Authored by Simon White, Bloomberg macro strategist,

Inflation will soon plateau at a higher level than the market expects, but this is historically not a sufficient reason to prevent the Fed from cutting. Kneejerk flattenings in the yield curve from higher-than-expected inflation should eventually lead to re-steepenings.

Today’s data is expected to show a continuation of the trend in falling headline CPI, but stubborn core inflation, expected to rise to 5.6% from 5.5%.

Leading indicators expect the fall in headline CPI to continue for now, but it is in core where we can do a biopsy to see what is going on under the surface.

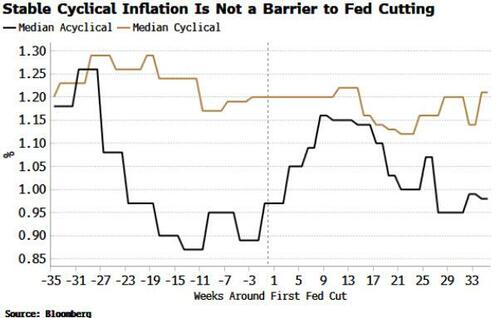

The San Francisco Fed splits core PCE into cyclical and acyclical inflation. Very simply, cyclical inflation are those inputs most correlated to Fed policy, and acyclical is anything left.

Core PCE has fallen from its peak, but only marginally. This fall has been driven by acyclical inflation’s decline, while cyclical inflation remains at its highs. This tells us that the “long and variable” lags of the Fed’s policy have yet to have a direct impact on core inflation.

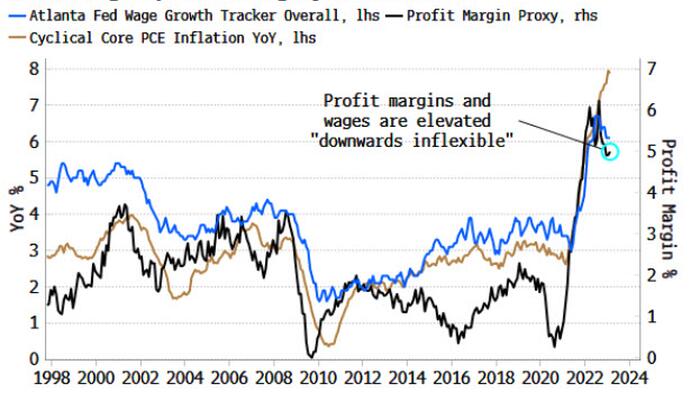

Why has core inflation been so intransigent? It’s hard to know for sure, but profit margins and wages are the two most likely drivers.

The early part of the pandemic saw one of the fastest rises in profit margins yet as companies took advantage of the unique circumstances of heavily disrupted supply chains and mushrooming demand. In the pandemic’s latter half, wages rose significantly. Thus rather than a wage-price spiral driving inflation as in the 1970s, in this cycle it is a profit-wage spiral.

Even though profit and wage growth are off their recent highs, both are “downwards inflexible,” and any relief in cyclical inflation is likely to be modest.

At the same time, China drives acyclical inflation. The recovery there will thus soon ensure that acyclical inflation will likely stop falling and begin rising again in the coming months.

So even if Fed policy starts to kick in, core inflation is poised to remain sticky and base at a higher floor.

But this may not be enough to hold the Fed back from easing if the economy and the jobs market continue to weaken (despite what they say). Historically, the Fed has started to cut rates after acyclical inflation has fallen, but while cyclical inflation is still near its recent high.