One day after Dick's Sporting Goods and Macy's shares crashed as the consumer situation deteriorated, sneaker retailer Foot Locker plunged in premarket trading Wednesday in New York due to a cut in guidance amidst the chilling echoes of "consumer softness."

Foot Locker slashed its adjusted earnings per share guidance for the full year, which missed the average analyst estimate. The company paused its dividend to "ensure that we have the flexibility to continue to fund our strategic investments appropriately," CEO Mary Dillon wrote in a press release.

Here are the second quarter earnings highlights:

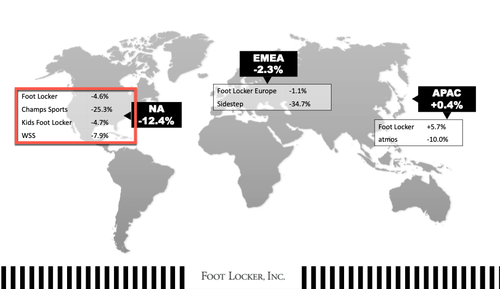

The weakest sales were reported in North America.

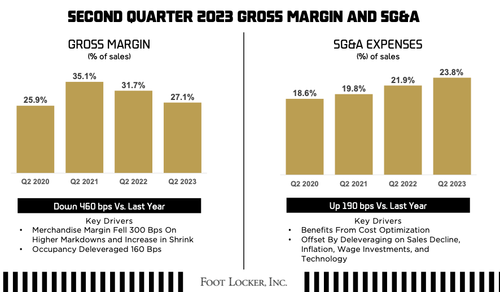

Deteriorating Gross Margins

Highlights from the full-year forecast:

"Our second quarter was broadly in line with our expectations, despite the still-tough consumer backdrop," CEO Dillon wrote.

She added: "However, we did see a softening in trends in July and are adjusting our 2023 outlook to allow us to best compete for price-sensitive consumers, while still leaning into the strategic investments that drive our Lace Up plan."

The dismal earnings report caused shares to crash in premarket trading, down nearly 29%.

Foot Locker's downgrade of the full-year forecast is the second time this year -- yet again blaming the weak consumer. It also plans to suspend the quarterly cash dividend beyond its recently-approved October payout of 40 cents per share.

It also noted promotions and retail thefts, otherwise known as "shrink," weighed on profits:

Gross margin declined by 460 basis points as compared with the prior-year period, driven by an increase in promotional activity, which included higher markdowns, as well as occupancy deleverage and higher shrink.

What's important to note is that about half (47%) of the retailer's customer base is in the lower income bracket and might serve as more evidence that the weakest households continue to pull back on spending.

At other retailers, including Dick's and Macy's, the same story of sliding sales and thefts were reported on Tuesday. We noted "Dick's Shrinkage Slams Stock" and "Macy's Crashes As Consumer Situation Deteriorates."

... and none of this should be surprising as the consumer credit card spending binge has ended while personal saving has drained. Consumers are reaching a breaking point with the highest interest rates in 22 years. Just wait until student debt payments restart at the end of next week.