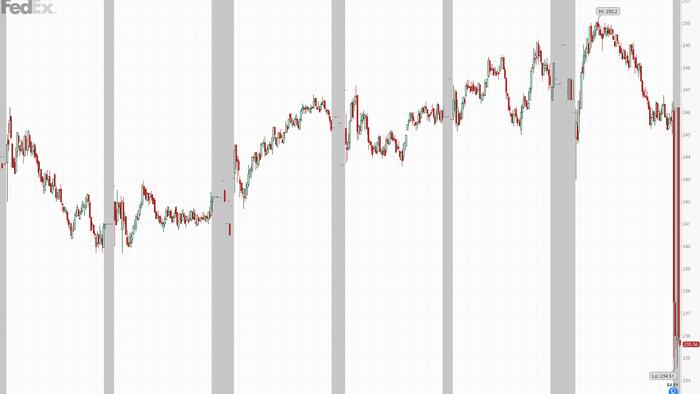

FedEx stock tumbled after the company missed EPS expectations and lowered its full-year profit outlook for a third consecutive quarter as mounting economic uncertainty added to sputtering demand already squeezing the parcel company’s bottom line.

For fiscal Q3, the company reported a revenue beat but this was offset by a miss in both profit margins, operating income and EPS:

But what really spooked investors and sent the stock plunging after hours, was the company's guidance which was slashed for the third time in a row, sparking rumblings about a possible CEO change:

The gloomier outlook shows how FedEx continues to wrestle with sputtering package demand amid mounting signs of economic slowdown. Weakness from industrial customers is weighing on its services that cater to businesses, CFO John Dietrich said in a statement Thursday announcing results.

Commenting on the quarter, CEO Raj Subramaniam said the company faced a “very challenging” operating environment in the period that included a shorter peak shipping season and severe weather. Subramaniam is working to transform the company by combining its Express unit that ships parcels by air with its Ground delivery network. The broader industry has been suffering from a prolonged period of weakness as cash-strapped customers spend on services rather than goods, and a growing preference for slower, cheaper delivery options instead of more profitable express shipping.

FedEx also made the following comments:

FedEx is the latest US company to sound the alarm over weakening consumer confidence and potential fallout from Trump’s escalating trade war, even though the company's stated reason for the miss - lower fuel surcharges - goes directly opposite to what it is accusing Trump of doing, namely pushing prices higher. Maybe Fedex can

The parcel company is considered an economic bellwether because of its exposure to a broad swath of the global economy, from retail to manufacturing.

In kneejerk response, FDX stock tumbled 5% after hours, and is down 12% this year through Thursday’s close. It is now at levels last seen more than a year ago.