Why slog through 40 years of office birthdays and bad coffee just to maybe retire at 65 — if inflation, layoffs, or AI haven’t already eaten your future? A new crop of young investors is saying no thanks to the traditional script and trying their hand at collecting dividends instead, according to Bloomberg.

Instead of grinding for a pension that may never materialize, they’re chasing cash. The strategy: dividend-heavy portfolios and exotic ETFs that spit out monthly checks. The dream isn’t just building wealth — it’s paying the bills, skipping the cubicle, and making “work optional.”

Bloomberg writes that at a July event at Nasdaq’s MarketSite in Manhattan, influencers gathered to celebrate the movement.

The appeal is obvious: regular cash. But experts warn that the payouts often come at the expense of long-term growth.

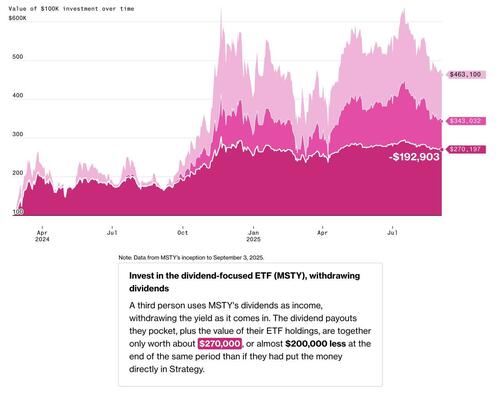

YieldMax’s MSTY fund, tied to a Bitcoin-related stock, pays eye-popping dividends but has trailed the stock by more than 100 percentage points since launch. “They’re fooling people into thinking that they’re somehow getting income,” says Benn Eifert of hedge fund QVR Advisors. “All you’re doing is giving me my money back.”

Still, the lure of immediate yield is powerful. Cesar Arteaga, 27, turned from memecoins to high-yield ETFs after moving to Montana and struggling to find work. He poured in savings, margin loans, and proceeds from selling his house and cars. “It’s just kind of become an addiction,” he says. “Now you’re seeing dividend funds … with insane numbers, more than 50%.”

Critics also warn about fees and taxes, especially since many of these payouts are taxed as ordinary income. But influencers like Thomas Bell, who runs the channel Live off Dividends & Options NOW!, argue that the real reward isn’t just the money — it’s autonomy.

“When you graduate college, you’re like 22, you’re young, you have the good looks and all that, but you don’t have the money,” he says. “And so it’s like, well how do you get the money fast?”

Certainly not by working, we guess...