Global stocks slid, US equity futures slumped and bond yields tumbled as a raft of news on collapsing Chinese trade, Italian banks hit with an unexpected windfall tax, and a downgrade of US banks by Moodys (on increasing funding costs/CRE exposure) sparked a fresh round of fears about the financial system and global economy. At 7:45am, S&P futures were down 0.7% trading as low as 4,502 while Nasdaq futures dropped 0.8% amid a broad flight to safety across markets which sent yields on the 10-year Treasury 10 basis points lower and the equivalent rates in Germany fell 15 basis points. The Bloomberg dollar index climbed 0.5% while oil resumed its slide following ugly oil import data by China. Today's macro data includes Small Biz Optimism, Trade Balance, and Wholesales Sales/Inventories … nothing market-moving as we await Thursday’s CPI print.

In the premarket, tech and small-caps underperformed while defensives were the green. Investors are also closely watching US financials after Moody’s lowered credit ratings for 10 small and midsized lenders and warned about the risks tied to commercial real estate: the XLF was indicated -67bps and KRE -1.3% lower in premarket trading. Eli Lilly extended gains to 8.6%, after the drugmaker boosted its revenue guidance for the full year; the guidance beat the average analyst estimate. Earlier, Lilly shares jumped following Novo Nordisk’s Wegovy update. Here are some other notable premarket movers:

In Europe, the Stoxx 600 dropped 0.7% with banks posting the steepest losses after Italy announced an unexpected tax on windfall profits, sending shares of UniCredit SpA and Intesa Sanpaolo SpA down more than 7%. The euro-area banks index slumped as much as 3.4%. BPER Banca, Banco BPM, Intesa Sanpaolo and UniCredit all fell at least 7%. In the UK, banks also fall as BNP Paribas Exane says that while lenders in Britain are cheap, it is staying relatively cautious, downgrading Barclays to neutral and Virgin Money UK to underperform. Here are the most notable European movers:

Earlier in the session, Asian stocks slumped as the early optimism following the positive lead from Wall St was soured as Chinese markets entered the fray, while the region also digested disappointing Chinese trade data.

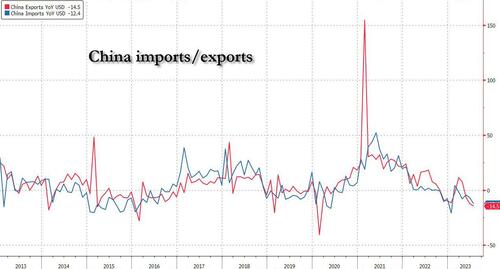

Investor sentiment took a big hit after China released more data that showed its economic engine is sputtering. Exports plunged by the most since early 2020, the beginning of the Covid pandemic, and imports contracted last month. The Hang Seng China Enterprises Index and a gauge of European mining shares fell about 2%. Commodities prices retreated, with oil and copper losing almost 2%. Sentiment was further dented after two missed coupon payments by Country Garden.

As Bloomberg notes, China’s disappointing economic recovery is being felt acutely among exporting nations in the developing world. The MSCI Emerging Market Index of stocks headed for the lowest close in almost four weeks and looked to breach the support level at its 50-day moving average. Its currency-index counterpart also traded at the weakest level since July 10, with the South Korean won and Malaysian ringgit among the worst performers.

“Reduced demand for raw materials and commodities due to its economic slowdown is likely to lead to a decrease in global commodity prices,” according to Nigel Green, CEO of DeVere Group. “Those countries heavily reliant on commodity exports would then experience economic hardships as their revenues decline.”

In FX, the Bloomberg Dollar Spot Index rises 0.4% with the world’s reserve currency advancing against all of its of Group-of-10 peers. The yen slid the most against the US currency after falling as much as 0.7%. The People’s Bank of China set Tuesday’s yuan reference rate at 7.1565 per dollar, revising an earlier fixing in the morning when it had indicated a stronger fixing of 7.1365. The latest fixing was set at the weakest level in nearly a month. “A clearly visible CNY depreciation trend might further strengthen the tendency of private domestic capital to leave China,” said Ulrich Leuchtmann, head of currency strategy at Commerzbank AG in Frankfurt. “The Chinese authorities have to be very certain that their capital controls work well if they want to risk that.”

