Authored by Peter Tchir via AcademySecurities.com,

We plan to cover much of this in the weekend report, but given the magnitude of the moves this week, we want to review where we stand ahead of Friday’s trading.

We did get to cover some of this on Wednesday on Bloomberg TV (starts at the 52 minute mark)...

...but here is a quick summary.

A lot of confusing messaging this week, some of which has to be corrected.

The negative news is that tariffs seem likely to be imposed, and even if they get relieved later on, some damage to the economy will be done. Mexico did deliver some cartel leaders to the U.S., so maybe they get another reprieve, which would be good for markets, but as a whole, my view is that no matter how tariffs play out, they are impacting the global economy negatively. Decisions are being made to front run them (which artificially propped up some data) but will leave companies somewhat frozen in terms of hiring decisions.

The risks and rewards in the AI space are shifting. Speaking with Academy’s General (ret.) Groen (former head of the Joint Artificial Intelligence Committee) he pointed out two trends, which are very good for companies and the economy, but I think will shift how investors invest:

AI is growing and evolving rapidly as is how it is used. That could continue to reshape how investors invest and who gains and who loses from that shift. Cheaper AI should in theory let more companies, including smaller companies benefit.

The wealth effect from crypto is real, and all too often ignored by “traditional” economists. Bitcoin is down a lot, but the “alt” coin world has been hit even harder. I think there will be continued pressure on bitcoin until a couple of things are “resolved”

With crypto weak, it is going to be difficult (not impossible, but difficult) for some segments of the stock market to do well. Those that tend to have cross ownership with crypto. It may also hurt the economy as significant wealth has dissipated in recent weeks.

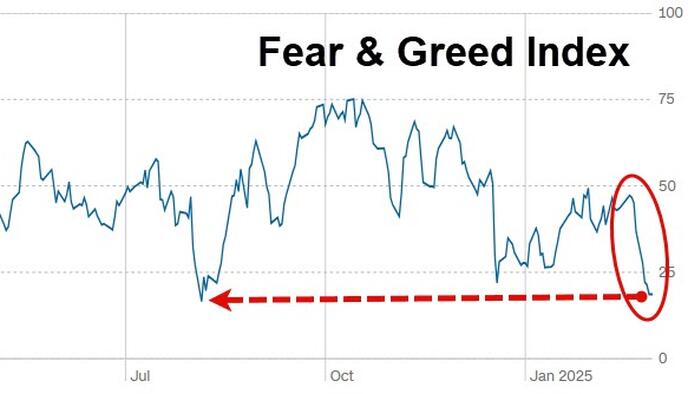

According to indicators like the CNN Fear and Greed Index and AAII Investor Sentiment Survey we have moved to high levels of fear. Normally positive as a contrarian.

However, when I check on some of the frothiest ETFs (see the aforementioned 2x etfs, amongst others) I see evidence that investors have been buying the dip all week.

Maybe buy the dip will work, but we haven’t seen a good capitulation in quite some time, so maybe this is the time the next leg or two down takes out the dip buyers? Investor cash on the sidelines, at least when looking at mutual fund cash holdings, is quite low.

Messaging screams bearish, but actual trading doesn’t seem to reflect that. So for now I’m going to largely ignore these contrarian signals. Thinking about them, but not acting on them.

Rates and the economy are both telling us the same thing. Ignore the rising concerns about inflation because there are a lot more negatives to discuss about the economy than positives. But that we can delve into in more detail this weekend.

Have to admit, I cannot be bearish interest rates here. I’ve basically capitulated on where I think 10’s should be and how many rate cuts we will. The capitulation is not so much because the administration seems to be focused on them (which is a good thing) but because no matter the end game, I see a lot of bumps in the coming weeks and months for the economy.

I’m less bearish overall on equities (it has been a good move), though my portfolio recommendation remains bearish large cap momentum/ QQQ while spreading risk across other sectors and factors. Getting back to pre-election levels for the S&P and Nasdaq remains my target, though I won’t be pounding the table quite as hard today, as we did coming into recent weeks.

Credit spreads are due to start feeling the pinch. While the equity move was primarily a valuation issue, spreads could remain stable. As this spreads to an economic risk, look for spreads to finally start to widen. Not yet exciting enough to dedicate a lot of time to credit spreads, but I suspect that in the coming days and weeks, credit will go from being dull and boring, to at least mildly intriguing. Issuers should be issuing into this low yield, low spread, high demand environment!