Since the last FOMC meeting on September 18th, bonds have suffered a bloodbath while gold, stocks, and the dollar are all up modestly...

Source: Bloomberg

Despite the apparent dovish pivot, the market's expectations for rate-cuts (this year and next) has plunged dramatically...

Source: Bloomberg

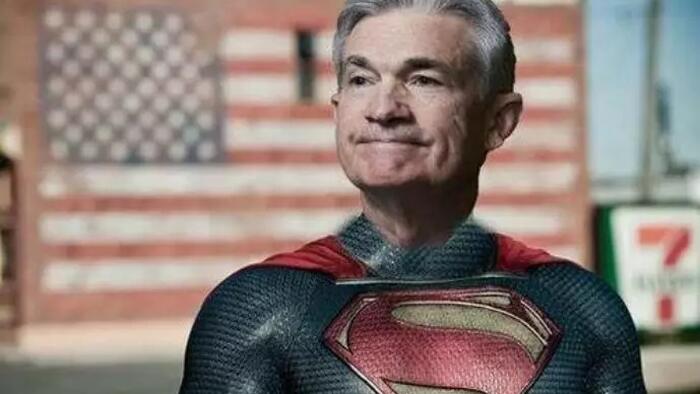

This should not come as a huge surprise as Powell's raison d'etre for major rate cuts evaporated as US macro data has surged higher, surprising to the upside almost non-stop...

Source: Bloomberg

It's hard to justify slashing rates any further in the face of that macro backdrop without exposing the 'political' decision-making process behind The Fed's move.

So, now we see the Minutes - what exactly is it that The Fed wants us to believe they are thinking?

Despite there only being one dissent against the 50bps cut (Michelle Bowman), The Fed Minutes suggest that the members are considerably more divided than headlines suggested...

Breaking down some specific topics...

ECONOMY

ECONOMIC OUTLOOK

EMPLOYMENT

Finally on INFLATION:

"With regard to the outlook for inflation, almost all participants indicated they had gained greater confidence that inflation was moving sustainably toward 2 percent. Participants cited various factors that were likely to put continuing downward pressure on inflation. These included a further modest slowing in real GDP growth, in part due to the Committee's restrictive monetary policy stance; well-anchored inflation expectations; waning pricing power; increases in productivity; and a softening in world commodity prices"

"Several participants noted that nominal wage growth was continuing to slow, with a few participants citing signs that it was set to decline further. These signs included lower rates of increases in cyclically sensitive wages and data indicating that job switchers were no longer receiving a wage premium over other employees. A couple of participants remarked that, with wages being a relatively large portion of business costs in the services sector, that sector's disinflation process would be particularly assisted by slower nominal wage growth."

"In addition, several participants observed that, with supply and demand in the labor market roughly in balance, wage increases were unlikely to be a source of general inflation pressures in the near future. With regard to housing services prices, some participants suggested that a more rapid disinflationary trend might emerge fairly soon, reflecting the slower pace of rent increases faced by new tenants."

This with home prices and rents at all time high, and Longshoremen just getting a 62% wage hike

ForexLive's Greg Michalowski highlights the broad use of the same quantity identifiers in the Minutes:

1. A Few

2. Some

3. Several

4. Many

5. Most

6. Almost All

7. A Substantial Majority

Read the full Minutes below...