iran’s strikes last week, with Israel’s public broadcaster reporting that the final decision will be made by PM Netanyahu and defence minister Gallant.

Against this backdrop, equities were unable to hold onto their recent gains, with the S&P 500 (-0.21%) moving off from its record high the previous day. The declines were pretty broad based, with nearly 70% of the S&P 500 lower on the day with the small-cap Russell 2000 (-0.55%) struggling in particular. Meanwhile in Europe, there was a similar pattern of evenly spread but modest declines, with small losses for the STOXX 600 (-0.18%), the DAX (-0.23%) and the CAC 40 (-0.24%). All change from today as we see the unofficial start of earnings season with releases beginning to ramp up, with several US financials reporting including JPMorgan, Wells Fargo, BNY Mellon and BlackRock.

Over in Europe, last night we heard the details of the French government’s 2025 budget proposal. This confirmed a fiscal deficit target of 5% of GDP, foreseeing some EUR 60bn of spending cuts and tax increases. The budget will now pass to parliament to be the first major test of PM Barnier’s minority government. Earlier in the day, the Franco-German 10yr spread had remained at 77bps, with yields on 10yr bunds (-0.1bps) and OATs (-0.1bps) both basically unchanged on the day.

Overnight in Asia, Chinese stocks are lagging behind other markets with Hong Kong closed for a holiday. The CSI 300 is down -1.88% while the Nikkei 225 and the Kospi are up by +0.72% and +0.18%, respectively. US equity futures are up less than a tenth of a percentage as I type. All eyes are on tomorrow's finance ministry briefing in China to hopefully get much more details on the stimulus package the market has grown a little more nervous of this week. So lots to report by Monday.

To the day ahead now, and data releases include US PPI for September, the University of Michigan’s preliminary consumer sentiment index for October, and UK GDP for August. From central banks, we’ll hear from the ECB’s Holzmann, and the Fed’s Goolsbee, Logan and Bowman. Finally, today’s earnings releases include JPMorgan, Wells Fargo, BNY Mellon and BlackRock.