In rates, treasuries hoeld gains into early US session with yields lower by up to 10bp across long-end of the curve. Treasury yields are down 3bp to 10bp across the curve with 2s10s, 5s30s spreads flatter by 5.5bp and 2.5bp on the day; 10- year yields just under 4% are richer by 10bp on the day with bunds and gilts outperforming by 4.5bp and 1bp in the sector. Treasuries drew support during Asia session following disappointing China trade data. Today's bull-flattening move is led by bunds, drawing flight-to-quality flows with Italian banks slumping after the government introduced a surprise tax on “extra profits” this year. US regional banks are also in focus after Moody’s Investors Service lowered credit ratings for 10 small and midsize lenders based on mounting funding costs. Treasury auction cycle begins with 3-year note sale at 1pm New York time. The treasury auction cycle includes $42b 3-year note followed by $38b 10-year Wednesday and $23b 30-year bond Thursday in upsized auction amounts. WI 3-year yield around 4.38% is ~15bp richer than last month’s, which stopped 0.2bp through the WI yield.

In commodities, crude futures declined with WTI falling 2% to trade near $80. Spot gold drops 1%

Looking to the day ahead, on the data side in the US we will get the July NFIB small business optimism, June wholesale trade sales and June trade balance releases. Over in Europe, we have the final Germany inflation print for July as well as the releases of the ECB’s latest consumer expectations survey. Our economists’ dbDIG survey suggests that the ECB survey should show a further slight easing of inflation expectations – see their earlier note here. Among central bank speakers, we will hear from the Fed’s Harker and Barkin. Finally, earning releases include Eli Lilly, UPS, Glencore, Bayer, Coupang, Barrick Gold, Take-Two Interactive, Rivian and Lyft.

Market Snapshot

Top Overnight News

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks traded mixed after the early optimism following the positive lead from Wall St was soured as Chinese markets entered the fray, while the region also digested disappointing Chinese trade data. ASX 200 traded rangebound after mixed consumer sentiment and business confidence surveys. Nikkei 225 was initially lifted by a weaker currency and earnings release but then wiped out nearly all of its gains as markets were spooked by selling in Chinese stocks. Hang Seng and Shanghai Comp spooked markets as they entered the fray with the Hong Kong benchmark heavily pressured as tech and property stocks lead the broad declines across sectors, while sentiment was also not helped by the wider-than-expected contraction in Chinese exports and imports data.

Top Asian News

European bourses are lower across the board, Euro Stoxx 50 -1.20%, risk tone hit by Chinese trade and reports around a property developer. Within Europe, the FTSE MIB -2.2% lags following Italy approving a 40% windfall tax on banks, pressuring the broader banking index, -2.7%. Elsewhere, sectors are more mixed; Banking lags as mentioned while Basic Resources are dented by the trade data and a poorly-received update from Glencore. Stateside, futures are in the red, ES -0.5% and feature continued modest underperformance in the RTY -0.8%. Elsewhere, the risk tone around banks was soured further by Moody's downgrading several US banks.

Top European News

FX

Fixed Income

Commodities

Geopolitics

US Event Calendar

DB's Jim Reid concludes the overnight wrap

As we approach the dog days of summer, and my holiday in a few days, it sometimes gets harder to explain moves in markets in both direction but as I’ve been doing this daily for nearly 17 years I’ve learnt to try to come up with rationales or I'll have a blank piece of paper. We’ve had some big moves in rates in the last week following the US Treasury announcement last Monday, the Fitch US downgrade, the Treasury refunding announcement and then the reverse move after payrolls. All others things being equal I thought the extent of the rates rally after payrolls was strange given how 2-way the release was, and yesterday a 10bps intra-day rally in 2yrs from an earlier sell-off was also difficult to explain. All in all, 2yr US yields were flat (-0.1bp) at the close, with 10yr and 30yr yields up +5.6bps and +6.9bps. The S&P 500 (+0.90%) did rise after four days of losses though. Overnight, US 10yrs and 30yr yields are back -4bps and -5bps lower as I type so we are seeing some decent sized moves in these thin markets at the moment.

We did hear contrasting comments from FOMC members yesterday on the potential for further hikes. Federal Reserve Governor Bowman, who typically leans hawkish, emphasised the potential for further hikes, saying she expects that “additional increases will likely be needed to lower inflation to the FOMC's goal”. By contrast, in an interview published by the New York Times, New York Fed President Williams said that “monetary policy is in a good place” and “whether we need to adjust it in terms of that peak rate — but also how long we need to keep a restrictive stance — is going to depend on the data”. To be fair, Bowman also stressed data dependence but she focused more on still high inflation and tight labour market. Williams did dangle a rate cutting carrot for 2024 if inflation continued to behave.

An ongoing theme in US rates has been that the sizable US yield moves have continued with only minor changes in near-term Fed pricing though. Rate pricing for end-23 rose by 1.5bps on Monday to 5.38%, while end-24 pricing retreated -2.0bps to 4.00%. So that is five and a half 25bp cuts priced for 2024. On the topic of 2024 rate cuts, yesterday our US economists published a report in which they consider what policy rules would imply for the timing and pace of rate cuts in 2024 under different economic scenarios. See their note here.

