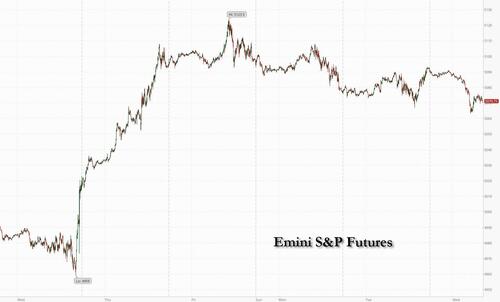

US stock futures slumped, pointing to a weak open on Wall Street with both Tech and small-caps underperforming, as traders braced for today's revised GDP print and tomorrow's core PCE report which whisper sees coming in hotter than expected and may further push back on expectations for rate cuts.

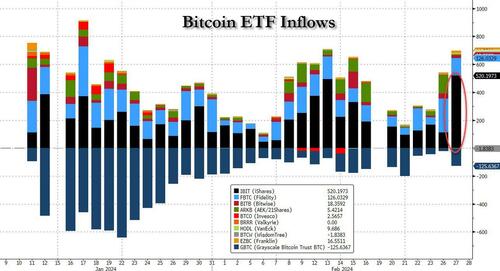

As of 7:50am, contracts on the Nasdaq 100 drop 0.5%, while S&P 500 futures down 0.4% as European stocks hovered below record high while Asia was dragged lower by Chinawhere regulators are taking steps to shrink the size of a popular quantitative trading strategy "Direct Market Access" that contributed to turmoil in the nation’s stock market this month. Bond yields are lower, and the USD is stronger, while commodities are mixed with base metals higher and energy lower. Bitcoin surged again rising just shy of $60K following record inflows into the Blackrock bitcoin ETF. The macro data focus will be on details surrounding the second estimate of Q4 GDP, as well as the latest inventory data (the more important data kicks off tomorrow with PCE and then Friday’s ISM number). Today’s price action may be more about month-end rebalancing where JPM's Quant & Derivs Strategy team thinks that we could see stocks lose as much as 1.5% on the rebalance and that rebalancing moves can occur before month-end.

In premarket trading, Nvidia dropped 1.3% in premarket trading, dragging the megacap sector lower. Here are some other notable premarket movers:

Cryptocurrency-linked stocks gained as Bitcoin advanced for a fifth day, on track for its biggest monthly increased since October 2021. The launch of spot Bitcoin exchange-traded funds in the US in early January has driven a surge in buying, overcoming concerns over slower Fed rate cuts. Bitcoin climbed above $59,000 Wednesday, up almost 40% in the month.

Aside from earnings, attention will be on the latest US GDP print and tomorrow's inflation numbers and a strong line-up of central bank speakers. Investors are contending with an erosion in expectations for how much the Federal Reserve and European Central Bank will lower rates.

“In December, markets priced sizeable rate cuts in 2024, but what’s happened is we have had slightly problematic inflation prints in most parts of the world,” said Guy Miller, chief market strategist at Zurich Insurance Co. “The US economy has done better than what many people expected, the labor market remains tight and wage gains have been higher than what central bankers are comfortable with.”

Meanwhile, traders have moved to price only 75 basis points of US easing by year-end, in line with what Fed policymakers in December indicated is the likeliest outcome. Treasury yields dipped Wednesday, while a gauge of the dollar strengthened to the highest since Feb. 20.

In Europe, the Stoxx 600 index edged 0.2% lower as investors digested the latest earnings; telecoms and insurance stocks outperforme while personal care stocks are the worst performers, led lower by Reckitt Benckiser, whose sales missed expectations and its shares tumbled 12%, the most since 2008, after the consumer goods company said its sales fell. Tech was also hit after Dutch chip gear firm ASM International slipped as it projected revenue for this quarter that fell far below market expectations. Here are the biggest movers Wednesday:

Earlier in the session, Asian stocks closed lower, dragged by China where the CSI 300 Index dropped as much as 1.3% to touch session low following a report that regulators are taking steps to gradually shrink the size of a popular quantitative trading strategy. Some quantitative funds that manage money for external clients were told to stop accepting new inflows and phase out existing products for “Direct Market Access.” Small-cap indexes fall more: CSI 1000 Index drops as much as 4.5% and CSI 2000 Index -6.8%. Meanwhile, Hong Kong stocks slumped more than 1% as the city’s budget report failed to impress investors. Chinese stocks fell after a recent rally took gauges to resistance levels, with traders looking to this week’s manufacturing report and a key political meeting in Beijing next week for momentum.

“This move to deleverage could lead to an extended drop and might be a replay of the slump in January. This is hits across all gauges, as quants usually hold thousands of stocks at once, and the unexpected move leads to a wave of selling,” says Chen Zunde, fund manager ate Guangdong Fund Investment Co.

