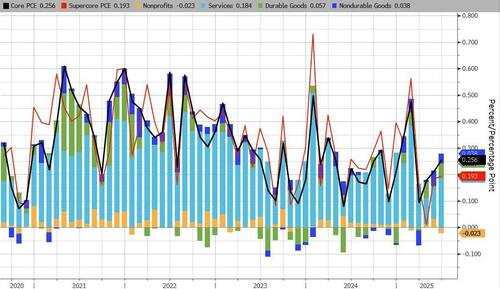

The Fed's favorite inflation indicator - Core PCE - rose 0.3% MoM (as expected) which pulled it up 2.8% YoY (hotter than the +2.7% YoY expected) - the hottest since February...

Source: Bloomberg

Not exactly the hyped-up inflationary surge the tariff fearmongers had been pushing.

Services inflation is accelerating as are Durable Goods costs on a MoM basis...

Source: Bloomberg

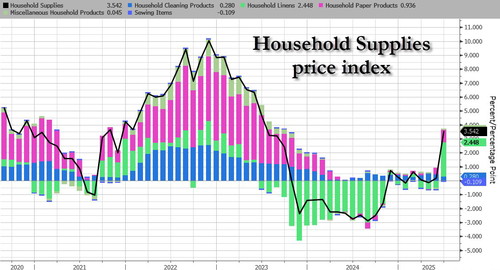

Deeper under the hood, household supplies seems to be getting hit with tariff trauma...

Source: Bloomberg

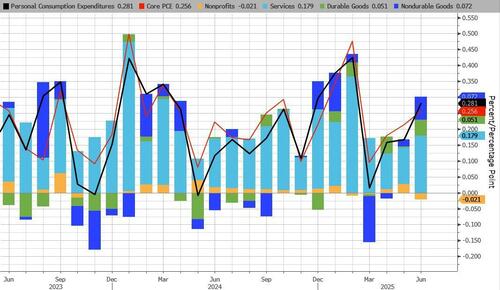

Headline PCE rose 0.3% MoM (as expected) and +2.6% YoY (hotter than expected)...

Source: Bloomberg

At the headline level, all the sectors (aside from non-profits) are accelerating...

Source: Bloomberg

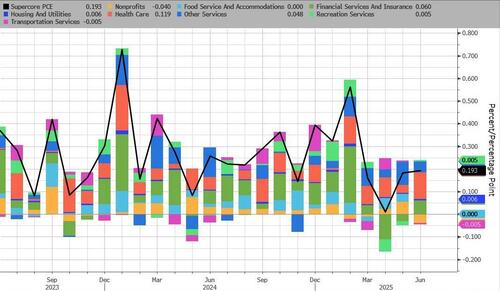

Super Core PCE - Services Ex-Shelter - dropped to +3.18% YoY in June...

Source: Bloomberg

Healthcare costs are starting to pick up (not exactly tariff-driven)...

Source: Bloomberg

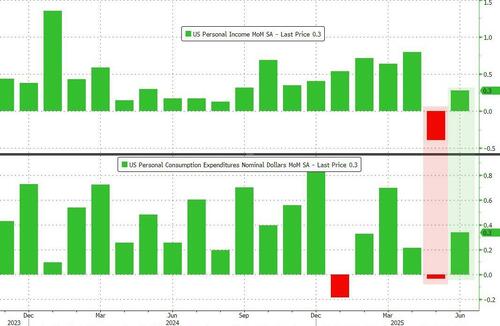

Both income and spending rose 0.3% MoM in June (after May's surprise decline in both)...

Source: Bloomberg

Wages are re-accelerating:

On a YoY basis, Spending and Income are both up 4.7% (in nominal terms)...

Source: Bloomberg

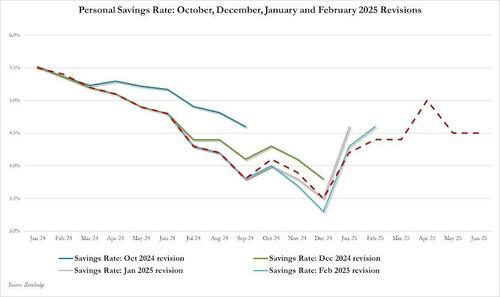

With the savings rate unchanged at 4.5%...

Source: Bloomberg

Is there enough here to nudge The Fed towards a cut? Or do we keep waiting for the 'lagged' effect of tariffs to finally show up in prices?

This is the 'transitory' no inflationary impact period!