FOMC Minutes Confirm Fed 'Pause', Potential QT Taper; Officials Blame Trump Policies For Uncertainty

Since the last FOMC meeting - on Jan 29th - the market has coped admirably well with the utter avalanche of headlines spewing from Washington (and around the world). Gold has been the standout choice while stocks, bonds, oil and the dollar are all about flat...

Source: Bloomberg

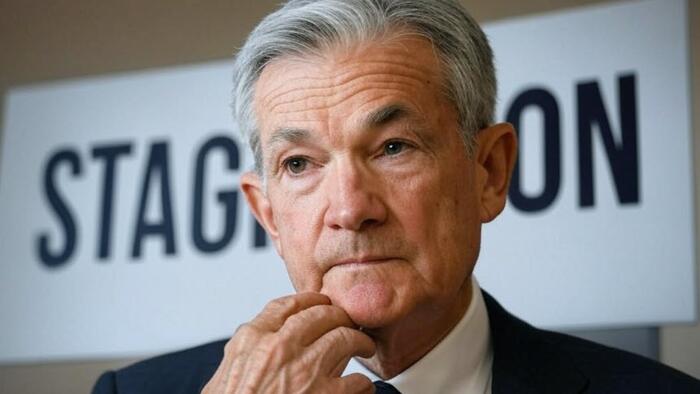

The macro data has been a nightmare (for The Fed) with stagflationary impulses clear as growth surprises have been to the downside while inflation surprises have soared to the upside...

Source: Bloomberg

...which helps explain why rate-cut expectations have tumbled since the last FOMC statement...

Source: Bloomberg

Additionally, FedSpeak since the last meeting has been guardedly hawkish with Powell reiterating his 'no rush to cut' comments and various other Fed heads noting that the central bank is 'in a good place' after they removed the optimistic 'inflation keeps trending down' language from the prior statement.

So, bearing in mind that hot CPI and PPI (and inflation expectations from soft survey data) will not be included in these Minutes, what does The Fed want us to focus on?

Here are the initial highlights:

Fed's on hold (confirmation)

The Fed's 19 officials who participate in its interest-rate decisions indicated that “they would want to see further progress on inflation before making” any further cuts.

Fed blames Trump:

The minutes also cited a “high degree of uncertainty” surrounding the economy, which made it appropriate for the Fed to “take a careful approach” in considering any further changes to its key interest rate.

Fed officials said that President Donald Trump's proposed tariffs and mass deportations of migrants, as well as strong consumer spending, were factors that could push inflation higher this year.

And diving into the details:

Read the full Fed Minutes below: