Update (1300ET): As we previewed and expected, French PM Francois Bayrou, the fourth prime minister in just 20 months, became the latest to depart having failed to get sufficient support to push a budget through parliament as 194 voted for him, 364 against.

Bayrou is reportedly going to submit his resignation to Macron early Tuesday, according to a government course.

Macron has limited options to steer France out of this crisis, according to PoliticoEU.

He is reportedly leaning toward appointing another prime minister — the fifth since January 2024 — but a new premier would face the same intractable parliament.

So too would a technical government made up of civil servants.

Another snap election looks unappetizing, though, as it could easily deliver another hung parliament.

In an extreme scenario, Macron could even resign, but that’s highly unlikely given his past statements.

Macron’s office hasn’t said whether he will speak tonight.

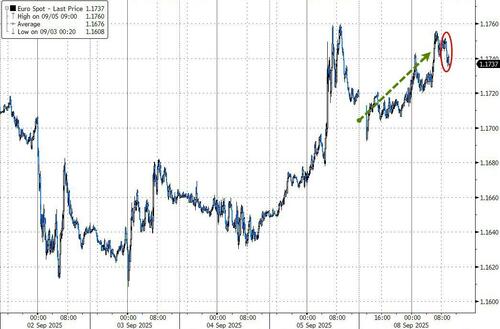

The EURUSD dipped very modestly on the news but remains higher on the day...

* * *

Prime Minister Francois Bayrou’s government will likely fall Monday, a victim of his push to chip away at France’s massive debt load. The premier called the vote to rally lawmaker support for his plan to narrow France’s 2026 deficit to 4.6% of economic output from an expected 5.4% this year. That plan includes €44 billion ($51.6 billion) of spending cuts and tax hikes. He also floated an unpopular proposal to cut two public holidays as a way to reduce costs in Europe’s second-largest economy. France’s fiscal deficit is now the widest in the euro area. Debt is rising by €5,000 ($5,840) a second, and the cost of servicing it is set to hit €75 billion next year, according to the government.

His plan may have backfired, however, as opposition parties in the National Assembly have mobilized against Bayrou’s minority government.

“There are moments when we need a rude shock,” Bayrou told France 5 television on Saturday. “There’s never been a situation as blindingly clear as this one.”

Bayrou will make a policy speech starting at 3 p.m. Paris time, followed by interventions by the political groups in the National Assembly.

The vote will take place in the evening, with the result expected between 8 p.m. and 9 p.m. (1400-1500ET)

Below is a full primer of what to expect, courtesy of Newsquawk

VOTE

TIMINGS

OUTCOMES

MARKET REACTION

RATING AGENCIES

WHAT HAPPENS IF THE FRENCH GOVERNMENT FALLS?

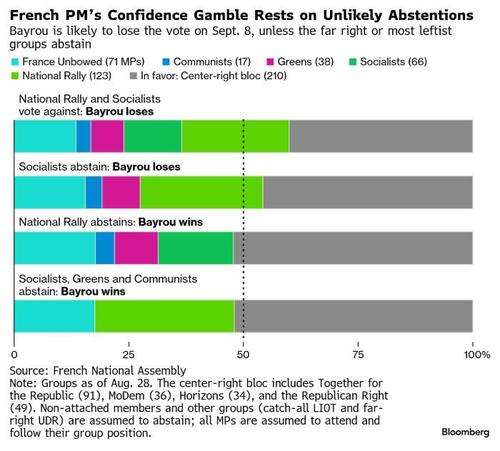

For Bayrou to survive, he needs to get the approval of a majority of those votes cast. Given that the groups that support the government represent just 210 seats out of 574 currently occupied (there are three vacant seats at the moment), Bayrou would need well over 100 abstentions in order to survive, assuming all members of those parties that support the government vote in his favor.

If Bayrou loses the vote, Macron’s options include naming a new premier or dissolving the lower house and calling early elections, which aides have said is not in the plans for now. Macron has repeatedly insisted he wouldn’t resign, as some parties have demanded.

If Macron were to name a new prime minister, it would leave unanswered the question of how the government passes an unpopular budget, which brought down the previous premier, Michel Barnier, last year. The context underscores the sudden return of France’s fiscal concerns to the forefront of investors’ attention at a time when European neighbors such as Italy are making comparative progress in taming deficits.