In FX, the dollar has benefited from the risk-off mood. The Bloomberg Dollar Spot Index rises 0.2% as the greenback gains versus all its G-10 rivals. The kiwi is the weakest, falling 1.2% versus the dollar after the RBNZ softened its threat of a hike amid signs inflation pressures are waning. Elsewhere, the New Zealand dollar slid more than 1% after the Reserve Bank of New Zealand delivered less hawkish comments on inflation, citing how most measures of price expectations have fallen. Meanwhile, Nigeria’s naira weakened to a fresh low after a much-bigger-than-expected 400 basis point interest rate increase by the central bank on Tuesday failed to support the currency. The naira has been sapped by a local scarcity of dollars and an outstanding backlog of demand for the greenback

In rates, treasury futures hold small gains accumulated during early London session as bunds and gilts advanced, with yields richer by 1bp-2bp across the curve. Weakness in US technology shares pressures S&P 500 futures, further supporting Treasuries. 10-year Treasury yields at 4.29% are ~2bp richer on the day with bunds slightly outperforming and gilts lagging by less than 1bp in the sector; Tuesday’s notable curve-steepening move remains intact with 2s10s and 5s30s trading near top of Tuesday range. IG dollar issuance slate already includes a few names; seven issuers priced $8.5b Tuesday, leaving weekly total already above the $35b expected. Borrowers paid concessions of less than 2bps driven by order books said to be 3.3 times oversubscribed. US session highlights include 4Q GDP revision, and corporate issuance slate is expected to remain busy.

In commodities, oil fell after a two-day gain as signs of higher US inventories vied with expectations that OPEC+ will extend supply cuts. WTI fell 1.1% to trade near $78. Iron ore resumed its slide, as investors remained undecided about the strength of China’s demand for steel ahead of the nation’s usual peak construction season. Spot gold falls 0.2%.

Bitcoin continues to soar and currently holds just shy of the $60k mark less than $10k away from a new all time high, boosted by a record inflow into the IBIT ETF.

Looking at today's calendar, US economic data includes second estimate of 4Q GDP, January advance goods trade balance and wholesale inventories (8:30am). Fed speakers scheduled include Bostic (12pm), Collins (12:15pm) and Williams (12:45pm).

Market Snapshot

Top Overnight News

Earnings

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded cautiously and followed suit to the rangebound performance seen on Wall St where stocks largely ignored weak US data ahead of key events, while the region also digested a couple of data releases and the RBNZ policy announcement. ASX 200 was indecisive with tech strength offset by weakness in telecoms, consumer stocks and financials, while data showed softer-than-expected monthly CPI in January and a miss on Construction Work Done for Q4. Nikkei 225 lacked conviction but remained above the 39,000 level in the absence of any pertinent catalysts. Hang Seng and Shanghai Comp. were pressured amid initial developer-related concerns after a wind-up petition was filed against Country Garden, although the property sector in Hong Kong then recovered after the government announced the cancellation of all demand-side property tightening measures for residential.

Top Asian News

European bourses, (Stoxx600 -0.1%), are mixed, but with clear underperformance in the AEX (-0.7%), after poor results from chip-maker ASM International (-3.8%). European sectors hold a negative tilt; Optimised Personal Care Drug and Grocery is dragged down by Reckitt (-8.9%) post-earnings, whilst Mercedes-Benz (+1.7%) drives Autos higher. US Equity Futures (ES -0.5%, NQ -0.9%, RTY -0.8%) are entirely in the red, paring back most of the gains seen in the prior session, with underperformance in the NQ hampered by Nvidia (-1.9% pre-market).

Top European News

FX

Fixed Income

Commodities

Geopolitics: Middle East

Geopolitics: Other

US Event Calendar

Central Bank Speakers

DB's Jim Reid concludes the overnight wrap

Henry is on duty tomorrow but given it will be a leap day I wanted to wish all those EMR readers who were born on February 29th a very happy birthday for tomorrow! The last time it fell on a workday was in 2016 so make sure your workmates shower you with 8 years' worth of gifts.

The week so far has been a bit of a crawl and not the leaps of last week as we await the all important core PCE print tomorrow. Yesterday saw equities post marginal gains (S&P 500 +0.17%), with bond yields edging up across the globe. Despite the subdued tone in markets, there’ve been some important headlines on the political side overnight, as former President Donald Trump seems to be on track to record another primary victory in Michigan. Current estimates are pointing to a big winning margin for Trump (68%) against Nikki Haley (26.8%) with 70% of the vote in, and that comes ahead of Super Tuesday next week, when 15 states will be holding votes on the Republican side. So if Trump is able to keep winning those contests, then he’ll soon have a very substantial delegate lead on the way to the nomination.

