Tl;dr: Nine months after it last adjusted rates, The Fed finally bent the knee this afternoon and cut rates by 25bps (as fully priced in by the market).

Only once since it started publishing its target rate in the 1970s had The Fed waited longer. That was 2001-2002 when, unlike now, it was a bear-market low, consumer spending was weak, and inflation was below target.

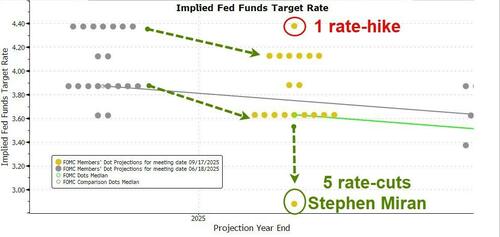

The Dot-Plot suggests The Fed members are also shifting in a dovish direction (narrowing the gap with the market) with 50bps more now set for 2025.

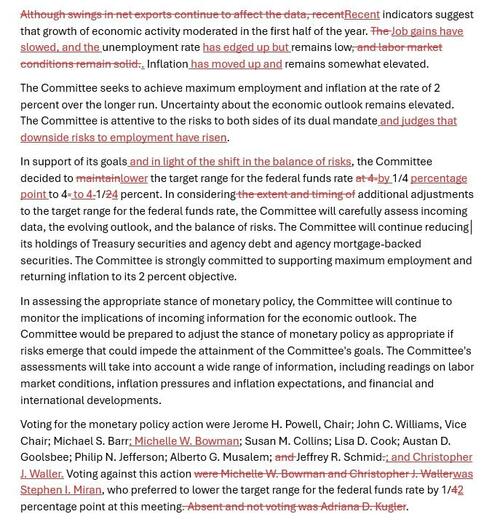

There was only one dissenter, newly appointed Stephen Miran who wanted a 50bps cut.

So, to clarify: The Fed is cutting rates, and projecting more rate cuts, at the same time as upgrading its growth forecast and nudging up its inflation outlook too.

WTF!!

* * *

Since The Fed's last meeting (July 30th), a great deal of catalyzing events have occurred - from massive downward revisions to the so-called 'strong' labor market to a continued lack of (hyper) inflationary pressure from tariffs; and from a decline in geopolitical uncertainty and trade policy uncertainty offset by a much-decried by MSM rise in fears over Fed 'independence'.

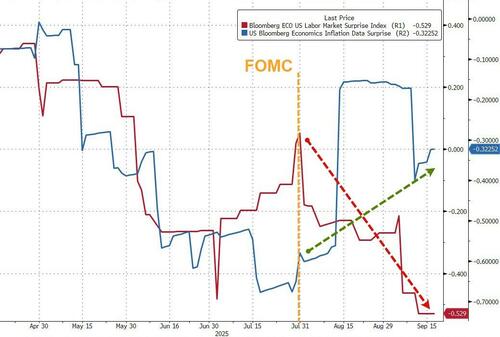

The economic data has pumped and dumped in the ensuing weeks...

Source: Bloomberg

But we do note that 'inflation' has surprised to the upside since the last FOMC (while the labor market has dramatically surprised to the downside)...

Source: Bloomberg

Gold has been a dramatic outperformer during the interim period with some weakness in the dollar and crude oil prices (Israel-Iran tensions eased) plunging most. Bonds and stocks are up since the last FOMC meeting...

Source: Bloomberg

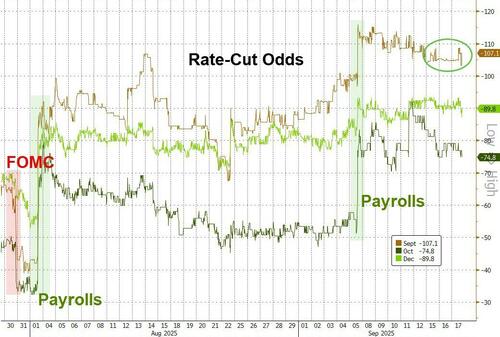

Rate-cut odds dipped after the last FOMC meeting only to surge on two weak payrolls prints, pricing in fully a 25bps today (and high likelihood of another cut in each of the remaining FOMC meetings this year)...

