For the second straight week, money market funds saw outflows, falling $18.2 billion - the biggest weekly decline since Xmas week 2022 (ex-tax day drop)...

Source: Bloomberg

And for the second straight week, all the outflows were institutional (-$24.89 billion) while retail funds saw a ninth straight week of inflows...

Source: Bloomberg

Is this related to the chase into tech stocks?

The money market fund outflow (which leads banks deposit data by a week), is interesting because it comes after banks saw a huge deposit outflow the prior week...

Source: Bloomberg

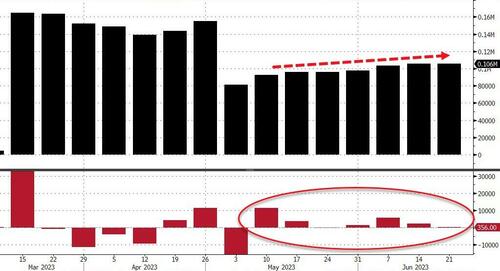

Having gone nowhere for two weeks, The Fed balance sheet shrank by $26.3 billion last week, basically back in line with pre-SVB levels...

Source: Bloomberg

As far as QT is concerned, The Fed sold a decent $19.4 billion of its assets, down to its lowest since August 2021...

Source: Bloomberg

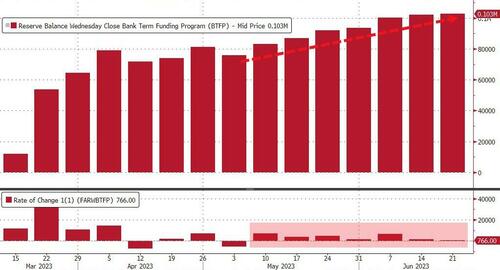

The US central banks has $106 billion of loans outstanding to financial institutions through its two backstop lending facilities...

Source: Bloomberg

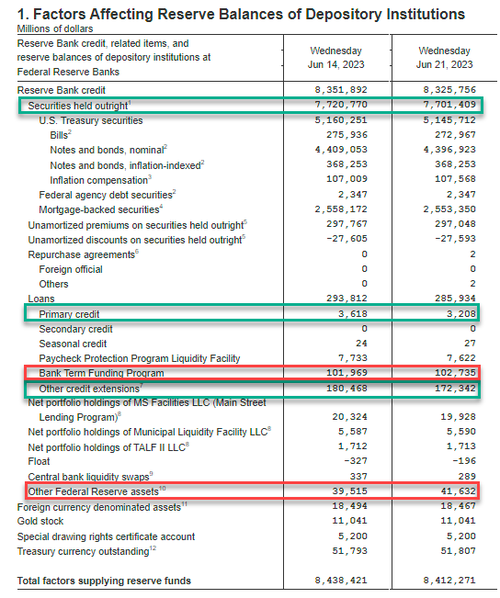

With banks' usage of The Fed's emergency Bank Term Funding Program rising once again to a new record at $102.7 billion (up $0.8 billion from last week), while discount window usage slipped $0.4 billion to $3.2 billion...

Source: Bloomberg

The breakdown from The Fed's H.4.1 table...

The US equity market continues to charge ahead, even as bank reserves at The Fed contracted modestly...

Source: Bloomberg

Finally, as a reminder, banks have 9 months left under the original 12-month BTFP Fed bailout program to find a way to stabilize their balance sheets.

Not only have they failed to do so, usage of the BTFP facility is at a new all time high, and yields are rising even more (great MTM losses).