Meanwhile, short-end yields in Europe rallied on Monday following news late on Friday that the Bundesbank will from October stop paying interest on domestic government deposits. Back in September 2022, the ECB had lifted the zero ceiling on such deposits to rise in line with policy rates amid fears of a negative impact on the repo market, before reducing this ceiling to ESTR minus 20bp in the spring. A decline in government deposits at the central bank and reduced collateral scarcity may have made the Bundesbank less concerned about the risks, though it is rather unusual for it to take this step unilaterally (without other euro area national central banks). Together with the recent ECB move to pay zero interest on banks’ minimum reserves, central banks might be looking for ways to reduce their high interest costs, at least if this can be done without hindering policy effectiveness.

The yield on 6m German bills thus fell by -4.7bps on Monday, while the 2yr yield declined by -2.7bps. The German curve notably twisted and steepened as 10yr Bund yields were +3.9bps higher. An additional notable feature in European rates has been the ongoing gradual rise in long-term inflation breakevens. The 5y5y rose for the seventh session in a row yesterday to 2.67%, its highest level since 2009. So the market is not giving a strong vote of confidence in the 2% inflation target. This is similar to the US where a similar measure is up over 10bps in the past week and at levels less than a handful of basis points from 10yr highs. Elsewhere, 10yr UK yields were the biggest underperformer yesterday and +8.1bps higher, largely reversing their Friday decline.

A risk-on mode returned to equity markets on Monday, with the S&P 500 rising +0.90%, ending a run of four declines in a row. A broad rally was led by communication services (+1.88%) and financials (+1.36%). Energy stocks underperformed (+0.15%) as oil prices retreated from their 3-month high reached on Friday (Brent -1.04% to $85.34/bl). Tech stocks were a slight underperformer, although the NASDAQ still posted a solid +0.61% gain. Within the megacaps, Apple (-1.73%) and Amazon (+1.90%) saw continued contrasting moves. Meanwhile, Berkshire Hathaway gained +3.60% after its results, further cementing its position as the largest US company by market cap outside the tech mega caps. Over in Europe, equities were near flat on the day. The STOXX 600 eked out a +0.09% rise, after being weighed down initially by the weak US session last Friday.

Asian equity markets are mixed this morning despite a strong handover from Wall Street overnight. Across the region, the Hang Seng (-1.15%) is leading losses with the KOSPI (-0.12%), the CSI (-0.02%) and the Shanghai Composite (-0.04%) inching lower. Otherwise, the Nikkei (+0.32%) is bucking the regional trend. S&P 500 (-0.22%) and NASDAQ 100 (-0.34%) futures are moving a bit lower.

Early morning data from China showed that exports dropped for the third consecutive month, sliding -14.5% y/y in July (v/s -13.2% expected; -12.4% in June) and recording its biggest drop since July 2020, highlighting that the world's second biggest economy is being dragged lower by weakness in global demand and a domestic slowdown. At the same time, imports contracted -12.4% y/y in July (-5.6% expected) compared to a -6.8% drop in the previous month. Elsewhere, household spending in Japan fell -4.2% y/y in June (v/s -3.8% expected), a steeper fall than the prior month’s -4.0% drop while recording a fourth straight month of decline. Meanwhile, real wages declined for a 15th straight month, easing -1.6% y/y in June (v/s -0.9% expected) and against May’s downwardly revised drop of -0.9%. Nominal pay growth in June (+2.3% y/y) came in lower than a revised +2.9% rise in May (v/s +3.0% expected).

It was fairly quite day on the data front yesterday. A highlight was Germany's industrial production print, which saw a larger-than-expected -1.5% mom decline in June (-0.5% exp). Also in Europe, French private sector labour market data showed a slowing in Q2. Employment grew 0.1% qoq, the slowest pace since Q4 2020, while wage growth was +1.0% qoq, down from +1.9% in Q1. So some evidence to argue against the risks of a wage-price spiral emerging in the euro area.

Looking to the day ahead, on the data side in the US we will get the July NFIB small business optimism, June wholesale trade sales and June trade balance releases. Over in Europe, we have the final Germany inflation print for July as well as the releases of the ECB’s latest consumer expectations survey. Our economists’ dbDIG survey suggests that the ECB survey should show a further slight easing of inflation expectations – see their earlier note here. Among central bank speakers, we will hear from the Fed’s Harker and Barkin. Finally, earning releases include Eli Lilly, UPS, Glencore, Bayer, Coupang, Barrick Gold, Take-Two Interactive, Rivian and Lyft.