Overnight, the Reserve Bank of New Zealand held its official cash rate (OCR) unchanged at 5.5% - a 15-year high but on a day where there was a small chance of a hike delivered a relatively dovish stance. The central bank in its statement highlighted that “core inflation and most measures of inflation expectations have declined and the risks to the inflation outlook have become more balanced”. Following the decision, t he kiwi (-0.94%) is trading at $0.6113, after being one of the best performers in the last month with some hiking probabilities priced in. Bonds rallied with yields on the 10yr government bonds dropping -9.2bps to trade at 4.71% as we go to print.

Asian equity markets are slightly lower as I type with the Nikkei (-0.10%), Hang Seng (-0.27%), CSI (-0.30%) and the Shanghai Composite (-0.67%) declining. Shares of embattled developer Country Garden fell more than -12.0% after it received a liquidation petition in a Hong Kong court over its inability to repay a HK$1.6 billion ($204 million) loan and complicating its debt revamp prospects. On the flip side the HK budget is ongoing and restrictions on the property market have been lifted and boosts to tourism have been announced. Elsewhere, the KOSPI is nearly +1.0% higher this morning after two days of declines. US equity futures are just below flat with yields on 10yr USTs down -0.98bps, standing at 4.29%.

In early morning data, Australia’s CPI unexpectedly remained steady at +3.4% y/y in January (v/s +3.6% expected). YoY Core-CPI was +4.1% in January down from the +4.2% increase seen in December.

When it came to yesterday, the main story was more that there wasn’t much of a story, with little movement across the major asset classes. Among equities, there were some modest movements, with the S&P 500 (+0.17%) closing just below its all-time high, having basically been in a narrow band since the Nvidia results last week. Currently it’s down -0.21% for the week, meaning it still needs to recover a bit in order to achieve a joint record of 16 weekly advances in the last 18 (currently on 15/17 for first time since 1989). Small-cap stocks continued to outperform, with the Russell 2000 up +1.34%, in contrast to the Dow Jones, which was down -0.25%. Tech stocks saw a marginal outperformance, with the NASDAQ up +0.37% and Magnificent 7 up +0.22%. It shows the signs of the times that Apple yesterday announced the closure of its electric car unit which it set up in 2014 that at one point promised autonomous driving within a reasonable timeframe. The fact that they did this partly to divert resources to AI shows how trends can change.

Over in Europe the aggregate equity move was very similar, with the STOXX 600 up +0.18%, whilst the DAX (+0.76%) posted a 5th consecutive gain to reach a fresh all-time high.

On the rates side, Treasuries saw a mild sell off despite a fairly well digested 7yr auction. By the close, the 10yr Treasury yield was up +2.4bps to 4.30%. That said, there were some interesting trends on inflation expectations, which have continued to move higher over recent days. For instance, while the nominal 2yr yield was down -2.6bps, the 2yr breakeven was up a further +3.6bps to 2.75%, which is its highest level since March last year. Bear in mind that the 2yr breakeven began the year at 2.02%, so we’ve seen a pretty substantial move in just two months, which goes some way to explain why investors now don’t expect the rapid rate cuts that were priced at the start of the year. The amount of Fed cuts priced in 2024 inched down to 77bps, so now essentially in line with the 75bps of cuts penciled in by the median FOMC dot back in December. Patience on rates cuts continued to be visible in the latest Fed comments, with Fed Governor Bowman (hawk) noting that the latest inflation data “suggest slower progress in bringing inflation down toward our 2 percent target”.

Over in Europe, gilts saw some of the largest moves, which followed comments from BoE Deputy Governor Ramsden that “key indicators of inflation persistence remain elevated”. So 2 yr gilt yields were up +4.0bps to 4.33%, and 10yr gilt yields ended the session up +3.4bps at 4.19%, which is their highest level since late November. Elsewhere in Europe there was a similar pattern, with yields on 10yr bunds (+2.5bps) also hitting their highest level since November, at 2.46%.

Elsewhere yesterday, there was a mixed tone from the latest US data. On the negative side, the Conference Board’s latest consumer confidence reading for February was down to 106.7 (vs. 115.0 expected), which is the first decline in four months. Moreover, the preliminary durable goods orders for January were down -6.1% (vs. -5.0% expected). Core capital goods orders were in line at +0.1%, but with the previous month revised down by four-tenths. That said, it wasn’t all bad news, with core capital goods shipments up +0.8% (vs. +0.1% exp) in January and the Richmond Fed’s manufacturing index up to -5 in February (vs. -9 expected), ending a run of 4 consecutive monthly declines. The stronger shipments data saw the Atlanta Fed’s GDPNow model marginally upgrade its estimate for Q1 growth to an annualised 3.25%. If realised, that would be a third consecutive quarter with growth above 3%.

To the day ahead now, and data releases include the second estimate of US GDP in Q4, along with the European Commission’s economic sentiment indicator for the Euro Area in February. From central banks, we’ll hear from the Fed’s Bostic, Collins and Williams, the ECB’s Muller and the BoE’s Mann.