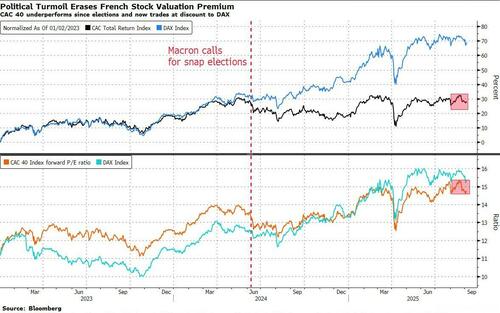

As Bloomberg's Michael Msika and Julien Ponthus detail below, French assets are set for long-lasting underperformance as the country’s unstable politics keep investors at bay.

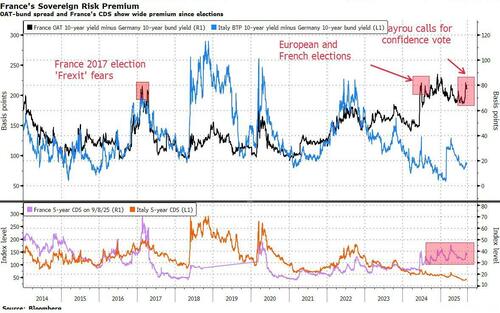

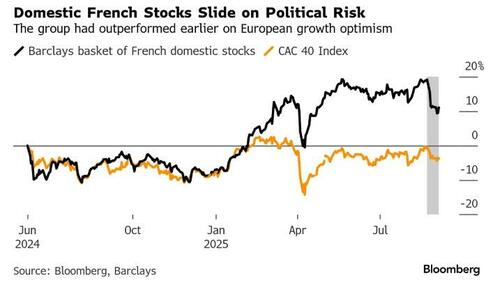

Since Prime Minister François Bayrou called a vote of confidence on Aug. 25, the CAC 40 Index has fallen more than a broad European stock benchmark. The extra yield investors demand to hold French 10-year government bonds over German bunds has surged. Even so, French assets aren’t yet pricing the instability that can unfold over the coming weeks or months.

“We’re not expecting for now a sudden tipping point by which bonds and stocks would suddenly collapse,” says Raphael Thuin, head of capital markets strategies at Tikehau Capital.

“It’s rather about pricing a potentially progressive and long-lasting decline. The feedback we get from our clients is that they’re getting used to the idea that there’s a durable risk premium being attached to France.”

France’s inability to fix its public finances has led to three governments in little more than a year, and there’s no sign that a fourth will fare any better.

So investors may be left facing another deadlock over the budget for months to come, the prospect of another snap parliamentary election and even persistent calls for President Emmanuel Macron to resign.

“The French equity market may be too optimistic about the political outcomes,” say Citi strategists led by Beata Manthey, who downgraded the country’s stocks to neutral at the end of August.

“Potential election would in our view imply about 5% lower equity market valuations. Combined with the fact that French equities tend to be more volatile than peers’ around elections, this could be a reason to expect additional choppiness.”

While the CAC 40 generates only 20% of revenues domestically, investors have been applying a discount to the benchmark since the snap elections last year and may continue to stay away on a relative basis. Sectors with the highest levels of local revenue reliance are telecoms, financials, and real estate, while technology, materials and health care are more internationally facing.

Banks are at the forefront of investor worries, given their exposure to government bonds.

Citi analysts note that key concerns include a higher cost of equity, increased funding costs and potential populist measures, but say that these fears remain “overblown” for now.

Defense stocks should also be watched, they add. While French defense spending will most likely trend upward in 2025 and 2026, things might become more difficult in the medium term out to 2030.

Construction and logistics companies like Vinci and Eiffage, residential real-estate developer Nexity and nursing-home operators Emeis and Clariane have also suffered recent bouts of volatility.

The discount on French assets is likely to be validated in the event of Bayrou’s ouster, because any new government will have to dial back his proposed budget cuts. The premier failed to find a majority to back his plan for €44 billion of spending reductions and tax hikes, with the goal of narrowing France’s 2026 deficit to 4.6% of economic output from an expected 5.4% this year.

The yield on France’s 10-year government bond climbed to almost 3.6%, threatening to surpass that of Italy, after Bayrou called the vote, though it has since receded to about 3.44%.

The yield premium on French bonds over bunds has risen to almost 80 basis points, roughly 10 basis points higher than prior to Bayrou’s political gamble.

Tension in the bond markets threatens to spill over to stocks, because higher benchmark yields mean higher borrowing costs, especially for smaller, indebted companies, says Thomas Helaine, head of equity sales at TP ICAP Europe.

That in return reduces the money available for capital spending and growth, he said, and as a result, investors are looking to other markets.