Source: Bloomberg

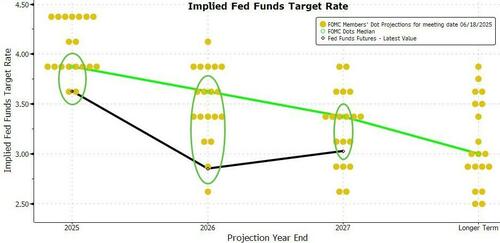

Expectations for cuts in 2025 have risen notably since the last FOMC meeting (from ~2 cuts to ~3 cuts) while 2026 expectations are only very modestly more dovish)...

Source: Bloomberg

And before we get the headlines, bear in mind that the market is dramatically more dovish than the current (old) dots from The Fed. Today we get a refresh that will likely see the median dots decline (dovishly)...

Source: Bloomberg

As we noted earlier, today's meeting has the potential to be explosive with multiple dissents (both hawkish and dovish).

RATES:

VOTE SPLIT:

LABOUR MARKET:

INFLATION:

ECONOMY:

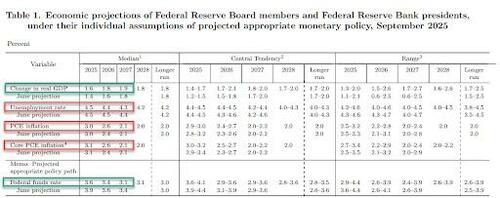

SUMMARY ECONOMIC PROJECTIONS:

The new projections show inflation finally returning to the 2% target in 2028. That would mark seven straight years of inflation surpassing the target!

Still, that’s less than the nine straight years of under-shooting from 2012 through 2020.

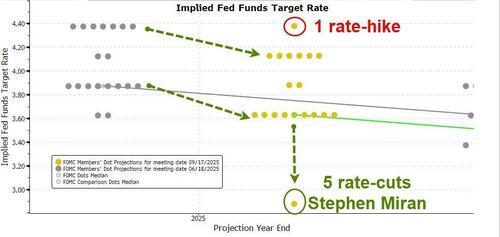

DOTS:

The dots for 2025 were massively shifted lower with one member calling for 5 cuts in 2025. 7 of the 19 members see no more rate-cuts this year...

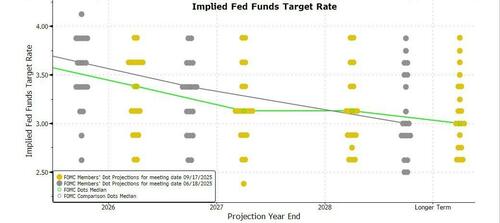

Fed Funds rate forecast cut for 2025 from 3.9% to 3.6% or another 2 rate cuts.

So the median forecast for next year pencils in just one more rate cut, after the two further moves this year. Not a lot there.

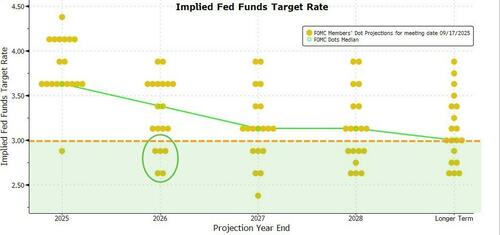

Bloomberg's Ira Jersey notes that while the skew of the Dot-plot remains for slower cuts this year, the median year-end 2026 dot not only moved lower, but there are now five members who see rates below 3%.

And then another cut in 2027 to 3.1%

That would mean 125 basis points of cutting from September 2025 until the end of 2027. That’s way, way short of the 300 basis points Trump has wanted for, like, now.

So, to clarify:

The Fed is cutting rates, and projecting more rate cuts, at the same time as upgrading its growth forecast and nudging up its inflation outlook too.

WTF!

Read the full redline below: