This afternoon at 2pm ET, we will get the minutes from the July FOMC meeting.

As a reminder, this is what happened at the July meeting:

With the Fed in a data-dependent policy-setting mode, the FOMC minutes from the July meeting are not expected to contain many surprises, however traders will be looking for any commentary on how the Fed assesses growth dynamics; given that inflation is slowly inching back down towards target, many expect the Fed to pivot policy, and eventually begin cutting rates to support the economy.

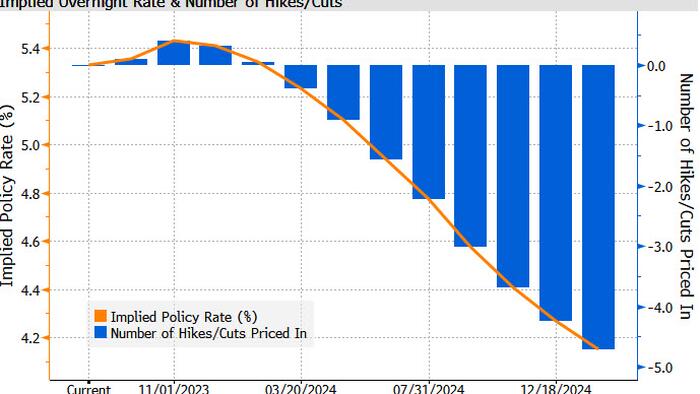

Money market currently price in the terminal rate between 5.25-5.50%, though the Fed's June projections have penclled in a further hike; markets are also expecting rate cuts to start in Q1 2024.

Mizuho expects the FOMC minutes to echo the “See you in September” message, even though we may see some doves argue for stopping rate hikes. In any case, it seems that the debate is now shifting – in the Fed’s Williams words “we’re pretty close to what a peak rate would be and the question will really be […] how long will we need to keep policy in a restrictive stance”.

Mizuho's view is one of “longer than expected”; the Japanese bank sees the first Fed cut in Q3-24 and the latest upside surprise in US retail sales numbers gives us more conviction on our view. As a reminder, earlier this week Goldman published a note (available to pro subs) in which it called for the first rate cut in Q2 2024.